Finder’s RBA Survey: The RBA will be “the Grinch that stole Christmas” this year

Homeowners hoping for a Christmas miracle will be left disappointed, with economists agreeing Santa won't be delivering rate relief this year.

In this month's Finder RBA Cash Rate Survey™, 35 experts and economists weighed in on future cash rate moves and other issues relating to the state of the economy.

All panellists (100%, 35/35) expect the RBA to hold the cash rate on Tuesday, keeping it at 3.60%.

Almost all experts (94%, 33/35) say the RBA should hold the cash rate next week, while just 6% (2/35) believe the Bank should deliver a final hike to close out 2025.

Graham Cooke, head of consumer research at Finder, said Australia's economists are sending a clear message: don't expect rate relief anytime soon.

"A hold is still a better outcome than an end-of-year hike, which was being suggested by some analysts – and would have added extra pressure to already stretched household budgets.

"With inflation starting to get away from the RBA, the board appears committed to steady rates for now.

"Any festive rate cuts are firmly off the table, and borrowers will need to prepare for a cautious start to 2026 rather than a sudden reprieve," Cooke said.

Scott Kuru from Freedom Property Investors noted "It will be no surprise to anyone that the RBA will be The Grinch that Stole Christmas, not Santa, this December."

Geoffrey Kingston from Macquarie University Business School agreed, saying this month the [Reserve] Bank will probably sit on its hands.

"As we move through 2026, however, we will probably see one or two rises in the cash rate," Kingston said.

Stephen Koukoulas from Market Economics said "The inflation lift we are seeing now is likely to be a blip that will unwind in the first half of 2026."

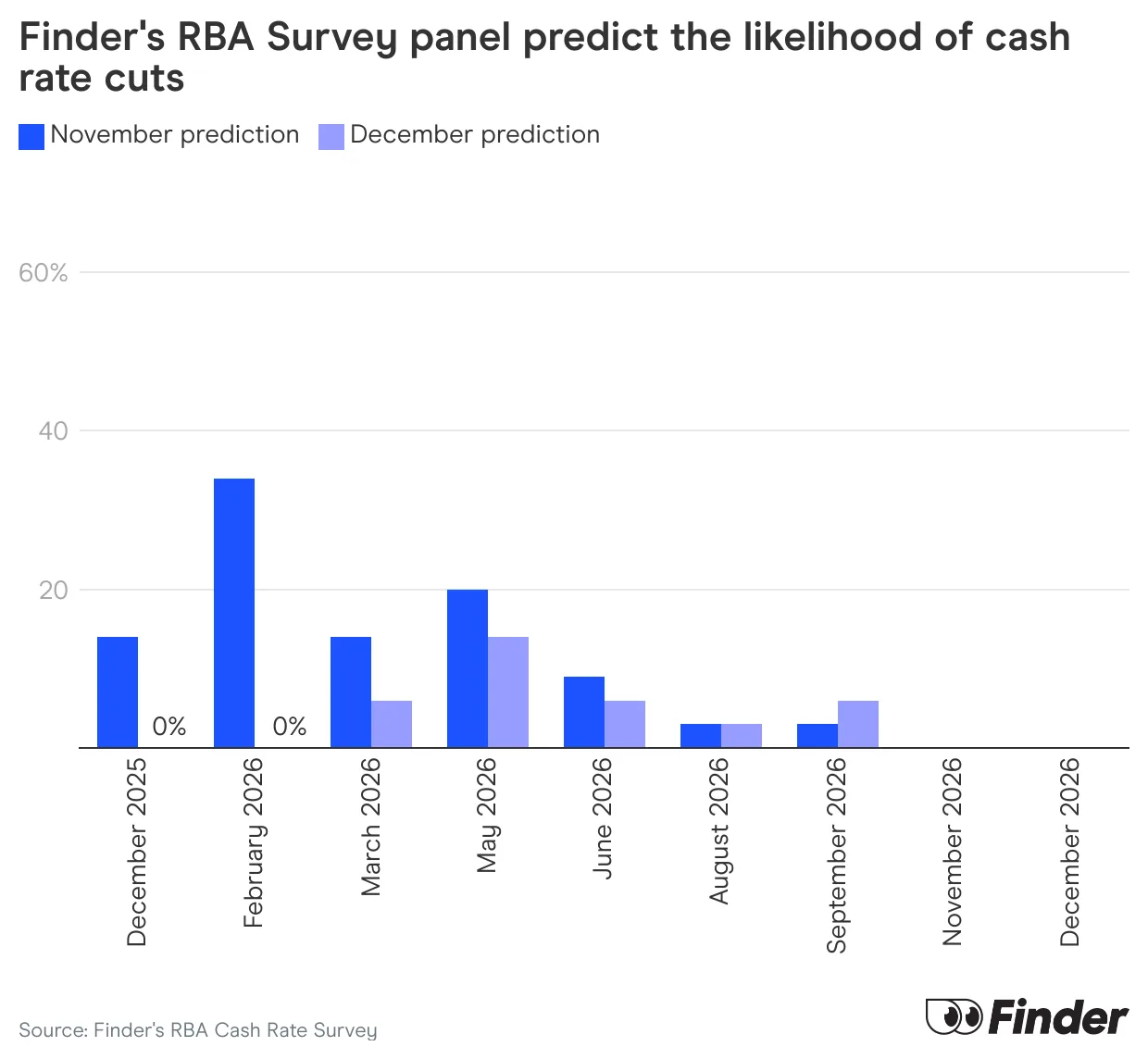

In November, 34% of the panel forecast a rate cut at the first meeting of 2026 in February, but that figure has plunged to 0% in December.

A more luxurious Christmas is off the cards for thousands of homeowners

With experts united in predicting a rate hold, many homeowners face a tighter festive season.

New Finder research shows 1 in 3 (30%) homeowners would have enjoyed a more indulgent Christmas if the RBA cut the cash rate.

If the RBA decides to cut the cash rate in December, will you have a more indulgent Christmas?

| Yes | 30% |

| No | 70% |

| Source: Finder survey of 297 mortgage holders, November 2025 |

More than half (55%) had even been planning how they'd spend extra cash if rates continued to fall – but those plans may now be on hold.

For those who were expecting some breathing room, travel was the top priority, with more than 1 in 4 (27%) saying they would have gone on a holiday or weekend getaway.

Other ways mortgage holders had planned to treat themselves included dining out or ordering takeaway more often (15%) and shopping for clothes, shoes, or accessories (13%).

Some were planning to splurge on bigger purchases such as buying or upgrading their car (13%), while 12% had plans to spend on home or furniture upgrades.

Experts divided on where interest rates are headed in 2026

Economists remain evenly split on the outlook for interest rates next year.

Half of experts who weighed in* (50%, 14/28) believe we've already hit the bottom of this easing cycle, while the other half (50%, 14/28) say there's still room for rates to fall.

There is also uncertainty over October's CPI reading of 3.8%, and whether this will impact the likelihood of a rate hike in the next 6 months.

More than a third of experts (38%, 11/28) say October's inflation data has "definitely" raised the likelihood of a rate hike within the next 6 months, while 34% (10/28) see it having little impact.

A further 28% (8/28) believe the CPI increases the chance of a hike by as much as 50%.

"Experts are not required to answer every question in the survey.

Here's what our experts had to say:

Nalini Prasad, UNSW Sydney (Hold): "Inflation has been stronger than expected. This indicates that inflationary pressures in the economy are stronger than originally thought. I think the RBA will not increase interest rates until inflation has eased more."

Tomasz Wozniak, University of Melbourne (Hold): "Let's take a deep breath! We all know that the RBA will not move the cash rate. Various forces pull in opposite directions, but both, a CUT and a HIKE, are not consistent with RBA's mandate, communication, and practice ATM. And we mostly benefited from this reserved approach in recent years. This is what my forecasts indicate as well. They are centered around the current cash rate value with the confidence bands away from it on both sides. Surprisingly, some bond yield curve models would indicate a RISE at 68% confidence. They get outweighed in the pooled forecast, though. My forecasts are available at: https://forecasting–cash–rate.github.io/"

Matthew Greenwood–Nimmo, University of Melbourne (Hold): "The RBA is likely to hold the cash rate constant given the current inflation and unemployment situation."

Evgenia Dechter, UNSW (Hold): "With recent inflation readings remaining at or above the top of the target range, the RBA is expected to maintain a cautious stance and keep the cash rate on hold for now."

Dr Andrew Wilson, My Housing Market (Hold): "Having misjudged the strength of inflation particularly in regard to the predictable post–subsidy spike in electricity costs, the RBA will hold rates but may have some difficult decisions in 2026 if inflation keeps rising as expected and the recent modest weakening of the labour market intensifies."

Shane Oliver, AMP (Hold): "There is still a possibility of another rate cut and inflation is likely to fall back to target but with growth likely to run around potential the most likely outcome is now for the RBA to leave rates on hold next year."

Geoffrey Kingston, Macquarie University Business School (Hold): "During the last few months there has been a distinct whiff of stagflation. This month saw a soft GDP print, and the last two months of inflation data were ominous. Behind all this are governments that are reluctant to rein in either spending, or the business taxes and regulations that stunt our tax base. This month the Bank will probably sit on its hands. As we move through 2026, however, we will probably see one or two rises in the cash rate."

Stella Huangfu, University of Sydney (Hold): "Because the data show an economy that's steady but not strong, and inflation is still above target. There's no case to cut, but also no case to hike so the RBA will stay put."

Tim Reardon, Housing Industry Association (Hold): "The shortage of housing stock will keep CPI elevated. Unemployment will remain low given home building will continue to absorb excess labour."

Brian Parker, Australian Retirement Trust (Hold): "No change in rates for a while, but with still soft GDP growth, we're likely to see the labour market soften enough to allow the RBA to cut once more in May."

Malcolm Wood, Ord Minnett (Hold): "Growth probably above trend and tight labour market, but signs August cut was offset by electricity price jump."

Stephen Koukoulas, Market Economics (Hold): "The inflation lift we are seeing now is likely to be a blip that will unwind in the first half of 2026."

Anthony Waldron, Mortgage Choice (Hold): "I expect the RBA to hold the cash rate in December. Unfortunately for borrowers hoping for early Christmas relief, inflation is proving stickier than expected. With the latest ABS data showing the Consumer Price Index climbing to 3.8% well above the RBA's target band and trimmed mean inflation sitting at 3.3% in the 12 months to October, the Board can't justify another cut yet. That said, after three cash rate cuts this year, now is still a good time to review your home loan to ensure you're still at a competitive rate."

Scott Kuru, Freedom Property Investors (Hold): "It will be no surprise to anyone that the RBA will be The Grinch that Stole Christmas, not Santa, this December. Those last inflation numbers were a shocker and have seen a third major bank – ANZ – now rule out any more rate cuts this cycle."

James Morley, University of Sydney (Hold): "Just as the RBA wanted to see if the jump in the unemployment rate in September would persist before cutting, they will now want to see if the jump in year–ended inflation in the new comprehensive monthly measure translates into such a large increase in year–ended inflation with the quarterly measure. They won't have data on this until before the February meeting. So I think they are likely to hold this meeting, awaiting more data to guide future movements. If future data releases continue to show a weakening labour market combined with little progress on inflation returning to the mid–point of the target range, I think they will hold for the time being. But I can imagine by mid–year 2026, there could be enough progress on inflation that they will want to test if the neutral rate is lower than the current setting."

Dale Gillham, Wealth Within (Hold): "Whilst CPI has increased recently, the RBA will be slow to change rates. I believe they will want to see if inflation continues to rise or whether the recent moves were just short–term. At present, it is difficult to predict rate movements in 2026."

Mathew Tiller, LJ Hooker Group (Hold): "I think the RBA will stay on hold. Inflation has lifted again and unemployment is still low, so they need more evidence that price pressures are easing before considering rate cuts. I think the RBA will stay on hold. Inflation has lifted again and unemployment is still low, so they need more evidence that price pressures are easing before considering rate cuts. The housing market has finished the year with solid momentum, with conditions improving over 2025 as buyers took advantage of rate cuts and an undersupply of listings and new homes kept competition strong."

Adj Prof Noel Whittaker, QUT (Hold): "There is no doubt that inflation is not under control, and more and more pressure is being put on the economy. You won't be seeing any rate cuts in the short to medium term."

Craig Emerson, Emerson Economics Pty Ltd (Hold): "World commodity prices are falling, which should bring down the trimmed mean inflation rate in Australia."

Leanne Pilkington, Laing+Simmons (Hold): "The surprise increase in inflation in the latest CPI data appears to have ended any hopes of further rate cuts in this cycle. The high cost of housing continues to have a major impact, and the next rate move may well be a hike. Most people, mortgage holders especially, will hope this is some way off."

Tim Nelson, Griffith University (Hold): "Inflation is running above the RBA target. The RBA won't want to continue easing until this is well back in the band."

Peter Boehm, Pathfinder Consulting (Hold): "As I have been saying for the past 12 months, the Federal Government's out of control spending would, and has, fuelled inflation. I have no reasonable expectation that rates will reduce anytime soon. In fact, I worry that rates will rise in February because there is nothing in the numbers or government policy to indicate anything other than rising costs in the near term. Labor's approach (federal and state) of increasing spending and funding this through increased tax is not going to increase productivity, drive economic growth in the private sector or address inflation. It will be left up to the RBA to fix the economic problem which it can only do through upward interest rate adjustments."

Nicholas Gruen, Lateral Economics (Hold): "My guess is that the bank will conclude that its credibility is on the line."

Kyle Rodda, Capital.com (Hold): "Inflation is above target and moving in the wrong direction. It's as simple as that."

Brodie Haupt, WLTH (Hold): "The CPI surprisingly jumped up once again to 3.8 per cent in October. I still believe the board will keep cash rates on hold to end the year and gather more data, but a decision to increase the cash rate is definitely a possibility in early 2026."

Nicholas Frappell, ABC Refinery (Hold): "Fiscal spend, weak productivity and growth risk a sustained rise in inflation after an increase in the last quarterly YoY report."

Jakob Madsen, University of Western Australia (Hold): "Inflation scare and the higher Federal Funds Rate."

David Robertson, Bendigo Bank (Hold): "The RBA are firmly on hold now after recent inflation data has shown a renewed uptick in price pressures; although this may well be a temporary uplift and some emerging weakness in labour markets should still see one more cut in the cycle in mid–2026 to a more neutral cash rate."

Garry Barrett, University of Sydney (Hold): "Recent CPI data take core inflation outside comfort / target zone."

Stephen Miller, GSFM (Hold): "I think the world economy is in for a challenging 2026 that will ultimately see inflation move toward the target."

Jeffrey Sheen, Macquarie University (Hold): "Headline inflation increased by 0.2 percentage points in November to 3.7%, the main contributor being the big jump in the cost of electricity as state rebates were used up. Though these electricity costs are not pure inflationary effects, the optics will prevent the RBA from considering a rate cut."

Cameron Murray, Fresh Economic Thinking (Hold): "Inflation is not quite under control, but the RBA will have limited interest in changing course until further data shows changing macro conditions."

Michael Yardney, Metropole Property Strategists Pty Ltd (Hold): "Another rise in inflation has put the possibility of a cash rate in December off the cards and future cuts next year in greater doubt. While I know some commentators suggest we could see a rate rise next year, I can't see that happening with the information currently available."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Hold): "The RBA can't ignore the increase in inflation since the middle of 2025. What remains unclear is whether this is the beginning of a new upward inflation cycle, or simply reflects the fact that "the last mile" of the inflation cycle which began in 2021–22 has proven harder to achieve than the earlier parts of it. I lean towards the latter explanation. I think it's more likely that, with consumer spending having picked up since earlier this year, businesses are now finding it easier to pass on cost increases which they've previously had to absorb into their profit margins. This should (and I think will) prompt the RBA from holding off on providing any further stimulus to aggregate demand until it's clear that this is no longer happening – which will take time – and, additionally, to limit the downside for rates from here to just one more cut."

Matt Turner, GSC Finance (Hold): "Uptick in inflation and stubbornly low unemployment is concerning. Would rather the RBA do something swift rather than delaying the pain like the last rate cycle."

Ask a question