6 ways to take the boring out of banking

Know you should focus on your finances, but just can't seem to get the motivation? Here are a few ways to make it more fun.

Sponsored by Virgin Money. Open a new Virgin Money Go Account before 10 April 2022 and spend $100 in the first 30 days to receive 20,000 bonus Virgin Money Points - enough for a $100 gift card! Plus, enjoy an interest rate of up to 1% p.a. on a bundled Virgin Money Boost Saver. Monthly criteria and T&Cs apply1. Learn more.

Sponsored by Virgin Money. Open a new Virgin Money Go Account before 10 April 2022 and spend $100 in the first 30 days to receive 20,000 bonus Virgin Money Points - enough for a $100 gift card! Plus, enjoy an interest rate of up to 1% p.a. on a bundled Virgin Money Boost Saver. Monthly criteria and T&Cs apply1. Learn more.Banking isn't what it used to be – but that's a good thing. Say goodbye to long queues at your local branch, ugly spreadsheets to track your spending and money-talk being taboo.

There are heaps of ways to rid banking of its boring reputation so you can get genuine enjoyment from saving, develop a better understanding of your finances and make your money work harder for you.

Join a bank that offers rewards

Yep, some banks will give you rewards when you bank with them. I opened a Virgin Money Go Account last year and I get 8 Virgin Money Points every time I buy something or make a direct debit or BPAY payment. It's pretty fun watching my points rack up when I'm not doing anything different.

There is monthly criteria to meet though. For me, that means depositing at least $2,000 into my Virgin Money Go Account (this could be as easy as setting up your salary to go in) and making at least 5 transactions every month. If you're under 25, you'll have a lower bar to meet, or no bar at all if you're between 14 and 17 years old.

I also get bonus points for shopping with certain partners, if I use my Virgin Money card. Right now, some of the offers include 25 points for every dollar spent at THE ICONIC, 2,000 points if I spend $25 on Menulog, or 18,000 points if I switch to OVO energy. These offers do change from time to time though.

These points do have genuine value too – 20,000 Virgin Money Points is enough for a $100 gift card from THE ICONIC. Or, you can use the points to erase purchases or transfer to cashback into your spending or savings account. Plus, Virgin Money actually has an offer on right now which lets you earn 20,000 bonus Virgin Money points if you open a new Go account before 10 April 2022 and spend $100 within the first 30 days.1

Choose a high-interest account

Don't you just love seeing extra money deposited into your account when you didn't have to do anything for it? Me too. Which is why I love high-interest savings accounts.

The higher the interest rate, the more money your bank will give you. So let's say you have $10,000 sitting in an account with a 0.5% p.a. interest rate, which is a little higher than what you can currently expect from the Big Four. After 12 months, you'd have $10,050 in the account.

But it's easy enough to find savings accounts with higher interest rates. For example, when bundled with the Virgin Money Go Transaction Account, the Virgin Money Boost Saver has a variable interest rate of up to 1% p.a. if you meet monthly criteria. In that case, your $10,000 savings would be worth $10,100 after 12 months.

Join an online community

Finance might have a bit of a reputation for being stiff and boring, but there has been a huge uptick in social media pages and online communities dedicated to shaking that up.

Whether it's TikTok, Facebook or Instagram, you can find online channels that support you on your money journey and connect you with like-minded people.

For example, She's on the Money is a podcast and online community helping millennial women better manage their money in a non-judgemental environment. Jump onto the Facebook forum and you can browse posts about everything from creating a first budget to investing in crypto.

Partner with (or compete against) a friend

Talking about money used to be considered taboo, but you shouldn't feel embarrassed discussing finances with your nearest and dearest.

Friends and family might have valuable life experience that you can learn from, and teaming up can be a great form of motivation.

Whether you prefer friendly competition and healthy rivalry, or emotional support and encouragement, friends and family can provide both, if you let them.

Think about joining forces with someone on the same wavelength so you can motivate each other to improve your finances. That could involve listening to money podcasts, researching bank accounts, or competing against each other in saving challenges.

Play a savings game (or two)

Speaking of saving challenges, give them a Google and see if there's anything that strikes a chord. I'm not going to list them all here (that's a different article altogether) but I've dropped a few below. Some are harder than others, so you might want to mix and match...

The receipt game: Check the bottom of every receipt for a "savings" section. Then put that amount of money away in a separate jar or account.

Frugal February: Commit to no-spend (except essentials) for the whole month. This is a pretty tough one but it's popular, so you'll have plenty of support when it rolls around.

Dollar deck: Pull a card from a deck every week and discard it. If it's a 2, save $20. If it's a 3, save $30, and so on. Face cards are all worth $100 and the ace is worth $150. By the end of the year, you'll have saved $4,760.

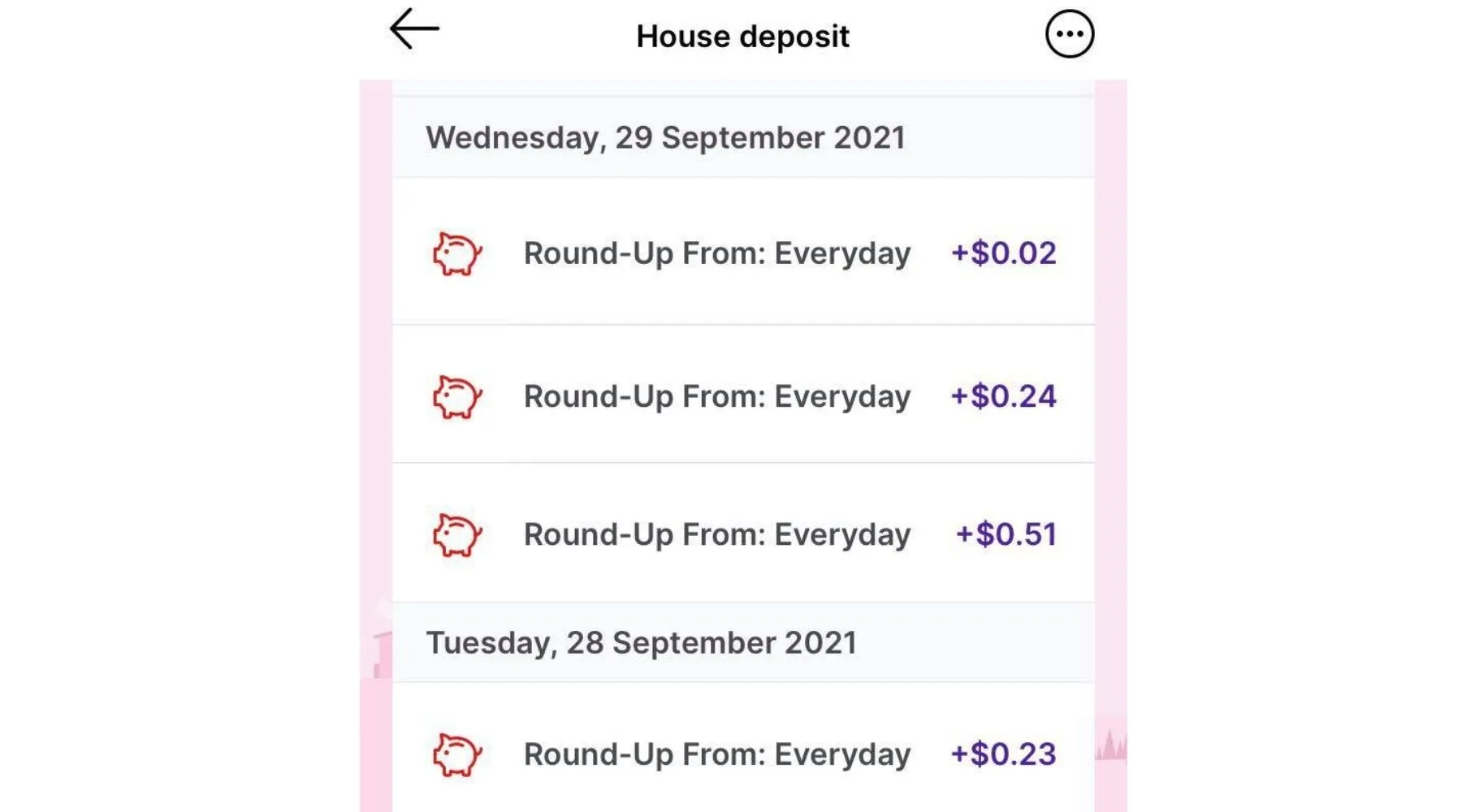

Use round-ups

If you're not using round-ups yet, or your bank doesn't offer them, it's definitely worth looking into. It's an easy way to boost your savings without really noticing too much.

In concept, round-ups work by collecting your spare change up to the nearest dollar. So if you buy something for $4.50, you'd be charged $5, but the 50c would be sent to your savings account of choice.

In some cases, you may be able to adjust your round-ups so you can send spare change up to the nearest $5 or $10.

Here's a screenshot from my Virgin Money Boost Saver account so you can see how it works. I've got my round-ups set up to go into my house deposit fund.

Learn more about a Virgin Money Go Account

Compare other products

We currently don't have that product, but here are others to consider:

How we picked theseFinder Score for bank accounts

We assess multiple product features for transaction accounts from over 100 providers and assign each product a score out of 10.

Compare other high-interest savings accounts here