September 2021: In response to the proposed strategic assessment of the implementation of an economy-wide CDR, Finder has prepared the following submission. Visit our government submissions hub for more Finder submissions to government consultations and inquiries.

About Finder

Finder.com.au ("Finder", "we") is a global fintech that helps consumers all around the globe make better decisions about a range of complex products and services. In Australia, more than 2.5 million Australians use our comparison tools, decision engines and educational material each month1.

We compare over 1,800 brands across more than 100 product categories, including credit cards, home loans, transaction accounts, savings accounts, insurance products, superannuation, telecommunications, energy and shopping deals. Finder was set up by 3 Australians and has remained independent over the years despite significant growth taking it to over 400 employees around the world across 7 different offices. We exist to help people make better decisions and our co-founders that still run the business have never lost sight of the transformative capacity of technology to improve people's lives.

Finder continues to be very supportive of the Consumer Data Right (CDR) regime, which we believe will empower Australians to take control of their personal data and use this information to make better financial decisions. Finder was the first comparison service to get accredited as a data recipient for the CDR in Australia in May 2021.

Overview of this submission

In this submission we share our consumer research across the sectors we compare and our views on the relative opportunity that the CDR could bring to each sector. To ensure it includes the perspective of multiple Finder stakeholders we ran internal workshops based on the consultation paper with 17 of our internal experts representing inputs from the varied sectors where we provide comparison services.

To make the document easier to navigate, we have split this submission into 5 distinct sections:

In this section we use our significant base of consumer research to provide insight on the different categories that we compare. This includes details of how much each product is used, how often it is switched, the value a consumer feels they are getting and how well they understand the product.

In this section we combine this research to assess the size and scale of the relative consumer benefit of bringing CDR to each of these sectors.

In this section we look at some of the use cases where CDR could bring significant benefit and explore the specifics in more detail including possible datasets. We also make recommendations where appropriate.

In this section we outline some of our previous recommendations for the future of the CDR which we think are relevant for this consultation.

In this section we provide a concise summary of all the recommendations in this submission.

We have written each section such that they can be read and referenced independently. As always, Finder is very happy to provide further information or answer questions on anything provided in this document.

Section 1: Finder consumer research to inform CDR strategic assessment

Finder is a research-led business that does consumer surveys on a regular basis. Our flagship survey is the Finder Consumer Sentiment Tracker which is a live, nationally representative study of the Australian public. Designed by Finder and conducted by Qualtrics, it aims to track consumer sentiment in Australia on an ongoing basis by running an online panel of at least 1,000 respondents every month. This survey has been live since May 2019 and now covers a sample of over 28,000 Australians.

1.1: How many Australians are using different products and services?

Our research shows that there is a significant difference between the usage of different products and services that we compare. Broadly speaking, utilities like electricity and telecommunications are among the products with the highest uptake. Simpler financial services such as transaction and savings accounts are also used by the vast majority of Australians. Insurance products and more complex credit-based financial services products like home loans and credit cards have a lower update among the general population.

1.2: How often are Australians switching providers for different services?

We also ask consumers that use a product or service whether they have switched providers for that product in the last 6 months. Shorter-term lending products like car loans and personal loans top the list for this question and this is probably because a high proportion of users will have taken the loan out for the first time in the last 6 months. Around 1 in 7 users have switched providers in the last 6 months for many of the products on our list while home insurance, superannuation and transaction accounts are the sectors with most inertia.

1.3: Are Australians happy with the value they get from different products and services?

We also ask consumers if they think they are getting good value for money when it comes to the various products and services that they use. Mobile phone plans come out on top with 80% of Australian mobile phone plan users believing they are getting good value for money. At least 7 out of 10 Australian users believe that they are getting good value on their transaction accounts, car insurance and broadband. At the other extreme, just 59% of Australian health insurance users think they are getting good value for money.

1.4: How much are Australians paying for these products and services?

The chart below is our best estimate for how much the average Australian user is paying for each of these products or services. This is formulated through a combination of publicly available data, product data and information gathered through Finder consumer surveys. These are averages so should be used cautiously as many consumers will be paying significantly more or less than the amount quoted. However, we do think they are useful for comparing the expense of one product or service in relation to other products. Unsurprisingly, home loan repayments are by far the biggest cost for users of these products while utility products like mobile phone plans, broadband and energy come at a lower monthly cost.

1.5: For which products and services are Australians most likely to receive an unexpectedly high bill?

We also ask consumers about which products they have received an unexpectedly high bill for in the last 12 months. This is a slightly different list to the other charts to cover services with a usage component that impacts bills as well as one-off bills that a consumer could cover with insurance if needed. By far the top of the list here was electricity with 23% of users experiencing an unexpectedly high bill in the last year. Credit cards and mobile phone plans were also a source of unexpectedly high bills at 9% and 7% of users respectively. Car repairs were the most common unexpected cost out of the bills that could be covered by insurance. We also find that 25% of Australians have had an unexpectedly high bill in the last 12 months in at least one of the categories that may have been covered by insurance (car repair bill, medical bill, vet bill or home repair bill).

1.6: Do Australians understand the different products and services that they use?

We also ask consumers how well they understand the various products and services that they use. Superannuation stood out as the service with the highest levels of consumer misunderstanding with 37% of users reporting they have little or no understanding of how the product works. Income protection insurance (which is sometimes bundled with superannuation products) was next on the list. At the other end of the spectrum, products like credit cards, mobile phone plans and savings accounts were relatively well understood by Australian users.

Section 2: Consumer benefit analysis on introducing the CDR to different sectors

We note that the consultation paper for this CDR Strategic Assessment and also a number of recent Treasury presentations outline the primary objective of introducing the CDR is to unlock consumer benefits from access to data. Secondary (and complementary) objectives include increasing competition, improving data security and enabling innovation. We have used the graphic on the right to visualise these objectives and keep them front of mind on our internal workshops in relation to this consultation.

In this section, we use our research from Section 1 to run a new consumer benefit analysis aimed at assessing the "size, scale and scope" of the potential consumer benefit of bringing the CDR to each of these sectors. This analysis is indicative in nature and the outputs should not be used as a perfectly accurate assessment of the potential benefit. We do, however, believe this analysis is useful for relative assessments for the CDR Strategic Assessment process. A summary of our approach can be found below and a more extensive methodology can be found in the appendix.

2.1: Overview of our approach to consumer benefit analysis for this submission

Our analysis combines the data points outlined above to create conservative estimates on the scale of the potential consumer benefit offered by each use case. The estimated total benefit to Australian consumers is calculated by looking at the proportion of customers that use a product or service, how likely the average consumer is to already have switched providers and the estimated average benefit of taking action. A more detailed summary of the methodologies and assumptions used for these calculations can be found in the appendix. It is important to note that these are estimates that are designed to be used for comparative purposes. The estimated totals can help with assessing the relative priority of the different use cases that the CDR could support but each figure should not be treated as a source of truth in isolation. It is also important to note that the use cases we have included in our modelling are skewed towards the sectors where Finder already offers comparison services as this is where we have the most consumer research. We would be happy to assess other use cases in the same way if this would be useful. An overview of the outputs from our modelling can be found on the page that follows.

2.2: Outputs from our consumer benefit analysis for introducing CDR to a sector

Core Finder comparison categories

| Yellow highlight = Use case covered in Section 3 |

2.3: Prioritising use cases for the CDR based on the consumer benefit analysis

Based on this analysis, we see the larger insurance categories as the top-priority sectors for introducing the CDR. For both home insurance and car insurance, we see markets where comparing the best available deals is currently extremely difficult and time-consuming for consumers. However, the total collective consumer benefit of taking action is significant. We also note that this is a sector which has had less policy reform in recent years to drive improved consumer outcomes when compared to banking, superannuation or energy. We think the CDR could be a key tool in delivering benefits for Autralians when it comes to general insurance and we recommend a full sectoral designation for this sector.

With health insurance we see a product with a relatively high monthly cost and low levels of consumer understanding. Product data is readily available in this sector but could be brought into the CDR regime to ensure consistency with other sectors. We also see opportunities for other datasets to be designated in this sector.

We also explore superannuation and home loans in more detail below given the scale of the opportunity presented. For superannuation, it is worth noting that the consumer benefit is largely based on investment returns which can't be guaranteed and consumer action could result in worse investment outcomes. Any benefits for actions taken here will also be realised in the future rather than the more immediate benefits of taking action in some of the other sectors. These factors along with the ongoing policy changes already being introduced in this sector mean we would recommend a limited implementation of the CDR for superannuation at this stage.

Home loans is another high-value sector with relatively high potential benefit per user for taking action and finding a better rate. However, this benefits a lower proportion of the population and the existing CDR rollout alongside other policy reforms in this space means we are not recommending this sector as a priority for expansion of the CDR at this stage.

As stated in our submission to the CDR designation paper for telecommunications sectors, the relative benefit of introducing CDR to telco is lower than sectors like insurance and, in our view, should be deprioritised. In Section 3, we also make recommendations in relation to bringing supermarket pricing data and fuel pricing data into the CDR as both have the potential to lead to significant consumer benefit.

Section 3: High-priority use cases for the CDR

In this section we look more closely at the impact that introducing CDR might have on the use cases highlighted as of potential interest based on the analysis outlined in Section 2. For each we then make a recommendation for this Strategic Assessment.

3.1: Priority CDR use case – Finding the optimal car and home insurance policy

The case for introducing CDR

Finder has called for the introduction of the CDR to the market for general insurance on a number of occasions including in our original submission and supplementary submission to the Senate Select Committee on Fintech & Regtech (now the Select Committee on Australia as a Financial and Technology Centre) with reference to the market in international jurisdictions. We note that both products can be a high monthly expense for users but that price comparison is not easy in this sector. Generally, the only way to gather quotes is to provide the same information to each insurer individually and directly. This is also a sector without as much policy reform aimed at improving competition and consumer outcomes when compared to superannuation, energy and home loans. Underinsurance is another issue in the sector that the CDR could help to tackle and our consumer research shows that 17% of Australians have been hit with an unexpectedly high car or home repair bill in the last 12 months. As a result, we continue to believe that bringing CDR to the market for general insurance will significantly improve competition and consumer outcomes. This was a position supported by the Senate Select Committee that recommended that the CDR should be expanded to general insurance in Recommendation 23 of its first interim report from September 2020.

The case against introducing CDR

The significant majority of Australians with car and home insurance feel like they are getting good value for money and product comprehension issues are less prevalent than in other sectors. There have also been challenges raised by insurers around the standardisation required for bringing the product and pricing data in this sector under the CDR regime.

Possible datasets

We think the CDR has a particularly important role to help standardise product and pricing data for both car and home insurance products in order to make it more readily available to consumers. Interesting datasets beyond product data for car insurance include a consumer's individual claims history (including any no claim bonus) which may already be held in some form by Insurance Reference Services and data relating to how much the vehicle is used which could be gathered using telematic or GPS technology. Government datasets may also be of interest here including any history of demerit points and even summarised vehicle crime statistics by suburb. For home insurance, other datasets could again include a consumer's individual claims history and information on the risk of natural disasters in the location.

3.2: Priority CDR use case – Finding the optimal health insurance policy

The case for introducing CDR

There is a strong case for introducing the CDR to the market for health insurance. Nearly two-thirds of Australians have a health insurance policy but 28% of these users have little to no understanding of how the product works. This is unsurprising with complex concepts like the Medicare Levy Surcharge and Lifetime Health Cover loading which the CDR could help make clearer for consumers. Health insurance also scores lowest for all the products that we tested for users feeling like they are getting good value for money and is also a relatively high monthly expense for those that use it.

The case against introducing CDR

There is less inertia in the market for health insurance than we see in other sectors with health insurance coming fourth on our list of products that consumers have switched in the last 6 months. There is also more readily available product and pricing data for this sector (especially compared to other insurance products) meaning it is possible for consumers to source multiple quotes at once rather than having to contact each fund individually. On the consumer data front, health data is highly personal and many consumers may not want to share this with a third party. Similarly, there is also a risk that some health data (such as data gathered by activity trackers) could lead to price discrimination which may lead to worse outcomes for consumers. As such, consumer data in this space should be treated with caution.

Possible datasets

Health insurance is another sector where a quick win would be making the product, pricing and coverage data that the government already holds (as displayed on PrivateHealth.gov.au) accessible through the CDR. This would improve consistency across sectors and allow data recipients to help customers find more suitable products. In the longer term, there are lots of interesting datasets that could help consumers better select and utilise the private health insurance they hold. One interesting area could be consumer data on completed waiting periods so that this can be transferred if a consumer switches provider. Another interesting dataset for health insurance (which may or may not exist already) is pricing data for specific procedures with different hospitals, specialists or doctors. Our research suggests these can vary significantly. The government's "Medical Costs Finder" provides a helpful starting point but does not specify pricing for different providers in a region. One possible way of making this data available more specifically under the CDR could be to make HICAPS a dataholder as it would hold significant information on how much customers have actually been able to claim when they have used their healthcare fund for different treatments.

3.3: Priority CDR use case – Choosing a superannuation fund

The case for introducing CDR

It is clear that superannuation is a sector where moving consumers to higher-performing funds will lead to hugely significant consumer benefit in the long term. It is also a market with high consumer uptake through mandated employer contributions. At the same time we see significant inertia present with few consumers actively switching providers on a regular basis. If consumers do engage in the market and successfully find a fund with higher returns and lower fees then the impact of compound interest means that the net consumer benefit can be very significant.

The case against introducing CDR

It should be noted that it is harder to calculate the consumer benefit in this sector compared to other sectors where consumers can effectively "lock in" the benefit more confidently. This is because the compound interest effect can play out in reverse if a consumer happens to opt for a worse-performing fund. It is also unclear if data can help with decision-making in this sector, particularly when past performance isn't a good indicator for future performance. There are also already significant policy changes ongoing in this sector with the "Your Future, Your Super" reforms so there is a case for waiting to see if this has an impact on market outcomes.

Possible datasets

One quick win for this sector would be to make the product and performance data on the YourSuper comparison tool on the ATO website publicly available through the CDR in the same way that product data is shared in the banking sector currently. If not too complicated this should also include the consumer superannuation balance data available on the YourSuper tool too to help with calculating possible returns. We note, however, that the product and performance data on the YourSuper tool is only for "MySuper" products which limits its utility. In the longer term, we would welcome more granular product and performance data being made available for this sector including summaries of superannuation fund portfolio holdings data as well as datasets to provide clarity on the benefits of bundled superannuation products such as life insurance.

3.4: Priority CDR use case – Finding a better home loan rate

The case for expanding CDR

Home loans quickly become a primary expense for the relatively small proportion of Australians that use them. As such the potential benefit to these consumers of finding better rates is significant as the loans are generally large and paid off over a long period. As a result, the home loan use case was prominent when the CDR was introduced to the banking sector. However, there is a growing cohort of non-bank lenders that are outside of the current CDR perimeter. These providers are gaining market share so there is a case for expanding the CDR to include them.

The case against expanding CDR

With a significant majority of the home loans in the market being provided by banks, the sector is already well covered by the CDR once these products are included for all banks by the end of the year. Again, this is also another sector with significant policy changes ongoing and in particular we await the government's response to the ACCC Home Loan Price Inquiry.

Possible datasets

Relevant consumer and product datasets for home loans have already been designated under the CDR rollout in the banking sector. At some point it may become important to assess whether there could be significant consumer benefit from including non-bank lender consumer and product data within the CDR framework. Another interesting dataset that would add value to a number of the products already included in the CDR is credit scoring data. This is an input for risk assessments for lots of lenders across the financial services landscape and adds value to a number of CDR use cases.

3.5: Priority CDR use case – Reducing consumer grocery bills

The case for expanding CDR

This use case goes beyond the main focus of our consumer research but data from the Australian Bureau of Statistics (ABS) has stated that groceries are one of the highest weekly expenses for many Australians with food alone coming in at $214 per week for the average household. As such, even a small reduction in the average Australian household's weekly shop has a very significant total consumer benefit as shown in our analysis. We believe that better availability of product/pricing data in this sector to be used for comparison purposes could be a catalyst for driving this consumer benefit while encouraging competition in this sector. From a CDR perspective, this sector also benefits from a small number of major supermarket chains that have a high market share. These supermarkets are likely to already have sophisticated data management processes making them good candidates for being data holders in the CDR.

The case against expanding CDR

Our understanding is the pricing of items in supermarkets differs significantly from store to store so it is not as simple as comparing the price for one supermarket chain compared to another. Similarly, it may prove hard to do exact comparisons even if the data was made available under the CDR as different supermarket chains will stock different products from different suppliers in different formats.

Possible datasets

The main dataset of interest here is supermarket product and pricing data which could be used to help consumers assess the best place to do their weekly grocery shopping. Given the expected variance by store it may be easiest to do this for online grocery shopping pricing data to begin with.

3.6: Priority CDR use case – Reducing consumer petrol bills

The case for expanding CDR

This is another use case that goes beyond the main focus of our consumer research but again ABS research shows that fuel costs are a significant expense for many households. It is also a sector where there is significant consumer benefit available for customers that actively seek out the best deals. From a CDR perspective, fuel pricing data is already becoming more readily available thanks to a state government focus on data sharing initiatives. To date, New South Wales, Queensland, Western Australia and the Northern Territory have launched fuel price APIs in similar formats.

The case against expanding CDR

Data sharing arrangements are more common in this sector than many others discussed in this submission so introducing the CDR may have less of a marginal benefit than in other sectors. There is also the potential for a large number of small data holders in this sector if CDR was to be introduced.

Possible datasets

The main dataset of interest for this use case is pricing data for fuel. This would need to be location-specific and updated regularly to ensure that the information remains useful for consumers.

Section 4: Additional CDR recommendations from prior submissions

4.1: Introducing "action-initiation" into the CDR regime

Finder has long been advocating for introducing "action-initiation" to the CDR. We first outlined this recommendation in our original submission to the Select Committee on Financial Technology and Regulatory Technology in December 2019 before adding more detail to this proposal in our submission to the Inquiry into Future Directions for the Consumer Data Right led by Scott Farrell in May 2020.

Broadly, we define the two versions of the CDR as follows:

- Read access. Allows accredited parties to obtain access to a customer's data when given permission and to use it for activities like insight generation or account aggregation.

- Action initiation. Allows accredited parties to take action on behalf of a consumer to perform activities when given permission such such as account switching or payment initiation

In summary, read-only CDR gives customers powerful insights about the way they spend money and use products, but it's action-initiation CDR that gives consumers the power to act on these insights quickly. Without action-initiation, a customer still has to go through the same slow process to change providers or make/cancel a payment. Action-initiation CDR could act as an antidote to the inertia we see today in the retail banking market.

We note that the final report from the Inquiry into Future Directions for the Consumer Data Right released in December 2020 was broadly supportive of introducing action-initiation to the CDR with a number of recommendations on how this could be implemented. We eagerly await the Government's response to these recommendations and an indicative timeline for when action-initiation CDR might be available for consumers to use in Australia.

4.2: Introducing regular "CDR Prompts" to increase uptake in the CDR

In this recommendation first outlined in our second submission to the Select Committee on Financial Technology and Regulatory Technology, we propose a demand-side policy intervention that leverages the CDR to nudge consumers into taking expedited action to improve their financial position. This proposed "CDR Prompt" would give consumers a regular personalised reminder as to how their products are performing compared to the market. In our view, these prompts could be the catalyst that ensures the CDR is a success and delivers on its initial stated purpose of driving competition and delivering better outcomes for consumers.

This recommendation will help the CDR to drive the consumer benefit outlined in our analysis above. Simply put, many consumers just do not think about switching to a better deal even if it could save them thousands of dollars a year. We suspect that this will still be the same even when comparing and switching is easier than ever thanks to regulatory and technological innovation such as the CDR.

Introducing a "CDR Prompt": What could this look like?

The CDR Prompt would be an additional layer to the CDR that reminds consumers to use the CDR to engage in the market for better deals. These prompts will inevitably have to differ by sector, and likely by product as well, but at a broad level, they could:

- Be mandated for all suitable sectors where the CDR has been introduced.

- Be delivered on a regular basis by the consumer's current provider through the consumer's preferred communication channel.

- Communicate the potential benefits of switching in a personalised way with a comparison between the provider's current deal and the average price paid on the market based on CDR product data for comparable options.

- Provide clear next steps on how to access the CDR powered tools that can help the user find a better deal.

This concept builds on the recommendations from the Your Super, Your Future reforms and the ACCC's Home Loan inquiry where we see a policy theme emerging of informing consumers that the products or services they are using could be uncompetitive compared to what is available on the market. In behavioural economics, this type of intervention is often referred to as a "nudge". Nudges have become a common tool in public policy in the last two decades since they were outlined in the "nudge theory" popularised by behavioural economist Richard Thaler and legal scholar Cass Sunstein. There is a growing evidence base that these "nudges" can have a significant impact on improving consumer outcomes.

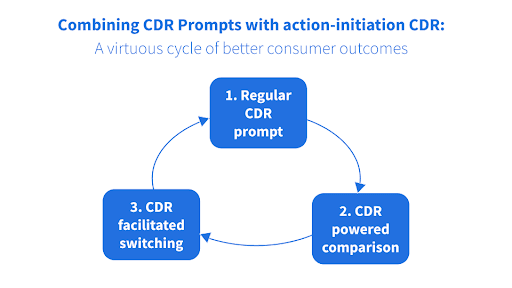

We believe that if regular CDR Prompts were to be introduced in Australia alongside "action-initiation" CDR, the outcome could be a virtuous cycle of better outcomes for consumers. The cycle starts when consumers are reminded by the CDR Prompt to compare, which tells them whether they could be getting a better deal. The consumer then uses a CDR-powered comparison service to make finding personalised product savings insights easier than ever. Finally, and thanks to action-initiation CDR, the consumer can also use the CDR to switch providers in a seamless way. The consumer then reaps the benefits of the improved deal until the virtuous cycle starts again through the next CDR prompt.

We note that the Senate Select Committee supported this concept in Recommendation 6 of its second interim report released in April 2021. This recommendation calls for the Australian Government to "develop consumer 'nudge' mechanisms to be incorporated into the design of the CDR regime, to ensure consumers are periodically made aware of their ability to find better products and services through the CDR".

4.3: Leading with product data to enable simultaneous CDR implementations

In this recommendation first outlined in our original submission to the Select Committee on Financial Technology and Regulatory Technology, we call for the prioritisation of product reference data for all sectors where CDR is set to be introduced. We believe this will help to expedite the introduction of the CDR to multiple sectors concurrently.

Product reference data is less sensitive than individualised customer data so legislation can be passed more quickly. Consistent API access to this product reference data from all providers in a given sector would allow for better like-for-like comparisons and would ultimately lead to better outcomes for consumers.

This was effectively the approach taken in banking, with product reference data from the major banks being the first thing made available in July 2019. Now that the go-live date for the remaining datasets has been pushed back until July 2020, we are looking at a staged rollout in banking with a 12-month gap from product reference data to customer data. We think this is a model that could be replicated in other sectors.

As with the CDR for other sectors, we would be happy to assist the Treasury and Data Standards Body with creating a format for each product reference dataset that is introduced that maximises their utility.

Section 5: Summary of recommendations and appendix

Summary of recommendations:

Appendix: Sources and methodology

The consumer benefit analysis summarised in Section 2 aimed to calculate an estimate for the potential benefit in dollar terms for consumers within each product area if they were to switch to a lower-cost or better-rate alternative. The calculations are based on a number of assumptions and should be treated as approximate values only.

Finder used internal product data as well as public sources such as RBA data to calculate the average cost or rate of each of the products. Our initial analysis found that relative savings across the products were consistent, at approximately 10% savings potential. We used this 10% as a proxy guide unless this produced results which were not realistic for the market.

In this instance, home loans were treated with an estimated savings potential of 4%, based on Finder analysis of internal data. Calculations for savings accounts were based on a consumer switching from the average standard rate to the average bonus rate, using RBA data.

National figures were calculated based on estimated individual savings, as well as Finder data on the number of Australians who have each product and the number of those who have already switched recently. Finally, we chose to build in a 50% contingency to account for the fact that even if given the opportunity, consumers may not make the decision to switch to a lower-cost alternative.

The analysis focused on the area of greatest savings potential for each product. For instance, superannuation calculations are based on an increased annual return rate, rather than reduced fees. To keep the analysis conservative and realistic, we assumed that only one of these levers could be significantly altered by switching.

In some cases calculations required additional assumptions. These are detailed below:

- Superannuation: Savings from switching super accounts are based on an assumed 40-year period, from age 25 to age 65. Estimated savings are averaged to an annual figure, but in reality the savings potential would increase over time as the power of compound interest grows account balances over the long term. Average income figures were taken from the ABS, and we assumed the average annualised 5-year return for a balance fund as of July 2021 from Super Guide. Average fees were assumed in line with ASIC MoneySmart data.

- Home loans: Assumes the average home loan according to the ABS, and the average variable interest rate according to the RBA. Analysis assumes a loan term of 30 years. Potential savings are based on a 4% rate reduction potential, calculated from Finder data.

- Savings accounts: Assumes the average savings account balance, according to Finder's Consumer Sentiment Tracker. The average savings account interest rate and bonus account interest rate were taken from the RBA.

- Credit card: Assumes the average credit card balance and average credit card interest rate, according to the RBA.

- Personal loan: Assumes the average variable personal loan interest rate according to the RBA and average personal loan figures from Finder's Consumer Sentiment Tracker.

- Car loan: Assumes the average car loan interest rate according to Finder data and average car loan figures from Finder's Consumer Sentiment Tracker.

- Income protection insurance: Assumes a 35-year-old non-smoker on a monthly pre-tax income of $6,000.

- Groceries: Average household grocery spending statistics were taken from the ABS.

- Fuel: Average annual kilometrage and fuel tank capacity data were taken from Budget Direct. Fuel prices were sourced from the Australian Automobile Association and averaged over the past 12 months. The ACCC's report Independent chains generally have the lowest prices from July 2021 was used to estimate savings potential per driver.

All other calculations used a combination of Finder site data and Finder's Consumer Tracker.

1 2.5 million average unique monthly audience (Aug 2019–Jul 2020), Nielsen Digital Panel

Ask a question