Trump’s tariffs crash crypto markets – Should you sell?

The cryptocurrency markets have crashed after Trump signs tariff order.

It wasn't meant to go like this.

After Donald Trump won the US election in November on an explicitly pro-crypto platform, many investors saw it as the dawn of a cryptocurrency golden age.

And things started so well.

Bitcoin quickly blazed past the US$100,000 mark for the first time in its history and Trump announced a number of crypto-friendly appointees to his administration.

Then came Trump's meme coin, which sucked the liquidity out the crypto markets, and Trump's crypto executive order, which threw cold water on the possibility of a US strategic Bitcoin reserve.

And now Trump's announcement of tariffs on Canada, Mexico and China have sent the crypto markets plummeting.

Bitcoin dropped more than 8% to US$92,000 and the rest of the market took an even greater hit.

XRP crashed more than 30% and Solana was down more than 22%. Meme coins like Dogecoin were the worst affected, with DOGE down more than 33%.

Is this supposed to happen?

While the crypto markets have enjoyed a relatively strong 12 months, it's been far from the explosive bull run that many investors and experts were expecting, especially following Trump's inauguration.

Crypto's well-publicised 4-year market cycle suggested 2025 would be period where the crypto market saw dramatic price appreciation, as happened in 2021 and 2017.

Yet so far the opposite has happened.

Is the bull market over?

According to analysis by crypto trader Kaleo, a so-called "alt season" (where cryptocurrencies other than Bitcoin perform strongly) could still be on the cards.

"A scenario where we see an *extended* alt season vs. what we saw the previous cycles makes a lot of sense under a Trump Presidency," Kaleo wrote on Twitter.

"As more money flows into Bitcoin (don't sleep on the significance of the spot ETF + public support of US gov + other countries will follow), it will *naturally* flow into more speculative assets."

While Trump's actions this year have negatively impacted the crypto markets, his presidency should still pave the way for more crypto adoption and investment, according to James Quinn-Kumar, Director of Community Engagement at Binance Australia and New Zealand.

"The pro-crypto stance of this new U.S. administration is expected to catalyse further regulatory clarity, encouraging broader participation and demand for crypto assets from traditional financial institutions," Quinn-Kumar said in a release.

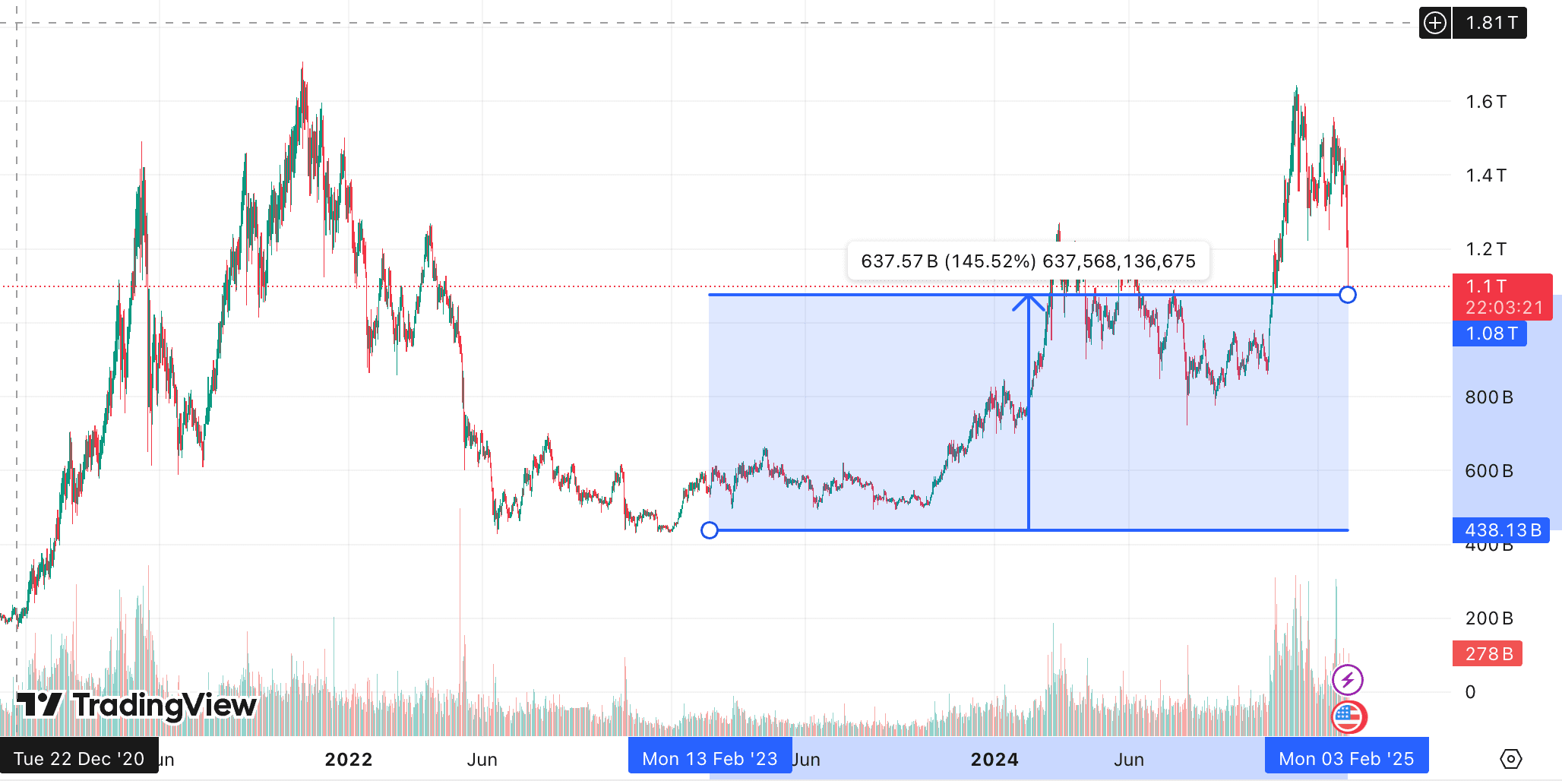

Zoom out further and the total crypto market capitalisation minus Bitcoin (TOTAL2) is still up 145% since 2023, despite the recent crash.

So while the short-term pain is undeniable, the wider economic and political environment suggests this isn't the end of the bull run.

Join the crypto conversation – Follow us on X now

Trying to get a handle on the markets? Cut through the noise with our overview of the best cryptos to buy right now, explore some strategies for how to trade crypto or see if there's a better platform for you with our guide to the best crypto exchanges.

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Trusted by over 500,000 Aussies

Trusted by over 500,000 Aussies

Sources

Ask a question