What are the best ASX blue chip stocks of 2020?

Work (and play) from home stocks Kogan, Domino's and Breville are among the top performing large-cap Aussie stocks this year.

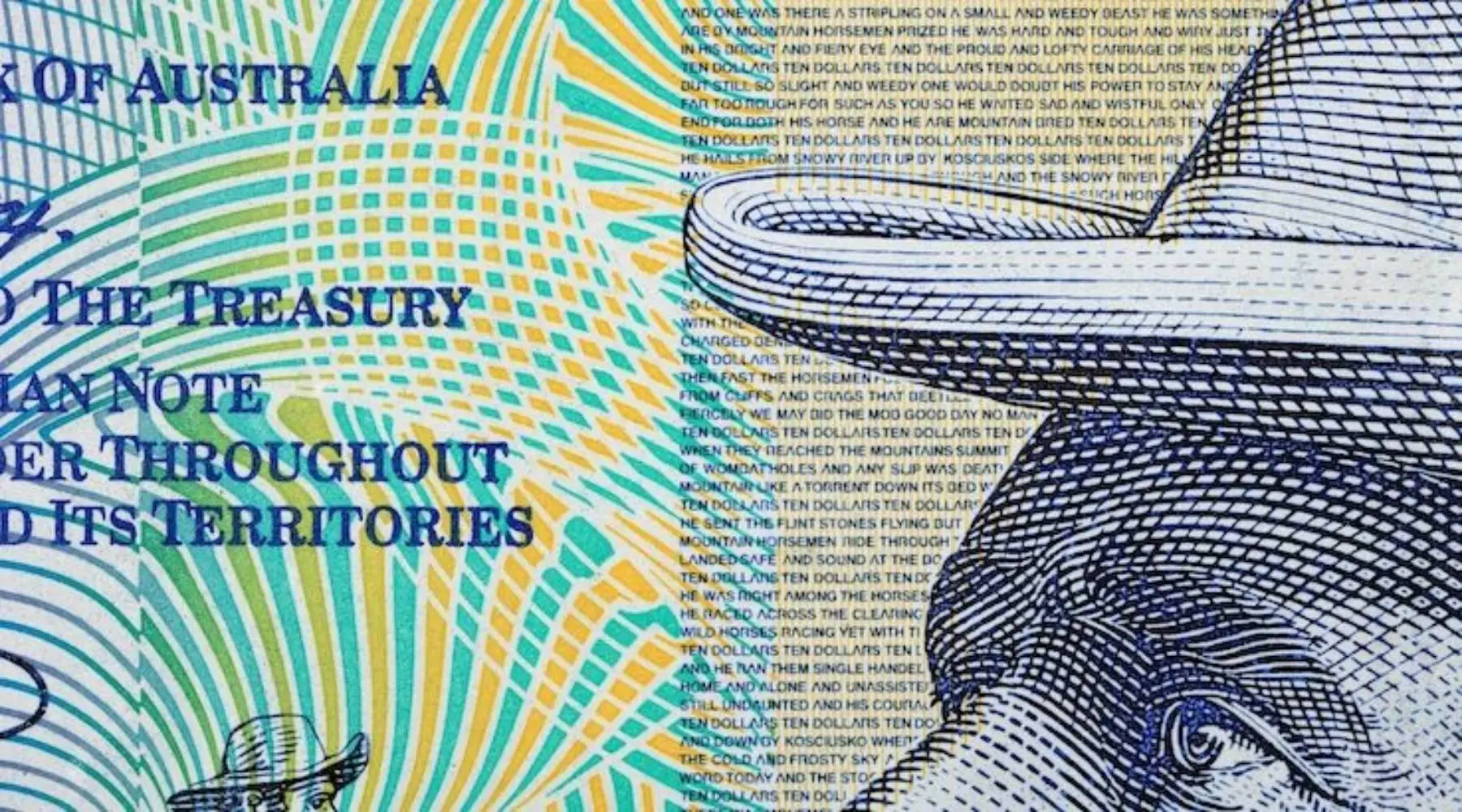

Blue chip stocks are popular in Australia thanks to their reputation as stable, dividend-paying companies. However, with Australia entering its first recession in decades and many companies choosing to cut dividend payments, it's worth taking a look at which blue chips are still dominating the market and which have fallen off the radar.

There's no blanket definition that covers what is or isn't a blue chip stock. Broadly speaking, the term refers to the biggest and oldest profit-making companies on the stock market. These large-cap companies can usually be found among Australia's largest 50 public companies (i.e. the ASX 50 index).

Because Australian stocks pay comparatively high dividends compared to other markets, blue chip stocks like CommBank, Westpac, Woolworths and Telstra are a favourite among long-term investors here.

However, COVID-19 has shaken up the market. The "great reset" has left many of our strongest listed companies underperforming the market, while newer technology firms quickly climb the ladder.

The working from home revolution has especially benefited certain industry niches. With more people shopping (and gaming) online, the best performing blue chips in the United States this year have included parcel delivery companies along with manufacturers of computer processing units.

Similar themes have also emerged in Australia, with online retailer Kogan among the best performing large-cap stocks along with fast-food delivery firms such as Domino's and home cookware and appliances suppliers like Breville.

To better understand which of our biggest and most reliable companies are dominating the market in the post-COVID-19 world, we compiled a list of the best performing blue chip stocks in Australia so far this year (to 7 October). To help narrow it down, we looked at dividend-paying companies at least 10 years old with a market cap of $2 billion or more.

How to invest in ASX blue chip stocks

To buy Australian blue chip stocks you'll need to open a brokerage account that offers ASX-listed shares. Not all online brokers offer Australian shares – some only allow you to trade US stocks – so it pays to double-check first.

Once you've chosen a share trading platform, you'll be able to search for the company name of your blue chip or its stock code. Depending on the broker you choose, it might offer additional information about each company, including broker rating, price targets, dividend payments and debt to value ratio.

Your other option is to trade stocks through CFDs. These are derivative investment products that allow you to trade using leverage. When you trade stock CFDs, you don't ever own the underlying shares, instead you're betting on a stock's price movements (either up or down) by the way of a contract.

Because CFDs are leveraged, you can make and lose money much more quickly than you normally would trading shares directly, but this also makes them a lot riskier. You can check out more about CFD trading in our guide.

Trade with IC Markets

Compare other CFD trading platforms here

More headlines

-

All the big savings account interest rate rises: ING, AMP, Westpac + more

6 Feb 2026 |

-

Australian credit card debt soars 10% in a year: How can you escape the trap?

6 Feb 2026 |

-

4 cashback home loan offers to ease the pain of RBA rate hike

4 Feb 2026 |

-

Finder’s RBA Survey: Easing cycle ends as RBA delivers first rate hike since 2023

4 Feb 2026 |

-

Ubank Save is increasing its bonus rate up to 5.35% p.a.

3 Feb 2026 |