5 smarter ways to manage your bills and budget

Want simpler, more streamlined finances? We've got you.

Sponsored by BPAY®. An easy and secure way to manage your bill payments all within the security of your online banking. Available in over 150 financial institutions and accepted by more than 60,000 businesses.

Sponsored by BPAY®. An easy and secure way to manage your bill payments all within the security of your online banking. Available in over 150 financial institutions and accepted by more than 60,000 businesses.

If you're feeling a little stressed by your finances, you're not alone.

In a Finder survey of over 35,000 Australians, 72% described themselves as either somewhat or extremely stressed by their financial situation. However, there are ways to take back control.

While these tips won't solve all of your financial problems, they could go a long way in lowering your stress levels. And that's a pretty good start.

Tick bills off your to-do list

Sort bills out as soon as they land in your inbox and it's one less thing to worry about. That doesn't necessarily have to mean paying them as soon as you see them though.

For example, if your bill can be paid via BPAY, you can schedule the bill for a later date*. Let's say your water bill lands on Monday but you don't get paid until Wednesday. You can set up the payment as soon as you see the bill, but schedule it for payday rather than paying it off immediately*.

You've ticked the job off your to-do list but haven't put yourself in a financial pickle either.

This can be a good alternative for anyone who finds themselves forgetting about their direct debits, only to be reminded by a sudden (and sometimes unexpected) charge.

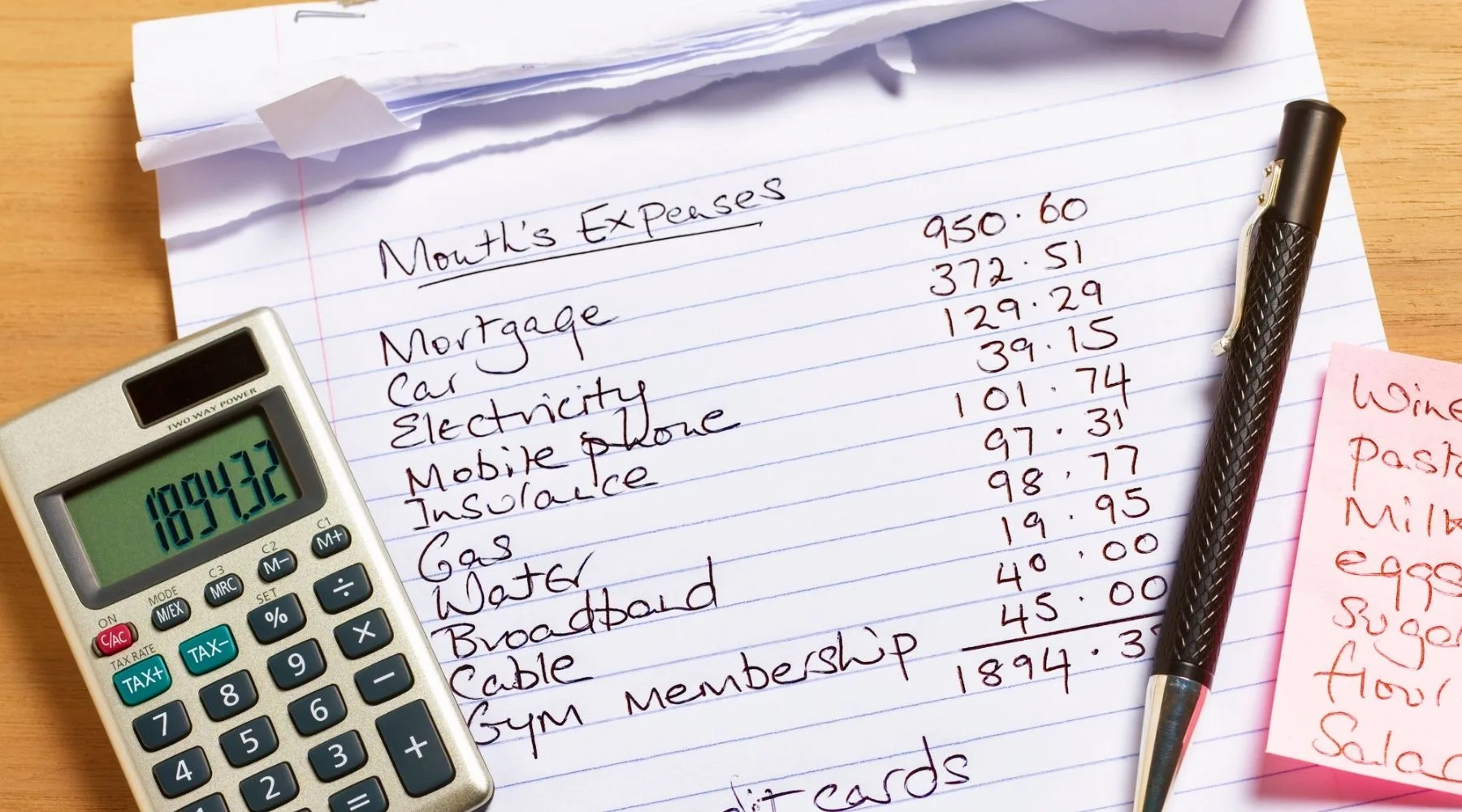

Track your spending

How much do you spend on groceries every month? What about eating out? Or ordering in?

If you struggle to give even a rough ballpark, it's time to start tracking your spending. Don't worry, you don't need to manually enter every single thing you buy into a spreadsheet. (Although if this works for you, go at it!)

Some banks and apps let you see all of your purchases and split them into categories, so you can get a clear picture of exactly where your money is going.

For example, the Finder app will show all spending on your linked accounts, separate them into different categories and compare the spend to your previous month's numbers.

You can even link your bills so you can get alerts for when your next bill is due and notifications when Finder thinks you may be able to save money by switching.

Use a budgeting app

Once you have a picture of how much you're spending, you can start to create a realistic budget, identify areas for cutting back and set savings goals.

Again, there are heaps of budgeting apps that can help you create a budget and stick to it. Often, budgeting apps work hand in hand with tracking tools so they're best used together.

You can't stick to a budget if you don't track your spending and there's not much point tracking your spending if you don't have a budget.

Track your energy usage

While we're on the topic of tracking, if you're always shocked when your utility bill comes through, you might want to try a device that tracks your usage in real time.

This won't guarantee lower electricity bills alone but seeing exactly how much you're spending can help encourage more economical choices.

Suddenly it's a lot easier to remember to switch things off when you can see exactly how much it's costing you. And that air conditioner probably doesn't need to be on.

Consolidate your debt

If you're paying off debt in multiple areas, look into debt consolidation. It sounds fancy but it's a surprisingly simple way to reduce stress and potentially save money too.

All it means is that you take out a new loan to pay off all of your other debts. It could be credit card debt, medical bills or even your buy now pay later balance. That way, you only have one bill to worry about and it's easier to track your progress.

If you do consolidate your debt, make sure you take out a loan with a lower comparison rate than you're currently paying across your other debts. You'll streamline your debts and reduce their costs too.