- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

Finder’s RBA survey: Cash rate cut, Melbourne and Sydney overvalued

- 67% (29/43) of experts surveyed correctly predicted the RBA would cut the cash rate

- 57% of experts say Melbourne property is overvalued, 56% in Sydney

- Experts' positive sentiment on housing affordability drops

3 November 2020, Sydney, Australia – The Reserve Bank of Australia (RBA) today announced that it has slashed the cash rate by 15 basis points to a new historic low of 0.10%.

In this month's Finder RBA Cash Rate Survey™, 43 experts and economists weighed in on future cash rate moves and other issues related to the state of the Australian economy, with 67% (29/43) accurately predicting a cut.

Graham Cooke, insights manager at Finder, said that the November rate cut was far from a certainty.

"For the first time since 2011, the RBA has declared a Cup Day cut despite some scepticism from experts around the effectiveness of further monetary stimulus measures.

"But significant considerations like the strength of the Australian dollar and a lagging Victorian economy have supported the case for further easing.

"I suspect the horse races weren't the only thing punters were betting on today," Cooke said.

According to Dr Andrew Wilson of My Housing Market, Australia's economy is turning a corner.

"Recovery has proved more positive than expectations and will continue to surprise on the upside with the reopening of borders fuelling a tourism and hospitality surge," he said.

John Rolfe of Elders Home Loans agrees, stating that "the underlying indicators are strong for Australia to lead the world in a recovery."

Experts say Melbourne, Sydney house prices overvalued, further price hikes expected

When asked about house prices in Australian capital cities, the majority of experts agree that Melbourne is the most overvalued city.

Of those who weighed in, over half (17/30, 57%) believe homes in Melbourne are overly expensive, with the average house price currently sitting at $724,000 according to the latest CoreLogic data.

This was followed closely by Sydney, where 56% (18/32, 56%) of respondents believe house prices are overvalued, and the average property costs $915,000.

| City | % of experts that | Average house |

|---|---|---|

| believe the city is overvalued | price* | |

| Melbourne | 57% | $724,000 |

| Sydney | 56% | $915,000 |

| Hobart | 34% | $521,000 |

| Canberra | 28% | $718,750 |

| Brisbane | 17% | $550,000 |

| Adelaide | 14% | $475,000 |

| Perth | 14% | $476,000 |

| Darwin | 14% | $468,750 |

Source: Finder, CoreLogic

*Median sales price last 3 months

Despite most respondents thinking that Melbourne and Sydney are overvalued, the vast majority of respondents (22/31, 71%) expect house prices to rise in both cities over the next two years.

Of those who weighed in on Australia-wide property values, 69% (22/32) expect prices to increase nationally during the same period.

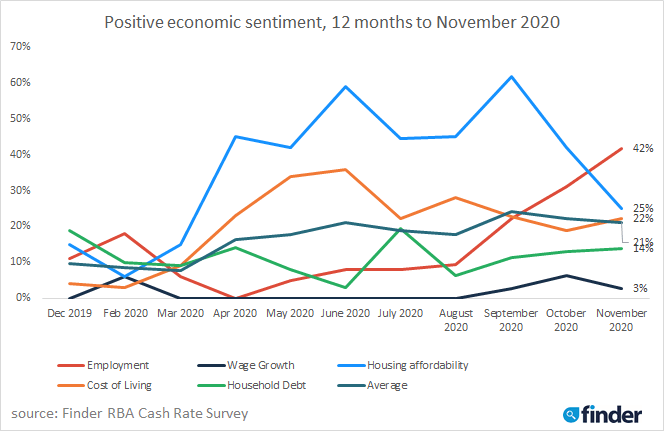

This is supported by results from Finder's Economic Sentiment Tracker, which show that positivity from experts around housing affordability has nosedived from 59% in June to just 25% in November.

Cooke said that there are multiple factors that are likely to boost property prices over the next year.

"Experts are feeling fairly confident about house price recovery over the next two years – especially in Melbourne and Sydney.

"The nation is experiencing a prolonged period of low-interest rates, alongside fiscal support from both regulators and the government, which is propping up buyer confidence.

"The recession also hasn't been as severe as expected, meaning our economic recovery should be more robust. However, there may be some pressure from emergency house sales once the mortgage holiday period ends in March 2021.

"The Aussie housing market has had a very bumpy road over the last 18 months. It looks like the period of relief and opportunity for first-time buyers may be drying up, particularly in regional hotspots.

"While house price increases are good news for homeowners, the clock is ticking for first home buyers who are trying to scrape a deposit together while the going is good," Cooke said.

Here's what our experts had to say:

Nicholas Frappell, ABC Bullion (Cut): "Weak payrolls and uncertainty over external demand and a clear message to maintain 'highly accommodative policy settings' in the October minutes."

Shane Oliver, AMP Capital (Cut): "The RBA's own forecasts show that it will not achieve its employment and inflation objectives over the next two years and so further easing is required to help address this. Recent RBA commentary has provided a strong signal that further easing is imminent. We expect this to take the form of a rate cut to 0.1% and broad-based quantitative easing."

John Hewson, ANU (Hold): "The RBA are reluctant to move to negative rates. Could drop to 0.1 this month as this is already an effective market rate. No doubt political pressure to do so. Politics is all about 'Announcement Value' but won't make much real economic difference."

Rebecca Cassells, Bankwest Curtin Economics Centre (Cut): "There are strong signals by the RBA that they intend to cut rates further to support the economic recovery, making borrowing as attractive as possible and discouraging households from holding onto their dollars. Low inflation figures will tip the RBA's decision to cut rates and we may also see additional quantitative easing over the coming months if progress towards the RBA's 2-3% inflation target is viewed as too slow. Now that Victoria can add its strength, the pace of economic and job recovery should pick up substantially in the coming weeks and months. Whether this pace will deliver a full recovery of jobs lost plus additional employment and wage growth remains more possible than probable at this time."

David Robertson, Bendigo and Adelaide Bank (Cut): "The RBA has been very clear in recent messaging that they wish to provide further monetary policy support to the economy, most likely to be via a reduction in the official cash rate to 0.10%, and further bond purchases/QE."

Sean Langcake, BIS Oxford Economics (Cut): "The RBA's recent communications suggest they are prepared to lower the current rate structure but are still wary of taking rates negative. We expect they will lower the cash rate target by 10-15 basis points at the next meeting."

Ben Udy, Capital Economics (Cut): "The RBA is coming around to our view that the Australian economy needs further stimulus. We expect the Bank to cut rates to 0.1% and launch further QE at their November meeting."

Peter Boehm, CLSA Premium (Cut): "The head of the RBA has previously indicated a further rate reduction is likely this year. Interest rates were kept on hold last month largely due to the timing of the Federal Budget. Now that the Budget has been announced (and generally well-received), and other than Victoria, states and territories are showing reasonable signs of economic recovery, the justification for further easing of monetary policy to help further stimulate economic activity would likely be supported by the RBA Board at its November meeting. Whether this is a good idea or not only time will tell, but I am troubled by the drag Victoria has on overall economic recovery and the national impact of the reduction in JobKeeper. A further rate reduction may not have the desired impact and leave nothing in the tank if the economy doesn't show sustained signs of positive movement. And we don't want a situation of negative interest rates."

Saul Eslake, Corinna Economic Advisory Pty Ltd (Cut): "RBA has signalled pretty clearly that it thinks it can and should do more to support the economic recovery, speed the return to full employment and get inflation back into the target band."

John Rolfe, Elders Home Loans (Hold): "I do not believe the RBA will wish to reduce rates further."

Craig Emerson, Emerson Economics (Cut): "The RBA has signalled a cut in the cash rate from 0.25% to 0.10%."

Angela Jackson, Equity Economics (Hold): "RBA will maintain current settings until the economy shows signs of a sustained recovery – while they may be concerned with lack of momentum in jobs data, they will wait to see if Victoria reopening and state borders opening helps spur the recovery before moving rates down further."

Scott Morgan, Greater Bank (Hold): "If [the cash rate] does move, it will only be a small increase in December."

Tim Nelson, Griffith University (Hold): "Fiscal policy is doing the heavy lifting during the pandemic (which may be for some time yet). When conditions improve and inflation picks up, the RBA will seek to increase rates to reflect this."

Tony Makin, Griffith University (Hold): "In light of the recent worse than expected unemployment numbers and to prevent appreciation of the dollar – a major risk to economic recovery due to government foreign borrowing – the RBA is likely to reduce the cash rate, the term funding facility rate and the three-year bond yield target to 0.1% at its November meeting. A more significant move would be if it introduces quantitative easing via purchases of longer-dated (5 to 10 year) government bonds."

Stephen Miller, GSFM (Cut): "The RBA Governor has hinted that further easing measures are coming. I suspect this is mostly aimed at preventing the AUD from rising to uncompetitive levels."

Tom Devitt, Housing Industry Association (Cut): "Australia is experiencing below-target inflation and elevated unemployment. The risks for the economy are highly asymmetric, with the costs of doing too little likely to be far greater than the costs of doing too much. The RBA's balance sheet expansion is also significantly behind that of other central banks. This is putting upward pressure on the Australian dollar, weighing on exports and potentially turning consumers towards imports rather than domestic goods and services."

Alex Joiner, IFM Investors (Cut): "The RBA has strongly signalled it thinks it needs to do more to support the economic recovery. Cutting the cash rate alone won't be enough though as a 15bp reduction won't do much, it will be part of another package from the RBA that will likely include a broader effort on quantitative easing as a minimum."

Leanne Pilkington, Laing+Simmons (Cut): "The Reserve Bank previously signalled another drop was a possibility in November as more restrictions ease around the country, meaning a cut can potentially have a greater impact. Equally, we were assured that negative interest rates remain off the agenda, which will be an important measure of economic resilience as the recovery progresses."

Nicholas Gruen, Lateral Economics (Hold): "They said they wouldn't [cut the cash rate] but have more recently suggested they would."

Mathew Tiller, LJ Hooker (Cut): "The RBA needs to provide a suite of monetary policy measures to help support and encourage activity and growth, given the challenges facing the Australian economy."

Geoffrey Harold Kingston, Macquarie University (Cut): "The RBA would like to cut the cash rate this November and has already been telegraphed by them. A couple of years down the track, however, will probably see inflation pressures build up."

Jeffrey Sheen, Macquarie University (Cut): "Though it will make virtually no difference to cut the cash rate to 0%, I think the RBA may well do it to appear active and responsive."

Stephen Koukoulas, Market Economics (Cut): "The recession rolls on and the RBA realises it has made a mistake not to ease monetary policy earlier. It is playing catch up."

Michael Yardney, Metropole Property Strategists (Cut): "The RBA has signalled its intention to stimulate the economy and help business and job creation."

Julia Newbould, Money Magazine (Hold): "I think the RBA might try and tweak the rate a final time before the end of the year."

Susan Mitchell, Mortgage Choice (Cut): "I expect to see the first Melbourne Cup cash rate cut in nine years at the RBA's next monetary policy meeting. The CPI for the September quarter is expected to show inflation below target yet again. Given the inflation and labour market will not meet the RBA's targets for some time, it's not surprising that Board members will decide to apply further monetary easing. It will be interesting to see what extent the rate cut is passed on to Australian borrowers."

Dr Andrew Wilson, My Housing Market (Cut): "Although last month's speculation of a rate cut missed the mark, the RBA is now pointing clearly to a November cut and bringing back the traditional Melbourne Cup Day move."

Jonathan Chancellor, Property Observer (Hold): "The December meeting would seem a more opportune time to consider the rate cut."

Rich Harvey, Propertybuyer (Hold): "Comments by the RBA Governor indicate they are still prepared to cut [the rate] further to provide every measure possible to stimulate the economy."

Matthew Peter, QIC (Cut): "The RBA has clearly communicated that it intends to ease monetary policy at its November Board meeting. This will include a cut in the cash rate to 0.1%. The RBA wishes to reinforce fiscal policy with further support to businesses and households in the form of lower interest rates and ample access to credit."

Cameron Kusher, REA Group (Cut): "This move basically looks inevitable at this stage. What will be much more interesting than the cut is what else the RBA announces along with that decision such as buyer longer-dated bonds or any other measures they may choose to proceed with."

Jason Azzopardi, Resimac (Cut): "The RBA indicated further easing of monetary policy will stimulate post growth as lockdowns are eased."

Christine Williams, Smarter Property Investing P/L (Hold): "After a projected 12 months of stability after COVID-19, I believe stakeholders will insist on increasing rates."

Felipe Pelaio, St.George Bank (Cut): "Since September, we were of the view that the RBA would further ease monetary conditions. The economic outlook was looking weaker than the RBA was forecasting. In October, Governor Phillip Lowe's speech indicated the possibility of further easing, driving market consensus closer towards our view of a rate cut in November. The minutes of the October meeting gave further indications the RBA would likely ease in its next meeting. Having heard the Governor and read the minutes, we believe the cut to the cash rate will come in November. At the same time, there should be a reduction to the 3-year bond rate target and changes to the rate on the Term Funding Facility. Further stimulus should be delivered by a fall in the Exchange Settlement Account (ESA) rate from 10 bps to 1 bp. Also, we believe the RBA will implement a large-scale bond-buying program to exert downward pressure on the longer end of the yield curve. We expect economic conditions to remain subdued for the next three years, at least. Currently, the RBA targets the 3-year bond yield as it believes this is the time frame necessary for the economy to recover. Governor Lowe has previously indicated that when the economy recovers, the board will first lift QE policies before lifting the cash rate. For these reasons, we believe the cash rate will be lowered in November and remain at this level until at least the end of 2022."

Dale Gillham, Wealth Within (Hold): "The Australian dollar is holding nicely just above US$0.70 and this is good for Australia. Given this, I think there is no need for rates to change in the short term."

Other participants: Alison Booth, ANU (Hold); Malcolm Wood, EL&C Baillieu (Cut); Tim Reardon, HIA (Cut); Alan Oster, NAB (Cut); Noel Whittaker, QUT (Cut); Sveta Angelopoulos, RMIT (Hold); Clement Tisdell, UQ-School of Economics (Cut).

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel