The ultimate guide to cryptocurrency mining: Part 2

How blockchain and mining work together.

Welcome to part two of the ultimate guide to crypto mining. Last week's blog entry covered hashing, encryption and decryption. This week we'll be discussing the blockchain and mining process itself.

What are cryptocurrencies?

Cryptocurrencies are digital currencies similar to the Australian dollar, but with no notes to print or coins to mint. They exist solely in the digital world and are generally not controlled by any central authority. Cryptocurrency transactions are not verified by a bank, like regular currency transactions, but are instead verified by a system called blockchain.

No blockchain, mo problems.

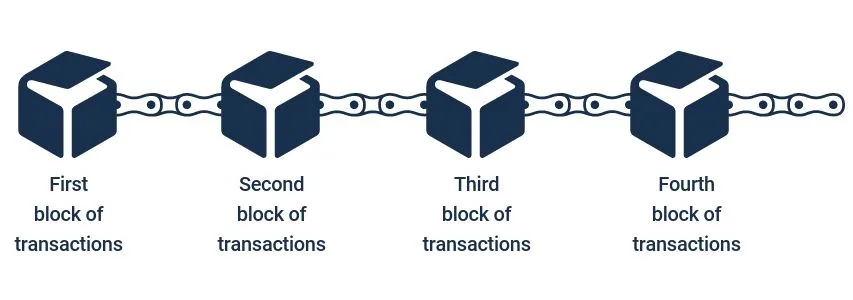

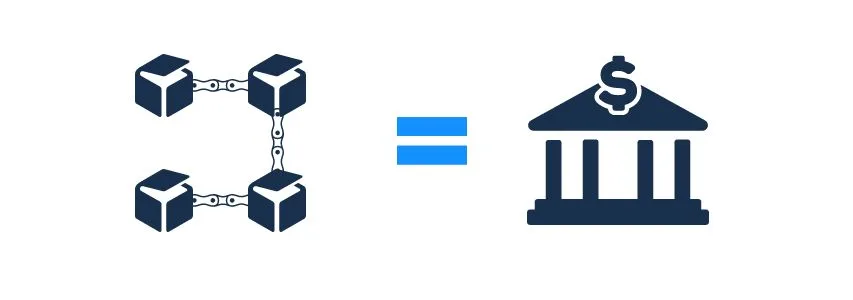

The blockchain is the recording system behind the operation of all cryptocurrencies. Different blockchain systems operate in different ways, but the essential concept remains the same - groups of recorded currency transactions are bundled up into blocks of data at regular intervals. Each block is linked to the previous block to form a "block-chain". The data in these blocks is recorded simultaneously on many computers around the globe. The blockchain in a cryptocurrency system acts as the verifying authority behind transactions. If you think of any non-cash purchase or transaction you’ve ever made, a bank or financial institution has always been at the centre of the process. Their role is to authorise and facilitate the transaction between you and the retailer. Blockchain essentially replaces the bank in this situation.

The blockchain in a cryptocurrency system acts as the verifying authority behind transactions. If you think of any non-cash purchase or transaction you’ve ever made, a bank or financial institution has always been at the centre of the process. Their role is to authorise and facilitate the transaction between you and the retailer. Blockchain essentially replaces the bank in this situation.

The blockchain recording system is decentralised and (in theory) highly unhackable. Information about each preceding block is encoded in the next block. This way, it becomes immediately obvious if any links are broken. In order to make a malicious change to the existing transaction record, a hacker would need to hack not only the block containing the transaction they want to alter but all blocks before it. They would also need to do this simultaneously across thousands of computers around the world. This is why blockchain is often described as a secure globally-distributed ledger.

The blockchain recording system is decentralised and (in theory) highly unhackable. Information about each preceding block is encoded in the next block. This way, it becomes immediately obvious if any links are broken. In order to make a malicious change to the existing transaction record, a hacker would need to hack not only the block containing the transaction they want to alter but all blocks before it. They would also need to do this simultaneously across thousands of computers around the world. This is why blockchain is often described as a secure globally-distributed ledger.

At the coalface: Miners

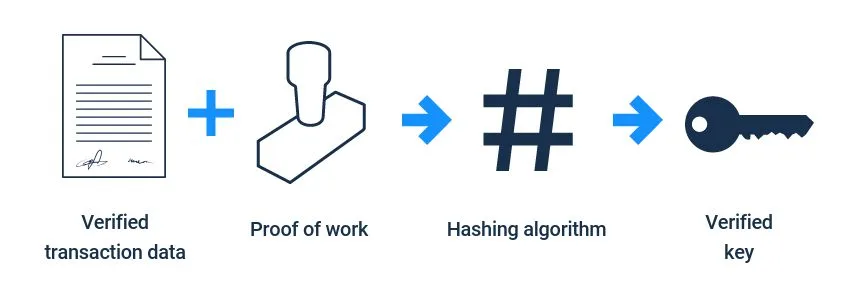

Cryptocurrency miners compete with each other to earn coins by processing blocks in the blockchain. Once currency transaction data blocks are created, they need to be verified. To do this, a miner needs to verify that the transactions recorded in the block are valid (we won’t address how they do this here), and produce proof that they have made that verification. This is known as "proof of work".

The verified transaction data and the proof of work are processed together via the hashing algorithm to create a key. However, just a like a real key needs to be a certain shape to fit a lock, this key will need to fit a certain pre-designated format to be accepted by the blockchain system. Multiple attempts are made to create a valid key using different proof of work inputs.

Therefore, the hashrate describes the number of attempts at solving the verification puzzle any piece of hardware (or a whole network) can process per second. The rate will depend on the algorithm used and the power of the hardware it is being run on. The number of attempts required to crack the puzzle is determined by a metric called difficulty.

The first miner to correctly verify the newly created block, and create a functional key, receives an award in currency. This verified block record is then copied across the network.

Not so fast: Mining limits

Obviously, a system where miners could generate infinite amounts of coin would not be functional as a currency. In order to control the amount of currency in circulation, a strict limit on the production rate is enforced across all cryptocurrencies. Therefore, if more miners pile into the system and attempt to verify blocks and earn coin, the verification process increases in difficulty. Some currencies, such as bitcoin, have a limit on the total number of coins that will eventually be produced. Others, such as Ethereum, are uncapped.

Part three is here. If you want updates on when the next part of this blog goes live, you can follow me on Twitter.

Graham Cooke's Insights Blog examines issues affecting the Australian consumer. It appears regularly on finder.com.au.

Picture: Shutterstock

Ask a question