Lingering to their loan: 1 in 5 first home buyers take a year or more to buy

Buying a first home can be a lengthy experience for many Australians, according to new research by Finder.

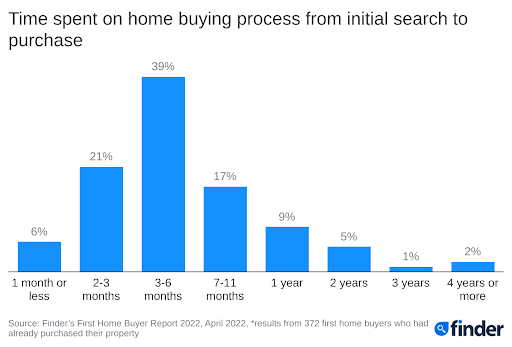

According to Finder's First Home Buyer Report 2022, which surveyed 1,001 first home buyers in Australia – 372 of whom had already purchased their property – nearly 1 in 5 (18%) first home buyers spend a year or more on the home-buying process.

This includes 8% for which it takes 2 years or more.

Among generation X first home buyers, the process takes 2 years or more for a staggering 17% of buyers.

Sarah Megginson, money expert at Finder, said the lack of housing supply in some areas has buyers competing fiercely with each other.

"The market is cooling and competition is easing off slightly, but it can still be daunting to go to inspections and auctions where you have several interested buyers.

"It's a house, not a pair of pants – so you have to really make sure it fits before you sign.

"You'll be stuck with it for a while, and you don't want buyer's remorse to sink in after it's too late," Megginson said.

Finder's research shows 2 in 5 first home buyers (39%) take between 3 and 6 months on the whole process, while a quarter (26%) spend 3 months or less.

Women (22%) are considerably more likely than men (13%) to have spent more than a year on the home buying process.

Between the generations, gen Z are the quickest buyers, with 30% taking 3 months or less, compared to 28% of millennials and 17% of gen x.

Megginson said there are things you can do to increase your chance of success.

"Before making an offer, it's a good idea to have a home loan pre-approval.

"With pre-approval, you'll be considered a preferred buyer. It will also shorten the time to approval once you've found a property.

"Remember that most pre-approvals only last 3 months, so if you haven't found a property by then you'll likely need to apply for another one."

Hoping to enter the market? Check out our tips for first home buyers or compare home loans for low deposit borrowers.

Ask a question