Do the wealthy really pay less tax than the average person?

What tax secrets do the wealthy know that you should know?

We read every day in the press how the wealthy seem to avoid the burden of tax. They have clever systems and pay big money to their accountants to help them achieve what you as an average person must shoulder.

How do they do it? What clever strategies do they use?

As an accountant to many entrepreneurs who fall into the above bracket, I am going to lift the lid on these secrets. Guess what – you can use them as well.

Tax is levied on your net taxable income. As an individual in the top marginal tax rate, it can be as high as 47% plus a 2% Medicare levy and, if you do not have private health insurance, up to an extra 1.5%. That's right – a total 50.5% of your income.

Over half of your money above that threshold is gone to the tax man. It pays to not be a victim of this, as half of your money is then lost.

You may say that is to pay your future pensions. But, in reality, it is not. It goes to maintaining the budget of the government so they can spend as they choose.

What is a simple way to reduce your tax?

So what can you do if you are a high income earner and you want to pay less tax?

If in the last year you made a high income and are now faced with a big tax bill, there is actually a lot you can do.

But before I go into the strategies, it is worth reviewing the tax rates of different entities. These are listed below. At Encore Accounting, we call this the tax rate game "Minimising your tax based on moving money around into different entities".

Using different structures can save a large amount of tax. Finding the right structure depends on your personal situation, but don't be afraid to look.

The tax act has lots of hard-to-find tax planning tricks that can save you lots of tax.

For example, capital gains tax (CGT) relief on the sale of your business, CGT 50% discount, sole and principal residence exemptions, roll over relief to super, along with extra tax write-offs for assets purchased and prepayment rules. The list goes on.

Sometimes it is a case of planning ahead, thinking how you can use what is available to change or amend the transaction so that you can get relief.

This is what the wealthy do. They never accept the status quo. Being in business, they always look for solutions, never problems. They engage the best advisors to find solutions and make them earn their money.

So let's look at the tax rate game. Below is the tax payable for various structures. This helps decide where income will be earned and the tax payable based on that decision.

Company tax

The ATO makes it confusing. A company is taxed at a higher tax rate (30%) if the income is either passive (like rent, dividends or a flow-through of distributions from other entities). This is called "non base rate entity".

Its passive income must be 80% or less of its assessable income.

It must also have a turnover of under $50 million.

A base rate entity – usually a normal trading company – has a lower tax rate of 27.5% for the 2020 tax year, 26% for the 2021 tax year and 25% for 2022.

A company does not have a tax-free threshold, like individuals. All its income is taxed as above.

Personal tax rates (for a resident of Australia)

| Resident tax rates 2021–22 | |

|---|---|

| Taxable income | Tax on this income |

| 0 – $18,200 | Nil |

| $18,201 – $45,000 | 19 cents for each $1 over $18,200 |

| $45,001 – $120,000 | $5,092 plus 32.5 cents for each $1 over $45,000 |

| $120,001 – $180,000 | $29,467 plus 37 cents for each $1 over $120,000 |

| $180,001 and over | $51,667 plus 45 cents for each $1 over $180,000 |

The above rates do not include the Medicare levy of 2% or the Health Insurance Surcharge.

Trust structure

This is a really interesting area and one that causes confusion. A trust is a flow-through entity. Hence its taxable income can be either taxed by the trustee at high rates or flow through to beneficiaries of the trust.

They will then pay tax at the respective tax rates, as a company or an individual, as per the above tax rates.

Accountants will always flow the profits from the trust to the most tax effective entity, playing what I mentioned earlier, the tax rate game.

Trusts have restrictions and do not work for every situation. For instance, if there is no-one in the family or tax group to distribute to that has a low tax threshold.

But they do allow scope for reviewing the income and distributing it to the lowest taxed member of a group. With restrictions, they also allow the trust to distribute income to entities that have tax losses.

Another aspect of trusts is that tax losses are trapped in the trust. Only profits can be distributed to beneficiaries, not losses.

If a trust does not distribute its profits to beneficiaries, or if no beneficiary is presently entitled to the income of the trust, it is taxed at rates similar to the personal tax rates above.

These are some of the ways that the wealthy use the tax system to their advantage.

My question for you now is: How can you use the tax act to your advantage rather than be a victim?

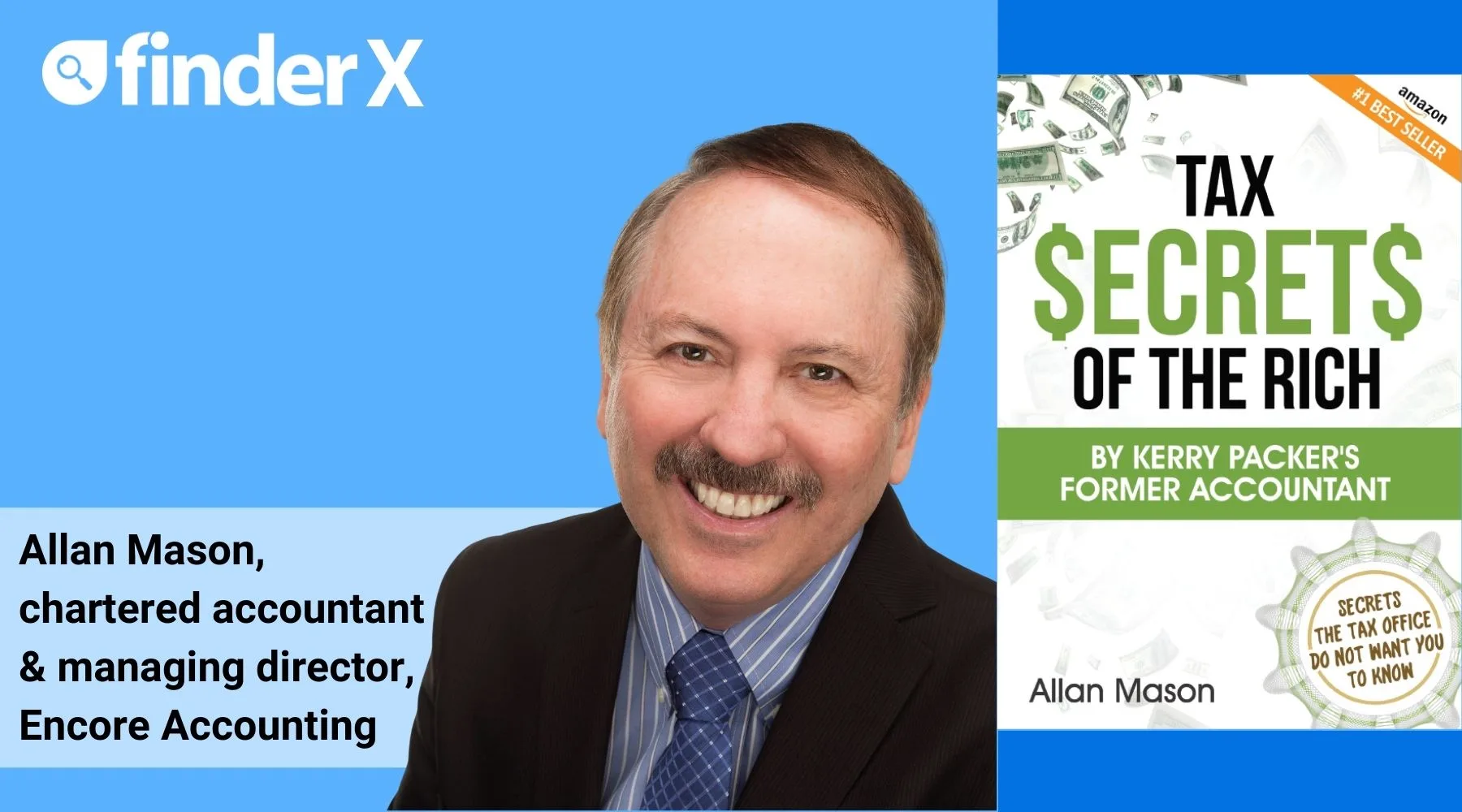

Allan Mason is a chartered accountant and managing director of Encore Accounting Pty Ltd, a Brisbane-based chartered accounting firm. He was the accountant to the late Kerry Packer, along with many other entrepreneurs, and is the author of 4 books, include Tax Secrets Of The Rich.

Disclaimer: The views and opinions expressed in this article (which may be subject to change without notice) are solely those of the author and do not necessarily reflect those of Finder and its employees. The information contained in this article is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice or recommendation of any sort. Neither the author nor Finder has taken into account your personal circumstances. You should seek professional advice before making any further decisions based on this information.

Read more Finder X columns

-

All the big savings account interest rate rises: ING, AMP, Westpac + more

6 Feb 2026 |

-

Australian credit card debt soars 10% in a year: How can you escape the trap?

6 Feb 2026 |

-

4 cashback home loan offers to ease the pain of RBA rate hike

4 Feb 2026 |

-

Finder’s RBA Survey: Easing cycle ends as RBA delivers first rate hike since 2023

4 Feb 2026 |

-

Ubank Save is increasing its bonus rate up to 5.35% p.a.

3 Feb 2026 |

Ask a question