Finder’s RBA Cash Rate Survey: Record refinancing to continue, house prices to jump

Australian property prices are tipped to bounce back in 2021, with weak population growth no match for low interest rates and a limited housing supply.

In this month's Finder RBA Cash Rate Survey™, 41 experts and economists weighed in on future cash rate moves and other issues related to the state of the Australian economy.

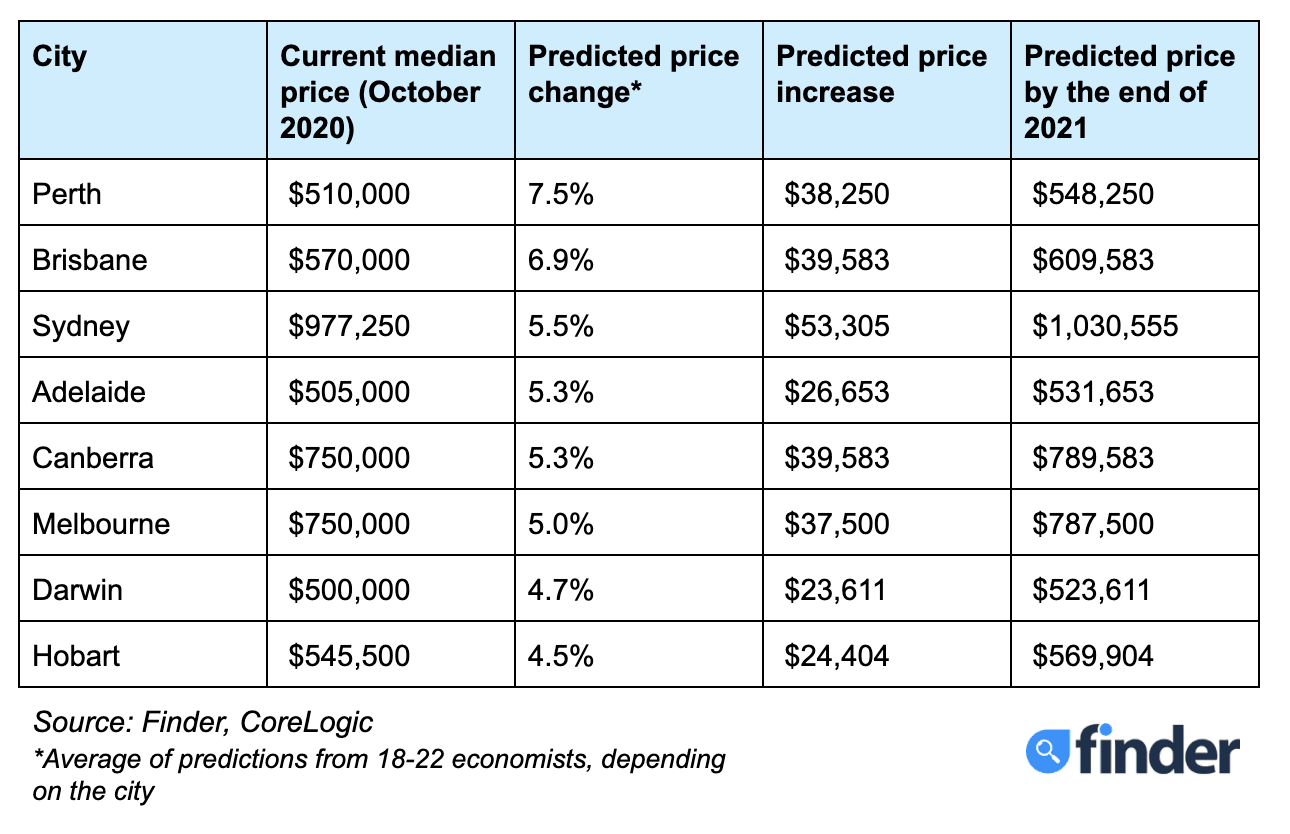

The panel expects house prices in every capital city across Australia to increase on average this year, based on current market conditions.

Perth is forecast to see the biggest gains, with experts predicting the median house price to rise by 7.5%, which would see it jump from $510,000 to $548,250 (+$38,250) by the end of 2021, based on the most recent CoreLogic pricing data.

This is followed closely by Brisbane (+6.9%, +$39,583) and Sydney (+5.5%, +$53,305).

Hobart and Darwin are expected to see smaller gains, at just 4.5% and 4.7% respectively.

Graham Cooke, Head of Consumer Research at Finder, said that this positivity in the housing market forecasts is even higher than it was pre-pandemic.

"The market is surging on the back of low rates, government stimulus and Aussies having more in their savings accounts on average.

"We expect this to continue through 2021, but Perth's snap lockdown is a reminder that things can change quickly," Cooke said.

Expected median house price changes in 2021 across capital cities

Record refinancing to continue

According to ABS data, last year, the total number of home loan customers who switched providers increased by 27% – from 143,664 in 2019 to 182,016 in 2020.

Experts are predicting another record year of lender hopping, with the number of externally refinanced home loans – those done with other banks – predicted to grow by 9%.

This would see nearly 200,000 Aussies switch to save in 2021.

And it's not just borrowers who are thinking about all this moving around.

The vast majority (23/24, 96%) of experts said that banks are focused on the threat of customers moving to other banks through refinancing.

"We usually tell Aussies to call your bank and ask for a better deal, but some banks are now calling their own customers to offer lower rates to keep them from jumping ship.

"If this has not happened to you, it's definitely time to dig out your loan details and compare your rate," Cooke said.

Cash rate expected to hold at 0.10%, majority expect stagnant rate in 2021

Experts and economists are united in their view that the RBA will hold the cash rate this month, with very few predictions for any movements at all in 2021.

According to Rebecca Cassells of BankWest Curtin Economics Centre, the Australian economy has experienced a V-shaped recovery.

"The RBA has committed to raising interest when the inflation target of 2-3% is achieved. We are unlikely to get there this year, but the heat in the property market may speed things up," Cassells said.

However, Money Magazine's Julia Newbould said that it is too early to tell what direction the rate may go this year, as the nation's recovery continues.

"There are still so many unknowns. What happens when moratoriums are lifted on bank loans and JobKeeper ends will have a great impact on the economy and how the Reserve Bank proceeds with its next rate change," she said.

Here's what our experts had to say:

Nicholas Frappell, ABC Bullion: "The RBA is likely to play out the yield curve control program until Q3-Q4 2021 before considering a change in the cash rate."

Shane Oliver, AMP Capital: "The economy has recovered faster than expected and the deployment of vaccines should aid further recovery so I have brought forward the timing of the first rate hike from 2023 to late 2022… but there will still be lots of spare capacity in the economy for a long time, which will keep underlying inflation down, so a rate hike is still a long way off."

Rebecca Cassells, BankWest Curtin Economics Centre: "The Australian economy has generally experienced a V-shaped recovery. There are more gains to make to achieve a full recovery and to progress beyond where the economy was in March 2020, but we are heading in the right direction. The RBA has committed to raising interest when the inflation target of 2-3% is achieved. We are unlikely to get there this year, but the heat in the property market may speed things up."

David Robertson, Bendigo and Adelaide Bank: "The RBA have been clear in their message that the official cash rate will remain at its current level for some years, although progress to full employment may occur more quickly than the market is currently pricing. An increase in rates in around two years is quite plausible."

Sean Langcake, BIS Oxford Economics: "It will be quite some time before the RBA's stated conditions for a rate increase are met."

Ben Udy, Capital Economics: "We expect the RBA to end its asset purchases in April as the labour market continues to recover faster than most expect."

Peter Boehm, CLSA Premium: "There is no reason for the RBA to move interest rates at this stage. In fact, current market sentiment indicates the Cash Rate will remain at its current level for the foreseeable future. This observation is reflected somewhat in forward interest rates, and for example, the banks' medium-term fixed-rate mortgages, which are at some of the lowest levels this century. It is hard to envisage the Cash Rate moving during the remainder of 2021. The economy needs stability, certainty and growth stimulus, and tinkering with the Cash Rate is unlikely to achieve this."

Saul Eslake, Corinna Economic Advisory: "The RBA has repeatedly committed to not raising rates before November 2023, and I am still inclined to take them at their word, but the risk is increasing that they may have to recalibrate that and prepare for the possibility that they might need to contemplate raising rates before then."

Malcolm Wood, EL&C Baillieu: "It will take some time to reach full employment and then inflation moving sustainably into the target range."

Craig Emerson, Emerson Economics: "The RBA will maintain the current cash rate until inflation actually enters the 2-3% range and stays there for a while."

Angela Jackson, Equity Economics: "As indicated, the RBA is unlikely to drop rates further but will keep rates low as long as required. However, the timing of an increase is highly uncertain until we know when international borders will reopen and the path to recovery for the international economy."

Mark Brimble, Griffith University: "Significant uncertainty and strong economic headwinds remain. Thus the economy will need monetary policy support for some time yet."

Tim Nelson, Griffith University: "Fiscal stimulus is likely to continue to do the heavy lifting."

Tony Makin, Griffith University: "The RBA reacts to international monetary developments. Given the expected strong economic recovery in China and the US (and less so in Europe), two factors would normally put upward pressure on world interest rates within the next year or so. First, inflation pressures should begin to build, and second, increased government borrowing will be required to fund huge budget deficits."

John, Hewson: "The economy will be flatter longer than expected and the next change could be after Q4 2022."

Tom Devitt, Housing Industry Association: "Record stimulus to date plus expected new Federal Budget announcements in May 2021 will be having a sustained impact on inflation before 2023."

Alex Joiner, IFM Investors: "The RBA will have no justification to raise rates until the unemployment rate is at or below 4.5% in order to get wages growth. We know fiscal policy will become more contractionary when the unemployment rate is below 6%, leaving monetary policy to do the rest of the work to stimulate economic growth and drive the unemployment rate lower."

Leanne Pilkington, Laing+Simmons: "The low interest rate environment is a major factor contributing to house price growth across the board and this is an important element in the nation's overall economic recovery. The Reserve Bank is well aware of the impacts of a rate change on house prices and has suggested that rates may stay steady for the next few years."

Nicholas Gruen, Lateral Economics: "It's pure guesswork at present when recovery will have taken hold."

Mathew Tiller, LJ Hooker: "RBA expected to hold the cash rate at its current level until inflation rises and employment strengthens."

Geoffrey Kingston, Macquarie University: "As suggested by rises in inflation breakevens and asset prices, worldwide inflation is a couple of years off and will need to be dealt with."

Stephen Koukoulas, Market Economics: "A full recovery and rising inflation will see the RBA move to hike rates in late 2022."

John Caelli, ME Bank: "The RBA have stated that rates will be on hold for at least three years."

Michael Yardney, Metropole Property Strategists: "The RBA will be pleased that the initiatives it took last year are working, our economy is recovering and jobs are being created."

Julia Newbould, Money: "There are still so many unknowns and what will happen when moratoriums are lifted on bank loans and JobKeeper ends will have a great impact on the economy and how the Reserve Bank proceeds with its next rate change."

Susan Mitchell, Mortgage Choice: "I expect the RBA to continue to hold the cash rate, with the next move at least three years away. Recent economic data has been positive, supporting a hold decision. The latest data from the ABS showed a recovery in the labour market. Despite a decline in January, consumer sentiment has also strengthened in recent months. The housing market has also had a strong start to the year, as the momentum we saw in the second half of last year continued into January."

Rich Harvey, Propertybuyer: "The RBA stated that rates are likely to stay on hold for next three years while dealing with coronavirus fallout."

Matthew Peter, QIC: "Notwithstanding the strong March quarter inflation report, the RBA will stick to its policy of a 0.1% cash rate and three-year bond yield until inflation is well entrenched within its target range of 2-3%."

Noel Whittaker, QUT: "It's anybody's guess, but I still think rates are in a downturn."

Jason Azzopardi, Resimac: "The RBA is providing market confidence of a long term low rate environment."

Christine Williams, Smarter Property Investing: "Globally, the cash rate will increase due to COVID-19 vaccines being distributed, therefore the markets will ease and settle into a positive position."

Mala Raghavan, University of Tasmania: "According to RBA Governor Philip Lowe, the board is not expecting to increase the cash rate for at least three years. He said the RBA will consider increasing the cash rate only when the inflation is comfortably above 2%."

Jonathan Chancellor, Urban.com.au: "The RBA will be keeping a close watch on emerging inflationary influences in the economy, and especially house price growth, but is not likely to move the cash rate upwards anytime soon. And the central bank's past form would suggest they do so more likely a little too late."

Dale Gillham, Wealth Within: "There is still a lot of uncertainty around COVID-19, stimulus packages and measures, travel and so many other areas likely to affect business confidence and growth. As such, individuals are preferring to save money rather than spend, which only makes any recovery slower than it need be."

Other participants: Michael Witts, ING Bank. Andrew Wilson, Jeffrey Sheen, Macquarie University. Mark Crosby, Monash University. My Housing Market. Clement A Tisdell, University of Queensland. Bill Evans, Westpac

Need home loan help? Quickly compare some of the market's lowest rates.

Ask a question