- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

Finder Cash Rate Survey: RBA holds rate at 0.25%, November cut expected

- 34/40 of experts (85%) correctly predicted a rate hold for this month

- 22% (9/40) believe the RBA will cut the rate in November in response to the pandemic

- Two-thirds of experts say now is a good time to buy property, predict rental hikes

6 October 2020, Sydney, Australia – Despite mounting speculation about the possibility of another cut, the Reserve Bank of Australia (RBA) has today announced that it will hold the cash rate at 0.25% in October.

In this month's Finder RBA Cash Rate Survey™, 40 experts and economists weighed in on future cash rate moves and other issues related to the state of the Australian economy.

The decision coincides with today's unveiling of the federal budget for 2020-2021, in which the government has detailed how it intends to steer the nation out of its first recession in 30 years.

Despite the October rate hold, 22% of experts (9/40) predict that a cut could still be on the cards in November.

Graham Cooke, insights manager at Finder, said that a standalone cut of 15 basis points is unlikely to have much of an impact on Australia's economy.

"The cash rate has fallen by 125 basis points over the last year and a half– 15 more is unlikely to make much of a difference beyond making the RBA feel like they are at least doing something.

"The decision to hold the rate for now also suggests that the RBA wants to assess the budget in detail before making a decision about further moves," he said.

Susan Mitchell, CEO at Mortgage Choice, agrees, stating that while the RBA has hinted at a rate cut, it would be unlikely to do so today.

"Although a case could be made for a cut this month, I think the RBA will keep the cash rate unchanged at its October monetary policy meeting.

"Board members will wait to digest the Federal Budget announcement before making their next move," Mitchell said.

Two-thirds of experts say now is a good time to buy property, rental hikes to come

Around 65% of economists who weighed in on this question (17/26) say now is a good time to buy property, with recent ABS data revealing a surge in owner-occupier purchases worth $1.2 billion between June and July 2020.

Almost all respondents (86%, 24/28) agree that the housing market is showing more resilience than expected, despite a rising unemployment rate, JobSeeker cuts and the Victorian lockdown.

Rebecca Cassells of Bankwest Curtin Economics Centre said that government stimulus measures during the pandemic have largely propped up the property market.

"The current resilience of the housing market is related to the stimulus that both federal and state governments are directing to the sector and not necessarily driven by current economic conditions," Cassells said.

When asked about the areas where house prices are most likely to retain their value, those who weighed in cited the coastal surrounds of Sydney (50%, 9/18), followed by Greater Melbourne (41%, 7/17).

Where do you think house prices are the most likely to retain their value?

| City | Area | Number of experts |

|---|---|---|

| Sydney | Coastal areas | 9 (50%) |

| Melbourne | Surrounding regional areas | 7 (41%) |

| Adelaide | Outer city | 6 (43%) |

| Brisbane | Surrounding regional areas | 5 (36%) |

| Canberra | Inner city | 7 (58%) |

| Hobart | Inner city | 5 (42%) |

| Perth | Outer city | 5 (45%) |

| Darwin | Inner city / Outer city | 5 (45%) / 5 (45%) |

Source: Finder RBA Cash Rate Survey of 11-18 experts, September 2020

Economic Sentiment Tracker

Experts are feeling optimistic about Australia's GDP, with two-thirds (66%, 19) expecting GDP growth before the end of 2020.

Yet over three-quarters (77%, 23) believe Australia has not seen the worst of the unemployment rate, and expect it to rise before 2020 ends. Only three respondents (10%) think that it will go down from here.

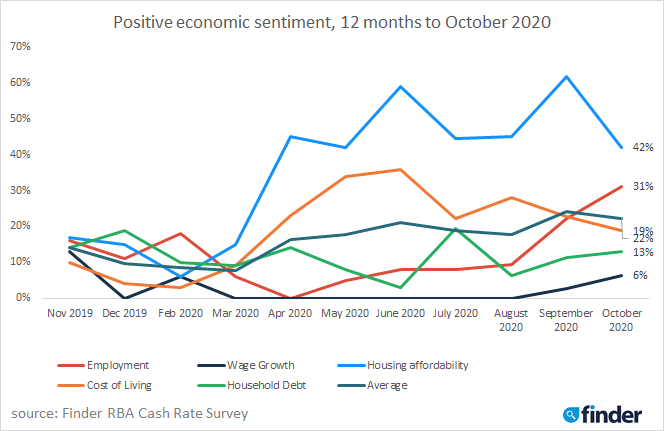

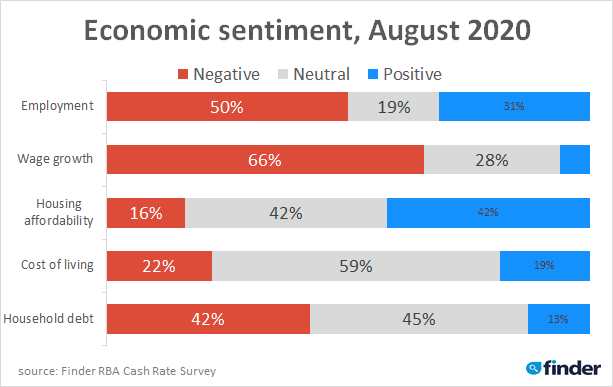

Finder's Economic Sentiment Tracker gauges experts' confidence in five key indicators: housing affordability, employment, wage growth, cost of living and household debt.

Cooke said that sentiment toward housing affordability is tipping down after a record high last month, signalling that property prices may not be set to plummet as hard as previously predicted.

"In terms of economic sentiment, there has been a curious rise in positivity around employment this month.

"With government benefits on the chopping block, it seems economists are increasingly confident that the slowly awakening economy will cushion the blow," he said.

Here's what our experts had to say:

Nicholas Frappell, ABC Bullion (Nov cut): "The RBA has repeatedly signaled an interest to cut the cash rate again, however it makes sense to wait until after the Federal budget is presented."

Shane Oliver, AMP Capital (Oct cut): "The recovery is gradual and uneven and the RBA's current forecasts show that it does not expect to meet its employment and inflation objectives in the next two years so further easing is warranted."

Alison Booth, ANU: "The RBA will not take any information at this stage but will maintain its current course. Probably hoping like many of the rest of us that appropriate fiscal measures are followed."

John Hewson, ANU (Nov cut): "Political pressure to cut to 0.1% will make very little economic difference."

Rebecca Cassells, Bankwest Curtin Economics Centre: "Signs of the RBA looking to increase interest rates could appear in late 2021 and a lift in interest rates as early as the first quarter of 2022. There is now a more optimistic outlook for the global and Australian economy and it's possible that recovery will be more rapid. The OECD has recently revised its global forecast from a 6% contraction in 2020, to 4.5%. The expectation is for positive growth throughout 2021, at around 5%. The IMF expects the same, with initial estimates of a 5% contraction in global GDP likely to be downgraded when they release their update on the 13th October. Australia will have more ground to make up, but with sufficient fiscal stimulus focussing on both short and longer-term productivity gains, there is every possibility that we could be out of the woods sooner than expected. Significant new virus outbreaks could set this trajectory back."

David Robertson, Bendigo and Adelaide Bank (Nov cut): "The RBA appears ready to add further monetary support by cutting the Official Cash Rate to 0.1%, although they will probably wait until Cup day (rather than Federal Budget day). Fiscal support will be more critical and effective than monetary, but the RBA are playing their part, including via more QE."

Sean Langcake, BIS Oxford Economics: "The RBA has raised the possibility of taking the cash rate lower, but this would be a move of less than 25 basis points. We expect the first rate rise will not be until the end of 2023."

Ben Udy, Capital economics (Oct cut): "The RBA seems to be coming around to our view that the pandemic will result in a sharp slowdown in wage growth and inflation. We think that announcing more support alongside the budget would send a strong "Team Australia" message and have penciled in a cut in the cash rate target, the 3-year yield target, and the TFF interest rate to 0.10% at the bank's October meeting. We also expect the bank to announce more bond purchases next week."

Peter Boehm, CLSA premium: "Whilst it might be tempting to reduce the cash rate, any reduction now would have little economic benefit and there would be no room to move if rates needed to be reduced during the next six months. A wait and see approach would be the prudent course of action to take for now."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Oct cut): "The minutes of the last board meeting, and public comments by both the Governor and the Deputy Governor in recent weeks, suggest that the RBA is coming around to the view that there is more that it can do to support economic activity and employment, and to ensure that inflation eventually returns to the target band - and that it should do it."

Malcolm Wood, EL&C Baillieu: "There is little, if anything, to be gained from one final rate cut given the Bank-Bill Swap is already at 9 basis points."

Craig Emerson, Emerson Economics: "The RBA might drop the cash rate to 0.1% but may hold off until after the Budget on Tuesday."

Angela Jackson, Equity Economics: "While there is some possibility of a further reduction, this remains unlikely with a focus on the role of fiscal rather than monetary policy to support economic growth. Such a decrease is unlikely to have a meaningful impact on growth at this point and would limit any future expansionary fire power."

Mark Brimble, Griffith University: "No movement for an extended period of time."

Tim Nelson, Griffith University: "For the foreseeable future, stimulus is likely to be provided through bond acquisition."

Tony Makin, Griffith University: "The biggest risk to recovery in coming quarters will be an appreciating exchange rate that should significantly raise government spending to be unveiled in the 2020-21 federal budget. International capital inflow reflecting foreigners buying bonds issued to fund the budget deficit strengthens the exchange rate, other things equal, as any good macroeconomics textbook tells us. Further debt monetisation (printing money) by the RBA will offset this pressure but continue to cause asset price inflation. In the longer term (18-24 months away) goods and services inflation would normally accelerate as the economy rebounds."

Thomas Devitt, Housing Industry Association: "RBA unlikely to decrease cash rate below 0.25% given this is already the effective lower bound and given their distaste for negative rates. So next move will be up, but not for years. In the meantime, state/territory/corporate/longer term rates can be decreased by further QE and term funding facility can be/has been expanded."

Alex Joiner, IFM Investors (Nov cut): "The RBA has signaled that it is considering easing policy further in the near term. On balance it will likely wait until after the budget to do this as it will be hoping that fiscal largess that is expected will be enough to prevent it from having to do anything."

Leanne Pilkington , Laing+Simmons (Oct cut): "The banks have recently priced in another rate drop across various loan products so there is an expectation of further easing, with the budget perhaps providing a conveniently timed distraction."

Nicholas Gruen, Lateral Economics (Oct cut): "Having said they wouldn't go below 0.25% they now seem to be suggesting they will."

Mathew Tiller, LJ Hooker: "Despite indicating that they are in favour of further easing of monetary policy, it's unlikely the RBA will do this by reducing the cash rate further and will look to other measures, like quantitative easing, to achieve their objectives."

Geoffrey Kingston, Macquarie University (Nov cut): "The Bank has flagged that a rate cut is under active consideration. I suspect that they will not want to do this on budget day."

Jeffrey Sheen, Macquarie University: "The cash rate is at its effective lower bound, and will remain that way until at least 2022."

Michael Yardney, Metropole Property Strategists: "While there is some temptation for the RBA to lower the interest-rate a little, I think I will wait to see what fiscal measures will be introduced in the budget."

Mark Crosby, Monash University (Nov cut): "RBA has signalled it will reduce rates - could be this meeting but more likely next, depending on budget settings."

Julia Newbould, Money magazine: "I think that monetary policy has had all the effect it will."

Susan Mitchell, Mortgage Choice (Nov cut): "Although a case could be made for a cut this month, I think the RBA will keep the cash rate unchanged at its October monetary policy meeting. Board members will wait to digest the Federal Budget announcement before making their next move."

Dr Andrew Wilson, My Housing Market (Oct cut): "The RBA will act to reduce official rates to support what is likely to be unprecedented fiscal stimulation to be announced in the Federal Budget - A two-pronged attack to restore the economy to growth."

Jonathan Chancellor, Property Observer: "The central bank will move at some stage to reverse its longhand view that another cut wasn't required, because it is required."

Noel Whittaker, QUT: "[There is] no point in dropping or raising [the cash rate] - so no movement."

Cameron Kusher, REA Group: "While there is a lot of talk about the RBA easing this month or next I believe they need to keep some powder in the keg. I would argue that further monetary policy easing will potentially be needed when a lot of the economic support measures such as JobKeeper, JobSeeker and mortgage holidays are ended in early 2021."

Christine Williams, Smarter Property Investing Pty Ltd: "Globally funds are being stretched. Once the Pandemic is under control rates will increase."

Besa Deda, St.George Bank: "Current and expected conditions warrant a downward shift. The RBA is a long way from its goals and wants to move towards them."

Other participants: David Bassanese, BetaShares Capital (Nov cut). Stephan Koukoulas, Economist. John Rolfe, Elders Home Loans. Alan Oster, NAB (Nov cut). Richard Harvey, Propertybuyer. Jason Azzopardi, Resimac.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel