A distant dream: 37% of Australians say they’ll never afford a home

Despite falling property prices, young people are feeling more disheartened than ever about their prospects of owning a home, according to new research by Finder.

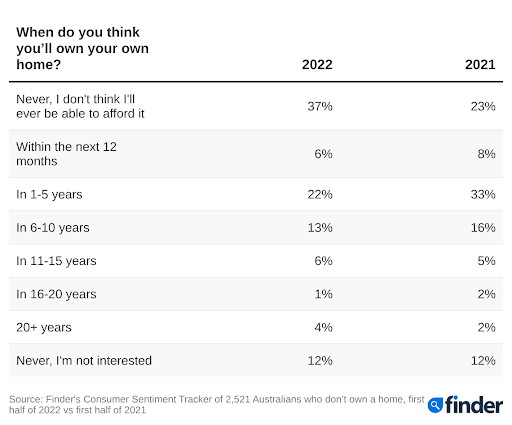

A nationally representative Finder survey found more than a third (37%) of non-homeowners say they don't think they will ever be able to afford a home, a substantial increase from 23% in 2021.

Among gen Z non-homeowners, the percentage who feel they will never be able to afford property has increased from 6% in 2021 to 15% this year, while for millennials it has grown from 21% to 34%.

Investment bank Jarden forecasts property prices in Australia could fall by as much as 20% over the next 18 months.

A 20% decline would knock $280,000 off the median Sydney house and $189,800 off a house in Melbourne.

Richard Whitten, home loans expert at Finder, said it was sad but understandable that many young people were worried about the prospect of owning a home.

"House prices have skyrocketed over the past few years, and have become downright ridiculous in some areas.

"But with economists predicting a recession and interest rates finally rising from their rock-bottom lows, it's likely we'll see house prices fall in the second half of 2022, especially in Sydney where prices can be more volatile."

Finder research shows more than 1 in 4 (26%) Australians believe property prices in their area will decrease over the next 12 months, compared to just 7% last year.

Whitten said given the strong price growth of recent years, a small decline in prices doesn't help housing affordability all that much.

"That said, the situation should improve as interest rates continue to climb, and prices fall further.

"This is a good opportunity for aspiring homeowners to get in while prices are lower, and balance out the extra costs that will come with rising mortgage rates."

Finder research shows only 27% of Australians believed it was a good time to buy property in March, a record low and down from a peak of 67% in December 2021.

That figure has since increased slightly to 33% in July, indicating that some may be starting to see the potential in a declining housing market.

Whitten said not everyone can afford property, and some don't even want to.

"Australians are obsessed with property, but there are other ways to build your wealth.

"Start with keeping your cash in a high interest savings account. Savings rates are becoming much more competitive, and as they increase all that interest you earn will compound.

"Share trading is also a way to build wealth, and you can get started with as little as a dollar with some platforms, or even investing your spare change through micro-investing apps.

Looking for ways to save money? Here's 50 practical money-saving tips.

Ask a question