Tips for trading in a volatile market

Volatility is a feature of trading in 2022, here's a few tips to trade through it.

Sponsored by TMGM - official trading platform of the Australian Open 2022. Trade the world with instant deposits, fast withdrawals, fast execution and spreads from 0.0 pips. Trade 2,000+ stock CFDs, 50+ FX pairs, 12 crypto CFDs and more.

Sponsored by TMGM - official trading platform of the Australian Open 2022. Trade the world with instant deposits, fast withdrawals, fast execution and spreads from 0.0 pips. Trade 2,000+ stock CFDs, 50+ FX pairs, 12 crypto CFDs and more.

Sponsored by TMGM - official trading platform of the Australian Open 2022. Trade the world with instant deposits, fast withdrawals, fast execution and spreads from 0.0 pips. Trade 2,000+ stock CFDs, 50+ FX pairs, 12 crypto CFDs and more.

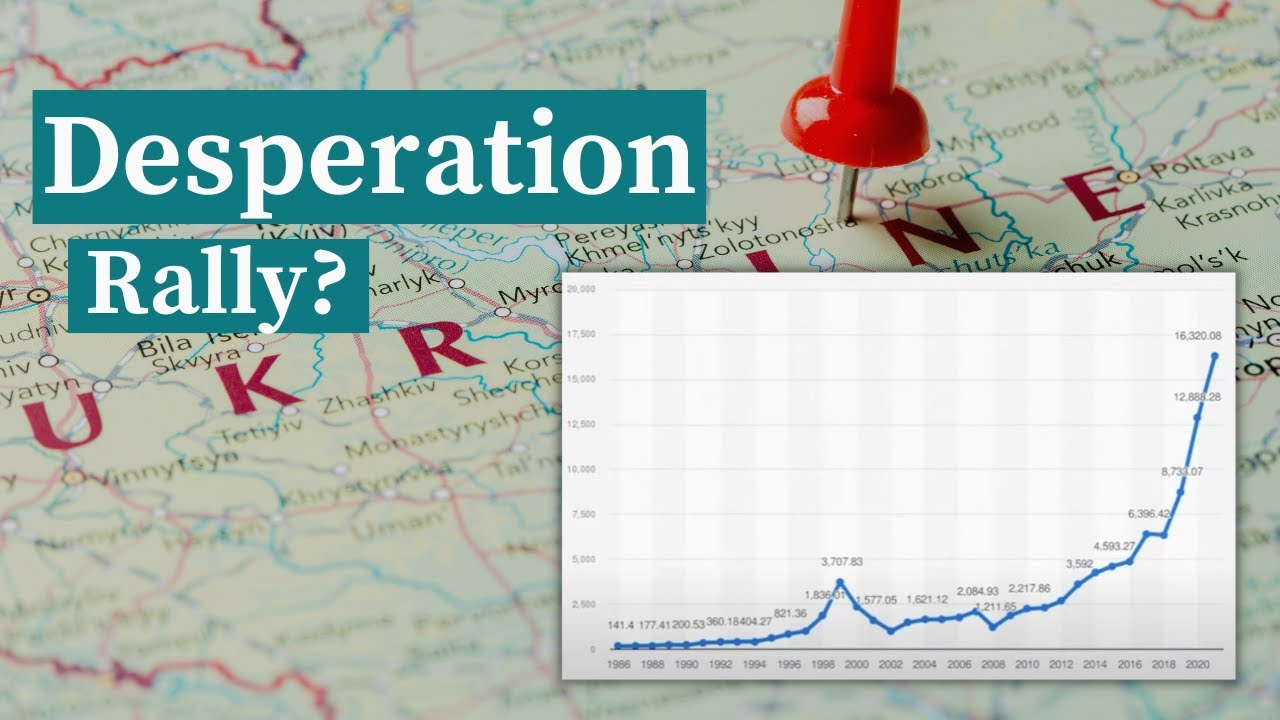

2022 is off to a rocky start for equity markets. Between conflicts in Europe, rising inflation and surging commodity prices, world markets are seeing huge swings.

And while investing through market volatility remains challenging even for the most experienced investors, now more than ever it's important that you do not panic and stick with your strategy.

If you're unsure what action you should take, then the answer might be to do nothing. While past performance might not be a reliable indicator of the future, remaining patient through market cycles has been a rewarding strategy for investors.

Here is why the current market is so volatile and some handy hints to trading in this market.

What is volatility?

You've probably heard it's a volatile market. Volatility in investing terms means markets or securities are experiencing periods of unpredictable and sometimes sharp price movements.

And while investors usually pay attention to volatility when prices are falling, a market with sudden price rises is also considered volatile.

What causes volatility?

Share traders generally like markets that have an element of certainty and predictability in order to smooth out valuations for businesses. However, when this prediction becomes harder, usually there's fluctuation in what they think is the "fair price" on an asset, causing volatility.

In today's market we have 2 key drivers:

Inflation and rate rises

While these are 2 different things, higher inflation leads to higher rates.

Inflation is the cost of goods rising. And while economies need some inflation in order to encourage spending today over tomorrow, too much is problematic. After all, people can no longer afford the cost of living should it spike.

Investors fear inflation as this has an impact on both costs and sales for the underlying businesses they hold. While some companies, such as Apple, have strong branding power and pass on costs, others can't and have been repriced accordingly.

To combat inflation, central banks will have to lift interest rates to slow down consumer spending. Higher interest rates are also bad for markets for 3 main reasons:

- The cost of debt for businesses rises.

- Long-term growth shares which aren't profitable today have lower valuations if interest rates rise.

- Investors hold more cash.

Conflict in Europe

Another form of uncertainty for the market is the current conflict in Eastern Europe.

The sanctions on the Russian economy also have an impact worldwide. Russia is a major exporter of oil, while Ukraine is a major wheat exporter.

Sanctioning Russia has seen the price of oil skyrocket, adding to input costs for most companies you might own. Again, while some businesses will be able to pass on the costs, others won't, meaning profits could fall.

At the same time, fears that Ukraine might not be able to export its wheat is seeing the price of the commodity rise. In a similar story with oil it will all depend on how the businesses you own can pass on costs, in terms of their value today.

Taking advantage of volatility

So now that you have a rough idea of what is causing today's market volatility, here are a few handy tips to take advantage of it.

A rapidly changing market does not necessarily need to be a bad thing for investors even if the movements are in a downward direction.

With a disciplined approach to investing, volatility can actually work for you.

Buy the dip

If a business is continuing to grow its earnings and has a bright outlook, but the market is not looking favourable on its share price, this is actually a fantastic opportunity for you to buy more of it at a cheaper price.

In the long-term, earnings growth drives share price growth. If you predict company profits will be larger in 5 years than today, then it's potentially an opportunity to buy more shares at a cheaper price.

Going long or short

The market moves in two different directions and so can investors.

When you maintain a long position in the market you expect the price to rise and when you take out a short position you're expecting it to fall.

During a volatile market, you can take out a long or short position and effectively follow the way the market is going.

CFDs: Long vs short market positions explained

Hedging against volatility

A simple way to protect your wealth is through what is called contracts for difference.

CFDs allow an investor to take out insurance on their own portfolio through a strategy known as hedging.

CFDs can offer you the opportunity to earn profits on price changes on various assets including commodities, shares, cryptocurrency and forex trading, without owning the asset itself.

Instead, they buy the CFD that tracks the underlying performance of a share. If you want to hedge against falls, you can simply take out a corresponding CFD, trade against the market and offset your potential losses.

Buying commodities

While still using CFDs, you can also buy commodities.

During a volatile period commodities can often rally. During the conflict in Europe the price of gold, oil and gas have all soared. This is tipped to continue over the short-term creating an opportunity for investors.

When in doubt wait it out

This might not be a money making move for you, but it's important to remember that you don't have to continue investing.

During certain periods of heightened volatility like we are currently having, the best trade might be to make no trade at all. Even if depressed prices lead to greater gains.

With a broker like TMGM and its market sentiment tool you'll be able to know when the market is turning and when it's potentially a good time to get back in.

The bottom line

During a volatile market there is no single strategy that will work or that everyone should follow.

Instead, you should understand your personal long-term goals and objectives, and find a solution that works best to achieve them.

Some might find comfort in buying the dip or hedging to protect their assets, while others will simply want to wait out the current market volatility.

Images: Getty

Trade with TMGM

Sponsored by TMGM - official trading platform of the Australian Open 2022. Trade the world with instant deposits, fast withdrawals, fast execution and spreads from 0.0 pips. Trade 2,000+ stock CFDs, 50+ FX pairs, 12 crypto CFDs and more.

Sponsored by TMGM - official trading platform of the Australian Open 2022. Trade the world with instant deposits, fast withdrawals, fast execution and spreads from 0.0 pips. Trade 2,000+ stock CFDs, 50+ FX pairs, 12 crypto CFDs and more.