Identity theft cost Aussies $3.1 billion in one year

Identity theft is costing Australians billions of dollars a year according to a recent Finder analysis.

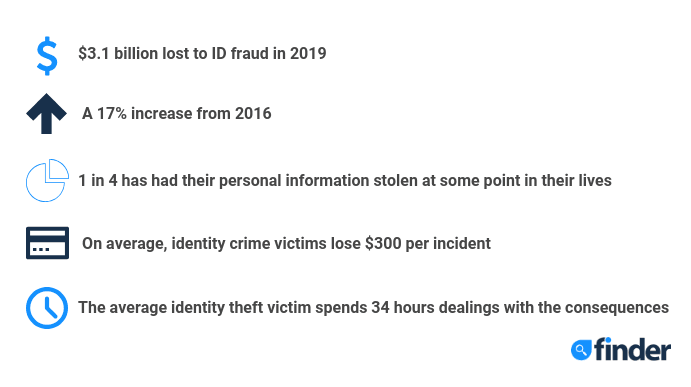

Finder’s analysis of data released by the Australian Institute of Criminology (AIC) has revealed that the cost of identity crime in Australia reached a staggering $3.1 billion in 2019, a substantial 17% increase from 2016.

Approximately 1 in 4 Australians (25%) has experienced misuse of personal information at some time in their lives, and, on average, identity crime victims lose $300 per incident.

The types of personal information most at risk include someone’s name, credit card details, bank account information, address and date of birth.

Beyond the financial consequences, having your identity stolen can lead to refusal of credit, refusal of government benefits or even being wrongfully accused of a crime.

Taylor Blackburn, personal finance specialist at Finder, urged Australians to alert their bank to any suspicious activity as soon as they notice it.

“The quicker you can get on top of a potential ID theft attack, the better your chances are of minimising any damages to your finances.

“Unrecognisable transactions, missing or unfamiliar bills in the mail and even a drop in your credit score can all be signals of fraudulent activity.

"Making use of free tools like the Finder app that give you a view of your spending as well as allow you to monitor your bank activity and your credit score can help you stay alert for any suspicious activity."

COVID-19 has further fuelled the growth in identity crime. In August, the ACCC reported identity theft was up 55% since the beginning of the pandemic.

In September, a Finder survey found nearly half of Australians (47%) had received a fraudulent call or text message since the beginning of the pandemic. Alarmingly, 69% of those people did not report the crime.

Scammers have preyed on heightened levels of fear and vulnerability, often by pretending to be from high-profile government departments. In one instance, a victim lost $62,000 after having their details stolen.

Blackburn said that technology is enabling fraudsters to create more sophisticated scams, making them harder to spot.

“Always verify the source of any communication that asks you for personal information.

“Whether it’s going to the website yourself or calling the business directly, it’s worth confirming that a request is authentic.

“Taking a few extra minutes to check the veracity of a request can save you hours resolving the issue down the track.”

Tips for protecting your personal information online:

- Avoid clicking suspicious email links. Many instances of ID theft start with a hacker taking control of your phone in order to gain access to your passwords. This can be done by sharing infected URLs that, when clicked on, implant hacking software onto the device.

- Look for the padlock symbol in the URL bar. As online shopping has become more prevalent, more Australians are using digital methods to pay for their purchases online. Before entering any payment details onto a website, be sure to check that the URL bar is displaying a padlock on the left, confirming that your information is secure.

- Check your credit score regularly. Your credit score is your financial identity so an unexpected change in that number is a good indicator that something could be wrong. Fraudsters can use your personal information to apply for financial products, which can damage your credit score and impact your chances of accessing finance down the track. You can check your credit score for free in under five minutes with the Finder app.

- Keep your mailbox secure. Your bills contain a lot of personal information, such as a customer ID, your date of birth and your home address, which can be used to gain access to your finances. Something as simple as ensuring your mailbox is easily accessible for postal workers and putting a padlock on it can help keep your mail and your personal information secure.

For more information on how to protect yourself from scammers, visit Finder's Identity Theft hub.

Ask a question