Lower credit card limits didn’t change my credit score… Why?

Your credit limits can affect your credit score and your chance of approval, but it's not always as simple as changing one to improve the other.

When I got my 2 current credit cards, I didn't request any particular limits and ended up with combined credit limits of over $22,000.

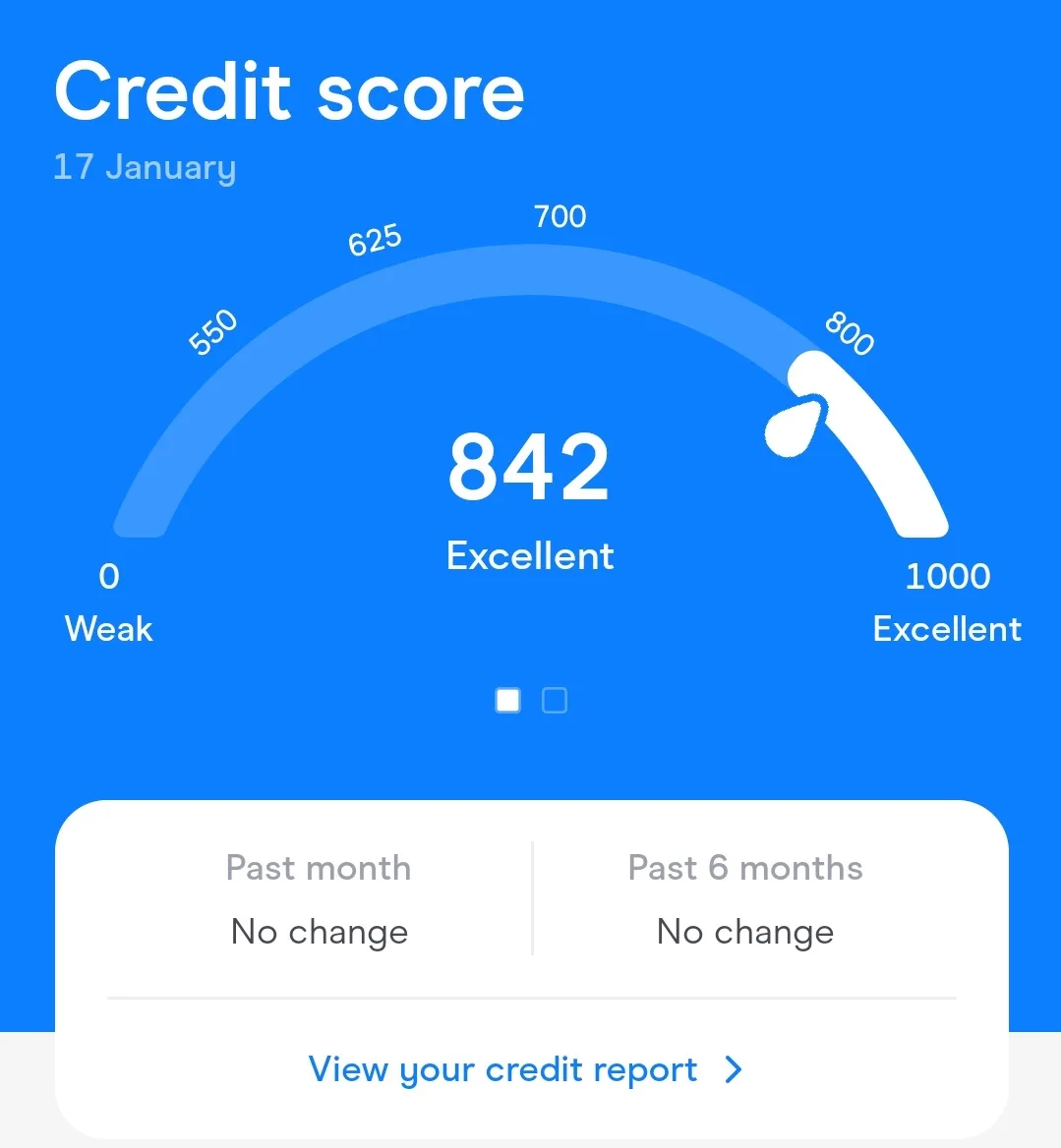

Last year, I basically halved my credit card limits and was curious to see if it would impact my credit score (which was already high). It did not.

My credit score in the Finder app has not changed in over 6 months, despite lowering my credit limits in that time. Image: Finder

This surprised me, because I knew having access to $22,000 in credit could have an impact on any new applications for credit cards, personal loans or even a home loan.

Some experts even suggest you reduce your credit limits or cancel your credit cards to help improve your chance of approval.

So, I decided to do a bit of digging and find out more about what your credit limit can affect – and when it really matters.

Credit scores and new applications

Experian general manager of credit services for Australia and New Zealand, Tristan Taylor, confirmed that credit limits are only "one of the factors that could influence a credit score".

"Having said that, not all factors are equally weighted in determining a credit score [and] these factors do not necessarily affect all people in the same way."

So, while my credit score didn't change after I reduced my credit limits, yours could.

Taylor also explained that credit scores are just one factor in a credit application.

"Some lenders will decline credit applications purely based on a very low credit score, although it is more common to use a credit score in combination with a range of other factors to make a decision," he said.

"A high credit score alone will never guarantee an approval, although it will almost certainly help."

"Lenders have an obligation to lend responsibly, which means factors such as your income and expenses must be considered in addition to your credit score."

Why your credit limits still matter to new lenders

Even if lowering your credit limit doesn't change your credit score, it could improve your chances of approval in other ways.

Gerry Incollingo, the managing partner of accounting and finance firm LCI Partners, said lenders base their assessments on "the total limits available to the applicant rather than the balance owing".

"For example, a client who has $50,000 in credit card limits, but only owes $5,000 will still need to be able to service the proposed loan based on $50,000 limits in place."

To put this another way, the application would be assessed based on the monthly repayments for a $50,000 credit card debt – even if you never carry a balance.

"Therefore, reducing these limits is very likely to increase total borrowing capacity. This also works the same way for existing mortgages in place," Incollingo said.

Note: Some lenders may factor your actual balances into their assessment when you apply – so paying off what you owe can still have a positive impact.

So, was lowering my credit limits worth it?

My credit score may not have changed, but the amount of money I can borrow (and my chance of approval) has potentially gone up because I lowered my credit card limits.

It also reminded me of a few key details to keep in mind if you're thinking about lowering your own credit limits, improving your credit score or want to get approved for a new loan:

- Your credit score is based on a lot of different factors, including your credit limits, repayment history and new credit enquiries.

- Your credit report contains a lot of valuable information for lenders – so it's worth getting your own copy as well.

- Higher credit limits also come with a risk of higher debt.

- Lenders look at details across most areas of your life to help them make a decision.

- If you want to apply for a home loan, you can use Finder's home loan serviceability calculator to see how much impact changing your credit limits can have.

Bottom line? Any changes that put you in a better financial position have the potential to help improve your credit score and the outcome of new applications.

Getting ready to apply for a new credit card or loan? You can check your chance of approval for free through the Finder app, plus get monthly updates on your credit score.

Image credit: Finder (Luke Dubbelde)

Ask a question