Less but better – the New Year challenge that’s good for your budget and the planet

Zero waste expert Anita Vandyke shares a creative way to tackle your big goals this year.

New year, new you eh? Well, as mid-January rolls around, how many of those New Year's resolutions are we really keeping? That is why this year I've created a challenge for myself that will enforce better spending habits throughout the whole year, and not just for the first few weeks of 2020.

The "Low Buy Year" is a challenge I've set for myself to buy only 20 items of clothing in 2020. Here are the rules for the Low Buy Year.

- I am allowed to replace things that I've used up

- I am allowed to buy 5 items per season (20 items the whole year) and these items can only be purchased via the secondhand economy (e.g. op-shops, eBay etc)

- I am not allowed to buy any extra clothing, accessories, beauty supplies

- I am allowed to spend money on experiences as long as I stick to my budget each week

My philosophy for this year is "less, but better". The main reason I want to embrace this challenge is to save money. I want to add to my investments and save money to buy the dream house next year. To tackle big goals, we need some big changes – this means reflecting on my shopping habits and changing them for the better.

After one week of my Low Buy Year challenge, I was already feeling the itch. You know the feeling: the sudden craving to check your favourite online stores to see what they have on sale, the urge to check your favourite secondhand stores, the need to check out your favourite brands during your work lunch break to buy a small pick-me-up.

I can do none of those things now, so I must learn to stop before I shop. This allows me to reflect on why I am buying things in the first place and it's usually to fill a void.

If you reflect on your own shopping habits, when do you buy things without thinking twice? I have found it is usually one of these reasons:

- To celebrate a success in your life: "You deserve this"

- To placate an emotional low in your life: "It's retail therapy"

- To get a quick dopamine hit: "It's cheap and cheerful"

- To alleviate boredom: "Shopping is a hobby"

If you use any of these "reasons" to justify your shopping, it's time to change your habits. Shopping should not be a source of reward, a form of therapy or something to do because you're bored.

Buying a new dress won't make you a new person, buying a new watch won't give you more time and spending your hard earned money on mindless consumption won't make you happier.

This challenge will make you reflect on the reasons why you're shopping and transform your shopping habits to something more positive.

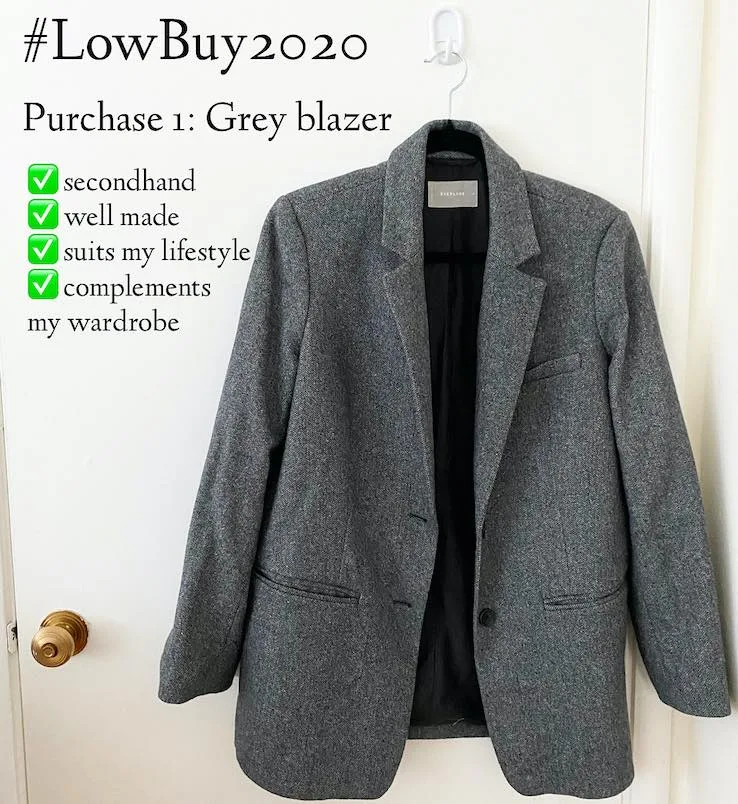

So far, I've bought 1 item out of the 20 items: a secondhand Everlane blazer from eBay. This purchase was thought about with much care. I spent a few days thinking about it and asking myself the following questions:

- Is it well made and designed to last?

- Will it suit my lifestyle

- Will I wear it again and again?

- Does it complement my existing wardrobe?

I used to be an impulsive secondhand shopper, jumping into purchases when I saw a bargain. This process has made me more discerning. It has made me reflect on the real reasons why I shopped in the first place. It's changed my shopping habits from an emotional, reactionary response, to a more mindful, slower process.

Changing our habits isn't easy, it means removing temptation and making positive switches. Here are some tips on how to make your shopping ban a bit easier:

- Unsubscribe from promotional emails. You don't need to know when the latest sales are.

- Unsubscribe from social media accounts that promote spending. Think brand accounts or product pushing accounts.

- Don't peruse the shops during your lunch break. Sit in a park, read a book, listen to a podcast or go for a walk instead.

- Replace shopping as a hobby with a new hobby. Hiking, swimming, yoga, cooking, learning a new language, there are so many things you can do for free that don't require you to be a mindless consumer.

- Have a goal. Keep a goal in mind and have milestones for that goal. Is it saving for the dream house? Is it saving for the dream holiday? Is it as simple as having less stress around your finances? Whatever it is, create a notebook to dedicate towards that goal. Create milestones, bar charts or spreadsheets that celebrate your achievements.

My Low Buy Year has just started, but I've learnt so much already. And you could start your own for anything. It could be drinking, gadgets, beauty products or whatever is your Achilles heel. It's time to be a more conscious consumer. Your bank account will thank you for it, but more importantly, your mental health and the planet will thank you for it too.

Podcast: How to live a zero-waste life on a budget with Anita Vandyke

Anita Vandyke is a qualified rocket scientist (graduated with a Bachelor of Engineering – Aeronautical Space) and runs a successful Instagram account (@rocket_science) about zero waste living. She currently splits her time between studying Medicine in Sydney and living with her husband in San Francisco. She regularly blogs about her passions of zero waste switches, minimalism, travel and all things green living at www.anitavandyke.com. Anita's first book A Zero Waste Life: in thirty days ($19.99) is published by Penguin Random House.

Disclaimer: The views and opinions expressed in this article (which may be subject to change without notice) are solely those of the author and do not necessarily reflect those of Finder and its employees. The information contained in this article is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort. Neither the author nor Finder have taken into account your personal circumstances. You should seek professional advice before making any further decisions based on this information.

Read more Finder X columns

-

All the big savings account interest rate rises: ING, AMP, Westpac + more

6 Feb 2026 |

-

Australian credit card debt soars 10% in a year: How can you escape the trap?

6 Feb 2026 |

-

4 cashback home loan offers to ease the pain of RBA rate hike

4 Feb 2026 |

-

Finder’s RBA Survey: Easing cycle ends as RBA delivers first rate hike since 2023

4 Feb 2026 |

-

Ubank Save is increasing its bonus rate up to 5.35% p.a.

3 Feb 2026 |

Ask a question