Finder’s RBA Survey: Rate cuts open doors for buyers, but renters are left behind

For the third time this year, the Reserve Bank of Australia (RBA) has cut the cash rate.

In this month's Finder RBA Cash Rate Survey™, 34 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

Almost all experts (91%, 31/34) correctly predicted the outcome, bringing the cash rate to 3.60%.

Graham Cooke, head of consumer research at Finder, said all eyes are now on the banks.

"Following recent rate cuts by the Reserve Bank of Australia (RBA), lenders are under immense pressure to pass the savings on to customers. So far, most have passed on the cuts in full.

"Experts are forecasting more rate cuts, which could change things. Lenders might start to pull back and offer smaller cuts to customers, as we observed during the last round of cuts.

"In a competitive market, lenders are fighting for business, which is a good opportunity for you to review your home loan.

"If your current mortgage rate is higher than 5.5%, you may be able to find a better deal."

The suburbs* that should now be affordable for the average Australian (following three rate cuts)

Following three 25-basis-point rate cuts from the RBA in 2025, Finder analysis reveals the suburbs where house and unit values are now affordable.

The average single Australian can now feasibly afford a place for $570,000 or less and the average Australian household with two incomes can look at suburbs where average prices are under $1,167,000.

In VIC, the median house in Wyndham Vale and Wodonga is now affordable for the average Australian.

For a couple with two average incomes, a house in Coburg is now affordable in VIC.

In NSW, a couple with two average incomes can now afford a house in Oran Park, Marsden Park, Glenmore Park, and Leppington.

Following three rate cuts from the RBA, the average Aussie on a single income can now afford a house in Kirwan in QLD.

The average Aussie on a single income in WA can now afford a house in suburbs including Armadale and Mandurah.

When it comes to units, the average Australian on a single income can now afford suburbs in Bankstown, Penrith, and Auburn in NSW, and South Yarra and Brunswick in VIC.

Australian couples with two incomes can now afford a unit in suburbs including Chatswood, St Leonards, Pyrmont, and Maroubra in NSW, and Burleigh Heads in QLD.

Cooke said rate cuts make mortgages more affordable, and it's encouraging to see more suburbs fall within reach for buyers.

"Even with a lower rate, you'll still need a hefty deposit.

"If lower borrowing costs drive increased market activity – as they have in the past – rising property prices and higher deposit requirements could ultimately outweigh the benefit of cheaper repayments."

Houses: Where the average Australian can now afford to buy (single income)

| State | Suburb | Median sales price last 12 months |

| VIC | Wyndham Vale | $568,825 |

| QLD | Kirwan | $550,000 |

| WA | Armadale | $560,000 |

| VIC | Wodonga | $562,000 |

| WA | Mandurah | $540,000 |

| Source: Finder analysis of Cotality data, based on median sales price |

Houses: Where the average Australian couple can now afford to buy (two incomes)

| State | Suburb | Median sales price last 12 months |

| NSW | Oran Park | $1,090,000 |

| NSW | Marsden Park | $1,150,000 |

| NSW | Glenmore Park | $1,167,000 |

| NSW | Leppington | $1,080,000 |

| VIC | Coburg | $1,165,000 |

| Source: Finder analysis of Cotality data, based on median sales price |

Units: Where the average Australian can now afford to buy (single income)

| State | Suburb | Median sales price last 12 months |

| VIC | South Yarra | $555,000 |

| NSW | Bankstown | $560,000 |

| NSW | Penrith | $565,000 |

| NSW | Auburn | $570,000 |

| VIC | Brunswick | $570,000 |

| Source: Finder analysis of Cotality data, based on median sales price |

Units: Where the average Australian couple can now afford to buy (two incomes)

| State | Suburb | Median sales price last 12 months |

| NSW | Chatswood | $1,120,000 |

| NSW | St Leonards | $1,159,000 |

| NSW | Maroubra | $1,100,000 |

| QLD | Burleigh Heads | $1,097,500 |

| NSW | Pyrmont | $1,155,000 |

| Source: Finder analysis of Cotality data, based on median sales price |

*These are the top 5 suburbs. A full list of suburbs for NSW, VIC, QLD, SA, and WA are available. Please get in touch if you'd like the full list and analysis.

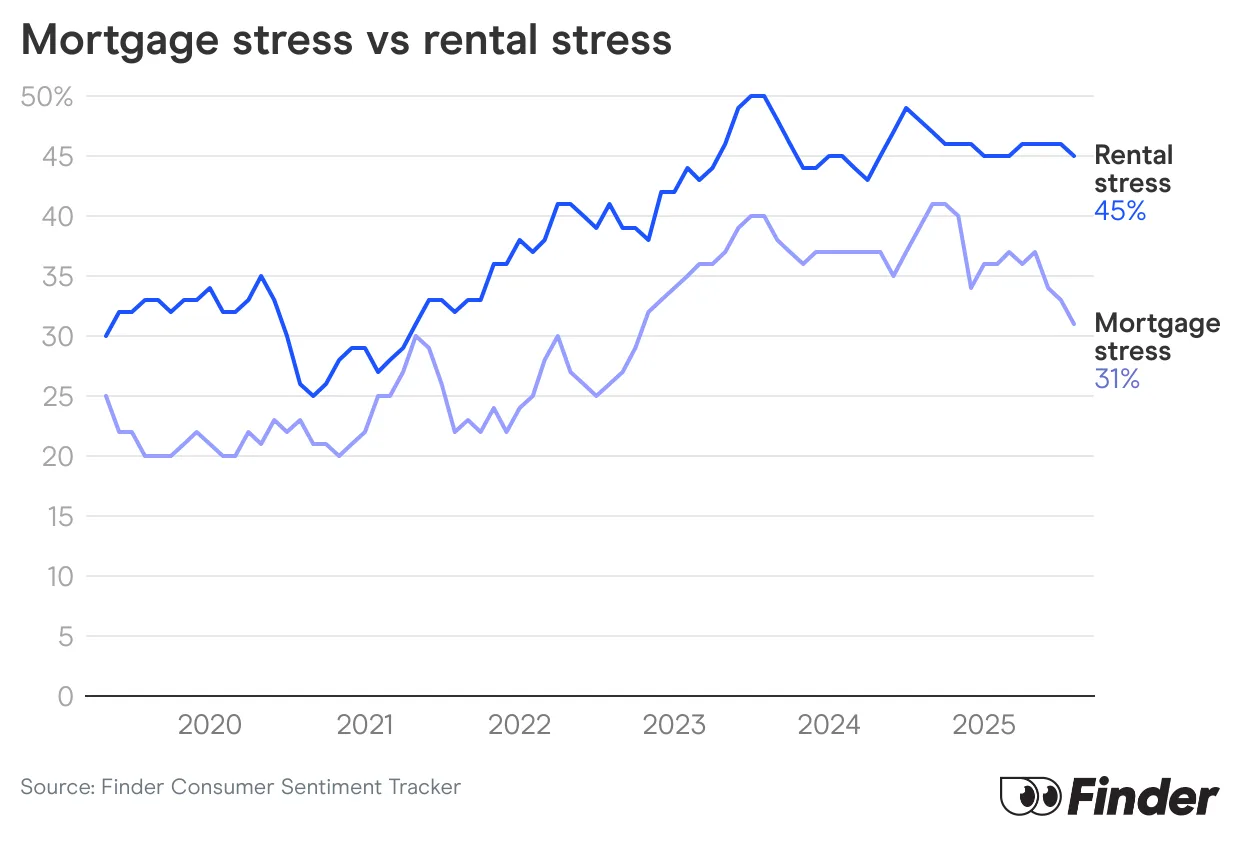

Rental stress persists as mortgage stress falls to two-year low

Rental stress has consistently been higher and more persistent than mortgage stress, according to Finder's Consumer Sentiment Tracker.

In July 2023, rental stress peaked with more than 50% of renters under pressure, while mortgage stress reached just over 40% at its highest point.

While both renters and mortgage holders have faced significant financial pressures, renters have borne the brunt of it.

The data shows mortgage stress has dropped to a two-year low (31%), while rental stress remains stubbornly high at 45%.

Cooke says the financial burden on renters has continued even as homeowners find some relief.

"Many landlords used rising mortgage costs as justification to raise rents, but as those costs fall they are unlikely to cut rents in response.

"The divide between renters and mortgage holders continues to widen. Those with a mortgage are now seeing relief, while lower income renters continue to pay through the nose, making saving for a home even more difficult."

Here's what our experts had to say:

Kyle Rodda, Capital.com (Decrease): "The markets got confused by previous RBA commentary that suggested a change in reaction function. All along, they hadn't shifted their focus from the quarterly CPI print. That was roughly where the RBA wanted it to be, so with the labour market also looking shaky, there's no reason not to cut."

David McQueen, Loan Market (Decrease): "Trimmed mean inflation has fallen again since the last RBA meeting, down to 2.7% in the 12 months to the June quarter, putting it firmly in the RBA's target range. Buyers - and mortgage holders, for that matter - are hoping for a rate cut. At Loan Market, pre-approved buyer numbers are more than 50% higher than they were 12 months ago. Buyers are getting their finances in order ahead of the spring real estate season, weighing up their options, and positioning themselves to act. Buyers want to walk into an auction with confidence or put forward strong private treaty terms that help them stand out from the crowd."

Tomasz Wozniak, University of Melbourne (Decrease): "This time they will, right? The markets are right in their assessment that the cash rate is on a downward-sloping trajectory. Last month's decision to HOLD does not contradict this. Unsurprisingly, this month, similarly to July, my predictions indicate a CUT. The predictive intervals do not contain the current cash rate value, but they include a 25bp cut. The forecast mean suggests a 15bp decrease. My forecasts are available at: https://forecasting-cash-rate.github.io/"

Dr Andrew Wilson, My Housing Market (Decrease): "The latest ABS June quarter CPI data has clearly matched the RBA's implied preconditions for a rate cut with the monthly data indicating continued weakening of inflation. Recent easing of the labour market also adds to the case for an August rate cut."

Anthony Waldron, Mortgage Choice (Decrease): "The Reserve Bank Board exercised caution at its last meeting, but since then we've seen the ABS's June quarter Consumer Price Index show that the headline inflation rate remains within the RBA's target band, up 2.1% annually. My view is this will give the RBA the confidence it needs to cut interest rates for the third time this year."

Mala Raghavan, University of Tasmania (Decrease): "Inflation has remained within the target range for some time, while unemployment has risen slightly. Ongoing uncertainty from unpredictable 'Trump Tariff' policies and the geopolitical tensions around the world have slowed the global economy. Due to these issues, the RBA may consider lowering interest rates."

Nalini Prasad, UNSW Sydney (Decrease): "The market expects a cut in the cash rate given the most recent inflation data which shows a continued downward trend in inflation. An increase in the unemployment rate also points to a softening in the labour market."

Nicholas Frappell, ABC Refinery (Decrease): "Softer inflation prints allows room for a small cut although the background narrative is of a shallow reduction cycle."

Sean Langcake, Oxford Economics Australia (Decrease): "The RBA showed an abundance of caution in keeping rates on hold in July. Since then, we've seen more evidence that the labour market is softening. Moreover, the Q2 CPI did not contain any red flags around core inflation pressures. This paves the way for an August rate cut."

Matthew Greenwood-Nimmo, University of Melbourne (Decrease): "The quarterly inflation data is in line with the RBA's expectations and is comfortably within the target band. Coupled with softening in the labour market, there is a good case for a rate cut."

Matthew Peter, QIC (Decrease): "Falling inflation, softening labour market - no remaining hurdles for a rate cut."

Brodie Haupt, WLTH (Decrease): "Last month, the board needed further evidence that inflation was on the decline and decided to play it safe with a hold. With new data confirming the decline of core inflation to 2.7% from the 12 months leading to June, I believe the board members may be more confident about a cut."

Geoffrey Kingston, Macquarie University Business School (Decrease): "The latest inflation data fall within the Bank's target range. The latest labour market data show a distinct weakening. The Bank is therefore likely to cut."

Noel Whittaker., QUT (Decrease): "At the last board meeting, the governor, Michele Bullock, hinted that they were just waiting to be convinced about getting inflation within a certain band, and that seems to have happened."

James Morley, University of Sydney (Decrease): "The quarterly inflation data confirmed that inflation, including trimmed mean, is coming down and within the 2-3 target range. Also, there are some indications of a weaker labour market."

Nicholas Gruen, Lateral Economics (Decrease): "I'd say they're a tad embarrassed by their last decision and so will keep things moving this time."

Mark Crosby, Monash University (Decrease): "Latest inflation numbers will allow the RBA some room to move."

Garry Barrett, University of Sydney (Decrease): "Latest core inflation numbers indicate easing of inflationary pressure."

Associate Professor Mark Melatos, School of Economics, University of Sydney (Decrease): "Monthly inflation readings have been falling precipitously for a while. The March quarter CPI report showed headline and underlying inflation within the RBA's target range (2.1% & 2.7% respectively). The monthly June CPI rate was 1.9% below the bottom of the RBA's target range; the first time this has happened since early-2021. The RBA has already felt sufficiently confident to cut rates at its February and May meetings and, if anything, the inflation situation appears to have moderated even more since then. Given that the Federal election has been held, and the increased geopolitical uncertainty, there seems to be little (apart from inexorably increasing house prices and continued full-employment) stopping the RBA moving to ease further now."

Mathew Tiller, LJ Hooker Group (Decrease): "I think the RBA will cut rates in August. Inflation is contained, the jobs market has softened and global growth is slowing, so the case for easing is strong. For property markets, a cut should lift buyer confidence, and while listings remain low, it could also encourage more vendors to list."

Tim Reardon, Housing Industry Association (Decrease): "RBA is conservative in cutting the cash rate."

David Robertson, Bendigo Bank (Decrease): "I expect the RBA to cut rates on August 12th by at least 25bp: a 50 basis point cut appears unlikely given recent RBA comments however 35bp (down to 3.5 %) would be a sensible compromise."

Tim Nelson, Griffith University (Decrease): "Core inflation (trimmed mean) fell to 2.7% annual, now inside the RBA's 2–3% target band—its lowest since late 2021. Headline CPI dropped to around 2.1% in June, easing pricing pressures. Weaker inflation, subdued spending, and a still-tight labor market support the case for gradual easing."

Jeffrey Sheen, Macquarie University (Decrease): "Inflation is sustainably in the RBA's target range. The cash rate needs to be returned to neutral. The RBA has more than sufficiently proven its strong commitment to its inflation target."

Craig Emerson, Emerson Economics Pty Ltd (Decrease): "Inflation is within the RBA's mandated target range of 2-3 per cent."

Shane Oliver, AMP (Decrease): "Underlying inflation is falling as the RBA expected and is now around the midpoint of its target, the risks to unemployment are shifting to the upside and monetary policy is still tight so it makes sense to continue easing."

Peter Boehm, Pathfinder Consulting (Decrease): "Political pressure - inflation is still in the economy and prices on key items like housing; utilities; food and other essentials are still rising. Ordinarily the RBA may choose to hold rates, but political and social pressures for a rate cut will probably prevail."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Decrease): "Underlying' inflation now very clearly in the RBA target range and good reasons to be confident that it is 'sustainably' so; monetary policy is still restrictive (but doesn't need to be as restrictive now as it currently is); last two labour market reports have been 'soft'."

Matt Turner, GSC Finance (Decrease): "Really surprised they didn't cut last month, with today's data re CPI it is really much in favour of a cut this month given the wait and see approach.*

Stephen Miller, GSFM (Decrease): *Inflation is trending toward the middle of the 2-3 per cent target band while the labour market looks a little fragile."

Michael Yardney, Metropole Property Strategists Pty Ltd (Decrease): "The RBA was waiting to see the result of the quarterly CPI figure and annual pace of headline inflation, at 2.1%yr, is now down to the bottom of the RBA target band meaning they should have the confidence to make a right cup this month."

Stella Huangfu, University of Sydney (Hold): "I think the RBA should keep interest rates on hold at its August meeting for two reasons. First, June quarter trimmed mean annual CPI inflation is still 2.7%, which is high within the 2–3% target band and slightly above the RBA's forecast of 2.6%. Second, the RBA has already cut rates twice this year, giving it scope to pause and assess the impact before moving further."

Cameron Murray, Fresh Economic Thinking (Hold): "Honestly, who knows!"

Jakob B Madsen, University of Western Australia (Hold): "The economic environment in Australia has not changed recently and the FED funds rate is still higher than the RBA cash rate".

Ask a question