The average Aussie investor earned $5,356 in 2021

Australian investors are making a small fortune through the stock market, according to new research by Finder.

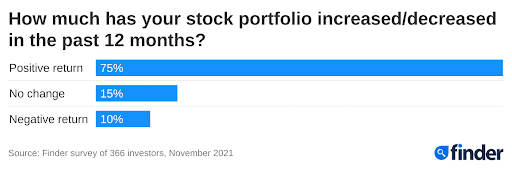

A survey of 366 investors found 3 in 4 (75%) received a positive return over the past 12 months, with an impressive average growth of 20.4%.

That's an annual return of $5,356 based on the size of the average investor's portfolio today ($31,613), according to Finder's Consumer Sentiment Tracker.

For comparison's sake, the S&P/ASX 200 Index posted a calendar year gain of 13% in 2021, or 17% including the value of dividends paid.

Finder research shows more than 1 in 3 Aussies (37%) are investing in the stock market, with millennials (46%) and generation Z (42%) the most likely to do so.

Kylie Purcell, share trading expert at Finder, said investing is a smart way to earn money while interest rates are low.

"With savings rates at record lows, Australians have been quick to adapt by putting some of their money into shares, which can deliver higher returns.

"The 2020 market crash was a game changer for Australians, with thousands of people a day signing up to online brokers for the first time."

Purcell said investing used to be a complex concept for many Australians.

"Now we're seeing more and more people who are keen to get involved and build their wealth.

"Online platforms and apps like eToro and Superhero have made it super easy for everyone to jump in. They're intuitive to use – but watch out for brokerage and subscription fees.

"Some platforms also charge an inactivity fee if you're not regularly trading, so it's worth comparing your options before getting started."

Purcell said many Aussies' investment strategies were paying off.

"The average person surveyed is beating the broader Australian market which has risen just 9.8% in the past 12 months.

"You don't need to be rich to get involved – there are also micro-investing apps that let you invest your spare change.

"It's a good idea to ensure your investment is diversified. Instead of betting all your chips on one or two companies, spread it out to reduce your risk."

Finder's research found those who received an increase in income this year reported a higher overall return (30.6%).

Want to trade Australian and global stocks without paying a fortune in brokerage fees? Compare share trading platforms at Finder.

Ask a question