How does IBM’s new Stellar system compare to SWIFT and Ripple?

How does the Blockchain World Wire work, and how does it stack up to the competition?

"The world has been using the same network to process financial transactions for 50 years. And even though globalization has changed the world, payment fees and other financial barriers remain the same. But now there’s a new way to move money," IBM states in its introduction of the Blockchain World Wire (BWW).

It's a not-too-subtle jab at SWIFT, the half-century-old international payment network that was once revolutionary but has now become more synonymous with high fees, opacity and unnecessary inefficiencies. Ripple took the same tack with its XRP-based payment solutions and has so far been even more blunt in its intentions to replace rather than join SWIFT.

How BWW works

It's pretty straightforward, at least on the front end.

- Two financial institutions connect their existing payment systems to BWW's API.

- The sender sets up a payment by selecting the initial currency they want to transfer, what kind of currency they want it to arrive as and which digital asset they'd like to use as an intermediary.

- The sender pushes a button.

- The system seamlessly converts the starting currency into the chosen intermediary digital asset and then into the arriving currency. It all takes place in a matter of seconds and is immutably recorded onto a blockchain for clearing.

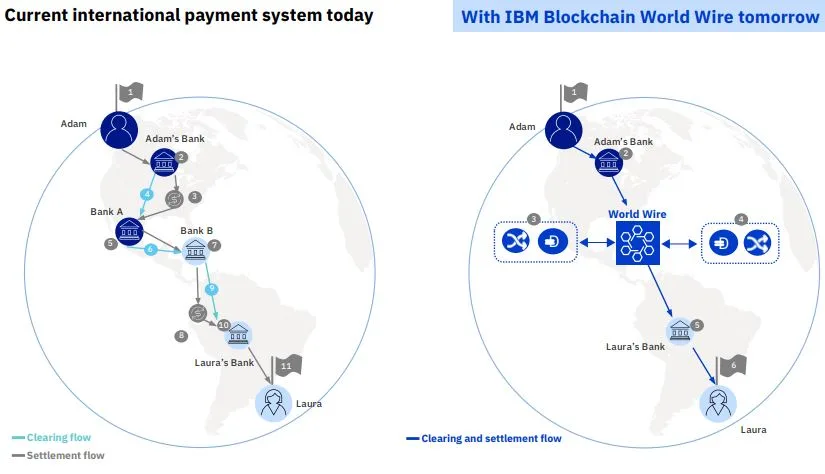

Functionally, this is like a single automated system to replace the expensive nest of intermediary banks involved in a SWIFT transfer.

In IBM's above diagram, SWIFT is on the left. Each of those banks does its own currency conversions, takes its own fees and bounces the money among themselves. These are known as correspondent banking networks, and they're constantly changing as banks merge, go in and out of business, sign new agreements and generally go about the business of finding ways to make more money.

The fees incurred and how long the transfer takes on the SWIFT network is determined by the path the money takes. This path is determined by the correspondent bank agreements. It has nothing to do with finding the most cost-effective or efficient option for a consumer, except to the extent that a bank thinks it might lose business if it gets too greedy.

It was revolutionary 50 years ago, but these days it's an excellent example of deliberate inefficiency on the customer's dime, kind of like a taxi driver deliberately taking a slower path to increase the fare for a passenger.

By contrast, the BWW lets two banks connect directly with each other as needed, skipping past the entire mess of correspondents.

Is there a reason for banks to use it?

One line of thinking might be that banks have no reason to abandon the SWIFT system that has been so generous to them, which wouldn't bode well for IBM's Stellar network or for Ripple and XRP.

But this might be an oversimplification. To better understand the potential for uptake of IBM's new system, it's worth considering the state of the much-maligned, and about to be even more maligned, SWIFT payment network.

First, note that banks are just one of many types of financial institutions, and many financial institutions just want a quicker and more cost-effective way of moving money overseas. So right off, even if banks themselves push back, there are still plenty of opportunities for these new systems.

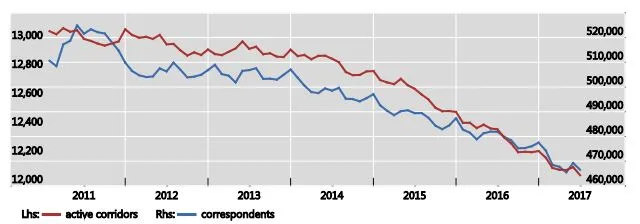

Second, the SWIFT network has been on the wane for years already. The SWIFT company naturally plays its data close to the vest where possible, but what's out there (PDF) paints a picture of a business in decline, even before blockchain became the word of the day.

The Financial Stability Board (FSB) hazards a few guesses at the potential reasons behind the decline, while sounding only slightly frustrated by SWIFT's opacity, but suggests that it's a combination of a decline in the number of correspondent banks and the rise of internal messaging systems within large international banks.

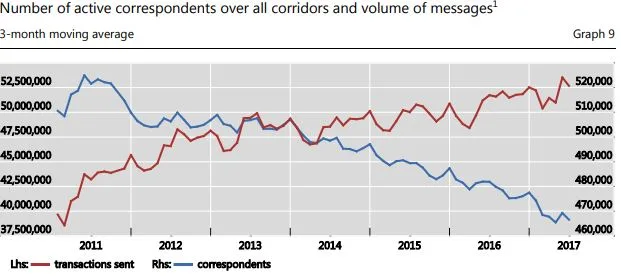

The number of messages sent across SWIFT has actually increased though, FSB notes. So counter-intuitively, the SWIFT network appears to be getting more use even as the number of users declines. The correlation is quite impressive. Note the wonderfully distinct spikes in both correspondent numbers and transactions sent at the end of each financial year.

It sounds odd on the surface, but as FSB explains this might actually be an expected side effect of a declining number of SWIFT participants coupled with a fairly steady rate of payments that need to be run across the network, FSB explains.

When a correspondent bank withdraws from the system, as many are doing, the remainder might need to ink some new deals or start sending payments along a new route. With fewer options out there, this generally means each payment will suddenly take more transactions to process. It's essentially a direct measurement of growing inefficiency and declining popularity.

The indirect goal of the BWW, as IBM's head of blockchain Jesse Lund explains, is to create a seamless system where anyone can move money anywhere in the world in a few seconds flat without any fees worth mentioning and to position this capability as an essential software service rather than a revenue stream.

Or as he put it, "charging fees simply to intermediate payments is lame."

SWIFT isn't a competitor to IBM and Ripple any more than the telegraph was a competitor to the telephone. They're fundamentally different services built on different technological backbones that both happen to fulfil the same customer need.

The real front line now might be Ripple and IBM, and XRP and Stellar Lumens, as rival telephone company equivalents.

Ripple, XRP, IBM and Stellar

Ripple is the services provider and XRP is the technology, just like IBM is the services provider and Stellar is the technology. And both have some fine points in their favour. But from some angles, the IBM solution has a few edges that Ripple doesn't.

One of the more notable ones is its wide scope. IBM has a huge range of existing partners. It supplies hardware and software and generally has its fingers in a lot of pies that Ripple doesn't. The almost plug-and-play nature of BWW means it might be rolled into various other products and services to facilitate adoption.

The other one might be that it uses Stellar rather than XRP, which brings a few advantages. Notably, it does away with all those "is it a security?" questions currently dogging XRP. Ripple associates have explicitly said that they're confident XRP isn't a security and that Ripple as a company has maintained sufficient distance from the token itself, but the question is still formally up in the air which might pose regulatory headaches for a financial institution that wants a better payment solution but doesn't want to step on any regulator's toes. Even if it is just on a technicality, Stellar Lumens doesn't have these issues.

Also, Stellar Lumens has a wider ecosystem which already includes elements like simple collateralised stablecoins that can help serve as an intermediary currency. This gives IBM an easy answer anytime a prospective client airs concerns around cryptocurrency volatility mid-transfer. In the future, it also opens up the potential for additional elements like the movement of tokenised assets on the Stellar blockchain via IBM systems. Ripple is well aware of XRP's relatively limited use cases to date and is making concerted efforts to solve that problem, but Stellar might be a couple of steps ahead.

However, the main benefit might be the Stellar DEX and automated matching system, which can be used to create the most efficient possible payment pathways for any transfer. When using XRP for fiat transfers, there needs to be cryptocurrency exchanges on both ends to convert the XRP to and from fiat. This is quite an obstacle, and an inherent inefficiency, and in some respects limits the scope of Ripple solutions to the same kind of service that might be provided by Coinbase. Plus, the new system reduces the need for financial institutions to maintain such large and potentially volatile liquidity pools for their payment needs, which further reduces the costs and risks associated with using it.

There is, after all, no reason why a couple of banks and an exchange can't just get together and start offering their own crypto money-transfer solution. At least one bank in Argentina has already done exactly this, powered by bitcoin.

IBM and Stellar can deliver more tangible advantages over those kinds of jury-rigged crypto payment networks where Ripple and XRP might not be able to, which might give it a longer term functional advantage.

Of course, Ripple already has a wide range of partnerships and XRP is already seeing real-world use in live consumer money transfers, where IBM and Stellar are only just getting started. It's premature to say one will be more successful than the other, or that there can be only one.

Of more immediate import for crypto speculators is that it might be worth emphasising that this doesn't necessarily have to have any impact on Stellar Lumen prices beyond general hype. Even with the actual Stellar Lumens cryptocurrency (XLM) forming the backbone of the IBM payment system, there's still no real reason to expect this alone to have much functional impact on the fair price of XLM. The BWW is another application for XLM and another integral part of the Stellar network, but putting a fair price on the digital asset is still tricky. A growing network should help grow prices, but it's not possible to say how much XLM should be worth with and without IBM's Blockchain World Wire.

Disclosure: At the time of writing, the author holds ETH, IOTA, ICX, VET, XLM, BTC and ADA.

Latest cryptocurrency news

-

The Coinstash Cryptocurrency Hub

30 May 2024 |

-

Ordinals and runes – the new crypto craze?

24 Apr 2024 |

-

Join the party: Finder’s giving away $200K worth of Bitcoin

23 Feb 2022 |

-

Australians have spent $50.9 million on crypto trading fees

31 Jan 2022 |

-

Stablecoins vs Bitcoin: What’s the difference?

3 Nov 2021 |

Picture: Shutterstock

Ask a question