Korean won cryptocurrency purchases rising significantly in October

After a quiet year to date, the Korean won is coming back to crypto markets in a big way.

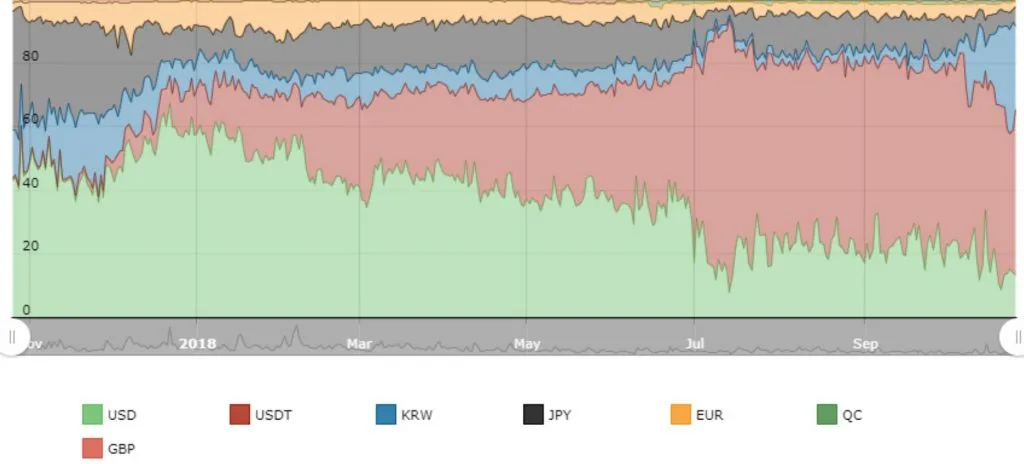

The Korean won is heading back to crypto, points out eToro senior analyst Mati Greenspan, looking at the following chart from CryptoCompare.

The so-called "kimchi premium", which refers to the phenomenon of higher cryptocurrency prices on Korean exchanges as seen in the 2017 surge, has not returned but Korean won trades certainly have. It's been relatively quiet throughout 2018, but October has seen the Korean won come back in a big way.

The so-called "kimchi premium", which refers to the phenomenon of higher cryptocurrency prices on Korean exchanges as seen in the 2017 surge, has not returned but Korean won trades certainly have. It's been relatively quiet throughout 2018, but October has seen the Korean won come back in a big way.

One theory is that this reflects ongoing turbulence in traditional markets, and a shifting of more assets to the now comparatively reliable-looking cryptocurrency markets. Last week, for example, the DOW dropped 3% and saw quite wild swings day to day, while bitcoin ended the week up 1%.

However, at the same time, Japanese yen trading volume has been declining as the won gains steam, which might suggest that there are factors beyond a straightforward shifting of capital from traditional to crypto markets.

This might be explained by a recent spate of high-profile heists from Japanese cryptocurrency exchanges though. The world's largest cryptocurrency heist to date saw over $500 million in crypto go missing from Japan's Coincheck exchange. And around 20 September – right as the yen trading volume started disappearing – $60 million disappeared from Japan's Zaif exchange. It's possible that these incidents have dissuaded crypto traders in Japan or caused them to start using the won out of Korean exchanges instead.

And there might not be any new developments in Korea which could account for the sudden shift. On the contrary, the industry recently received a regulatory blow when it emerged that Korea's cryptocurrency exchanges would no longer be afforded the same venture firm tax benefits as other local startups and would lose these advantages at the end of the year.

Disclosure: At the time of writing, the author holds ETH, IOTA, ICX, VET, XLM, BTC and ADA.

Latest cryptocurrency news

-

The Coinstash Cryptocurrency Hub

30 May 2024 |

-

Ordinals and runes – the new crypto craze?

24 Apr 2024 |

-

Join the party: Finder’s giving away $200K worth of Bitcoin

23 Feb 2022 |

-

Australians have spent $50.9 million on crypto trading fees

31 Jan 2022 |

-

Stablecoins vs Bitcoin: What’s the difference?

3 Nov 2021 |

Picture: Shutterstock

Ask a question