Compound interest: Your secret to supercharge your wealth?

Compound interest can take your money and supercharge your returns over time. Here's how to take advantage.

Interest is the amount of money or return you get when you invest your money.

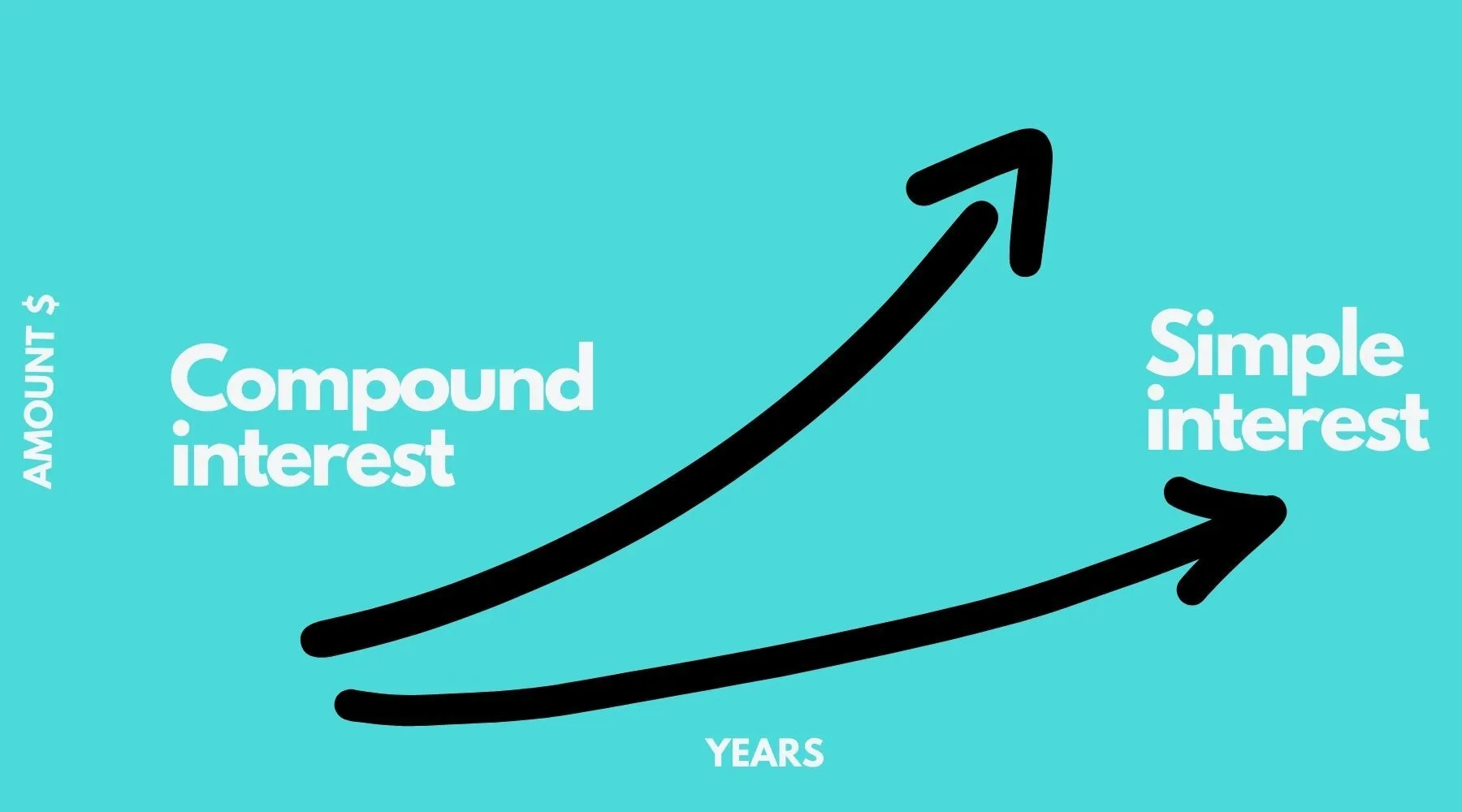

Simple interest is when you earn a return at a flat rate based on your initial investment.

Compound interest is when you earn a return based on your initial investment, plus any interest you've already earned.

Confused?

Let me break it down for you:

Simple interest is paid only on the principal amount you have invested. It's usually paid at the end of the investment period.

A term deposit is a great example of simple interest:

- You invest $10,000 for 12 months.

- The interest rate is 3%.

- At the end you're repaid your initial amount ($10k) plus $300.

- Final sum after 12 months = $10,300.

What is compound interest, then?

It's like simple interest – but better.

Compound interest is a return made up of 2 parts: interest on the initial investment, and interest on interest.

It can be compounded daily, monthly or yearly.

Let's say you invest $10,000 in a savings account with daily compounding interest, at a rate of 3% per annum.

- At the end of day 1, you have $10,000.82.

- On day 2, your interest is calculated based on 3% of $10,000.82.

- You get an interest payment of $0.82, bringing your new balance to $10,001.64.

- This repeats daily and you earn interest on interest.

- Final sum after 12 months = $10,304.52.

The difference between simple and compound interest in the above example is $4.52 over 12 months.

Now, you might be thinking… big deal? It's only a few dollars.

The secret sauce and where you can supercharge your wealth is when interest compounds over time.

After 5 years, that initial $10,000 would be worth $11,619.23.

After 10 years, it'd be worth $13,500.

After 25 years, you'd be sitting on a pot worth just over $21,000.

And 40 years on, your initial $10k would be worth more than $33,000.

And you haven't added a single extra dollar of your own money beyond your initial investment.

If you were to add $100 a month to the pot, you'd supercharge those savings to the point where you'd have:

- $11,520 after 1 year...

- $18,067 after 5 years...

- $27,420 after 10 years...

- ...and $124,500 after 40 years.

How's that for a financial win?

Ask a question