- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

RBA Survey: Experts favour Melbourne and Brisbane for property investment

- 86% of experts think the property market has turned a corner

- Perth and Adelaide are the capital cities least likely to draw interest

- Next rate drop predicted for November

3 September, 2019, Sydney, Australia – Sydney is not the most attractive capital city in which to invest your property dollar, according to Finder, Australia's most visited comparison site.

In the latest Finder RBA Cash Rate Survey – the largest of its kind in Australia – experts and economists were asked which Australian capital city they thought was best to invest $500,000 in property.

Results were hugely divided with Melbourne and Brisbane sharing the top spot with 27% (6/22) of the vote each.

Graham Cooke, insights manager at Finder, said the vast majority of economists chose to steer clear of advising investment in Sydney.

"Sydney has traditionally been Australia's darling in the property market, but it is no longer the belle of the ball.

"Prices have just started to recover after falling nearly 15% from the heady days of 2017, but sales volumes are still low and many investors and potential sellers are in a holding pattern.

"While prices fell across the board, the ratio of house prices relative to income is still higher in Sydney than in other cities, which may slow the bounce back somewhat compared to Melbourne and Brisbane.

"On the bright side, both prices and auction clearance rates are slowly heading in the right direction in the Harbour City, but these results indicate that the previous market highs are still a way off," he said.

Which Australian capital city would be the best to invest $500,000 in property?

| Capital City | % |

|---|---|

| Melbourne | 27% |

| Brisbane | 27% |

| Sydney | 14% |

| Canberra | 14% |

| Adelaide | 9% |

| Perth | 9% |

Source: Finder RBA Cash Rate Survey

Sydney and Canberra received 14% (3/22) of the vote while Adelaide and Perth were the least enticing to experts and only received 9% (2/22).

When asked if they felt the property market in Australia had turned a corner, fewer than half of the experts (45%, 13/29) said yes and that prices will continue to rise.

A further 41% (12/29) expected prices to remain at their current level for a while, with only 14% (4/29) predicting a further drop in prices.

Cooke said these results are a clear indication that recent gains are not the product of a "dead-cat bounce".

"Recent clearance rates and sale prices in Sydney and Melbourne are tentative but positive.

"Potential first time buyers may not be buying at the bottom of the market, but there is still plenty of value to be had with home loans at record lows," Cooke said.

Cash rate holds

The Reserve Bank of Australia (RBA) today announced a hold on the cash rate at 1.0% for the second consecutive time, an outcome accurately predicted by nearly all experts (95%, 39/41) in the Finder RBA Cash Rate Survey.

Craig Emerson of Craig Emerson Economics said the RBA will save its last few bullets for now, predicting a cut in October.

"The RBA will be reluctant to use up its little remaining ammunition," Emerson said.

Economics professor Tony Makin from Griffith University is one of the 61% of experts who expect the RBA to cut the cash rate in November.

"Previous RBA research suggested it takes up to 18 months for the effects of official interest rate changes to feed through to the wider economy.

"The RBA should therefore be waiting a little longer before cutting further, especially in light of the weaker dollar of recent weeks," Makin said.

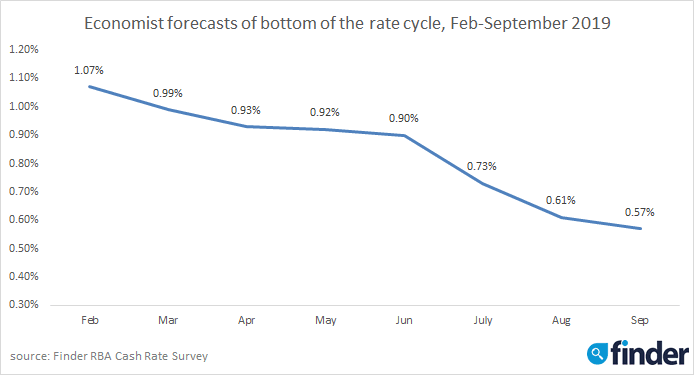

Experts surveyed have dropped their forecasted bottom of the cash rate – the number where they think the rate will not drop below – by more than 50 basis points to 0.57% on average. This is down from 1.07% in February.

Here's what our experts had to say:

Nicholas Frappell, ABC Bullion (Hold): "Domestic data looks steady and the RBA may pause to observe developments overseas."

Shane Oliver, AMP Capital (Hold): "Given the threats to growth from falling housing construction, weak consumer spending and the trade war along with the RBA's own forecasts showing no progress in reducing unemployment, boosting wages growth or reaching its inflation target anytime soon the RBA should be cutting again on Tuesday. But while it wouldn't surprise us if they did and it's a close call, it looks more likely that they would prefer to wait a bit longer to gauge the impact of recent rate cuts and the Government's tax cuts."

Alison Booth, ANU (Hold): "Change not warranted yet."

John Hewson, ANU (Hold): "Still unsure of state of economy."

Julie Toth, Australian Industry Group (Hold): "No significant change in local or global conditions, outlook or risks since last meeting."

Malcolm Wood, Baillieu (Hold): "Ideally the RBA would like to assess the impact of their first two easings and the tax rebate before easing again."

Rebecca Cassells, Bankwest Curtin Economics Centre (Hold): "Further cuts at this point in time are unlikely given the recent pick-up in the housing market, and the labour market holding steady. Moving the cash rate any lower will elevate market uncertainty, countering any potential benefits to stimulate investment and consumption responses."

David Robertson, Bendigo and Adelaide Bank (Hold): "A cut would not shock, however I expect the RBA would like more time to analyse the impact of the last two rate cuts and the recent tax cuts."

Sarah Hunter, BIS Oxford Economics (Hold): "The Board have signalled that they want to see how activity unfolds before potentially cutting again, and given there has been limited data since their last meeting (and none of it has been surprising), I expect them to remain on hold."

Ben Udy, Capital Economics (Hold): "The labour market remains solid so the RBA will probably hold off for a little longer before cutting rates to 0.5% by early next year."

Craig Emerson, Craig Emerson Economics (Hold): "The RBA will be reluctant to use up its little remaining ammunition."

Ilce Blazeski, Credit Union Australia (Hold): "Although it is likely that the RBA's next cash rate move will be down, the RBA have made it clear that they would like more time to observe and assess what impact the two recent cuts have had on the economy before moving again."

Trent Wiltshire, Domain (Hold): "The RBA has expressed a clear easing bias, but recent comments indicate they are content to observe the data flow and international developments for a few months before making their next move."

John Rolfe, Elders Home Loans (Hold): "With uncertainty in the world markets, I believe the RBA will want to hold their nerve until more plays out."

Debra Landgrebe, Gateway Bank (Hold): "It's a watching brief, with mixed outcomes coming from key indicators."

Mark Brimble, Griffith University (Hold): "Will wait to see [the] impact of recent cuts."

Tim Nelson, Griffith University (Hold): "Given recent cuts, the RBA will need to see the impact of these before providing further easing."

Tony Makin, Griffith University (Hold): "Previous RBA research suggested it takes up to 18 months for the effects of official interest rate changes to feed through to the wider economy. The RBA should therefore be waiting a little longer before cutting further, especially in light of the weaker dollar of recent weeks."

Peter Haller, Heritage Bank (Hold): "It is too early to determine the impact of the June and July cash rate cuts on the economy."

Tim Reardon, Housing Industry Association (Hold): "The impact of the last two cuts have not taken hold."

Alex Joiner, IFM Investors (Hold): "The RBA have stated that it would like an 'accumulation' of evidence before it acts again to ease policy. So it is clear it wants to monitor the data flow, particularly that on the labour market, before it moves again."

Leanne Pilkington, Laing+Simmons (Hold): "We see another cut on the horizon, potentially later this year. The recent pick up in housing market performance is a bright spot amid broader concerns, both domestic and global, and we may find the importance of housing to the national economy will be further reinforced in the face of these challenges."

Nicholas Gruen, Lateral Economics (Decrease - 25 basis points): "They should cut the rate by more, but they like the optics of doing it slowly."

Jeffrey Sheen, Macquarie University (Hold): "The real cash rate (after accounting for inflation) is negative and sufficiently low to encourage borrowing and spending."

Geoffrey Harold Kingston, Macquarie University Business School (Hold): "I'm inclined to think the next cut will come after the next CPI print, although a cut this Tuesday is entirely possible."

Stephen Koukoulas, Market Economics (Decrease - 25 basis points): "Low inflation and a deteriorating labour market suggest it should cut and not postpone the decision."

John Caelli, ME Bank (Hold): "It hasn't been long since two consecutive rate cuts were made, so it's likely the RBA will hold the cash rate, and gather more information on the economy before they move again."

Michael Yardney, Metropole Property Strategists (Hold): "The RBA is now going to wait and see how things pan out following its 2 consecutive interest rate cuts, however it won't hesitate to take further future action if the unemployment rate doesn't fall or inflation doesn't pick up."

Mark Crosby, Monash University (Hold): "RBA is likely to sit and wait [for the] next couple of months to assess [the] full impact of recent rate cuts."

Susan Mitchell, Mortgage Choice (Hold): "The RBA will wait and assess the impact of the two most recent cuts before lowering the cash rate again. The latest data from the ABS revealed a stable unemployment rate and flat annual wage growth. There are encouraging indicators from the property market that a gradual recovery may be on the horizon. Auction clearance rates indicate that buyer demand is growing and the latest dwelling value data points to a clearer stabilisation of the property market. The RBA will continue to monitor developments in the domestic economy, as well as the global economy, which is currently under threat by US-China trade tensions before providing further monetary policy easing."

Andrew Wilson, My Housing Market (Hold): "[The] RBA clearly primed to cut rates again but should be mindful of keeping some stimulus in reserve given volatility of global markets. Latest labour market data positive for steady rates although another cut still likely this year."

Andrew Reeve-Parker, NW Advice Pty Limited (Hold): "Adopt a wait and see approach for the recent two cuts."

Jonathan Chancellor, Property Observer (Hold): "There's no pressing need to move again as the RBA will now sit back to judge the impact of their two recent cuts."

Matthew Peter, QIC (Hold): "The RBA is reluctant to cut rates further. They will hold out until the unemployment rate begins to rise or if GDP growth slumps. Until then, rates will be on hold."

Noel Whittaker, QUT (Hold): "Too early to move."

Christine Williams, Smarter Property Investing Pty Ltd (Hold): "I feel with the issues between USA and China, the Reserve Bank is waiting to see what the outcome will be."

Janu Chan, St.George Bank (Hold): "A pause is expected after two rate cuts earlier this year. Nonetheless, the RBA is prepared to lower rates 'if needed', so a further reduction in the cash rate is likely over coming months."

Mala Raghavan, University of Tasmania (Hold): "It is still early days for further interest rate cuts. If the slow growth, both locally and globally continues, then [the] RBA might cut rates [in the] later part of the year."

Richard Holden, UNSW (Hold): "They are inherently cautious and will want to see how trade tensions evolve."

Clement Tisdell, UQ-School of Economics (Hold): "[The] RBA might take a steady approach."

Other participants: Bill Evans, Westpac (Hold).

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel