How a pink trading platform won over New Zealand

Sharesies boasts 500,000 Kiwi customers - or one-tenth of the New Zealand population.

When Kiwi investing app Sharesies first looked at entering Australia, its management were advised a pink trading platform would never fly in Australia.

“We were told, ‘I don’t think the pink will work here (in Australia),’” Sharesies CEO and co-founder Sonya Williams shared of the advice given by consultants ahead of their launch.

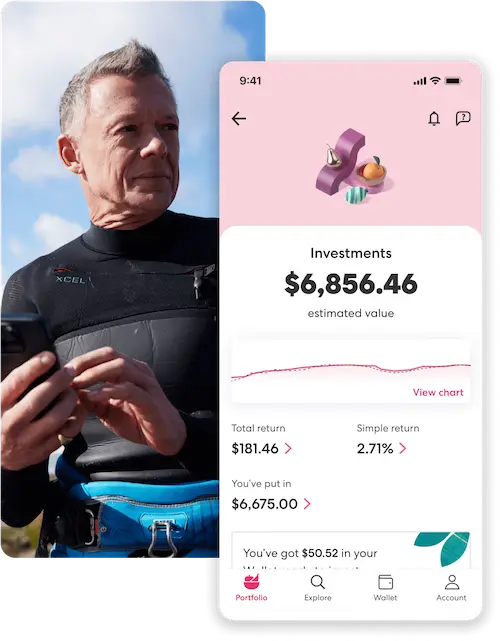

Sharesies app Image: Supplied

Investing is still a male dominated industry and, let's face it, pink is seen by many as a ‘girly’ colour.

“And we really thought about that, because our brand is so important to us.”

Sharesies' arrival in Australia in 2021 already followed huge success in their hometown of New Zealand, where today around 500,000 people – one-tenth of the total Kiwi population – hold an account with Sharesies.

The colour palette didn't seem to be an issue across the ditch.

Filling the gap

Sharesies launched in New Zealand in 2016 and quickly took the country by storm.

Starting with just 6 ETFs, it recorded 10,000 trades within the first 2 months alone.

"At the time, there was really nothing like it," Williams told Finder.

For Kiwis the most common investment was in property – but with house prices sky rocketing in recent years, many at the time felt priced out of the market.

Sonya Williams | Image: Supplied

"We started looking around for alternatives, and there really wasn’t anything accessible for people who were starting out."

Their market research showed while 99.9% of people wanted to be an investor, most people felt they couldn't be, either because it was too expensive, they didn't understand the jargon or because the products didn't suit.

"If you Googled 'investor' at the time, it definitely looked like one type of person. We wanted to say, hey, everyone should have the opportunity to invest."

While share trading platforms did exist, many were costly and had high minimum investments, explained Williams.

"So this is the big opportunity that we saw – to make an online platform for everyone to invest, with no minimums."

Today, Sharesies let's you invest from just a few cents at a time into US, Australian and NZ shares.

To Finder's knowledge, it was also the first platform to offer fractional Australian shares – cutting out the usual $500 minimum needed to invest in any one ASX-listed company.

The pink elephant in the room

Despite the initial feedback, Williams said Sharesies stood firm on the pink.

“We don’t see colours as having a gender… it was more around, we needed to be different to what’s already out there," said Williams.

"Because what’s out there makes you feel like you can’t be involved. And we’re trying to say 'you can be'."

“A huge part of it is about overcoming the cultural barrier of thinking that you can’t be an investor or what people thought of as a typical investor, and we’re really working to change that belief."

“It got to the point where the message of ‘it can’t be pink’, was almost supporting our mission in a way. Because it’s saying 'that’s true, that isn’t what’s known in Australian financial services'. And it’s been great… it connects to what we do."

Despite much fiercer competition in Australia, Williams and the Sharesies team decided to stick to their guns on branding.

"Colour is one thing – but it’s also a way of being open. We’re so much about accessibility and striving for that personal experience. If we’re connecting with someone then that’s the goal."

"What we've found is it actually hasn't come back as a blocker for us."

Since its initial launch, Sharesies has added auto-investing and a spare-cash round feature, bridging the gap between online broker and micro-investment platform.

For more on Sharesies, check our review page.

Looking for a low-cost online broker to invest in the stock market? Compare share trading platforms to start investing in stocks and ETFs.

Ask a question