- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

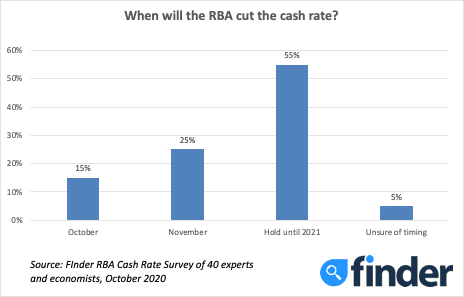

40% of experts predict cut by November, Finder survey

- 2 in 5 experts and economists predict a 0.10% RBA cash rate in the next two months.

- Just 41% believe that the superannuation guarantee should be increased to 10% as planned.

- 89% predict that domestic border restrictions will be removed before 2021.

2 October 2020, Sydney, Australia – A cash rate trimming may be here before Christmas, according to experts.

In this month's Finder RBA Cash Rate Survey™, 40 experts and economists weighed in on future cash rate moves and other issues related to the state of the Australian economy.

About 1 in 7 experts (15%, 6/40) are predicting the rate to drop to 0.10% this coming Tuesday.

An additional 25% predict a cut in November, meaning that 2 in 5 experts (40%, 16/40) expect a cut to come in the next two months.

Graham Cooke, insights manager at Finder, said a cut would be more symbolic than practical.

"The cash rate has dropped by 125 basis points over the last year and a half – a further fall of 15 is unlikely to make much of a difference beyond showing that the RBA is taking action.

"Economists will be keeping a closer eye on community transmission of COVID-19 and the reopening of domestic borders than they will on the cash rate," Cooke said.

Many of the experts predicting a cash rate hold say another cut alone will have minimal effect on the national economy.

Peter Boehm of CLSA Premium said that reducing the rate is a hollow move.

"Whilst it might be tempting to reduce the cash rate, any reduction now would have little economic benefit and there would be no room to move if rates needed to be reduced during the next six months."

Those who predict a cut do so because of recent RBA comments hinting at the potential for further monetary easing, which coincides with the announcement of Tuesday's Federal Budget.

Ben Udy, economist with Capital Economics, said communication from the RBA indicates that it foresees a sharp slowdown in wage growth and inflation, and that it would be prudent to act.

"We think that [the RBA] announcing more support alongside the Budget would send a strong 'Team Australia' message and have pencilled in a cut in the cash rate target, the three-year yield target and the TFF interest rate to 0.10% at the Bank's October meeting," Udy said.

Leanne Pilkington, managing director of real estate group Laing+Simmons, said that banks have factored in another rate drop across various loan products in preparation for another cut.

"There is an expectation of further easing, with the budget perhaps providing a conveniently timed distraction," Pilkington said.

Less than half of experts support the super guarantee increase to 10%

More than half of experts who weighed in on super (59%, 16/27) believe that the compulsory superannuation guarantee should not be increased to 10% next year as planned.

Experts opposed to the super increase cited a wide range of reasons against it, including that it stunts wage growth, that the fees outstrip returns for low wage earners, and that "now is not the time" due to the pandemic.

Saul Eslake, economist at Corinna Economic Advisory, said there is also the issue of the gender super gap.

"An increase in the [superannuation guarantee contribution] rate will not do anything to solve one of the major weaknesses… that it does not deliver adequate retirement incomes for a significant proportion of women.

"How does making men contribute more solve that problem?" Eslake said.

Those in favour of the intended super increase said it is needed for a number of reasons, including that it will boost stunted wages, allow people to start rebuilding what they withdrew during the pandemic and give the Australian savings system itself a needed shot in the arm.

Dr John Hewson of ANU said this decision should not be taken lightly.

"Retirement incomes are a long-term strategic policy in national interest, not a short-term political plaything," Hewson said.

9 in 10 experts expect open domestic borders by Christmas, but stock market correction looms

The vast majority of economists (89%, 25/28) expect domestic border restrictions to be removed before Christmas.

Cooke said that this is possibly the best news from the survey in 2020.

"Assuming this happens and we can travel domestically, a trans-Tasman travel window between Australia and New Zealand is the inevitable next step.

"Many Aussies may be taking their summer holidays in Hobbitville," Cooke said.

Despite feeling optimistic about open borders, more than half of the experts (52%, 11/21) believe that a stock market correction will happen before the end of 2020.

Nicholas Frappell of ABC Bullion said that this is driven by fear of a second wave of COVID-19.

"The degree of market volatility and the likelihood of risk aversion arising from a second round of coronavirus makes [a market correction] a plausible outcome," Frappell said.

Here's what our experts had to say

Commentary

Nicholas Frappell, ABC Bullion (Nov cut): "The RBA has repeatedly signalled an interest to cut the cash rate again, however, it makes sense to wait until after the Federal budget is presented."

Shane Oliver, AMP Capital (Oct cut): "The recovery is gradual and uneven and the RBA's current forecasts show that it does not expect to meet its employment and inflation objectives in the next two years, so further easing is warranted."

Alison Booth, ANU: "The RBA will not take any information at this stage but will maintain its current course. Probably hoping like many of the rest of us that appropriate fiscal measures are followed."

John Hewson, ANU (Nov cut): "Political pressure to cut to 0.1% will make very little economic difference."

Rebecca Cassells, Bankwest Curtin Economics Centre: "Signs of the RBA looking to increase interest rates could appear in late 2021 and a lift in interest rates as early as the first quarter of 2022. There is now a more optimistic outlook for the global and Australian economy and it's possible that recovery will be more rapid. The OECD has recently revised its global forecast from a 6% contraction in 2020 to 4.5%. The expectation is for positive growth throughout 2021, at around 5%. The IMF expects the same, with initial estimates of a 5% contraction in global GDP likely to be downgraded when they release their update on the 13th October. Australia will have more ground to make up, but with sufficient fiscal stimulus focussing on both short and longer-term productivity gains, there is every possibility that we could be out of the woods sooner than expected. Significant new virus outbreaks could set this trajectory back."

David Robertson, Bendigo and Adelaide Bank (Nov cut): "The RBA appears ready to add further monetary support by cutting the Official Cash Rate to 0.1%, although they will probably wait until Cup day (rather than Federal Budget day). Fiscal support will be more critical and effective than monetary, but the RBA are playing their part, including via more QE."

Sean Langcake, BIS Oxford Economics: "The RBA has raised the possibility of taking the cash rate lower, but this would be a move of less than 25 basis points. We expect the first rate rise will not be until the end of 2023."

Ben Udy, Capital Economics (Oct cut): "The RBA seems to be coming around to our view that the pandemic will result in a sharp slowdown in wage growth and inflation. We think that announcing more support alongside the budget would send a strong 'Team Australia' message and have pencilled in a cut in the cash rate target, the three-year yield target and the TFF interest rate to 0.10% at the bank's October meeting. We also expect the bank to announce more bond purchases next week."

Peter Boehm, CLSA premium: "Whilst it might be tempting to reduce the cash rate, any reduction now would have little economic benefit and there would be no room to move if rates needed to be reduced during the next six months. A wait and see approach would be the prudent course of action to take for now."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Oct cut): "The minutes of the last board meeting, and public comments by both the Governor and the Deputy Governor in recent weeks, suggest that the RBA is coming around to the view that there is more that it can do to support economic activity and employment, and to ensure that inflation eventually returns to the target band – and that it should do it."

Malcolm Wood, EL&C Baillieu: "There is little, if anything, to be gained from one final rate cut given the Bank-Bill Swap is already at 9 basis points."

Craig Emerson, Emerson Economics: "The RBA might drop the cash rate to 0.1% but may hold off until after the Budget on Tuesday."

Angela Jackson, Equity Economics: "While there is some possibility of a further reduction, this remains unlikely, with a focus on the role of fiscal rather than monetary policy to support economic growth. Such a decrease is unlikely to have a meaningful impact on growth at this point and would limit any future expansionary firepower."

Mark Brimble, Griffith University: "No movement for an extended period of time."

Tim Nelson, Griffith University: "For the foreseeable future, stimulus is likely to be provided through bond acquisition."

Tony Makin, Griffith University: "The biggest risk to recovery in coming quarters will be an appreciating exchange rate should significantly higher government spending be unveiled in the 2020-21 federal budget. International capital inflow reflecting foreigners buying bonds issued to fund the budget deficit strengthens the exchange rate, other things equal, as any good macroeconomics textbook tells us. Further debt monetisation (printing money) by the RBA will offset this pressure but continue to cause asset price inflation. In the longer term (18-24 months away) goods and services inflation would normally accelerate as the economy rebounds."

Thomas Devitt, Housing Industry Association: "RBA unlikely to decrease cash rate below 0.25% given this is already the effective lower bound and given their distaste for negative rates. So next move will be up, but not for years. In the meantime, state/territory/corporate/longer-term rates can be decreased by further QE and term funding facility can be/has been expanded."

Alex Joiner, IFM Investors (Nov cut): "The RBA has signalled that it is considering easing policy further in the near term. On balance, it will likely wait until after the budget to do this as it will be hoping that fiscal largess that is expected will be enough to prevent it from having to do anything."

Leanne Pilkington, Laing+Simmons (Oct cut): "The banks have recently priced in another rate drop across various loan products so there is an expectation of further easing, with the budget perhaps providing a conveniently timed distraction."

Nicholas Gruen, Lateral Economics (Oct cut): "Having said they wouldn't go below 0.25%, they now seem to be suggesting they will."

Mathew Tiller, LJ Hooker: "Despite indicating that they are in favour of further easing of monetary policy, it's unlikely the RBA will do this by reducing the cash rate further and will look to other measures, like quantitative easing, to achieve their objectives."

Geoffrey Kingston, Macquarie University (Nov cut): "The Bank has flagged that a rate cut is under active consideration. I suspect that they will not want to do this on budget day."

Jeffrey Sheen, Macquarie University: "The cash rate is at its effective lower bound, and will remain that way until at least 2022."

Michael Yardney, Metropole Property Strategists: "While there is some temptation for the RBA to lower the interest rate a little, I think I will wait to see what fiscal measures will be introduced in the budget."

Mark Crosby, Monash University (Nov cut): "RBA has signalled it will reduce rates – could be this meeting but more likely next, depending on budget settings."

Julia Newbould, Money magazine: "I think that monetary policy has had all the effect it will."

Susan Mitchell, Mortgage Choice (Nov cut): "Although a case could be made for a cut this month, I think the RBA will keep the cash rate unchanged at its October monetary policy meeting. Board members will wait to digest the Federal Budget announcement before making their next move."

Dr Andrew Wilson, My Housing Market (Oct cut): "The RBA will act to reduce official rates to support what is likely to be unprecedented fiscal stimulation to be announced in the Federal Budget – a two-pronged attack to restore the economy to growth."

Jonathan Chancellor, Property Observer: "The central bank will move at some stage to reverse its longhand view that another cut wasn't required, because it is required."

Noel Whittaker, QUT: "[There is] no point in dropping or raising [the cash rate] – so no movement."

Cameron Kusher, REA Group: "While there is a lot of talk about the RBA easing this month or next, I believe they need to keep some powder in the keg. I would argue that further monetary policy easing will potentially be needed when a lot of the economic support measures such as JobKeeper, JobSeeker and mortgage holidays are ended in early 2021."

Christine Williams, Smarter Property Investing Pty Ltd: "Globally, funds are being stretched. Once the pandemic is under control, rates will increase."

Besa Deda, St.George Bank: "Current and expected conditions warrant a downward shift. The RBA is a long way from its goals and wants to move towards them."

Other participants: David Bassanese, BetaShares Capital (Nov cut). Stephan Koukoulas, economist. John Rolfe, Elders Home Loans. Alan Oster, NAB (Nov cut). Richard Harvey, Propertybuyer. Jason Azzopardi, Resimac.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel