The ‘bank of mum and dad’: 1 in 5 first home buyers tap the family bank

The 'bank of mum and dad' is turning the Aussie dream of home ownership into a reality for thousands of young buyers.

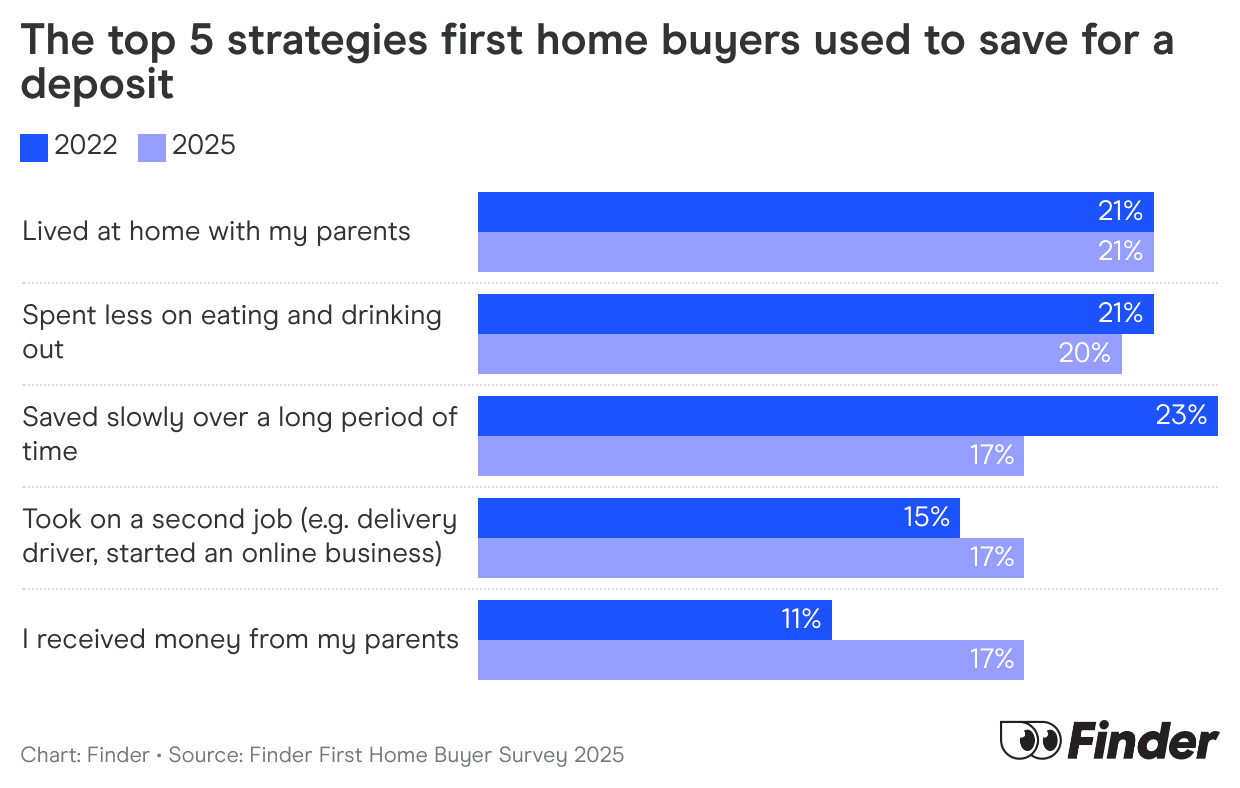

Finder's First Home Buyer Report 2025 – based on a survey of 1,006 first home buyers in Australia – reveals almost 1 in 5 (17%) first home buyers relied on the financial help of mum and dad to save their deposit, up from just 11% in 2022.

That's almost 20,000 first home buyers a year who are lucky enough to receive financial assistance from their parents.

Sarah Megginson, personal finance expert at Finder and mum-of-three, said millions of Aussies are counting on the bank of mum and dad.

"The bank of mum and dad has become one of the biggest unofficial lenders in the country.

"For many young Australians, homeownership feels like a dream that won't be realised, unless you've got parents who can tip in some financial help – sometimes up to six figures.

"First home buyers with parental help aren't just getting in earlier – they're getting in stronger, with more savings, bigger budgets, and a huge head start."

The report reveals first home buyers who receive financial support from their parents had 41% more money left over in savings after buying their first home – compared to those who don't have parental financial help – to weather unexpected expenses in the future.

Megginson warned that too much generosity from parents' could hurt their own standard of living in retirement.

"Supporting your kids is part and parcel of being a parent, but you need to do it in a way that's sustainable for everyone. The worst-case scenario is if mum and dad leave themselves vulnerable in the process of trying to help their kids.

"I've heard of parents who end up working longer than they planned, delaying retirement or leaving themselves financially short once they retire, because they were too generous when giving their kids a financial leg-up."

Among buyers without family support, 40% took 5 years or more to save a deposit, compared to just 29% of those who received assistance.

Ask a question