Bitcoin down after the halving – is this price action normal?

The halving is a huge deal for Bitcoin, but it normally takes months for its affects to be felt.

The fourth halving has come and gone, not with a bang, but with a... whimper?

Given how much is made of the halving, you could be forgiven for expecting more fireworks in the immediate aftermath.

Instead, we've had more than a week of effectively nothing, with Bitcoin now down a few percent from its price at the time of the halving.

So is this cause for concern? Is the crypto bull run already over?

Is Bitcoin underperforming after the halving normal?

In a word, yes. As we've discussed before, Bitcoin's performance either side of the halving is a very mixed bag.

Over the longer term, the trend is much clearer, with Bitcoin performing exceptionally well in the 12-18 months after the halving.

But when would we expect that this time around?

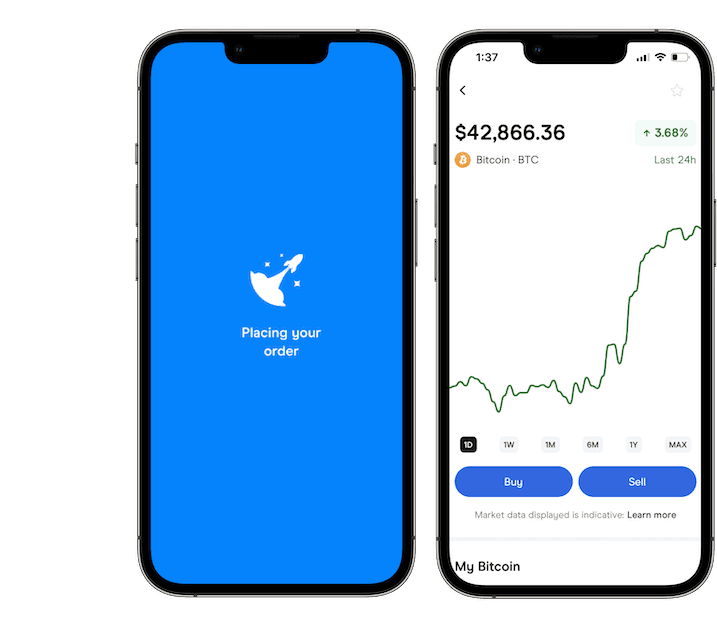

Bitcoin's performance relative to halvings

Image source: Stockmoney Lizards

According to analysis by Stockmoney Lizard (@StockmoneyL) on X/Twitter, it normally takes around 40 days from the halving for Bitcoin's price to accelerate upwards.

That would mean we'd be waiting until the end of May before Bitcoin makes a definitive move past its all-time high.

As Stockmoney Lizard says in their thread, "As you can see, after halving, the first thing that happens is... nothing. It usually takes a couple of weeks/months until the second part of the bull market kicks in."

Of course, the usual caveats still apply. There's absolutely no guarantee that Bitcoin will follow the same pattern this time around.

Think you know better than the experts?

See if you can correctly predict what the price of Bitcoin will be in US dollars next Monday, and come back then to see the results.

Join the crypto conversation – Follow us on X now

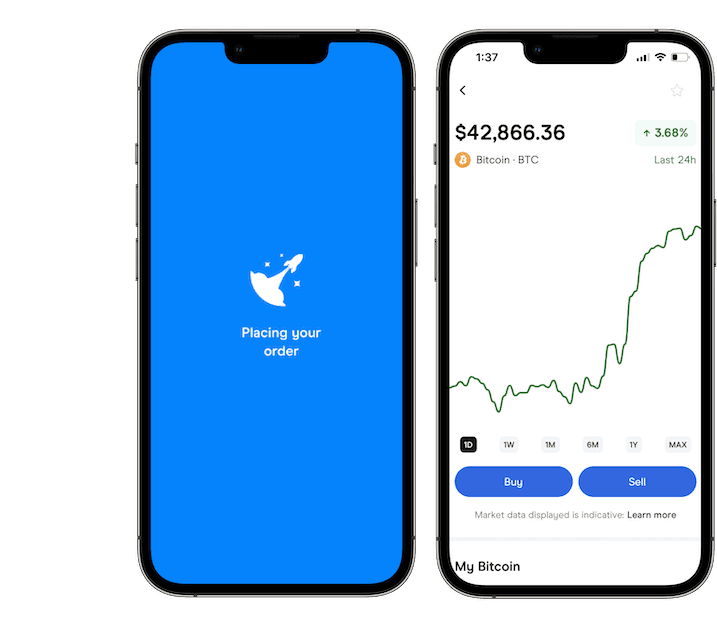

Trying to get a handle on the markets? Cut through the noise with our overview of the best cryptos to buy right now, explore some strategies for how to trade crypto or see if there's a better platform for you with our guide to the best crypto exchanges.

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Trusted by over 500,000 Aussies

Trusted by over 500,000 Aussies

Sources

Ask a question