Forex Roadtest #3: All that glitters is gold

My first week of actual currency trading had arrived. My mind was bursting with information from the Active Traders Group training day (covered in part two of this series) and my $400 was on its way to my trading account.

Sunday

Eager to be prepared for my first week of trading, I review the forex calendar Daniel had recommended.

There are many events and announcements that can have an impact on the US, European, Japanese, Chinese and Australian markets. I add the high-risk events to my calendar and leave a reminder to read the daily outlook piece to see what else I should be wary of.

Tuesday

While I’m waiting for my live account to be finalised, I take a look at how different events can affect each currency pair. The calendar at myfxbook shows how positive and negative readings for different events can affect a currency.

For example, the US Goods Trades Balance is a recording of the difference between the exports and imports of the US over the previous month. Higher exports can mean a stronger US dollar, which can in theory positively affect any currency pairs where USD is the base currency.

The Active Traders Group is buzzing during the day, with users chatting about trades and their experiences. It’s clear that what Daniel says about the group is true: sometimes trading can be lonely, and being part of a team means you can share not only your wins but your losses too.

My account is finalised in the afternoon, just in time for North Korea’s missile launch.

Wednesday

Following warlike events, it's common for money to move into "safe haven assets" such as gold. The theory is that these assets will retain more value in volatile times.

I jump into the WhatsApp group to see a flurry of activity around the Gold/US dollar pair (XAU/USD).

I take a look at the fundamentals and the other tools Daniel taught us and decide the trade satisfies my (admittedly basic) knowledge. I set up my stop loss and take profit levels using the Hungry Wolf strategy and with a little bit of anxiety and sweaty palms I lodge my trade… and I set it up incorrectly.

Due to the tiny balance in my trading account and my poor maths skills, I accidentally take on more risk than the 1% proscribed in the strategy.

The trade doesn’t move much over the day but then it swings into a slight loss as the US dollar strengthens after positive economic news comes out during the night.

Thursday

The day doesn’t see much activity, with my trade hovering at around a $20 loss.

Friday

I wake up to see a $80 floating profit on my trade! Remembering Daniel’s advice to consider closing trades before the end of the week, and being too excited to consider keeping my trade open with this much of a potential profit, I close the trade. Immediately, regret sets in.

My gold trade. You can see my entry and exit points here.

The strategy I’ve used calls for traders to stick out trades and wait until their take profit or stop loss levels are hit.

I see Daniel on the way to work and tell him about my trade. He’s ecstatic and mentions that sometimes taking profit early is a good thing.

Buoyed by the outcome of my first trade, I notice another Hungry Wolf signal being mentioned in the group, this time for the USD/JPY pair. I eagerly put on the trade.

I wait out the day for the release of key US data, which comes out softer than expected. My trade falls a bit in the meantime and I notice that my original take profit level from my first gold trade would have been hit if I had stuck with my strategy, netting me much more than my $80 profit.

With the weekend fast approaching I close my USD/JPY trade to minimise my risk. This trade nets me a $17 profit.

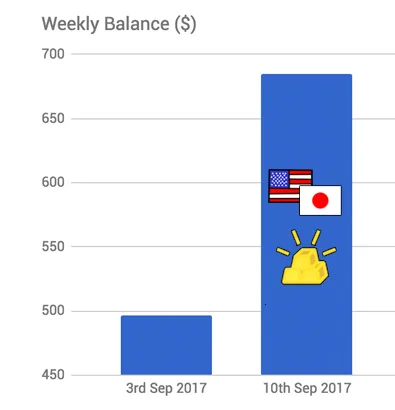

The results of my first week of trading

So far my account is now $97 richer, leaving me with an amazing result of $497. With a taste of success I’m eager for the next week.

Trading CFDs and forex on leverage is high-risk and you could lose more than your initial investment. It may not be suitable for every investor. Refer to the provider’s PDS and consider the risks before trading.

Ask a question