Successful investors share tips for 2021

Want to know what other investors are up to? Well, we asked so you don't have to.

In partnership with The Perth Mint. Buy gold, silver, and platinum from Australia's largest fully-integrated precious metals enterprise. Choose from bullion bars and coins through to ETFs and a digital app. Learn more.

In partnership with The Perth Mint. Buy gold, silver, and platinum from Australia's largest fully-integrated precious metals enterprise. Choose from bullion bars and coins through to ETFs and a digital app. Learn more.No matter where you are on the journey to financial freedom, there's one question you'll always ask yourself: "I wonder what they know that I don't?"

While nobody has all the answers, there are plenty of people who have golden nuggets of advice that could seriously help the average Aussie investor.

So we asked a few of our expert friends to share their tips. Here's what they told us.

Buy gold in Aussie dollars

Regardless of where you stand on the gold argument, nobody can deny the precious metal's impressive performance as a defensive asset. Over the past 20 years, it has outperformed other major assets and has provided competitive returns over other time periods too.

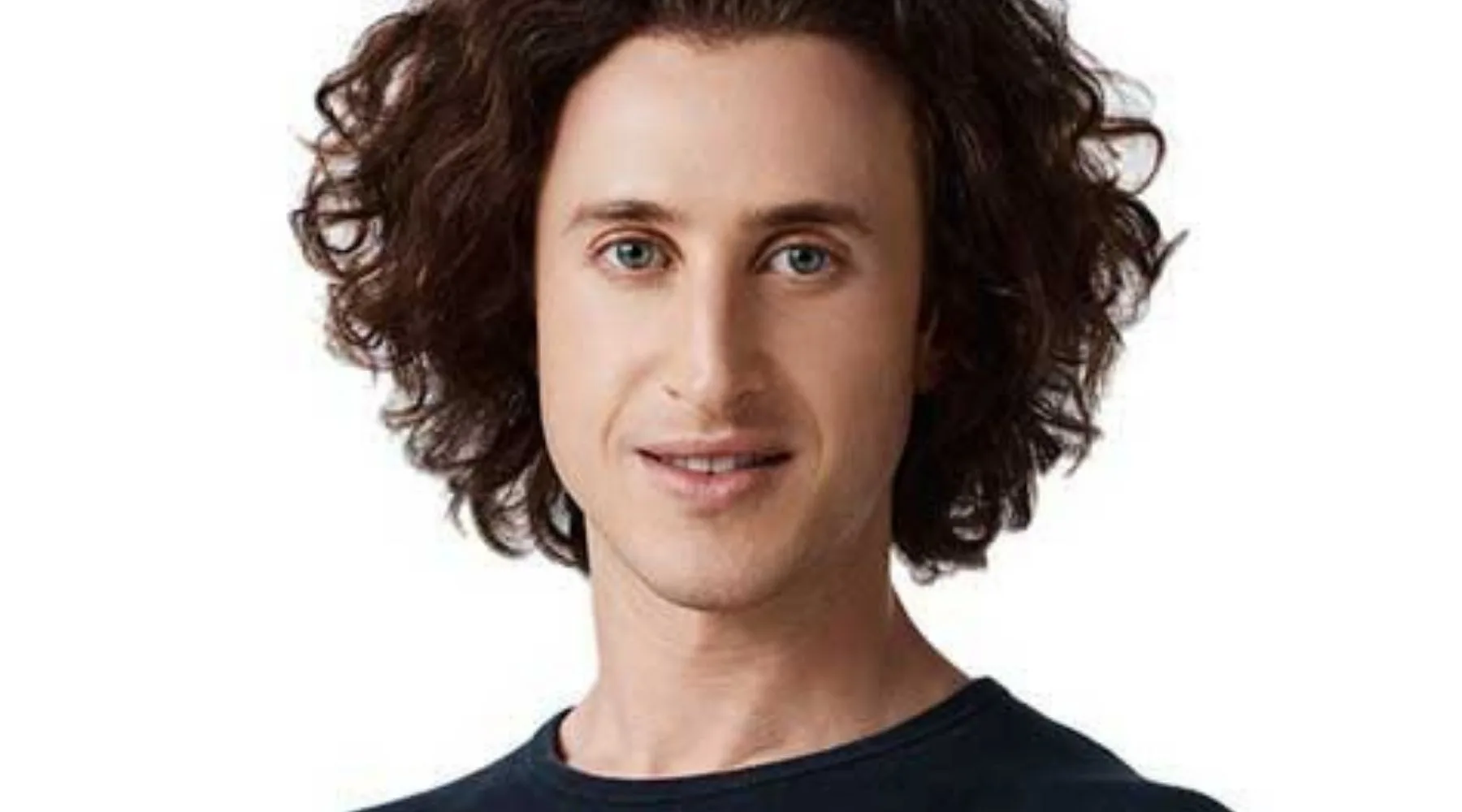

If you're keen to get on the gold bandwagon, Chris Brycki, founder and CEO of Stockspot, says it should be bought in Aussie dollars, rather than US, so you own unhedged gold.

"This is important because unhedged gold helps protect your portfolio against a devaluation of the Australian dollar. One of the main reasons to own gold is to defend yourself against the debasement of your home currency," said Brycki, who spent most of his early career as a portfolio manager for UBS.

"The Australian dollar tends to decline more than the US dollar when the share market falls, and owning gold in Australian dollars magnifies the defensive characteristics of gold in your portfolio. You can see positive examples of this strategy during the GFC in 2008 and COVID-19 in 2020."

Thankfully, there are local options for potential gold investors. The Perth Mint, one of the world's largest gold refineries, is operated entirely by the government of Western Australia, and offers the sale and storage of Aussie gold.

Hedge against inflation

According to the Q3 Global Outlook report from investment bank Saxo, persistent rises in inflation aren't going anywhere, so investors should look to protect themselves where possible.

"It's our view that rising inflation is likely to be longer-lasting than transitory, thereby creating continued demand from investors as they will need real assets, such as commodities, to hedge their portfolios. Precious metals – both gold and silver – should continue to attract demand," said the bank's head of commodity strategy, Ole Hansen.

"Tightening market conditions emerging during the past 6 months are another reason why, for the first time in a number of years, asset managers are once again viewing commodities as an interesting investment case."

Buy gold or silver from The Perth Mint, currently storing more than $5 billion in gold and silver for more than 40,000 investors.

Make the most of support

According to research from investment platform Sharesies, the 2 most common ways Australians access financial education are by searching online (42%) and speaking with their friends and family (32%).

Co-founder Leighton Roberts says these efforts should be taken up by everyone interested in investing, especially when they're just starting out.

"Make sure you are taking advantage of the great resources that are available online including educational podcasts and financial news sites," Roberts told Finder. "If there is someone in your network that you know invests, why not pick their brains about how they got started."

Use the economic clock

After 29 years in the financial planning industry, Boston Trading Co. CFO Jeremy Britton says his advice has changed very little.

"Use the economic clock," he urged investors. "Like chess, it takes an hour to learn and a lifetime to master, but it gives you an enormous advantage in knowing where markets will be ahead of time."

Assembled by academics in the early-mid 20th century, the economic clock amalgamates individual economic cycles to give a simplified view of the wider economy.

"Using century-old tools such as historical charts and the economic clock, our office predicted the 1999 'tech wreck', the '9/11' market crash and the 2008 GFC, up to 2 years before they occurred," said Britton.

Buy physical gold

In addition to buying gold in Aussie dollars, Stockspot's Brycki says it's also a better idea to buy physical gold or a physical gold ETF rather than gold miners or gold mining shares.

"Gold mining shares or gold miners are easy to trade on the share market, but they don't provide the same defensive characteristics as physical gold," he told Finder.

"They have higher correlation to shares, and won't always perform the same as physical gold because of operational decisions, hedging and capital management."

For Aussies looking to buy physical gold, The Perth Mint offers access to physical precious metals as well as storage if required. It's also possible to trade gold on the ASX. For example, you can buy it from The Perth Mint under the ticker PMGOLD. Just be aware that there's a management fee of 0.15%, but that's the cheapest for a gold-tracking ETF on the ASX.

Understand your risk and return

Laura Rusu has long been committed to helping retail investors. She has previously partnered with the Australian Shareholders' Association (ASA) to deliver educational seminars and even founded digital platform Lensell, which aims to improve communication between corporations and investors.

"My number one tip for investors would be: know where you stand from a portfolio risk and return perspective, and know where you want to be. Are you looking to minimise your portfolio risk, maximise your return, or both?" she said.

"Granular diversification (at security level) and technology enables investors not only to calculate the portfolio risk and see how that fits with their risk tolerance, but also to calculate the minimum risk portfolio and the optimal portfolio for their selection of securities."

Look to experts

Christopher Golis is a venture capital veteran with more than 30 years' experience in the Australian industry under his belt. He has been a director of some 30 public and VC-backed private companies as well as a lecturer of venture capital finance at the University of Sydney. Despite the illustrious career, his advice to retail investors was refreshingly simple.

"As the founder of the BT Retail Funds Manager Division and the person who launched the first retail equity product to reach $1 billion in size, may I suggest the same tip I give to everyone. Read as many of the annual letters sent out by Warren Buffet."

Invest (a little) in crypto

Everyone and their auntie might be talking about crypto but Adam Smith, CEO of Saxo Markets Australia, said cryptocurrencies should only form a small percentage of a strong, diversified portfolio.

"By and large, allocating around 7% of a portfolio to crypto is appropriate, as is investing in the currency fractionally," said Smith. "Buying a whole Bitcoin can be a rather large exposure for the average retail investor, so a trusted and regulated way to benefit from crypto is to trade it as a currency pair or via an ETP (exchange traded product)."

According to Smith, the remaining 93% of your portfolio should look to incorporate equity, commodities, real estate, fixed income and volatility.

Look for property trends

Ben Handler has worked in property for over 15 years and founded the Buyer's Agent Institute in 2018. His tip for anyone considering adding property to their investment portfolio in 2021? Go coastal.

"With the normalisation of remote work, more and more individuals are moving outside major cities to the coast to take advantage of what they perceive to be a better lifestyle," he told Finder. "Don't believe me? The Gold Coast is now one of the most expensive areas to rent a property in Australia."

Data is there to support Handler's claim. March figures from Domain's Rent Report revealed a vacancy rate of just 0.3% in the Gold Coast, with skyrocketing rents now comparable to expensive suburbs of Sydney and the ACT.

Don't assume you're priced out

Whether it's buying Bitcoin, looking for gold bullion or getting on the property ladder, investors shouldn't assume they're priced out. Fractional investing is an easy way to get into crypto or commodities, while property investors may also be able to find affordable avenues.

"There are certainly very affordable entry points for those looking to start their [property] investment journey. For as little as $250,000 there are major regional markets with diverse economies which are a great starting point, if someone prefers a metropolitan market, buyers can get in as cheap as $350,000," said Bobby Haeri, founder of The Investors Agency.

Haeri also said that the current lending environment is far more favourable than many potential property investors realise.

"Lending laws at the moment allow for buyers to enter the market with as little as 5–10% deposit, so while you need to pay LMI (lenders mortgage insurance), LMI is generally far less than trying to save another 10% deposit when house prices are increasing at 20% per year," he said.

Buy gold or silver from The Perth Mint

Compare other gold dealers here