- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

RBA cuts: Cash rate heading to 0.50%

- 25 of 45 experts from the Finder RBA Cash Rate Survey™ predict a cut in October

- The majority of experts predict at least one more cut in the current cycle

- What rate cuts have meant for borrowers historically

1 October, 2019, Sydney, Australia – After just two meetings of holding it at 1.00%, the Reserve Bank of Australia (RBA) today reduced the cash rate to 0.75%.

In the latest Finder RBA Cash Rate Survey™ – the largest of its kind in Australia – 45 experts and economists made their predictions, with 55% (25/45) correctly predicting an easing of the rate, citing recently released data on employment, retail sales and consumer sentiment.

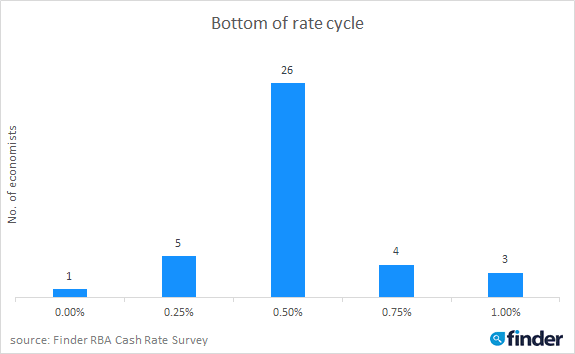

Graham Cooke, insights manager at Finder, said nearly three-quarters (72%, 26/36) of experts predicted that the cash rate will reach 0.50% before it starts to increase.

"The RBA uses each cut like a defibrillator to zap the economy back to life but as the rate gets closer to zero, they are running out of options.

"An injection of cash [quantitative easing] and the potential of a negative cash rate may be the only option to stimulate the economy.

Cooke said that lenders are likely to pass on most, but not all of the 25 basis point rate cut if recent history is any indication.

"From across the market, we've seen more than 8,700 loan products reduced since June 2019.

"Some lenders have passed on the full 50 point reduction (from the June and July cuts), but most have not.

"After today's cut, you can expect to see more lenders offering variable rate loans that start with a '2', so if yours doesn't start with at least a '3' it's time to shop around," Cooke said.

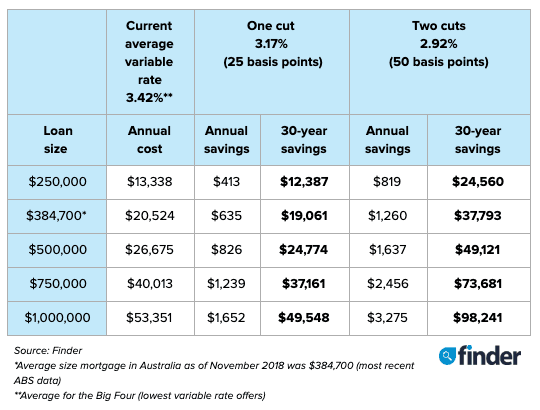

How much you could save

Cooke said every cash rate cut is a blessing to borrowers and a stick in the eye to savers.

"While many lenders may pass on a cut to their customers, you may not see the full 25 basis point cut applied to your loan.

"Keep an eye on your lender's website and digital channels to see how they are responding. If they aren't passing on the cut, it might be time to start comparing home loans.

"However if your lender passes on the full 25 basis point cut, an average mortgage holder could save $19,000 over 30 years on their mortgage.

Potential rate cut savings on different loan amounts

Sentiment for wage growth and employment at all-time low

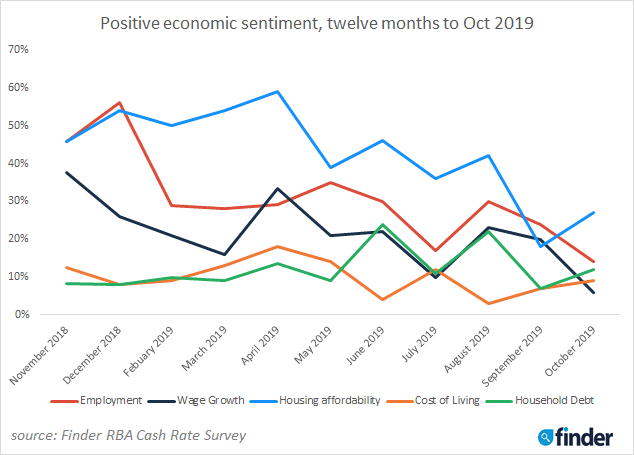

Results from Finder's Economic Sentiment Tracker, which gauges five key indicators – housing affordability, employment, wage growth, cost of living and household debt – were split this month, with housing affordability seeing the best gains while wage growth sentiment dropped most dramatically.

Introduced in March 2018, this month's tracker set an all-time low for economic sentiment in wage growth (6%) and employment (14%), likely stemming from the August Labour Force data which revealed increases in the unemployment and underemployment rates.

Cooke said these figures are both moving in the opposite direction than the RBA hoped.

"The signs for Australia's employment rate look grim, and because of that the potential for wage growth continues to look weak.

"While we have seen a small increase in the number of jobs in the market, these are heavily dominated by part-time work.

"All these signs point to more cuts on the horizon, and the RBA slowly running out of options," Cooke said.

For a real-time list of lenders who announce they will pass on the cut, click here

Here's what our experts had to say:

Nicholas Frappell, ABC Bullion (Decrease): "In no particular order, weak Chinese domestic demand, a slight rise in Australian unemployment and the global easing cycle remaining in place for now."

Shane Oliver, AMP Capital (Decrease): "Growth remains subdued, the risks to global growth have increased, unemployment and underemployment are trending up and this will make it even harder to get wages growth and inflation up. So the RBA will need to respond with more monetary stimulus."

Alison Booth, ANU (Hold): "Rate changes not yet warranted."

John Hewson, ANU (Hold): "Waiting for more relevant data."

Julie Toth, Australian Industry Group (Hold): "No change in short term outlook, although global risk has definitely increased compared to last month."

Rebecca Cassells, Bankwest Curtin Economics Centre (Decrease): "The RBA has given a strong signal that it will make the decision to lower interest rates next week, with global rather than domestic pressures driving the decision. The lower global interest rate environment overall means that not following suit could undermine the small gains we're seeing, through a higher exchange rate. But lower interest rates can also undermine progress, sending a negative message to businesses and households and eroding savings. Getting the balance and the message right will be a challenge."

David Robertson, Bendigo and Adelaide Bank (Decrease): "A much closer call than markets are suggesting, but the latest jobs data still points to 'spare capacity ' that needs to be addressed. So a cut is likely, probably in October."

Sarah Hunter, BIS Oxford Economics (Decrease): "The RBA have made it clear that further cuts are on the way, and with the labour market again making no progress towards a lower unemployment rate in August they are more likely than not to go again at their October meeting."

Ben Udy, Capital Economics (Decrease): "The labour market has continued to deteriorate. And while domestic growth may have reached a trough any recovery is likely to be sluggish. What's more, Lowe mentioned in a recent speech that global interest rates had structurally declined and it would be " unhelpful in terms of achieving both the inflation target and full employment" if Australia ignored these developments. Therefore, we expect the RBA to cut rates at its October meeting to avoid an exchange rate appreciation and to support further progress towards its inflation and full employment targets."

Craig Emerson, Craig Emerson Economics (Decrease): "Global interest rates are falling and the RBA won't want the Australian dollar to appreciate."

Tim Moore, Credit Union Australia (Decrease): "Whilst the most recent jobs growth was a positive read, the continued increase in participation saw the unemployment rate rise against the RBA targets. This perceived ongoing capacity and therefore weak outlook for inflation drives the view why we see the RBA to continue their easing cycle at the upcoming meeting."

Trent Wiltshire, Domain (Decrease): "The labour market is softening and the RBA needs to follow the rest of the world and lower interest rates."

Malcolm Wood, EL&C Baillieu (Decrease): "Sluggish growth, rising unemployment, mixed response to initial cuts and below target inflation."

John Rolfe, Elders Home Loans (Hold): "No need to move again yet. Housing activity increasing and potential oil crisis in the Middle East will give further reason to hold."

Mark Brimble, Griffith Uni (Hold): "The RBA is likely to hold to see the impact of recent rate changes and also to hold back some monetary policy ability for use at the end of the year and into 2020."

Tim Nelson, Griffith University (Decrease): "RBA has indicated that further easing likely to be required for sustainable growth."

Tony Makin, Griffith University (Decrease): "The US Federal Reserve and European Central Bank have both recently further loosened monetary policy in the US and the Eurozone, and hence the world. The RBA is not entirely independent in the sense that to prevent the Australian dollar appreciating against the US dollar and euro it will soon have to follow suit. It's line ball if it's to be very soon or a little later in the year."

Peter Haller, Heritage Bank (Hold): "The RBA will wait for an additional month's economic data before deciding to cut again."

Tim Reardon, Housing Industry Association (Hold): "Waiting for effects of previous cut to come into effect."

Michael Witts, ING (Hold): "The economic outlook doesn't justify a decrease in rates at this time."

Peter Boehm, KVB Kunlun (Hold): "The recent round of cuts need to work their way through the economy plus it is not clear whether any further cuts are going to have the desired effect on their own. Whilst the RBA has signalled further cuts are not off the table, if this does happen it may not be until October or November, depending in part, on the Federal Government's response to the growing call for more infrastructure spending."

Leanne Pilkington, Laing+Simmons (Decrease): "Housing, particularly in Sydney and Melbourne, is playing an important anchor role in a broader economic sense. It will be interesting to see if the housing rebound lasts beyond the spring supply increase. But for now, with unemployment creeping up, the RBA Governor's signals that a cut is on the cards cannot be ignored. How low rates go in this cycle is the next question."

Nicholas Gruen, Lateral Economics (Decrease): "It's consistent with their announcements and strategy which is to ease but try not to frighten the horses."

Mathew Tiller, LJ Hooker (Decrease): "A string a soft economic data results (GDP, unemployment and retail sales) will see the RBA reduce the official cash rate by 25 basis points to 0.75% at its October board meeting. Given the muted economic response of the last two rate cuts, the RBA will continue to push its message that more fiscal stimulus is required to boost economic growth. Property markets have been one of the few beneficiaries of recent rate cuts with higher levels of buyer demand pushing prices higher, particularly in Sydney and Melbourne."

Jeffrey Sheen, Macquarie University (Hold): "The downside risk to Australia remains how the global economy performs in the next 12 months. The RBA is likely to wait and see for a few more months."

Geoffrey Harold Kingston, Macquarie University Business School (Decrease): "Cut in FF rate by Fed, fall in f/t jobs here, fall in ANZ job ads series."

Stephen Koukoulas, Market Economics (Decrease): "Low inflation, weak growth, weak labour market."

John Caelli, ME Bank (Decrease): "It's likely the RBA will cut the cash rate in October, primarily due to employment numbers not tracking in the right direction, and in light of central banks cutting globally."

Michael Yardney, Metropole Property Strategists (Decrease): "The worse than expected unemployment rate, the fact that the Fed cut rates and deterioration in the global economic background makes it more likely that the RBA will make a rate cut in October."

Mark Crosby, Monash University (Hold): "RBA is likely to continue to hold unless international or local data suggest deterioration in growth or weakening labour market outcomes."

Susan Mitchell, Mortgage Choice (Decrease): "The minutes of the RBA September monetary policy meeting and the latest economic data, point to a cut in October. The August Labor force data revealed an increase in the unemployment rate, as well as an increase in the underemployment rate, which is now in line with its recent peak. National Accounts data released after the September monetary policy meeting revealed that the economy grew below what the RBA had forecast a month earlier."

Andrew Wilson, My Housing Market (Decrease): "Short odds that the RBA will cut official rates below 1% for October. Most recent data clearly points to yet another cut with the jobless rate rising, retail sales falling, consumer sentiment also down and the rate cut last week by the US Fed the icing on the cake. The RBA has a plan – it hasn't worked so far so they will continue to cut rates until hopefully it does. No use waiting for likely more bad news."

Alan Oster, NAB (Hold): "Too early yet to see if previous stimulus has had much action. That said October is clearly live."

Andrew Reeve-Parker, NW Advice Pty Limited (Decrease): "Fit one more cut in before Christmas and the lack of action on the fiscal front from the Federal Government."

Jonathan Chancellor, Property Observer (Hold): "They will still give the recent cuts time to take effect."

Matthew Peter, QIC (Hold): "The RBA is reluctant to drive the cash rate to its lower bound. Dr Lowe will resist pressure from the Federal government to cut rates on the inflation outlook alone. The RBA will cut rates if the labour market or growth outlook deteriorate."

Noel Whittaker, QUT (Hold): "Too early to move yet."

Nerida Conisbee, REA Group (Hold): "The market is overwhelmingly pricing a cut because of the slight rise in unemployment in August. I don't think this will be quite enough to cut rates in October. At this stage, I think we are looking at a November cut."

Sveta Angelopoulos, RMIT University (Hold): "Reducing the cash rate may have little effect in the current economic conditions and uncertainty. The RBA may want to keep it on hold for the time being – essentially holding it in reserve for a more opportune time."

Christine Williams, Smarter Property Investing (Hold): "Employment is stabilised as is the retail sector."

Besa Deda, St George Bank (Decrease): "The RBA has cited spare capacity in the labour market and low wages growth as missing ingredients for a return to trend growth in the domestic economy. Given the soft labour market outcomes recently and continued sluggish consumption growth, further easing seems likely and we see no reason for the RBA to wait until after October."

Janu Chan, St.George Bank (Decrease): "Increasing uncertainty in the global economy, ongoing signs of soft domestic activity, particularly in consumer spending, plus an upward trend in the unemployment rate all point to the case for the RBA to lower official interest rates."

Mala Raghavan, University of Tasmania (Hold): "I think the RBA will hold the cash rate for another month and if the rising unemployment and weaker domestic and global economic conditions persist, then there is a high possibility for the cash rate to fall in November."

Richard Holden, UNSW (Hold): "They need to cut in Oct or Nov but will probably want to see more data on the tax cut and house prices before acting."

Other participants: Bill Evans, Westpac (Decrease).

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel