Average super balance by age revealed: Is yours on track?

Here's how much the average Aussie has in their super fund, and how to boost your balance if it's falling behind.

Ever wondered how your super balance compares to your peers? Well, now you'll know.

Data from the Association of Super Funds Australia (ASFA) reveals the average super balance is is $182,667 for men and $146,146 for women (across all ages).

But the median balance is lower, at $66,159 for men and $52,075 for women.

The median figure is more useful as a point of comparison because it smooths out the impact of people with very high super balances.

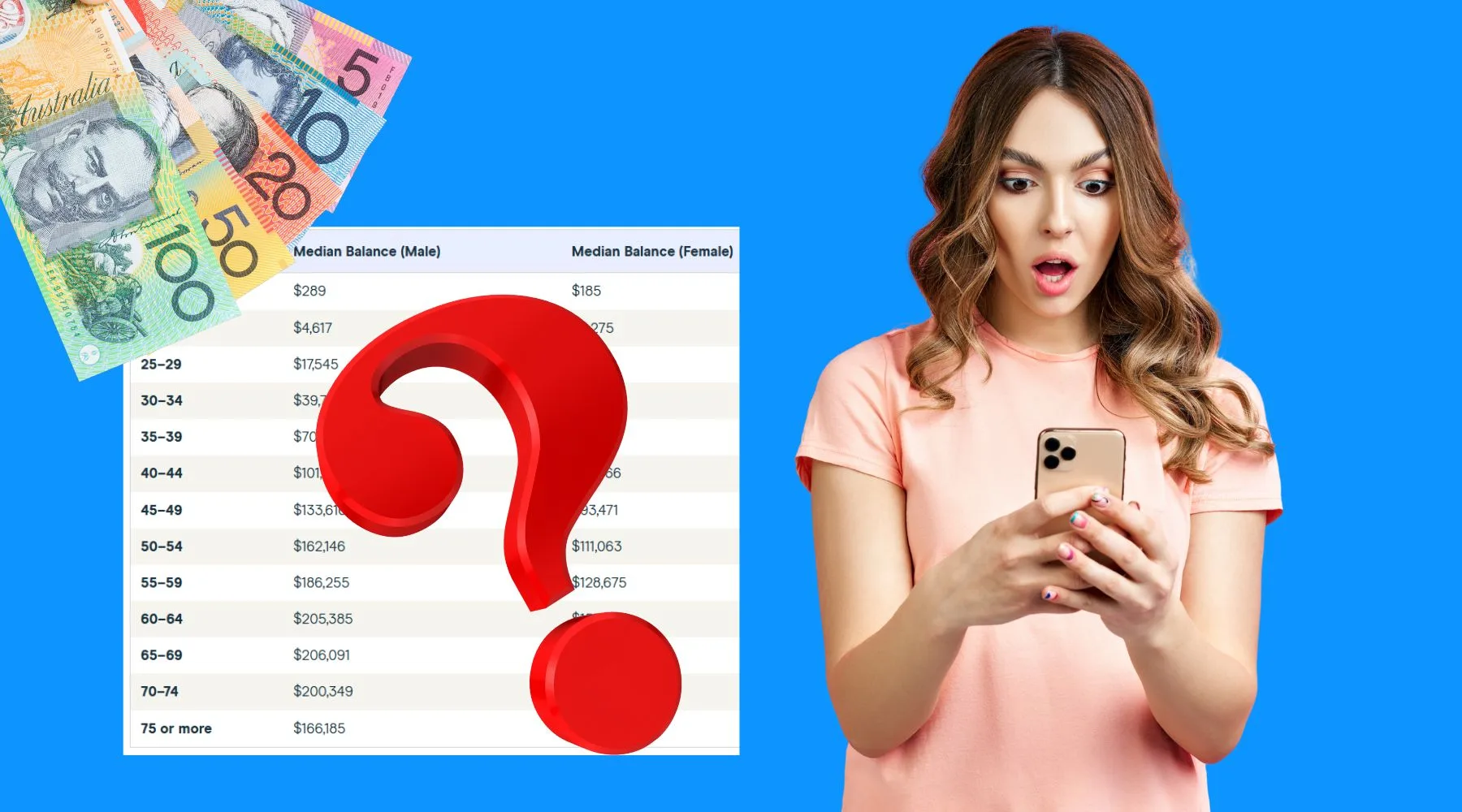

Median super balance by age

Let's take a look at the median super balance for each age group (again, the median figure gives a more realistic picture than the average).

| Age Range | Median Balance (Male) | Median Balance (Female) |

|---|---|---|

| Under 18 | $289 | $185 |

| 18–24 | $4,617 | $4,275 |

| 25–29 | $17,545 | $17,840 |

| 30–34 | $39,796 | $34,327 |

| 35–39 | $70,181 | $54,391 |

| 40–44 | $101,231 | $74,066 |

| 45–49 | $133,616 | $93,471 |

| 50–54 | $162,146 | $111,063 |

| 55–59 | $186,255 | $128,675 |

| 60–64 | $205,385 | $153,685 |

| 65–69 | $206,091 | $191,475 |

| 70–74 | $200,349 | $198,005 |

| 75 or more | $166,185 | $161,201 |

As you can see, the median balance is fairly similar for men and women until around the age of 35, where women have less super.

The median super balance for men in their early 30s is $39,796, while for women it's $34,327.

One you're in your late 40s, this jumps to $133,616 for men and just $93,471 for women.

Compare Super funds

Time to switch super funds? Compare the performance of 300+ super options over the last 10 years!

How to boost your super balance

It's worth noting that according to the ASFA, none of us are really on track to have enough for retirement.

It suggests Australians need to retire with $595,000 (or $690,000 for couples) to have a comfortable retirement.

There are a few key things you can do to really boost your super balance while you're still working.

1. Consolidate funds

If you have more than one fund open in your name, consolidate them right away. Having multiple funds means you're wasting money on fees across multiple accounts.

2. Choose the right fund

Compare your current super fund against others in the market and make sure you're in a top-performing super fund and that it has low fees.

3. Invest in more growth assets

While you're young (in your 20s, 30s and 40s), it's a good idea to invest your super in a growth or high growth option. You have plenty of time to ride out any market falls, and investing more heavily in growth assets (like shares) will increase your chances for better returns over the long term.

4. Make extra contributions

Small, regular contributions into your super will have a big impact by the time you retire. Plus, you can make these contributions via salary sacrifice and save money on tax at the same time (here's how to do it).

Sources

Ask a question