June 2021: In response to the Select Committee on Australia as a technology and financial centre, Finder prepared the following submission. Visit our government submissions hub for more Finder submissions to government consultations and inquiries.

In this submission, we focus exclusively on the topic of cryptocurrency along with the decentralised finance (DeFi) and centralised finance (CeFi) industries that are forming around it. In our first submission to this Select Committee in December 2019, we stated that there is a strong need for a clearer legal and regulatory framework when it comes to blockchain and cryptocurrency in Australia. The need for clarity has become more urgent in the 18 months since that submission, particularly as DeFi and CeFi businesses have taken off around the world.

Finder.com.au ("Finder", "we") is a global fintech that helps consumers all around the globe make better decisions about a range of complex products and services. In Australia, more than 2.5 million Australians use our comparison tools, decision engines and educational material each month.

We compare over 1,800 brands across more than 100 product categories, including credit cards, home loans, transaction accounts, savings accounts, insurance products, superannuation, telecommunications, energy, cryptocurrency platforms and shopping deals. Finder is a business set-up by three Australians that has remained independent over the years despite significant growth taking it to over 400 employees around the world across six different offices. We exist to help people make better decisions and our co-founders that still run the business have never lost sight of the transformative capacity of technology to help improve people's lives.

Finder has been an active participant in both the blockchain and cryptocurrency sectors in Australia and around the world since 2017. The Crypto Finder section of our site provides consumers guides, news and comparisons in relation to cryptocurrency and has received over 1 million visits in Australia in the last 12 months alone. We also have a Crypto Finder YouTube channel that has a highly engaged audience of over 12,000 subscribers. Finder parent company Hive Empire has also launched and sold an over-the-counter cryptocurrency brokerage called HiveEx, which provides trading services to high-net-worth individuals, family offices, businesses, funds and trusts. More recently, we have made it possible through Finder Wallet Pty Ltd to buy Bitcoin and Ethereum in a matter of seconds through the Finder App. Finder co-founder Fred Schebesta is also a fellow of Blockchain Australia.

This submission has been split up into three sections:

- Section 1: Finder consumer research on cryptocurrency in Australia: In this section, we use our significant base of consumer research to demonstrate that consumer interest and uptake in cryptocurrency is significant and growing in Australia.

- Section 2: The scope and size of the global DeFi & CeFi opportunity: In this section, we collate research from around the globe to demonstrate the size and nature of the opportunity presented by decentralised finance and centralised finance around the globe.

- Section 3: Policy settings to encourage cryptocurrency innovation in Australia: In this section, we will provide some specific ideas for policy settings that could make the most of the growing consumer demand and burgeoning market in this space. These include introducing a regulatory sandbox, a specific regulatory unit, a new accreditation scheme for crypto deposit holders and a RBA-backed stablecoin.

We have written each section such that they can be read and referenced independently but we believe that in combination they make a strong case for policy settings that encourage innovation in this space in Australia. As always, Finder is very happy to provide further information or answer questions on anything provided in this document.

Section 1: Finder consumer research on cryptocurrency in Australia

Finder is a research-led business that does consumer surveys on a regular basis. Our flagship survey is the Finder Consumer Sentiment Tracker which is a live, nationally representative study of the Australian public. Designed by Finder and conducted by Qualtrics, it aims to track consumer sentiment in Australia on an ongoing basis. The survey so far covers a sample of over 23,000 Australians and is growing by over 1,000 respondents every month.

The findings related to cryptocurrency outlined below come from the January 2021 and the June 2021 waves of the Finder Consumer Sentiment Tracker. The January figures represent a sample of 1,004 whilst the June figures represent a sample of 1,012. Both are nationally representative and comparable.

How many Australians own cryptocurrency?

Finder research from June 2021 shows one in six Australians (17%) owns cryptocurrency. While this hasn't changed since January this year, the number of people who say they plan to buy cryptocurrency has increased from 8% to 13%, and the number of people who don't own cryptocurrency and don't plan to has decreased from 75% to 70%.

Bitcoin remains the most popular cryptocurrency, but only just. Bitcoin is owned by 9% of Australians, while 8% say they have Ethereum. This is followed by Dogecoin (5%) and Bitcoin Cash (4%). Bitcoin ownership has fallen 4 percentage points from 13% in January.

Looking at these figures from a demographic perspective, men (23%) are more than twice as likely as women (11%) to own cryptocurrency. Generationally, close to a third of Gen Z own cryptocurrency (31%), a figure that has more than doubled since January 2021 (15%). In comparison, the number of Millennials owning cryptocurrency has decreased from 33% to 24% over the same period. Gen X is also less likely to own cryptocurrency in June (13%) compared to January (18%), while the number of Baby Boomers with digital coins has remained consistently low at just 2%.

What are the reasons Australians do and don't buy cryptocurrency?

Close to one in three (30%) Australians who purchased cryptocurrency say they did so to diversify their portfolio. One in four (24%) purchased cryptocurrency because they say it is going up in value. This figure has fallen from 45% in January to 24% in June.

Other reasons Australians have bought into digital coins include not wanting to miss out (17%) and for the novelty factor (11%). Compared to January, these reasons have become more prevalent, increasing from 8% and 7% respectively.

When it comes to reasons Australians don't buy cryptocurrency the most common response is the perception that it is too volatile or risky (43%). The belief that cryptocurrency is volatile and risky has become more common since January, when 29% said this was the reason they hadn't bought digital coins. One in three (32%) haven't bought cryptocurrency because they would rather have money in shares or savings, and a further 25% think it's overvalued. The number of Australians who believe cryptocurrency is overvalued has grown 9 percentage points from 16% in January.

Interestingly, our research shows men are more likely than women to be reluctant about cryptocurrency because of the belief it's too volatile or risky (50% compared to 37%) or because they think it's overvalued (34% compared to 17%). Meanwhile women are more likely to say they are not sure how to buy it (27% compared to 16%) and that they don't know what cryptocurrency is (26% compared to 11%).

What do Australians think about the future of Bitcoin?

Our research also asked our nationally representative sample of respondents about their view on some future-facing statements relating to Bitcoin. The majority of respondents think Bitcoin is a bubble and that it is a purely speculative asset at 73% and 63% respectively.

Strikingly though, we found that more than a third of Australians (35%) believe Bitcoin will eventually be transacted more widely than fiat currency. Among Gen Z, that figure grows to 52%. There is clearly a belief, particularly with younger audiences that it will inevitably become the future of money.

Section 2: The scope and size of the global DeFi & CeFi opportunity

In this section, we will explore the particular opportunity presented by the decentralised finance (DeFi) sector globally. This is an important segment of the cryptocurrency industry for policy decisions due to both its high-growth in the last year and the potential benefits it offers to consumers in Australia and around the world.

What is decentralised finance (DeFi)?

Decentralised finance or "DeFi" is a term that broadly refers to a category of blockchain and cryptography based applications that provide the equivalent of products and services found in the traditional financial services sector.

This includes services like loans, payments, currency exchanges, yield products, insurance, crowdfunding and derivatives. This is made possible thanks to smart contract blockchains such as Ethereum. "Smart contracts" are blockchain based programs that are executed when certain conditions are met, generally without third party or further intermediary input. These smart contracts enable developers to build complex offerings. These services built on decentralised platforms are often called decentralised apps, or "dapps".

A pure-play DeFi service differs from traditional financial services in a number of ways including:

- Managed by code rather than institutions - Rules are set-up in the code of the Dapps which are visible to all users. Once live, they run with almost no human involvement.

- Fully transparent - There is transparency in the code that drives the application and the flow of actions or transactions on the service so that activity can be scrutinised by users.

- Global with no gatekeepers - Anyone can build and use Dapps. There are no applications or lengthy processes. Users can plug-in and go anywhere with the internet.

- Interoperable as standard - Dapps are built on decentralised platforms that are often highly interoperable. This allows users to combine apps to achieve new outcomes.

In contrast, traditional finance services are dominated by large institutions with lots of intermediaries and complexity whilst processes and transactions are rarely transparent. Applying for products is time-consuming, services rarely cross borders and interoperability is only becoming possible thanks to the advent of things like Open Banking.

There are also a number of Centralised Finance (CeFi) offerings that sit somewhere in between. These offer crypto-based products but are managed by a central entity. This is the model for many of the biggest businesses in this space globally like Binance and Coinbase.

How big is the DeFi market today and how quickly is it growing?

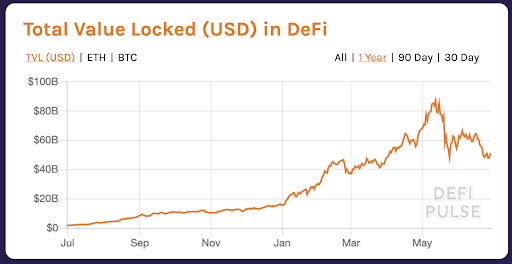

When outlining the features of DeFi, it makes sense that there is considerable interest in these services. The last two years in particular have seen extremely high-growth in this industry. According to a report from The Defiant in December 2020, in just one year:

- The value of digital assets locked in DeFi increased by 1800%, from $670 million USD to $13 billion USD

- The volume of trading on DeFi exchanges grew by 3700% from $500k USD to over $19 billion USD

- The number of DeFi user wallets grew by a factor of 1100%, from 100,000 to 1.2 million

Since the release of the above report, growth in DeFi has taken on an even steeper trajectory across the course of 2021. At the time of writing and according to the same sources, there is now:

- Over $48 billion USD locked in DeFi contracts (up over 4x since December)

- More than 2.8 million DeFi user wallets (up over 2x from December).

Others estimate that these figures may be even higher. Research by Morgan Stanley from June 2021 suggests the total value locked in DeFi is over $80 billion with a 65:15 split between Ethereum and Binance Smart Chain projects. Regardless of which figures you look at, it is clear that there has been a global boom in interest for DeFi projects, particularly in the last 6 months.

One of the foundations for the DeFi ecosystem is cryptocurrency assets referred to as 'stablecoins'. The most common stablecoins are cryptocurrencies which are pegged to the US Dollar. These are generally minted and redeemed at a 1:1 rate and the largest three US Dollar stablecoins (Tether, USD Coin and Binance USD) have a market capitalisation of over $90 billion USD at the time of writing.

While the need for a fiat-backed digital asset may first seem unintuitive, their adoption has been fueled by two realities;

- People want to convert their cryptocurrency into less volatile assets from time to time.

- People want to retain the benefit of cryptocurrencies

Stablecoins retain the full feature benefits of existing on blockchain based technology. Accessible at any time, high-speed transactions, zero international transfer fees and secure ownership through virtual or physical wallets. At the same time, stablecoin users can simply redeem stablecoins through the issuer at a 1:1 rate and re-enter the traditional system. Stablecoins can be seen as one of the gateways between the traditional and DeFi financial systems.

Section 3: Policy settings to encourage cryptocurrency innovation in Australia

As we can see in Section 1, consumer interest in cryptocurrency in Australia has already arrived with nearly 1 in 5 Australians already owning at least one type of cryptocurrency. At the same time, Section 2 shows that the market for DeFi offerings is growing rapidly around the globe and is set to offer value to millions of consumers in Australia and around the world in the coming years.

Currently, we see this demand being served mainly by overseas projects but this could change quickly. The Australian Government has the opportunity to use this new industry as a lever for economic growth whilst also implementing regulations to protect Australian consumers. This is a fleeting moment for Australia and the stakes are high.

The possible upside here for the Australian economy is significant. Attractive policy settings could make Australia the international hub for decentralised finance and achieving this would mean flow-on economic growth, tax revenues and job creation that could benefit our overall economy. Simultaneously, a consumer-centric approach to introducing these settings will ensure that Australian consumers are protected in this uncharted new market.

The risks of failing to act are also significant. The people and capital in this space tend to be highly geographically mobile due to the borderless nature of this technology. Projects regularly choose to not operate in markets considered to be overregulated, underregulated or otherwise uncertain. Australia will quickly lose some of our most promising businesses, engineers and leaders if we do not act. Instead, these people would choose to build, innovate and bring to life their vision from overseas markets that are better suited to innovation.

The opportunity in a nutshell: Australia as a regional hub of DeFi funds

Australia, with its strong banking sector and fair laws, could establish itself as the regional centre for cryptocurrency holders to deposit their funds in our crypto custodianship regime. This could bring a multi-billion dollar inflow of funds into the country and establish a flourishing industry for Australia creating more jobs and growing tax revenues. Cryptocurrency is already a trillion dollar industry and the net benefit to Australia so far has been limited. Australian-based projects choose not to domicile here because the regulation is unclear. A collaborative public-private framework is needed to help these Australian projects compete globally. Get this right and we'll see new companies, new government revenues and the potential for thousands of jobs in the next decade.

In the remainder of this submission, we present a number of recommendations for policy settings that would help to make this opportunity a reality.

Recommendation 1: Introduce a sandbox for cryptocurrency projects

Our first recommendation in this submission is the introduction of a regulatory sandbox designed specifically for innovative cryptocurrency and DeFi products in the Australian market.

Sandboxes allow approved participants to test new concepts in the market with lighter regulatory requirements alongside clear oversight from regulators. This approach creates a win-win outcome for both private entities and regulators as shown in a research paper by the World Bank which reviewed 73 unique fintech sandboxes in 57 countries.

The research found that for regulators, sandboxes provide an evidence base from which to make policy decisions; influence future supervisory methodology; help to define, create, or amend regulation; and, in some cases, support the regulator's competition mandate. For firms, it found sandboxes have been shown to offer a faster route to market and a better understanding of the regulatory environment. From a macro perspective, the indirect benefits include spillover effects into the overall fintech ecosystem, spurring consumer-centric products, and signaling that the market is open to innovation.

Importantly, these sandboxes also help to create a collaborative relationship between innovative businesses and forward-thinking regulators with open and reciprocal channels of communication in place. This gives regulators a rare opportunity to be proactive in their policy approach as opposed to reactive approach when something goes wrong.

One way to introduce a sandbox for cryptocurrency and DeFi projects would be to extend the current Enhanced Regulatory Sandbox run by ASIC to allow for these offerings. This is the approach favoured by the Financial Conduct Authority in the UK which has been accepting crypto asset and blockchain propositions into its fintech sandbox since 2018. It is also the approach favoured by the recently introduced fintech sandbox in Spain which has accepted a number of cryptocurrency projects in its first cohort. However, it is important to note that many DeFi projects are still excluded from the UK sandbox as stablecoins are considered outside of the jurisdiction of the Financial Conduct Authority. If this approach was taken, we would advocate for a cohort of the Enhanced Regulatory Sandbox specifically designed for blockchain, cryptocurrency, DeFi and stablecoin-based projects. The alternative would be to create a new sandbox regime altogether. This would require more work and investment but would allow for a completely bespoke approach that might be better suited for the industry.

Any sandbox should have a number of limitations. Firstly, like the current Enhanced Regulatory Sandbox, the scope of projects that can be included should be limited to only the projects likely to lead to a net benefit for Australian consumers. A key part of the application process for the sandbox should be to explain to the regulator in layman's terms how Australian consumers could benefit from this innovation. Secondly, there should be clear requirements for participants on what they need to report to the regulator to ensure that communication between parties is clear and transparent. What is being reported will depend heavily on the type of project included but details around numbers of customers onboarded, amounts invested or yield accrued could all be made mandatory.

Importantly, we do not advocate for limitations for any sandbox created based on customer numbers, geographical region or financial thresholds. All of these could limit consumer benefit if a particular project proves to be successful. We advocate for a sandbox with strong controls in place but a significant upside if projects work for consumers and regulators alike.

Recommendation 2: Introduce a specialised cryptocurrency regulatory unit

Finder also recommends the introduction of a specialised regulatory unit to take oversight of cryptocurrency and DeFi regulation in Australia. This sits alongside our first recommendation as this unit would be well placed to take the lead if a regulatory sandbox were to be introduced. This is an approach also suggested in the transitional mechanisms section of the World Economic Forum DeFi Policy Maker toolkit released in June 2021.

The report notes that: "Creating a targeted desk with qualified staffing can serve as an initial gateway to gain experience in new technology, interact with the industry and provide guidance. This knowledge can be shared with policy-makers and actions may include issuing non-action letters under existing regulatory regimes. These groups may provide legal clarity to DeFi projects and encourage early-stage discussions with regulators. Regulators should also invest in technology and technical expertise to understand these markets more effectively. Though initially small and limited in authority, these units quickly became an important point of contact for both internal and external communities".

We also note that a number of jurisdictions have already taken this approach, with the FinHub created by the US Securities and Exchange Commission (SEC) which was upgraded to a formal stand-alone office in late 2020. The FinTech Desk created by Switzerland's financial regulator (FINMA) is another example.

Finder would support the introduction of a specialist fintech regulatory function or department at a federal level in Australia. We would also support this function having a sub-unit focused specifically on cryptocurrency and decentralised finance projects. These are complicated sectors that require deep domain expertise to be well enforced. We would also welcome a recruitment push for any new unit created to ensure it has the skills and expertise required to do this work well.

Recommendation 3: Introduce an accredited cryptocurrency deposit holder scheme with an associated code of conduct

Another option the Australian Government could explore is a new accreditation framework for Australian-based cryptocurrency deposit holders. Consumers in Australia and around the world are looking for a safe place to deposit their cryptocurrencies and an accreditation framework in Australia could address this issue. The accreditation system used for the Consumer Data Right is a good example of a Government-led accreditation framework that could be replicated.

Getting the right level of compliance requirements for this accreditation framework would be the important thing and we would welcome further consultation on this topic if a new accreditation framework was to be considered. The challenge will be setting the requirements at a level that protects consumers whilst also ensuring the compliance burden does not make the framework unattractive or overly expensive for projects in the space. This will ensure that accredited Australian cryptocurrency deposit holders are able to compete with offshore projects not subject to the same requirements.

Again, we would advocate for the specialised regulatory unit discussed in Recommendation 2 to manage the accreditation framework if it were to be introduced. If the Government did explore this idea, then a Government-backed code of conduct developed with industry members would also supplement it well.

Recommendation 4: Introduce a consumer guarantee for deposits held with accredited cryptocurrency deposit holders

A more radical idea to complement Recommendation 3 would be to create a Government-backed consumer guarantee for funds held with these newly accredited cryptocurrency deposit holders.

This would significantly improve consumer protections in this space and could be operated like a separate, small-scale version of the Financial Claims Scheme (FCS). The FCS was introduced in 2008 during the global financial crisis to ease consumer concerns about where they held their money. Today, deposits with any accredited deposit-holding institution (ADI) in Australia are protected up to a sum of $250,000. As noted by the Treasury review in 2011, the scheme has never been used but has increased consumer confidence in banks considerably.

Importantly, the FCS is also a post-funded scheme. If an ADI fails, the Government will provide funds to depositors through APRA. The Government would then recover funds through a priority claim on the assets of the insolvent ADI in the liquidation process. If the assets were insufficient to meet the Government's claim, the Government could levy the ADI industry to meet the shortfall.

Th Australian Government could look at replicating a separate but similar consumer guarantee for funds held with accredited cryptocurrency deposit holders to encourage low-level uptake from a broader audience. Setting a guarantee that would protect consumers to the equivalent of somewhere between $500-$1,000 would create protections to the value of less than 1% of the current FCS offered to consumers in the traditional Australian banking system. This feels prudent as it is certainly not unthinkable that cryptocurrencies will make up 1% of Australia's total money supply in the years to come. Indeed, some estimates suggest that Bitcoin could already account for nearly 2% of global money supply.

This solution could be a relatively low-cost way for the Government to introduce some consumer protections in the cryptocurrency sector. By setting a Government cryptocurrency guarantee that is significantly lower than the FCS, the Government would also be reinforcing that cryptocurrencies are riskier assets that consumers should treat with caution whilst also signalling that the Government is cautiously open to innovative new products and services in this space.

Recommendation 5: Introduce a transparent, Australian-based stablecoin

The Reserve Bank of Australia (RBA) has stated it is working with CBA, NAB, Perpetual and ConsenSys to develop a proof-of-concept central bank digital currency (CBDC) for wholesale settlement on an Ethereum-based distributed ledger. We look forward to reading the public report on this project that will hopefully be released soon. However, from a retail perspective, the RBA stated in September 2020 that it is still unconvinced on the public policy need for the introduction of a CBDC in Australia.

Our view is that this paper from the RBA misses the opportunity that an RBA-backed stablecoin could provide in tax revenue to the Australian Government in a DeFi sector that is growing quickly.

What is a stablecoin?

Stablecoins are a type of cryptocurrency that peg their market value to an external asset. The idea is that these external reference points help to stabilise the value of these assets. Today there are over $100bn USD of stablecoins in circulation with popular coins such as Tether, USD Coin and Binance USD being pegged to the US Dollar.

Currently there are very few stablecoins linked to the Australian Dollar and the tax income from those that do exist is extremely limited. We see a scenario where the RBA could set-up an Australian Dollar backed stablecoin to operate on a decentralised platform like Ethereum that takes a very small fee for each transaction to fund the Government's work in this space. To demonstrate the potential here, there is currently around $75bn USD of stablecoins being traded every day. If the RBA successfully introduced a stablecoin that gained 5% of this volume then this would equate to more than $1 trillion USD of the RBA-backed currency being traded a year. A Government levy of just 0.01% on these transactions could be worth more than $135m USD ($178m AUD) in funding for Government projects. Obviously, the upside here in tax revenues could be much higher with factors like the growth of DeFi, stronger market share for the RBA-stablecoin and/or a higher levy being charged all leading to increased income for the Government.

Importantly, DeFi users already expect these types of small transaction fees. So-called "gas-fees" exist on all platforms and help to support the integrity of those platforms. An additional small surcharge to support an innovative, Government-backed stablecoin is likely to be well received by the cryptocurrency ecosystem - particularly if these funds were ringfenced for cryptocurrency related innovations such as those recommended above.

If the RBA did not want to get involved in a direct issuance of an AUD-backed stablecoin then this should not deter other private entities from doing so. This type of AUD-based stablecoins could be created and issued by businesses and backed by reserves at the RBA or a custodian or a new crypto fund manager. Again, these stablecoins could benefit from an industry-developed and Government-backed code of conduct. Currently the leading AUD-backed stablecoin is not operating out of Australia.

Ask a question