Finder’s RBA survey: Renters continue to feel the squeeze even as cash rate holds

Borrowers have been spared for another month as the RBA holds the cash rate in September.

In this month's Finder RBA Cash Rate Survey™, 38 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

The majority of panellists (97%, 37/38) correctly predicted the cash rate would hold in September at 4.10%.

Graham Cooke, head of consumer research at Finder, said another rate pause was imminent.

"Mortgage holders can take a breather from the relentless pressure of the back-to-back interest rate hikes – we may even see the rate stagnate until the end of the year.

"The outlook for the economy, though, is still uncertain.

"We are seeing 40% of homeowners struggle to pay their mortgage, with many fixed loan holders facing dramatically higher payments over the coming months.

"Right now it's more important than ever to understand your interest rate, and find out if you could be getting a lower one," Cooke said.

The panel is largely split on what issue is most important to address in order to bring inflation down.

AMP's chief economist Dr Shane Oliver thinks it's about more than just wages and profit margins.

"Wages and profit margins can be just symptoms of inflation, not its causes. The key is to rebalance demand relative to supply which means cooling demand and boosting supply," Oliver said.

Record level rents driving tenants to relocate

With some calling for more supply, newly advertised rents have increased by 11% per year over the past 3 years.

Three-quarters of the panel (72%, 21/29) believe this will drive more people to buy or rent outside of the major cities.

Panellists largely cited that cheaper rents will be a price signal to push people outside major cities if they can find the jobs.

New Finder research revealed 6% have relocated from a major city to a regional area in the last 12 months. A further 7% are planning to relocate in the next 12 months.

This comes as Finder's Consumer Sentiment Tracker revealed 49% of tenants struggled to pay their rent in August.

Cooke said Australians in search of cheaper rent might opt for a tree change if they can.

"Tenants are facing record high rents – with some being asked to fork out up to 50% more with very little notice. This has led Australians to call for better legal protection for tenants.

"If your rent is too high, moving to a lower-cost area may be the only option.

"On the other hand, with many employers asking workers to return to the office, the idea of working remotely may not be the panacea it once seemed," Cooke said.

Matthew Peter from QIC said the price signal from the rental market will shift people to relocate to lower-cost areas.

Nalini Prasad from UNSW Sydney pointed out employment opportunities might deter people from relocating.

"It's also important to think about where jobs are, and most jobs are in the big cities," Prasad said.

Experts say monetary policy unevenly targets younger people

The majority of those who weighed in* (63%, 17/27) believe that monetary policy unevenly targets younger generations.

To spread the burden, the panel suggested the government uses fiscal policy to redistribute incomes or provide tax relief to younger generations.

Increasing the GST and being more flexible with payments for HECS loans were also put forward.

Cooke said the government needs to act.

"Rental protections in Australia are weak, and negative gearing encourages older, wealthy Australians to hoard property.

"At least 1 of these 2 factors will need to be examined to ease pressure on younger Australians," Cooke said.

Nicholas Frappell from ABC Refinery said monetary policy has had the effect of increasing asset prices, particularly housing.

"While the government cannot explicitly drive prices down, the tightening cycle may reverse some of the early asset price inflation," Frappell said.

Wage growth positivity on the rise

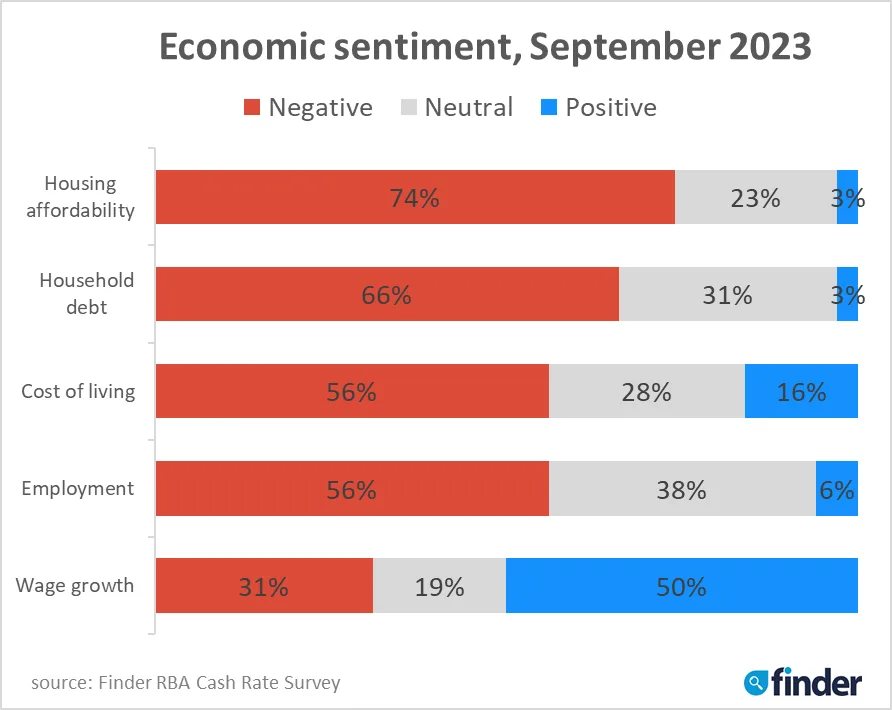

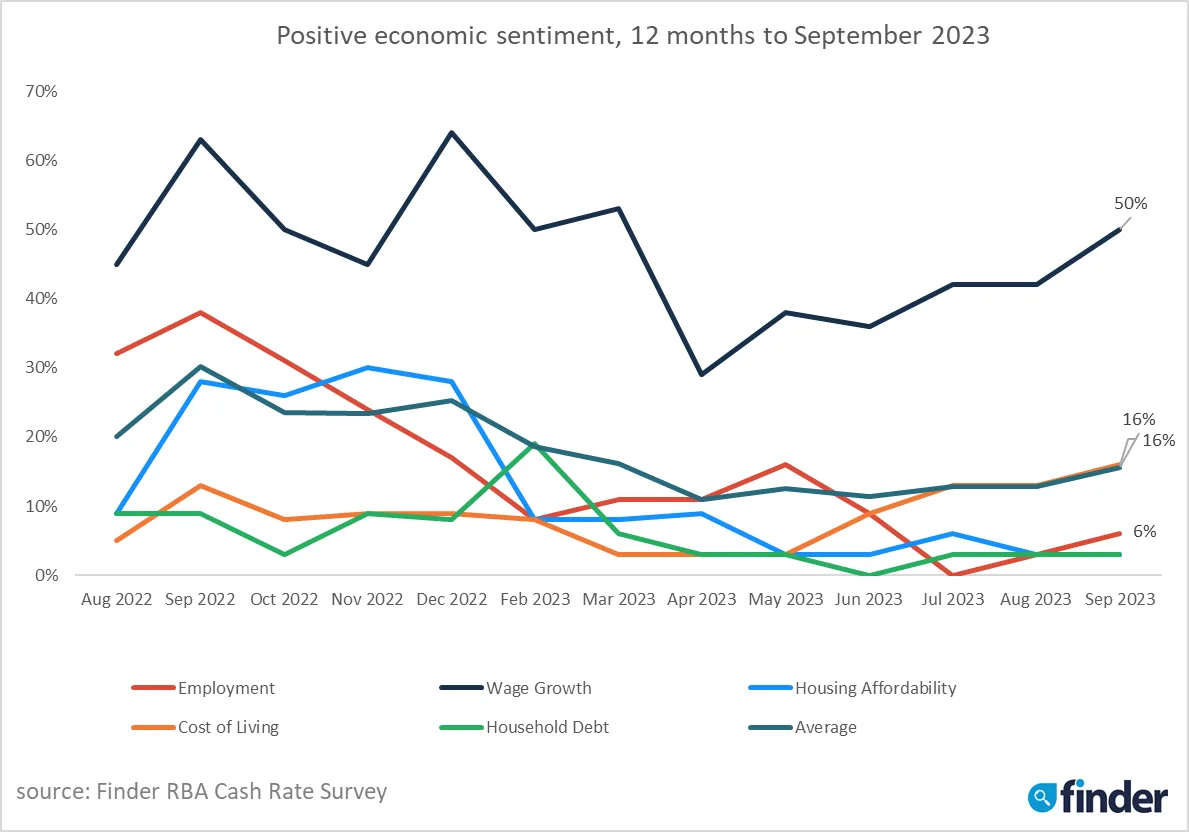

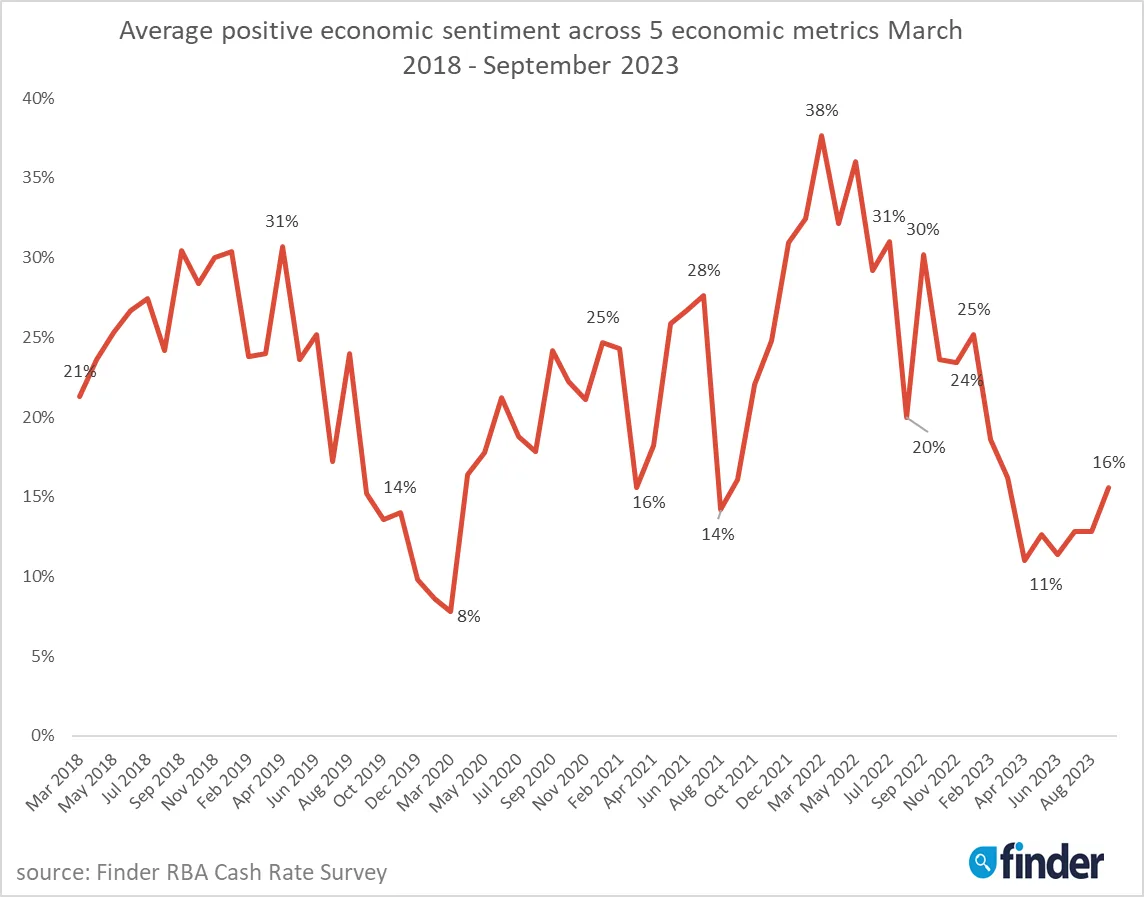

Finder's Economic Sentiment Tracker gauges experts' confidence in 5 key indicators: housing affordability, employment, wage growth, cost of living and household debt.

Positivity toward wage growth has tipped up to above 50% for the first time since March.

Average positive sentiment across each of the 5 areas has tipped slightly higher this month, thanks mainly to the move in wage growth.

This is roughly in line with consumer thinking.

Finder's positivity index – a monthly measure of Australian consumer sentiment, and a useful way to gauge the financial health of Australian consumers at a glance – grew 10% in August to 94.2 points, the largest monthly increase since January.

The index is collated from over 50,000 responses to Finder's Consumer Sentiment Tracker since May 2019.

*Experts are not required to answer every question in the survey

Here's what our experts had to say:

Jakob Madsen, University of Western Australia (Increase): "Inflation is still a concern."

Tim Nelson, Griffith University (Hold): "Awaiting further information about rate of change of inflation."

Stella Huangfu, The University of Sydney (Hold): "Apparently, inflation is on the right track. The 4-percentage point increase since May last year is finally showing its full effect! However, 4.9% annual inflation is still high. RBA should wait and see."

Tomasz Wozniak, University of Melbourne (Hold): "Even though the 68% interval of my pooled forecast coming from a system of a hundred various predictive models does not include zero change, this is the case for over half of the models. Additionally, the 90% forecast interval includes the HOLD decision. This fact, combined with the decreasing monthly inflation at 4.9% in August, makes me interpret the forecasts indicating no change in the cash rate for at least another 3 months."

Garry Barrett, University of Sydney (Hold): "Latest CPI indicates economy is cooling."

Jason Azzopardi, Resimac (Hold): "Inflation print is gradually decreasing in line with the RBA strategy to manage a soft landing and not give away employment market gains."

Shane Oliver, AMP (Hold): "The RBA has already tightened significantly and the recent run of data for wages growth and jobs were weaker than expected, retail sales are trending sideways (or down in real terms) and inflation is continuing to fall."

Evgenia Dechter, UNSW (Hold): "A range of indicators suggest a slowdown in both economic growth and inflation."

Cameron Kusher, REA Group (Hold): "Inflation is falling in line with RBA forecasts and most economic indicators point to a slowing economy, exactly what the goal has been of the recent rate-hiking cycle."

Matthew Greenwood-Nimmo, University of Melbourne (Hold): "The latest data shows that inflation is easing. Given that the full effects of the RBA's previous rate hikes are yet to work their way through the economy, there is a strong case for the RBA to hold."

Jeffrey Sheen, Macquarie University (Hold): "With inflation slowly trending downwards, and provided there are no major unexpected shocks, the RBA has now done enough tightening to achieve its inflation target in a reasonable time. There is a significant risk of exported deflation and stagnation from China in the next 6 months, which may require the RBA to ease monetary policy."

Nicholas Frappell, ABC Refinery (Hold): "Slightly weaker headline inflation domestically and deflationary pressures from our biggest trading partner imply the RBA can pause."

Tina Teng, CMC Markets (Hold): "Australian inflation declined but is still above the targeted level of 2%. The economic growth slowed and the unemployment rate climbed."

Dale Gillham, Wealth Within (Hold): "The data is suggesting that the economy is slowing and pushing rates higher now may force us into a recession, which I am sure the RBA wants to avoid."

Harry Murphy Cruise, Moody's Analytics (Hold): "Inflation is coming down quickly – more so than the Reserve Bank of Australia expected. As such, interest rates won't need to rise any further. Instead, rates will stay on hold until the middle of next year. At that point, with inflation firmly retreating to the RBA's 2–3% target band, a series of cuts will see that cash rate finish 2024 at 3.35% and drop to 2.85% in the second half of 2025."

Nalini Prasad, UNSW Sydney (Hold): "The monthly CPI indicator pointed to a continued, albeit small, easing in inflationary pressures. I think that this will give the RBA time to wait and see what happens in the future."

Stephen Miller, GSFM (Hold): "No smoking gun yet but I expect some meaningful wage and price inflation in H2 23."

Brodie Haupt, WLTH (Hold): "With the latest inflation numbers easing to 4.9% in July, down from 5.4% in June, it reduces the likelihood of the RBA pushing rates higher this month."

Mark Crosby, Monash University (Hold): "Inflation is falling at about the expected rate, and while it remains elevated, we can hope that it is close to the RBA's target range by early 2024."

Noel Whittaker, Adj Professor QUT Business School (Hold): "Inflation is down a little, in that there isn't much anecdotal evidence of reduced consumer spending. Also, the interest rates to date are really starting to bite."

Sveta Angelopoulos, RMIT University (Hold): "Softening of inflation suggests that the RBA will continue to hold the cash rate."

Mathew Tiller, LJ Hooker Group (Hold): "Recent data reveals that inflation continues to decrease, and the employment market has slightly softened, indicating that the earlier rate rises are starting to impact households and businesses."

James Morley, The University of Sydney (Hold): "I think the RBA will hold given the decline in inflation and weakening of domestic demand. There is a good chance Australia will avoid recession, with a low dollar helping exports. But weakness in China's economy is a worry. If there is an outright decline in real GDP in Q4, then I would expect the RBA to start cutting rates in February."

Tony Sycamore, IG Markets (Hold): "I am looking for the RBA to hike rates one more time before the year as it fine-tunes its monetary policy settings to ensure inflation returns to target within a reasonable time frame."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Hold): "The latest monthly CPI data for July show a further and welcome decline in 'headline' inflation to 4.9%, the lowest since February 2022, but of course still well above the RBA's target range. 'Underlying' inflation also fell, but only to 5.6%, even further above the target range. So, no need to tighten policy further, but nor any reason to anticipate any reductions in interest rates any time soon."

Sean Langcake, Oxford Economics Australia (Hold): "Having held rates in August, the RBA appears to be comfortable with the path the economy is following. Upside risks to inflation remain as wage growth has yet to peak. But the RBA's forecasts and communications show they are willing to weather an extended period of above-target inflation."

Geoffrey Kingston, Macquarie University (Hold): "The Bank will probably hold in September because year-on-year employment growth was slightly negative in June, and annualised monthly CPI inflation was only 3% in that month."

Nicholas Gruen, Lateral Economics (Hold): "Because there are fewer reasons to raise rates than last time when they left them alone."

Craig Emerson, Emerson Economics (Hold): "The RBA will consider it too early to ease and will maintain its pause position."

Peter Boehm, Pathfinder Consulting (Hold): "The combined impact of a slowing Australian economy and a slowing Chinese economy means the need to raise rates is not needed right now. The RBA needs to allow the recent rate increases to flow through the economy, and to provide some respite for the average Australian family who has been doing it tough over the past 12 to 18 months. There is no benefit in plunging the Australian economy into recession through further rate increases."

Geordan Murray, Housing Industry Association (Hold): "RBA wants to be very sure that inflation is returning to target. We see risks of softening household demand being a greater consideration in monetary policy settings in the first half of 2024."

Cameron Murray, Fresh Economic Thinking (Hold): "Inflation falling. Tightening cycle needs time to wash through the economy."

Mark Melatos, School of Economics, University of Sydney (Hold): "Inflation remains significantly above the RBA's target band. While it appears that the labour market might be starting to slacken, the RBA is still in catch-up mode with respect to matching their cash rate settings to the inflation reality. The RBA currently seems particularly concerned about services inflation and potential wage increases unaccompanied by productivity gains. The recent slide in the value of the $A is likely to add to imported inflation in the near term. There is inconclusive evidence as to the impact of monetary tightening on consumption."

Stephen Halmarick, CBA (Hold): "On hold and lagged effect of rate hikes impact the consumer, labour market and inflation."

Rich Harvey, Propertybuyer (Hold): "To date, the data is showing that inflation is decreasing slowly as households are finally feeling the real pinch of significantly higher mortgage repayments. There's likely to be many discussions around the dinner table as to how households will adjust spending patterns to cope with higher rates. Discretionary spending is down and likely to stay low for next 6 months, and likely to see some investors offload investment properties if the drag on their budget is too strong. All this provides good buying opportunities for savvy buyers with financial means to secure more property."

David Robertson, Bendigo Bank (Hold): "The RBA appears comfortable holding the cash rate at 4.1% ahead of the next quarterly CPI report out on October 25. Another hike to 4.35% remains the risk as core services inflation remains stubbornly high, but not until November at the earliest."

Michael Yardney, Metropole (Hold): "There is enough evidence that inflation is under control and slowly falling for the RBA to keep interest rates on hold."

Matthew Peter, QIC (Hold): "The RBA has clearly signalled that it is on hold unless data reveals a risk to the steady decline in inflation. To date, we have wage and employment data that have surprised to the downside, so there is virtually no risk of any other result than on-hold at the RBA's September meeting."

Ask a question