What are the Finder Personal and Car Loan Awards?

Finder's Personal and Car Loan Awards recognise market-leading secured, unsecured and car loans, with a ratings methodology that compares features for 600 loans in our database.

Why you can trust our research

Selection criteria

Providers were included in the categories if their products were currently available, Finder had a full data set for the previous 12 months, and met the following criteria:

- Personal Loans - Secured: Not a car loan, requires security and has a valid interest rate.

- Personal Loans - Unsecured: Does not require security and has a valid interest rate.

- Car Loans - New: Car loan available for new vehicles.

- Car Loans - Used: Car loan available for used vehicles.

- Car Loans - Electric Vehicles: Car loan specifically for "green" or "electric" purposes.

Scoring

Metrics scored using either the tiered scores when dealing with categorical data points or a dynamic scoring when dealing with numeric data. Finder's dynamic scoring means a product's metric is scored in comparison to the data points of all the other competitor products.

| Features | Scoring method |

|---|---|

| Interest rate | Dynamic scoring |

| Monthly service fee | Dynamic scoring |

| Application fee | Dynamic scoring |

Weights

| Features | Unsecured | Secured | New car | Used car | Electric car |

|---|---|---|---|---|---|

| Interest rate | 70% | 70% | 80% | 80% | 80% |

| Monthly service fee | 15% | 15% | 10% | 10% | 10% |

| Application fee | 15% | 15% | 10% | 10% | 10% |

Final award score

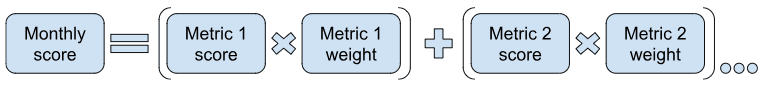

The final award score is calculated by first calculating a score for each of the previous 12 months. This evaluates each product against the competing products in those particular months. This score is calculated by multiplying the score for each metric by the weight percentage and summing the weighted scores:

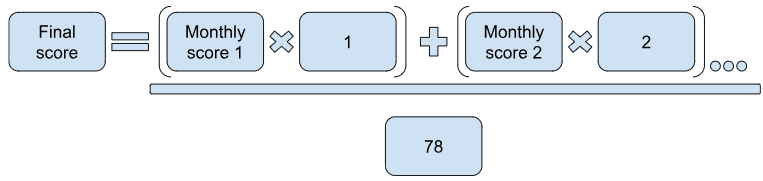

The final award score is calculated by taking a weighted average of the monthly scores with more recent months being weighted progressively more. This final award score is then ranked to determine the overall winners for each category.

Ties

In the event of a tie between two loans, Finder uses profile-based scoring to decide a winner.

More guides on Finder

-

Car loans for pensioners

On a pension but need a new car? There are still many choices if you know where to look.

-

Compare car loans for classic cars

Want to buy a classic car but don't have the ready money? There are still financing options available for classic vehicles. Find out what loans you have to choose one and which one will work best for you.

-

Car loans for casual workers

You can still get a car loan even if you work casually, and there's a range of loans for you to choose from. Find out here how you can get finance for your next car and which loan might be best for you.

-

Quick car loans

You don't need to wait to get car financing. Some lenders can approve you instantly and send your funds on the same day. You can also consider pre-approval. Find out all the ways to get a quick car loan in this guide.

-

How long will it take for your car loan to be approved?

Read our guide to the approval times for popular lenders and how the application process works.

-

Tesla Superchargers Map: Where you can charge in Australia

Find out the extent of Australia's Tesla Supercharger network with our complete map of every charging station.

-

Can you pay off your car loan early?

Repaying your car loan early can save you money, but some lenders impose restrictions and charge additional fees.

-

Compare car loans for students

Ready to get behind the wheel of your own car? Find out how you can get a loan as a student.

-

How to find the best caravan loan in Australia

Don't buy a new caravan until you've read this guide. Find out exactly what financing options are available and how to compare your caravan loan options to find the right loan for you.

-

Used car loan rates Australia

You can still get a car loan if you want to finance a used car. Find out how you can get a used car loan and see what rates are available for the used car you want. Learn how to best compare lenders and apply for your loan today.