- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

Finder’s RBA cash rate survey: Experts reveal their top economic predictions for 2021

- All respondents think Australia will exit and stay out of a recession in 2021

- 85% expect property prices to return to 2019 levels

- All experts correctly predicted a cash rate hold this month at 0.10%

1 December 2020, Sydney, Australia –Experts are positive that Australia is on track to exit a recession, and that property prices will return to 2019 levels next year.

In this month's Finder RBA Cash Rate Survey™, 40 experts and economists weighed in on future cash rate moves and shared their key economic and financial predictions for 2021. All 40 correctly predicted that the cash rate would remain at 0.10%.

From the closure of major bricks-and-mortar retail stores to the national uptake of a COVID-19 vaccine, experts were asked to rate the likelihood of various economic scenarios unfolding in the year ahead.

Australia will exit the recession

When asked about the likelihood of Australia exiting and staying out of a recession in 2021, all 28 experts who weighed in agreed that this is either "likely" (54%, 15/28) or "very likely" (46%, 13/28).

Economists are also optimistic about the nation's GDP growth, with 79% (22/28) expecting the economy to see its first quarter of growth before the end of 2020.

Graham Cooke, insights manager at Finder, said that the nation's economy may have already recovered.

"Official GDP figures for the September quarter will be released this Wednesday, with the general consensus being that Australia may have already exited a recession.

"This can largely be attributed to almost $500 billion in government and central bank stimulus and effective COVID-19 control measures, alongside news of a vaccine, strong consumer spending and a resilient property market.

"It remains to be seen if our economy can keep moving uphill once the training wheels come off.

"The December quarter is likely to be robust as well, meaning it's highly probable that we may see a gradual recovery of GDP through 2021," Cooke said.

Property prices and sales volume to return to 2019 levels

Australia's property price recovery looks set to continue.

More than 4 in 5 experts (85%, 24/28) predicted that house prices will increase above 2019 levels in the new year, and 79% (22/28) think that sales volumes will recover to match or exceed 2019 levels.

CoreLogic data shows that, despite predictions of up to 15% drops in value earlier in the year, house prices in Australia have proved resilient.

Prices increased in all capitals bar Melbourne in October and were significantly higher compared to October 2019 in all cities bar Perth, which saw a marginal price increase of only 0.04%.

According to Matthew Tiller of LJ Hooker, record-low interest rates have been a key driver of market stability.

"One of the main beneficiaries of the ongoing record low rates has been property markets, with LJ Hooker agents reporting a significant increase in enquiries and strong levels of sales transaction volumes," he said.

Closure of major bricks-and-mortar stores due to online shopping surge

Ecommerce surged during the pandemic, with more than 8.5 million households shopping online between March and October in 2020 according to Australia Post figures.

Yet over half of the experts (56%, 15/27) believe that the recent uptick in online shopping could be the death knell for major bricks-and-mortar department stores like Myer and David Jones.

Cooke said that Aussie shoppers are becoming increasingly wise to the outdated retail model used by department stores.

"Department stores operate on an old-fashioned regular discounting model, where an item is advertised at an inflated price for several weeks, only then be 'on sale' for several more weeks.

"Consumers are becoming annoyed by this false discounting, and they prefer the flat low-cost pricing offered online," Cooke said.

Trans-Tasman travel passage to go ahead

Australia is permitting New Zealand residents to travel to a number of states without undergoing quarantine, however, our Kiwi neighbours are yet to reciprocate.

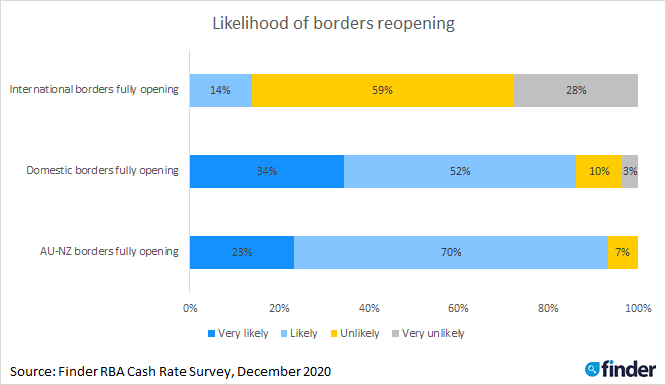

Despite this, 93% of experts (28/30) are confident that borders will fully open between both countries in the year ahead.

Oddly, the opening up of domestic borders was seen as slightly more problematic, with just 86% of respondents (25/29) foreseeing this possibility in 2021.

Experts are also less optimistic about international borders overall, with just 14% (4/29) expecting Australia to fully reopen to international travellers in the new year.

"Tourism accounts for 3% of the Australian economy, so unlocking our international borders will open up a much-needed economic lifeline.

"Not opening international borders in 2021 could also be devastating for farmers and rural areas, which rely heavily on working holiday travellers," Cooke said.

National COVID-19 vaccine uptake unlikely

Australia has entered into five separate agreements for the supply of COVID-19 vaccines if they are proven to be safe and effective.

Yet little over a third of experts (37%, 11/30) anticipate that all Australian adults will get vaccinated in 2021, should a national rollout begin.

Cooke said that it may not be necessary for all Australians to be vaccinated in order to stop the virus in its tracks.

"Medical experts say that a vaccination rate of around 80% is desirable to prevent the spread of COVID-19.

"But with current vaccine candidates boasting effectiveness of above 90%, a lower vaccination rate should be sufficient to prevent disease spread," he said.

Here's what our experts had to say

Shane Oliver, AMP Capital: "Given that the cash rate is already at 0.1% and the RBA does not want to take it negative, the next move is likely to be a hike. But given the high level of spare capacity in the economy, inflation is unlikely to meet the RBA's conditions for a hike of being sustainably within the 2-3% target range for another three years or so. As a result, the first rate hike is unlikely until sometime in 2024."

David Robertson, Bendigo Bank: "The RBA has cut the official cash rate to its effective lower bound at 0.1%, and it will stay at this floor for some years. The next tightening cycle may commence in FY23. Further monetary stimulus, if needed, will come in the form of expanded QE, but negative interest rates are not on the table."

Sean Langcake, BIS Oxford Economics: "The RBA's forward guidance has turned a little more dovish. It will be quite some time before their conditions for a rate increase are met."

Ben Udy, Capital Economics: "In May, we were the first to forecast that the RBA would launch QE in earnest with markets, and the consensus forecast only came around to our view in recent months. In November, we were proved right. Looking ahead, we think the Australian economy is poised to recover faster than most expect."

Peter Boehm, CLSA premium: "There appears to be little justification for further cuts to the cash rate. In fact, interest rates have probably reached their floor. This is because the relative success of the Federal Government's stimulus packages combined with various State-based initiatives has carried the economy such that the time has come to focus less on monetary policy, and more on fiscal policy. The last thing the economy needs right now is zero or negative interest rates."

Saul Eslake, Corinna Economic Advisor: "I think the RBA's commitment not to raise the cash rate for at least three years is credible."

Malcolm Wood, EL&C Baillieu: "RBA commitment to keep rates at effective zero for three years."

John Rolfe, Elders Home Loans: "The RBA won't go to zero, but it will want to see a few quarters of positive growth before increasing."

Craig Emerson, Emerson Economics: "The RBA has a new target: it won't increase the cash rate until actual (not forecasted) unemployment is much lower and actual (not forecasted) inflation is in the 2-3% range. That will be well beyond end-2022."

Tony Makin, Griffith University: "Large scale monetisation of government bonds must eventually put upward pressure on inflation as economies recover from the COVID-19 recession. If economic theory and history are any guides, a rise in the official cash rate will then be necessary. World interest rates should start to rise as markets become saturated with government bonds that continue to be issued on a massive scale. A rate to watch is the rate on long-dated US bonds."

Tim Nelson, Griffith University: "Conventional monetary policy is unlikely to be utilised to manage stimulus out of COVID-19, but will be used to manage a quickly growing economy post-COVID-19."

Michael Witts, ING Bank: "[The RBA] has indicated the cash rate will remain unchanged for three years, however, the recovery from COVID-19 appears to be going faster than anticipated, hence the RBA may adjust the cash rate earlier than three years, although the timing is highly uncertain."

Leanne Pilkington, Laing+Simmons: "Like most industries and consumers as well, we're hopeful the cash rate remains unchanged for some time. The Reserve Bank recently made the landmark move and it will take some time to ascertain its success in supporting the economic recovery. We see the cash rate remaining steady until well into the new year."

Nicholas Gruen, Lateral Economics: "All I'm saying is that increases look to be a long time coming."

Mathew Tiller, LJ Hooker: "After last month's reduction in the cash rate to close to zero, the RBA will look to support and stimulate the economy via other measures moving forward. One of the main beneficiaries of the ongoing record low rates has been property markets, with LJ Hooker agents reporting a significant increase in enquiry and strong levels of sales transaction volumes."

Sam White, Loan Market Group: "There's renewed confidence in the marketplace. The next change in the cash rate will be an increase, but the timing on that is difficult to predict as there are numerous factors – including the availability of a COVID-19 vaccine – to consider. The market doesn't need a rate cut at the moment – it needs easier access to finance. There's no shortage of pre-approvals at the moment. In many suburbs, it's now cheaper to pay a mortgage than to rent. We're seeing the economy stabilise relatively quickly. The economy has proved to be much more resilient than first thought."

Jeffrey Sheen, Macquarie University: "The RBA has provided forward guidance that the cash rate should not be increased until about three years after the COVID-19 shock."

Geoffrey Kingston, Macquarie University: "I expect – without high confidence – that inflationary pressures will emerge by the second half of 2022."

Michael Yardney, Metropole Property Strategists: "The RBA will now wait and see how effective their recent interest rate cut and the QE program is."

Mark Crosby, Monash University: "The RBA has signalled holding rates low until 2023 at the earliest."

Julia Newbould, Money Magazine: "I think that by the second half of 2021, there should be signals that the rates have achieved their goals and there will be a review."

Susan Mitchell, Mortgage Choice: "I expect the RBA to hold the cash rate at its last meeting in 2020. In the minutes of the November monetary policy meeting, members said that negative rates were extraordinarily unlikely, suggesting that we may not see another reduction to the cash rate so soon. That being said, the historic low cash rate is supporting the lowest borrowing cost on record and driving activity in the nation's housing market. It is also encouraging a surge in refinancing from borrowers looking for a better deal."

Alan Oster, NAB: "Nothing for forecast period re-rate rises. If further support is needed it will be via QE."

Jonathan Chancellor, Property Observer: "Next time is up, but who knows just which year."

Rich Harvey, Propertybuyer: "No further rate cuts. RBA has said it will not go to negative rates. Rates likely to stay at this level for three years."

Noel Whittaker, QUT: "Low rates are here for years. The big question is whether they will move to negative rates."

Cameron Kusher, REA Group: "I think the RBA is extremely reluctant to cut further and take rates negative, while I also think they may be somewhat optimistic in their forecasts around a rebound in inflation. I don't see an increase until after 2022 and, if anything, a move lower, albeit very reluctantly, looks more likely than an increase, but I am still unsure that would occur."

Jason Azzopardi, Resimac: "RBA monetary policy indicates QE and a period of sustained low rates will remain."

Christine Williams, Smarter Property Investing: "Global rates will remain low due to COVID-19."

Besa Deda, St.George Bank: "Subdued economic conditions will continue to require strong monetary stimulus for at least the next three years."

Dale Gillham, Wealth Within: "Whilst Australia is coming out of the COVID-19 climate that has plunged us into a recession, things are not as bad as they could be and so the recession is likely to be short-lived and so interest rates are unlikely to fall further. The release of figures around retail spending and GDP in this second quarter will be an indication as to whether rates will rise in 2021 or remain at current levels. If retail spending is strong, then a movement in rates will occur earlier rather than later."

Other participants: Nicholas Frappell, ABC Bullion. Alison Booth, ANU. John Hewson, ANU. Rebecca Cassells, Bankwest Curtin Economics Centre. Angela Jackson, Equity Economics. Mark Brimble, Griffith University. Alex Joiner, IFM Investors. Stephen Koukoulas, Market Economics. Dr Andrew Wilson, My Housing Market. Bill Evans, Westpac.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel