Bitcoin price watch: 10 days til halving

It's now less than 2 weeks until the Bitcoin halving, how is the price likely to react?

Bitcoin's main event is now approximately 10 days away and investors are watching closely to see how Bitcoin performs in the lead up to the big day.

But how does Bitcoin normally fare around the time of the halving, and why could it actually be different this time?

How does Bitcoin perform around the halving?

Predictably unpredictable is the best way to describe it.

If we take the last halving on 12 May 2020, Bitcoin's price action was relatively volatile in the weeks leading up to the halving.

Bitcoin shot up from around US$7,780 two weeks before the halving to briefly hit US$10,000, before retracing back to around $8,770 by the time of the halving.

Of course, it then went on to hit US$64,000 within 12 months.

2016 was a similar, but different, story.

Two weeks out from the halving Bitcoin was at US$658, very close to the price at the time of the halving (US$653) on 10 July.

But in the month or so prior to that, Bitcoin gained more than 70%, rising from $440 in mid-May to around US$777 by mid-June.

Two weeks after the halving and Bitcoin briefly crashed back as low as US$466.

18 months later and it was at US$20,000.

So it seems volatility is the name of the game when the halving is on the horizon.

This time is different?

What's interesting this time around is that Bitcoin has already reached a new all-time high prior to the halving. With all previous halvings, it was only in the months following the halving itself that Bitcoin set a new all-time high.

This is also the first halving event since the approval of spot Bitcoin ETFs (exchange-traded funds), which have likely accounted for Bitcoin's better-than-anticipated performance at this point in the Bitcoin halving cycle.

As a result of both of these developments, it could be argued that general sentiment towards Bitcoin is the best its been this close to a halving.

In 2012 and 2016, Bitcoin was still a niche asset and trading volume was a fraction of what it is today.

In 2020, Bitcoin had just been hit by the major Covid crash that had devastated markets across the world and there was understandable uncertainty around its future.

Today, Bitcoin is recognised as a legitimate alternative asset class and has outperformed traditional markets in 2024 despite ongoing inflation pressures.

So what does that mean for Bitcoin's price going forward?

If history is any indicator, the real Bitcoin price appreciation happens in the period after the halving.

We may even see an accelerated bull run this time out, says CoinJar CMO Dominic Gluchowski.

"Notably, we haven't [previously] seen such a steep price increase, with Bitcoin reaching an all-time high and a surge of new retail customers entering the market before the halving," said Gluchowski.

"Unless there's a considerable pullback or a period of sideways trading in the next few months, we might witness a bull market that could conclude sooner than in past cycles. Specifically, this means we could see the peak between October and December this year, much earlier than the 12-18 month timeframe observed after previous halvings."

So will this time really be different? There's only one way to find out.

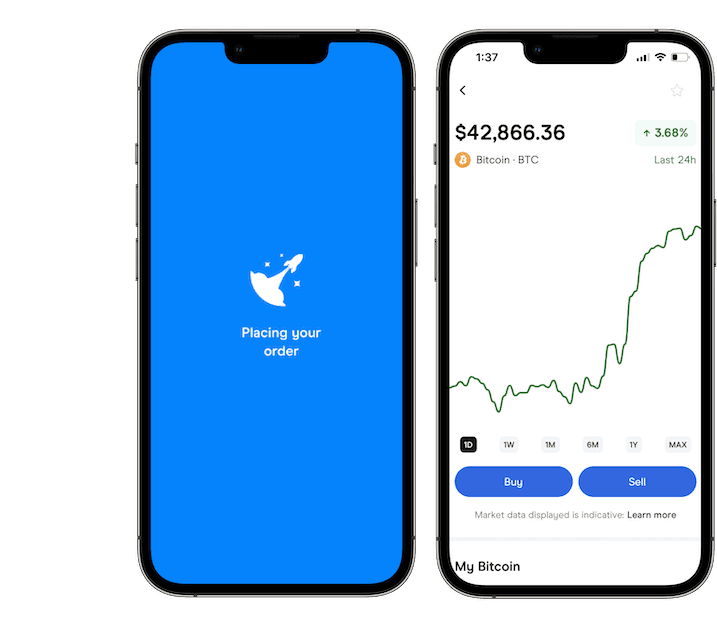

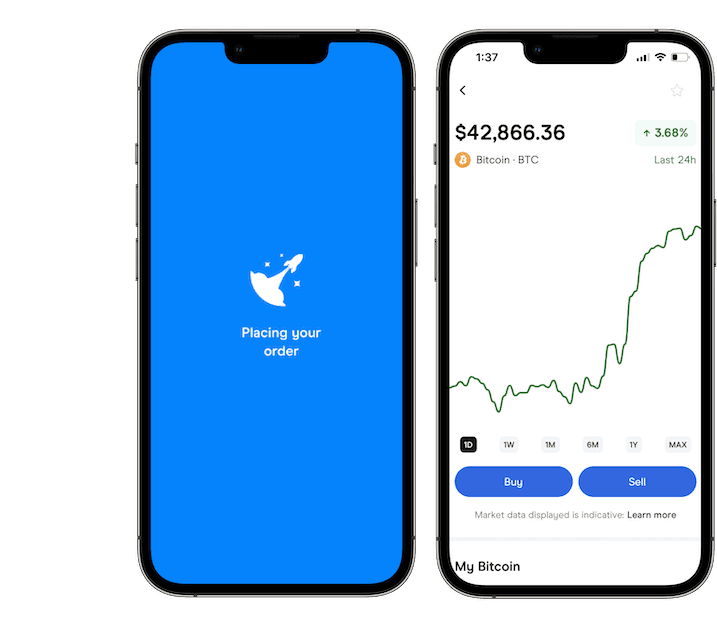

See how to buy Bitcoin in Australia.

Join the crypto conversation – Follow us on X now

Trying to get a handle on the markets? Cut through the noise with our overview of the best cryptos to buy right now, explore some strategies for how to trade crypto or see if there's a better platform for you with our guide to the best crypto exchanges.

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Trusted by over 500,000 Aussies

Trusted by over 500,000 Aussies

Sources

Ask a question