Dude, where’s my rate cut?

How the banks are increasingly unlikely to pass on a full rate cut to mortgage holders.

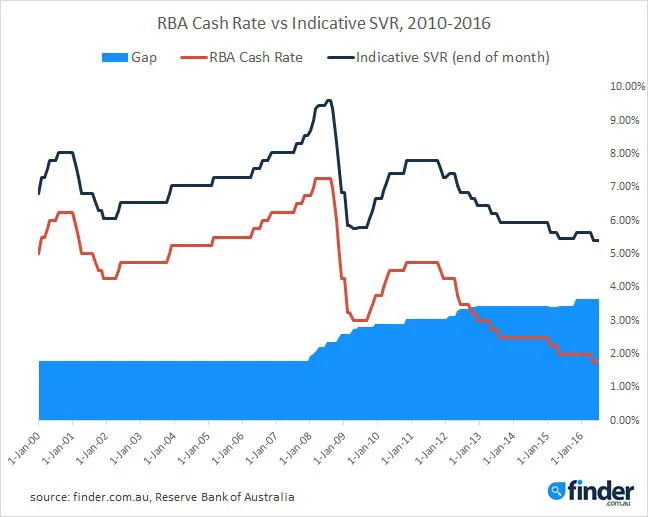

The Reserve Bank of Australia (RBA), which held its cash rate today after cutting last month, is losing its influence over standard variable mortgage rates in Australia. A recent finder.com.au analysis of the RBA cash rate and the indicative standard variable rate (SVR) - an average of the rates charged across the market - shows that the days of the RBA’s rate cut being passed on in full by the banks are over.

At the start of the millennium, the RBA cash rate was 5.00% and the average variable rate across the banks sat 1.80 percentage points higher at 6.80%. When the cash rate was increased by 0.50 percentage points in February 2000, the full rate increase was passed on, as were all the increases for the rest of the year.

When the RBA cash rate was cut by 0.25 percentage points in March 2001, the banks passed on the full cut to customers. In fact, the average standard variable rate offered by the banks was directly tied to the RBA cash rate, sitting 1.80 percentage points higher, from 2000 until 2008. Then, everything changed.

The global financial crisis in 2008 triggered a rapid drop in the cash rate. By April 2009, it had fallen by more than half to only 3.00%. The indicative standard variable rate followed suit, but did not drop as steeply, bottoming out at 5.75% in April, 2.75 percentage points above the cash rate. To alleviate the effect of the financial crisis, banks started to retain some of the RBA cash rate cuts for themselves, to help their bottom line.

Parity was restored briefly through to the end of 2011, but since then the indicative standard variable rate has started to pull away dramatically from the RBA cash rate. On average, the banks did not pass on the full extent of any rate cut in 2012. Helped by a bank out-of-cycle rate hike in November 2015, the gap between the two rates has continued to widen. As of July 2016, just before the most recent RBA cut, the indicative SVR was 5.40%, which is triple the RBA cash rate of 1.75%.

What this means for the RBA is that the full extent of the cut is not being felt by the majority of mortgage holders. Based on the average home loan size in Australia of $360,100 (June 2016), a homeowner with a 5.40% interest rate (the average in July) would be down about $369,000 in interest over the course of paying off their mortgage. If the indicative SVR was still tied to the RBA rate as it was in the first eight years of the century, and sat at 3.55% in June, that same mortgage holder would be paying only $226,000 in interest, a saving of almost $143,000 - or $90 per week for the course of the loan.

It’s important to note here that many people will not be on the indicative standard variable rate, and most will be paying less. However, in an increasingly competitive market it’s important to know that you have options when it comes to your mortgage. If you’re not happy with what savings your bank have passed on to you following last month’s rate cut, don’t be afraid to call them and ask for a further discount. Most of the time, you’ll get something.

If your bank won’t reduce your interest rate, shop around. Many of the smaller lenders are currently offering better rates than the big banks, with some under 3.7% available. The days of feeling tied down to one mortgage agreement for life are gone. You’d be surprised how a little effort now can result in big savings in the long run.

Graham Cooke's Insights Blog examines issues affecting the Australian consumer. It appears regularly on finder.com.au.

Recent Insights blogs

-

All the big savings account interest rate rises: ING, AMP, Westpac + more

6 Feb 2026 |

-

Australian credit card debt soars 10% in a year: How can you escape the trap?

6 Feb 2026 |

-

4 cashback home loan offers to ease the pain of RBA rate hike

4 Feb 2026 |

-

Finder’s RBA Survey: Easing cycle ends as RBA delivers first rate hike since 2023

4 Feb 2026 |

-

Ubank Save is increasing its bonus rate up to 5.35% p.a.

3 Feb 2026 |

Ask a question