- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

RBA Survey: Coronavirus economic impacts just beginning

- 56% of experts foresee COVID-19 causing 'significant' negative impact on the Australian economy

- Tourism, education and property expected to take a hit

- 90% (35/39) expect an RBA rate cut to happen in 2020, 15% (6/39) predict cut in March

2 March 2020, Sydney, Australia – Experts fear the Reserve Bank of Australia (RBA) will need to take action in the wake of the COVID-19 (coronavirus), according to Finder.

In this month's Finder RBA Cash Rate Survey™, 39 experts and economists weighed in on future cash rate moves and the state of the Australian economy.

Graham Cooke, insights manager at Finder, said 20 economists specifically called out the threat the virus poses.

"House prices are still rising in an almost unsubstantiated way, the effect of the smouldering bushfires is still to be felt and inflation is still sluggish – but it's the coronavirus above all that is concerning economists right now.

"Specifically, whether the affected countries can keep a lid on the spread of the virus. With COVID-19 now spreading through Europe and the Middle East, that looks unlikely."

The major fears of the panel centred around education, tourism and property. This follows last week's news that the Aussie dollar had dipped to 65 US cents, a low-water mark last seen in March 2009.

Shane Oliver of AMP Capital said that March quarter growth is already likely to have been depressed by the COVID-19 outbreak via the hit to tourism from China in particular.

"If [COVID-19 is] not contained by the end of March, the impact will likely broaden significantly to education and hard commodities and could drive a second negative quarter of growth in Australia," Oliver said.

A budget surplus, as promised by the federal government, now looks unlikely, according to economists.

19 experts (66%) said a surplus was unlikely, with a further 2 (7%) saying it was very unlikely.

Craig Emerson of Craig Emerson Economics foresees "very heavy impacts on tourism and higher education", which he notes are Australia's second and fourth-largest export industries and big employers.

Angela Jackson of Equity Economics said the virus's impact in these sectors will undermine domestic demand.

"Combined with the impact on international travel and supply chains, [COVID-19] threatens the global economy," Jackson said.

Alex Joiner of IFM Investors agreed that Australia is heavily exposed to Chinese tourist and student flows but offered a glimmer of hope.

"A silver lining may be that Chinese authorities stimulating their economy may do so via infrastructure spending and the property market.

"This may be positive for Australia's traditional exposure to China via the resources sector," Joiner said.

Since the outbreak started to affect Australian markets on 21 February, the ASX200 has fallen 10%.

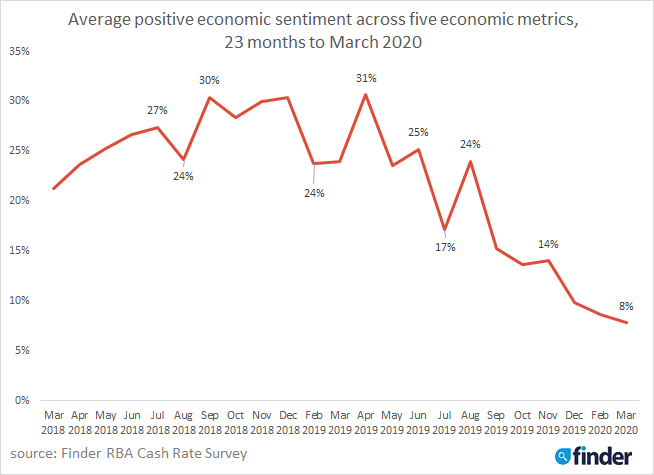

Cooke said COVID-19 fears, along with the uncertainty of the impact of the bushfires, has driven overall economic confidence down among the panel to an all-time low of 8% across the five metrics tracked. This is down from a high of 31% in April of 2019.

90% predict a cash rate cut in 2020

Nearly all experts (90%, 35/39) in Finder's RBA Cash Rate Survey expect an RBA rate cut to happen in 2020, while just 15% (6/39) are predicting a cut on Tuesday.

Cooke said he was surprised to see even 15% of our experts predict a cut this month.

"With the resurgence of the housing market still happening, coronavirus hitting markets hard and general economic figures remaining stagnant, the general consensus is that it's too turbulent a time to make the call for a rate easing.

"However, all experts, bar four, are predicting that a cut is on the horizon," Cooke said.

7 respondents (18%) expect a 0.25% cash rate by the end of the year and 28 (72%) expect 0.50%.

April and May are the most likely months for a cut, cited by 10 (26%) and 9 (23%) experts respectively.

Here's what our experts had to say:

Commentary (Cut)

Shane Oliver, AMP Capital (Cut): "The next move is likely to be a cut in EITHER March or April. I don't have a strong view which one it is and it's not a big deal which one it is either. The coronavirus outbreak coming on the back of the bushfires is likely to see the economy go backwards this quarter which in turn is likely to push unemployment up further after the rise to 5.3% seen in January. Growth should rebound in the March quarter but given the uncertainty around COVID-19 and its impact globally there is much uncertainty around that and given we are so far from full employment and the inflation target the RBA is likely to cut the cash rate again in the months ahead."

Trent Wiltshire, Domain (Cut): "The RBA is reluctant to cut rates further as it is worried that house price rises will accelerate. But the soft labour force figures combined with the escalating shock from the coronavirus means the RBA will be forced to lower the cash rate."

Angela Jackson, Equity Economics (Cut): "The duel impact of the coronavirus and the summer bushfires have undermined the economic recovery of late 2019, and in the absence of fiscal stimulus the RBA will need to move to cut rates further. On balance I think there is enough information for them to move in March, but they may wait until April."

Tim Reardon, Housing Industry Association (Cut): "A reduction due to the adverse impact of restrictions on trade and tourism."

Nicholas Gruen, Lateral Economics (Cut): "Coronavirus will begin to weigh on our economy."

Dr Andrew Wilson, My Housing Market (Cut): "Jobless falling, wages growth still low and growing concerns over economic impact of coronavirus."

Commentary (Hold)

Nicholas Frappell, ABC Bullion (Hold): "The very slight rise in unemployment doesn't reflect the impact of bushfires or COVID-19. The slight weakening probably isn't enough to justify a cut considering 'the long and variable lags' referred to by the governor, and would leave scope for more cuts later if both of the above factors create persistent drag."

Alison Booth, ANU (Hold): "Although the prospects for the Australian economy are not looking good, I think the RBA will hold. In my opinion, the governments should be doing more in terms of fiscal policy and I suspect the RBA shares this view."

John Hewson, ANU (Hold): "Unsure of outlook and aware that int rate cuts do little to stimulate the economy except asset prices esp housing."

Malcolm Wood, Baillieu (Hold): "Sluggish growth and below target inflation."

David Robertson, Bendigo and Adelaide Bank (Hold): "Another RBA rate cut remains likely in H1, although the timing is subject to a range of factors that remain fluid. The latest jobs data was weaker than hoped, and COVID-19 global concerns are rising, so another cut is expected."

Ben Udy, Capital Economics (Hold): "We were already expecting the Australian economy to remain weak in 2020. The disruptions due to the coronavirus only add downside risk to that forecast. We think the unemployment rate will continue to rise, prompting the RBA to cut twice."

Peter Boehm, CLSA Premium (Hold): "I expect the RBA to hold rates for the time being. The economy would have to be facing serious problems if rates were to be reduced further and I don't think we're there yet – and hopefully won't be."

Craig Emerson, Craig Emerson Economics (Hold): "Not much ammunition left and the RBA considers fiscal policy should provide stimulus."

Mark Brimble, Griffith Uni (Hold): "The impact of ongoing national and global events is still being determined, while the economy continues to be largely stagnant, thus suggesting more support is required."

Tony Makin, Griffith University (Hold): "The weakness of the dollar combined with the metropolitan property market rebound suggest a hold decision at the March meeting. However, if COVID-19 is not contained, its impact on global supply chains significantly worsens (with domestic unemployment rising), a rate cut becomes highly likely in May, or even before, in April."

Alex Joiner, IFM Investors (Hold): "The RBA's challenge with respect to easing policy further is having to judge whether any near term uptick in the unemployment rate is due to the impact of the bushfires and coronavirus – which it may choose to 'look through' – or the beginning of more entrenched weakness in the labour market. Consequently it will want to see ample evidence of this in the data flow and may not get a clear signal until early in the second half of the year."

Leanne Pilkington, Laing+Simmons (Hold): "From an ease in the bushfire crisis to a rise in the coronavirus threat, there are economic challenges in addition to the health and safety challenges to be faced, and the impacts of these are not yet fully known. Maintaining the hold pattern at this time of significant uncertainty seems appropriate."

Mathew Tiller, LJ Hooker (Hold): "After releasing fairly upbeat meeting minutes last month, the RBA is now assessing the global economic impact of the coronavirus and domestic implications of droughts and bushfires before it reduces the official cash rate further. Real estate markets across the country continue to benefit from low interest rates with strong buyer demand resulting in auction clearance rates above 75% and a steady lift in dwelling values."

Jeffrey Sheen, Macquarie University (Hold): "RBA is likely to wait to see the effects on the economy of the recent natural disasters (fire, flood, epidemic)."

Geoffrey Harold Kingston, Macquarie University Business School (Hold): "Support economy in the face of the coronavirus."

Stephen Koukoulas, Market Economics (Hold): "It will want to guard against asset price rises."

John Caelli, ME (Hold): "The cash rate will likely fall in May as the RBA looks to get the unemployment rate lower. The uncertainty around the impacts of the coronavirus and weak consumer spending will also be factors."

Michael Yardney, Metropole Property Strategists (Hold): "The Reserve Bank will be disappointed with the latest unemployment figures but is likely to hold off cutting rates in fear of adding fuel to the already strong property markets."

Mark Crosby, Monash University (Hold): "RBA will likely cut this meeting or next as COVID-19 fears escalate. Subsequent moves will depend on how quickly this is brought under control."

Julia Newbould, Money magazine (Hold): "It will allow the RBA to assess the lag effects of the June cut from last year, but that all depends on the impacts of the coronavirus and the

bushfires."

Susan Mitchell, Mortgage Choice (Hold): "A further reduction to the cash rate is a question of when, not if. That being said, recent data suggests there may not be enough reason to warrant a cut in March as the benefits would not be sufficient enough to offset the risk of doing so. The latest Labour Force data from the Australian Bureau of Statistics (ABS) revealed that the unemployment rate rose in January, following better than expected results the month prior. Further, the December quarter Wage Price Index revealed that subdued wage growth persists. On the other hand, housing market data suggests the housing market continues to benefit from the historic low interest rate environment. The latest data from the ABS showed a rise in the value of home loan approvals in the month of December. Further, the low-interest rate environment continues to stimulate housing values, with CoreLogic figures revealing national dwelling values rose 0.9% in January. RBA Board members would be wary that another cut to the cash rate may put further upward pressure on the already high cost of housing."

David Lowe, Newcastle Permanent (Hold): "The RBA is likely to hold rates in March, allowing more time for the effects of its previous cuts to flow through the economy. The Board has noted the potential risk for lower rates to spur on increased borrowing and debt in the housing market at the time of an upswing, where the Australian household has only just started repairing balance sheets. A recent rise in unemployment may increase the chance of a rate cut sooner than previously thought, but not enough for a cut in March."

Jonathan Chancellor, Property Observer (Hold): "The central bank will want to sit and watch the economy for another month or two before cutting."

Rich Harvey, Propertybuyer (Hold): "RBA does not want to see property market over-inflated but waiting to see if past cuts will flow through and if lower AUD will stimulate exports."

Noel Whittaker, QUT (Hold): "I think rates have bottomed – there is so much uncertainty right now."

Nerida Conisbee, REA Group (Hold): "The biggest risk to economic growth right now is the coronavirus. If Chinese economic growth plummets for more than one quarter, this will hit the Australian economy. Already our tourism and education sectors are being hit due to their reliance on Chinese consumers. We don't have much room for movement with interest rates and if things start to get bad, we likely only have one or two cuts left. It is likely that May's federal budget will be far more interesting than last year and the government may need to give up their surplus."

Christine Williams, Smarter Property Investing Pty Ltd (Hold): "We are not due for a federal election for another 12 months, therefore the rise will occur at least 6 months prior."

Peter Haller, Treasurer (Hold): "There are downside risks to the RBA's current forecasts which, if crystallised, will bring forward a rate cut from the time currently expected by the market."

Mala Raghavan, University of Tasmania (Hold): "The recent unprecedented bushfire and the coronavirus outbreak means detrimental effects on the Australian economy. Trade, tourism and education sectors are the hardest hit. In addition, the global economic uncertainty and the gloomy world economic outlook, will drive down domestic household and business confidence and investments. Given these scenarios, there is a high possibility that the RBA will bring down the cash rate as low as 0.5% around July."

Clement Tisdell, UQ-School of Economics (Hold): "May hold till the effects of the coronavirus are clearer and fiscal policy is more apparent."

Other participants: Bill Evans, Westpac (Hold), Jason Azzopardi, Resimac (Hold)

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel