Are Ethereum ETFs on the way?

With the success of the Bitcoin ETFs, attention is now turning to Ethereum.

Bitcoin and the wider cryptocurrency market are back in the news after a barnstorming week that saw new all-time highs for Bitcoin.

A huge part of the recent surge in price is the ongoing success of the 11 spot Bitcoin exchange-traded funds (ETFs) that were approved back in January.

Since then, billions of dollars of net inflows have helped push Bitcoin above AU$100,000 for the first time.

As a result, the potential spot Ethereum (ETH) ETFs are back in the spotlight.

Are Ethereum ETFs officially confirmed?

Not yet. While companies like Grayscale, Fidelity and VanEck have submitted Ethereum ETF applications to the Securities and Exchange Commission (SEC) in the US, they are yet to be approved.

This week, the SEC delayed making a decision on whether to approve those applications, instead inviting commentary and feedback from the wider industry on whether the arguments made in favour of spot Bitcoin ETFs also applied in the case of Ethereum ETFs.

Ultimately, the SEC has until 23 May to make a decision, but there's nothing to say it won't approve the ETFs before that date, or not approve them at all.

In fact, some experts believe rejection is more likely.

Jake Chervinsky, chief legal officer at crypto fund Variant, recently wrote on twitter that he believed legal question marks and the current political environment made a May approval unlikely.

Jonathon Miller, managing director for Kraken Australia, said it's too early to count the chickens on Ethereum ETFs just yet.

"Whilst an ETH ETF seems inevitable with the green-lighting of BTC equivalents earlier this year, it's worth pointing out that ETH and Bitcoin are very different assets 'under the hood', and have different use cases," he said.

What will this do to Ethereum's price?

It's difficult to say.

The expectation that Ethereum ETFs will be approved may already be "priced-in" so to speak, so any further delays or outright rejections may actually damage the price of ETH.

Even SEC approval may have little bearing on ETH's performance, depending on how much demand materialises for any Ethereum ETFs.

Whatever happens, the advent of Ethereum ETFs should be seen as a positive for the industry, said Miller.

"Increasing the availability and accessibility of ETH, Bitcoin and cryptocurrencies more generally is something to be celebrated," he said.

"An ETH ETF will have a similar role to the Bitcoin ETFs: legitimising the asset to a broader range of investors and acknowledging that the crypto asset-class will be a part of many investor portfolios in the future."

Join the crypto conversation – Follow us on X now

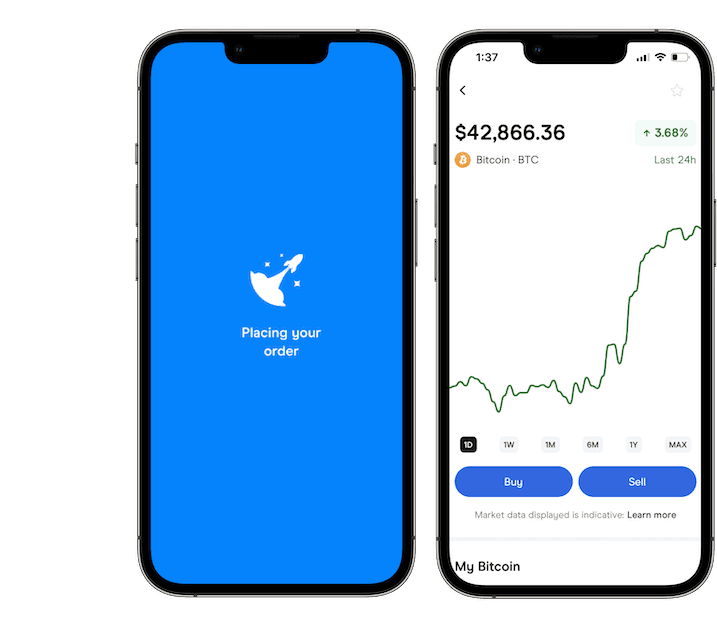

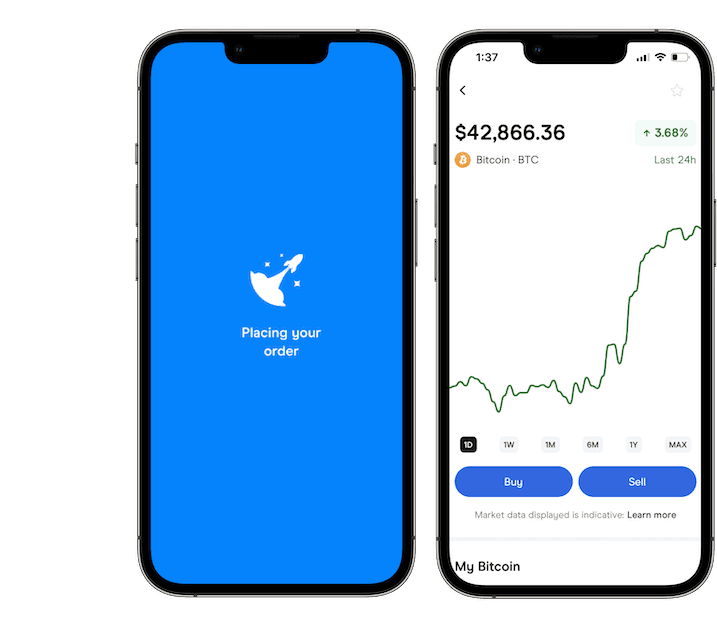

Trying to get a handle on the markets? Cut through the noise with our overview of the best cryptos to buy right now, explore some strategies for how to trade crypto or see if there's a better platform for you with our guide to the best crypto exchanges.

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators' websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Trusted by over 500,000 Aussies

Trusted by over 500,000 Aussies

Ask a question