Cost of living crisis: Would you move house to save money?

It's an expensive time to be alive but that doesn't mean you have to sit back and let your finances drain.

Interest rates and rents are going through the roof. Petrol, power and produce are pricier than ever.

The cost-of-living squeeze tightens its grip on household budgets and many Australians wonder what they can do to ease the pressure.

We can't control overseas politics or a pandemic but we can change where we live.

And that's exactly what some Australians do to ease their cost of living.

The 2022 Muval Index shows that Aussies are starting to pack up their lives and relocate to a more affordable part of the country.

This is to maintain their lifestyle or even upgrade it.

A month's rent is $1,059 cheaper in Hobart than in Sydney. Find out how else the cost of living differs between states.

Which areas are Aussies moving to?

For many people, the prospect of owning a home by the beach or with water views has long been out of reach.

But it doesn't have to be.

Since the pandemic made it possible for more people to work from home, those who can't afford a beach house in Sydney are moving to Port Macquarie, Ballina, Coffs Harbour and Shoalhaven to find a home by the coast and live their dream life.

Meanwhile, South East Queenslanders who have been squeezed out of their skyrocketing suburbs by rising rents and house prices are going in search of cheaper housing in Toowoomba, Rockhampton, Mackay, Townsville and Cairns.

This regional shift is one of the big trends that emerged in Muval's 2022 Index as the rising cost of living overtook COVID as a reason to move.

In the annual report, we analysed our national moving data and surveyed hundreds of Australians about their intentions. This was to gain a clearer understanding of why and where they are moving.

Almost two-thirds of survey respondents (65%) said a rise in the cost of living would increase their desire to move, compared to 27% for COVID.

Around 1 in 10 Aussies (11%) have already moved to improve their financial wellbeing.

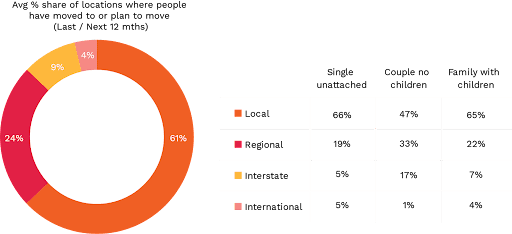

And while most (61%) Australians move locally, almost a quarter (24%) are relocating to a regional destination, with that figure rising to 33% for couples with no children.

Note: Some percentages may not add to 100% due to "prefer not to answer" survey responses.

Unsurprisingly, the search for affordable housing in the regions is being driven largely by first home buyers, with almost a third (27%) of regional moves undertaken by people shifting from a rental property into a purchased home.

Regions are receiving an influx of new residents because people want to upgrade their living space (26%), achieve a better lifestyle (18%), downsize (13%) or reduce their cost of living (11%).

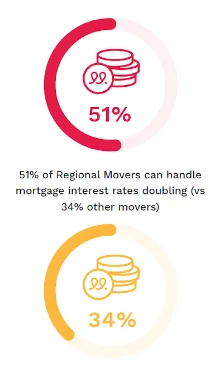

Because houses are more affordable the further you move from a CBD, regional homeowners told us they're experiencing less mortgage stress.

Around 51% said they could comfortably handle a doubling of mortgage interest rates over the next 12 months, compared to the national average of 34%.

The figures are also high for renters. Around 40% of those surveyed said a $50 rent rise would send them packing.

And 27% said an interest rate rise of more than 2% would spark their desire to move.

Given these high figures, we're expecting to see the regional influx ramp up in the last quarter of this year as more people move out of the cities in search of a more affordable lifestyle.

The Index has been compiled using Muval's own data, which paints the most up-to-date picture of moving trends based on online searches for removalists as well as a sample size survey of Australians.

James Morrell is the chief executive officer of Muval, a free platform that helps movers save time, money and stress by aggregating Australia's most reputable local and interstate removalists into 1 place to compare prices and book online.

Ask a question