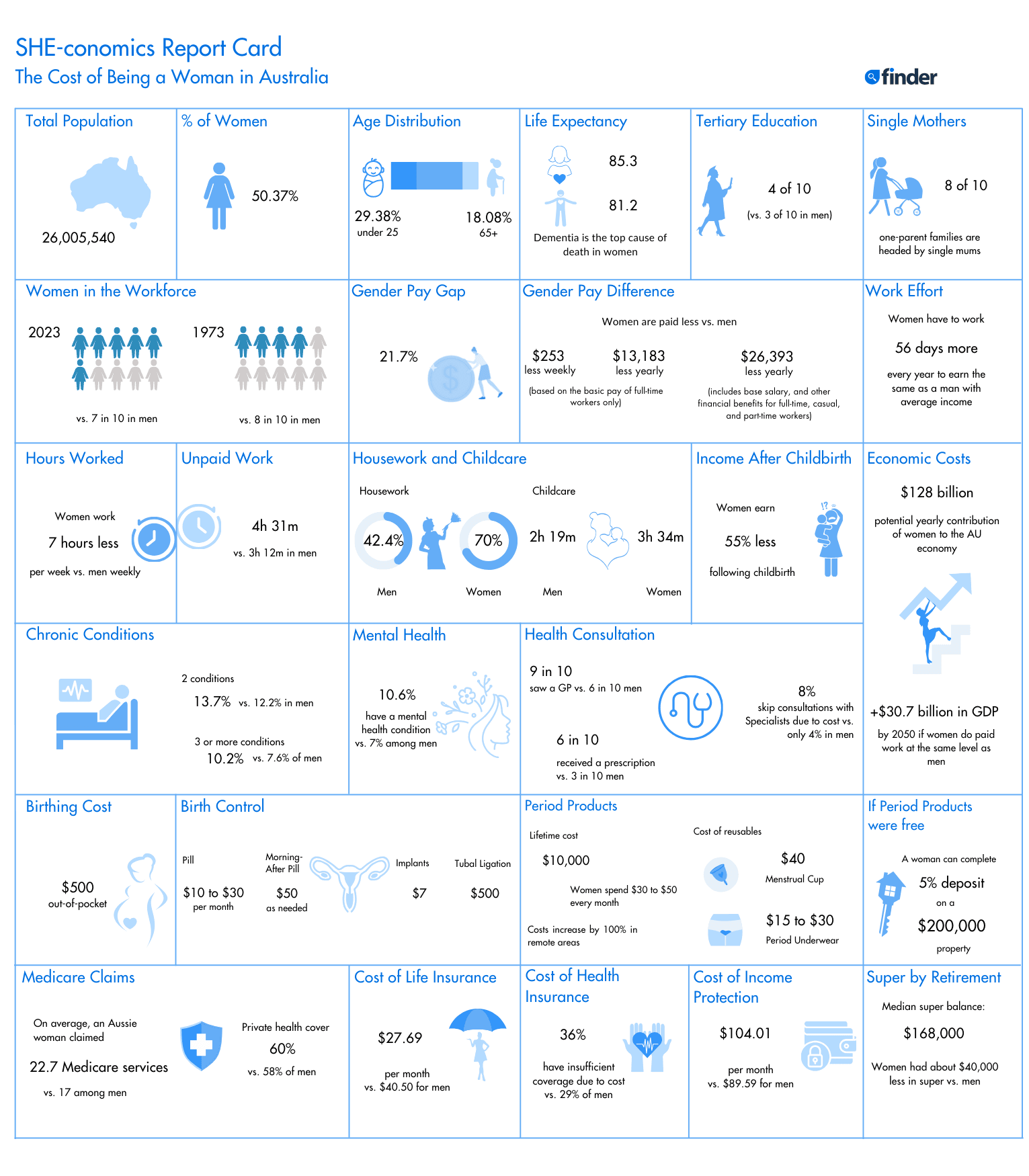

'Fairness' and 'equality' have been driving norms in democracies like Australia for decades. Surprisingly, when it comes to matters affecting women, including the gender pay gap and pink tax, the double standards are glaring.

Even when the law has upheld Aussie women's rights to equal work for equal pay since 1972, women still make $26,000 less every year than men.

But that barely scratches the surface of the gender pay gap and the stark differences in women and men's wealth couldn't be any clearer. As subtle as it seems, even the "pink tax" — premium women pay for basic tees, tampons, and even healthcare is a hidden invoice slapped for simply being a woman.

This year's International Women's Day call to action, "Count Her In: Invest in Women. Accelerate Progress." presents an apt time to examine how far we've come to championing Aussie women's rights to accessing economic opportunities — in the workplace and everywhere their finances and well-being are impacted.

What is the real cost of being a woman in Australia? Are we building a fairer Australia where opportunity knows no gender?

Money and financial security

Finder cost of living report revealed women (58%) reported financial difficulties more than men (46%).

Finder CST also reveals Aussies have $37,179 in savings. Men enjoy a hefty amount of cash tucked away ($52,655), while women enjoy only about half as much ($23,223). As for the availability of emergency funds, women are confined to just a third ($6,859) of what men have ($17,832) available at any given time.

The trend can be expected to continue in retirement. Among the 65+ years population in 2019 and 2020, women had about $40,000 less in super than men.

Is the gender pay gap real?

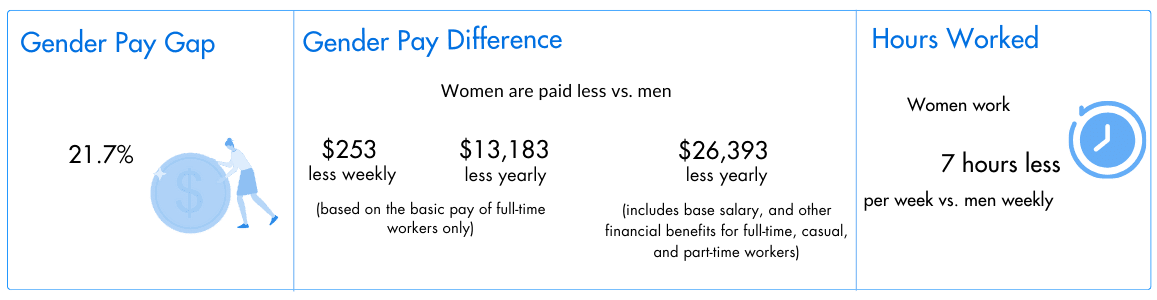

Many attempt to debunk gender pay gap and dismiss it as a myth but data shows Aussie women endure a 21.7% gender pay gap. For every dollar a man earns, a woman gets paid just 78 cents. The WGEA gender pay gap statistics cover base salary, overtime, bonuses, and other financial remuneration for full-time, casual, and part-time workers.

Even when only the base salary is considered, women still earn $13,183 less than men and have to work 56 days more every year to earn the same amount as a man with an average income.

Compared to men, women work close to 7 hours less weekly which limits their earning potential.

Full SHE-conomics Report Card

Cost of childcare and other unpaid work

Why is there a gender pay gap? Data shows the gap is most prominent between the ages 35 and 64 — corresponding to a woman's most productive years and child-rearing for those who choose to have children. On average, women earn about 55% less following childbirth. This figure slightly increases after five years but remains low for another 10.

Every day, women render close to 1.5 hours of unpaid work and engage in 1 hour less of paid work than men. Women have been inequitably tied to childcare and other domestic activities that limit their energy and time to perform work that pays despite there being more women (35.2%) holding a bachelor's degree than men (28.8%).

SHE-conomics Report Card Cost of Being a Woman in Australia Image: Supplied

Cost of healthcare

Women live longer than men, and for Aussies born between 2020 and 2022, life expectancy is pegged at 85.4 years and 81.3 years, respectively. Australian women's health is better than ever — if age is the only indicator to factor in but quality of life is an entirely different matter.

Can women afford healthcare?

Aussies spent $33.7 billion in out-of-pocket healthcare costs in 2021-22. Over a third was spent on unsubsidised medications.

Men are more likely to die prematurely from fatal diseases like ischaemic heart disease. While women are more likely to suffer from two (14% of females vs. 10% of males) or more (11% of females vs. 7% of males) chronic conditions. They are also more likely than men to be affected by anxiety (21% vs. 12.4% for men).

As a result, women are spending more to manage multiple chronic conditions and closing the gender pay gap could help pay for the added cost burden.

Between 2020 and 2021, women 15 years and over claimed 23 Medicare services on average. But, while 88% (vs. 63% men) of women consulted with a GP, only 8% (vs. 4% men) consulted with a specialist due to cost.

While 60% had private health insurance cover (vs. 58% men), Finder found more women (36% vs. 29% men) claim they have insufficient coverage.

Full SHE-conomics Report Card

Cost of pregnancy

A woman's anatomy predisposes her for pregnancy — but should she be predisposed to pay for the financial burdens that come with a cervix too?

Depending on the conditions of pregnancy and the mum's preexisting health and well-being, delivering a baby could cost upwards of $5,000 without Medicare.

Women with Medicare and private health insurance coverage typically pay up to $500 only, which includes delivery expenses only and excludes hospital fees — coverage of which depends on the health insurance plan availed.

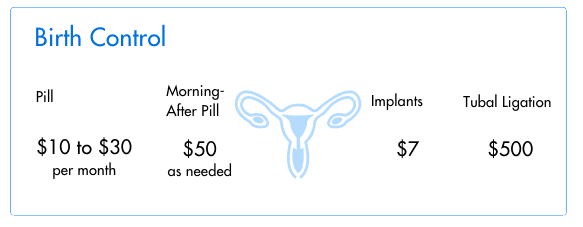

Cost of female birth control

For women who aren't ready to endure the joys and pains of motherhood, the contraceptive pill is often the first option.

The pill was first made available only to married women in Australia in 1961. Though it ushered in a new era where women could plan and time pregnancies, and dedicate more energy to doing work that pays, the pill came with a hefty price tag plus a 27.5% luxury tax on top of that.

The sales tax was scrapped in 1972, and later on, the pill was added to the Pharmaceutical Benefits Scheme (PBS), bringing down the cost to just $1 a month.

Fast forward to this day, Aussie women are paying $10 to $30 per month for the pill, with some brands reportedly excluded from the PBS which significantly raises the cost to $1 a day.

In hindsight, it appears that whatever progress was achieved then has been lost again. Pink tax is at play, women are back to where they started, and the gender pay gap is making it even more difficult to bear the padded costs.

Intrauterine devices (IUD), whether copper- or progesterone-releasing, are available for $150 to as much as $250. Thankfully, with Medicare and their inclusion in the PBS, IUDs now cost as low as $7. Costs recur annually or up to 10 years depending on the type and brand used.

If a woman decides to take a more permanent solution to birth control, tubal ligation can set them back by as much as $1,800 (vs. $1,000 for vasectomy among males). With Medicare and private health insurance, out-of-pocket contributions could fall to $500.

Cost of insurance

Women are charged lower premiums for life insurance due to higher life expectancy than males. Under an HBF policy, a 25-year-old woman who never smoked can get covered for $27.69 per month only (vs. $40.50 for a non-smoking man of the same age).

Women, period products, and vanity

Once again, women are physiologically predisposed to spend on menstrual and period pain products. It's harder to explain, however, the added financial pressure of the pink tax — an added premium price on consumer goods marketed with women in mind that is over the price of a similar product marketed for men.

Cost of period products

Are tampons taxed in Australia? They used to be. Removing the Goods and Services Tax (GST) from menstrual products in 2018 helped provide some relief for women to cover the costs. Still, it only translates to a 9.1% reduction in retail price.

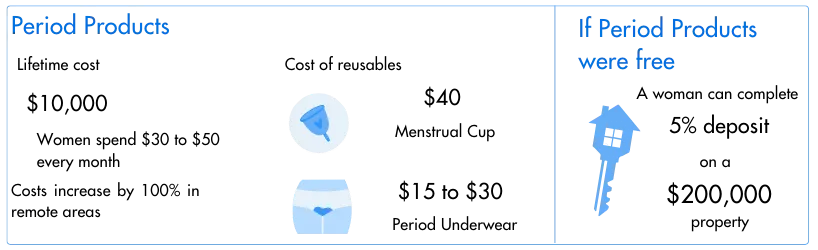

Exactly how much do women spend on period products? Estimates point out a woman will spend roughly $10,000 throughout her lifetime on period products. If she experiences period pain, she'll need more to cover the cost of drugs for pain relief and possibly other underlying conditions. Women in remote areas are already paying as much as 100% more for period products.

Reusable period products seem like attractive alternatives but the upfront cost remains steep. Although a menstrual cup could last up to 10 years, a woman would need at least $40 upfront to buy just one piece today.

Some localities are helping women access reusable period products by providing subsidies. In the City of Fremantle, women can get up to $50 in rebates for buying reusable period products.

If period poverty could be addressed and period products were free, a woman could allocate the resulting savings instead to:

- Complete a 5% house deposit for a $200,000 property.

- Pay for a secondhand car in good running condition.

- Invest in a financial instrument that matches their risk appetite and could earn interest.

- Top up super contributions to maximise returns upon retirement.

Pink tax on consumer goods

When pink tax compounds the gender pay gap, expect a disastrous impact on women's finances — and it's sad how women wouldn't even be able to tell at all.

You'd think a pair of tees from the same brand would cost the same for both sexes. In the absence of a comprehensive report on pink tax statistics, Finder checked out the price tags of women's and men's V-neck shirts from the same brand. A woman's tees were twice as likely to be expensive ($8 vs. $4.50). The same is true for a brand of four-pack hipster undies ($28 vs. $14.40 for men). Another brand also sells women's rash shirts at $20 more ($90 vs. $70 for men).

Even for girls' toys, the pink tax is glaring. Finder found that an identical blue and pink toy car from the same brand were priced differently. The pink variant was $40 more expensive — could it be because it's pink? It's that ridiculous!

As for toiletries, the price differences weren't as bad as they were in previous years. Finder checked the prices for some items from a leading retail supermarket. A four-pack razor from the same brand sells for $6 for both women's and men's variants. A brand of underarm roll-on is priced at $5 for the same quantity for both variants.

Women and self-care

As if the gender pay gap and pink tax aren't enough, women, sadly, elect to spend more on luxuries that drain their pockets — fashion, Botox, and other fleeting trends.

Finder found that 3 in 5 women indulge in self-care services, including hair appointments, teeth whitening, and plastic surgery.

That $431 women spend monthly on skin and hair treatments could've helped cover mortgage raise rises — that is, about a third of the $12,000 annual servicing cost for a $600,000 mortgage. Any resulting savings could help women build an emergency fund or allocate more for investments.

Is it more expensive to be a woman?

Women are already burdened by the gender pay gap and they're spending more on goods and services uniquely necessary for women such as period products and prenatal checkups.

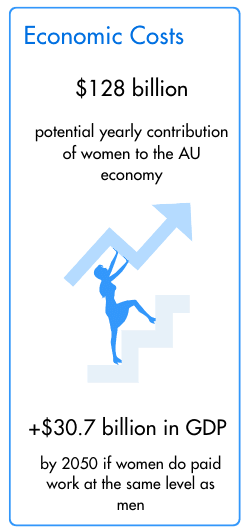

Ironically, women are also working more but are paid less. Although almost half of the Aussie workforce consists of women and more women have college degrees or wave skills certificates, their talents are undervalued.The Women's Economic Equality Taskforce estimates that maximising women's participation in economically productive activities could add $128 billion to the economy every year. If women could get the support they need to participate fully in work that pays, that could add $30.7 billion to the country's GDP and 1 million jobs could be created by 2050.

Barriers have been broken down to help women earn, save, and retire happy — yet so much more needs to be done. The system that feeds the vicious cycle of unfair and unequal playing field which puts women's most productive years to waste badly needs an overhaul. After all, the gender pay gap isn't really about just pay.

It takes changing people's mindsets about women's roles at home, in the office, and in our communities. It calls for new norms that allow women more flexibility to build their careers while continuing to care for their families and themselves. It requires abolishing the absurd pink tax on women's products and services.

More innovative work arrangements, such as working from home, help women stay employed. The Melbourne Institute highlights that giving women at least a day's worth of WFH per week can help reduce unpaid work hours. Another measure that has the potential to help improve women's career advancement is making affordable childcare more accessible.

Lawmakers, employers, peers, and family members — anybody can pitch in to make women's lives easier. So, now you know the high price women pay for being born a woman, how can you help?

Sources

Ask a question