- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

Finder helps Australians financially prepare for economic uncertainty

- Finder encourages Australians to get a better view of their finances in the current economic climate

- Australian-first app finds savings across credit cards, home loans, savings accounts, health insurance

- Australian households could save up to $8,496 per year by switching financial products

17 March 2020, Sydney, Australia – Australia's most visited comparison site1 has launched the Finder app to help Australians manage their money as the country faces unprecedented economic conditions.

New research from Finder reveals 74% of Australians are stressed about their finances, with three in five (60%) saying they want to put aside more money in 2020.

Finder estimates Australian households could free up an extra $8,496 each year across four common financial products – home loans, savings, health insurance and credit cards – if they were to switch providers.

Fred Schebesta, Co-founder of Finder, says the Australian-first app aims to help Aussies fast-track their savings.

"By securely connecting to bank accounts, the free Finder app will analyse your financial products and spending habits and alert you to potential savings across four major categories.

"We've been building the app for the past year-and-a-half and, while we never could have predicted the current global crisis, it may help mitigate the financial fallout for those facing uncertainty.

"The Finder app allows Australians to take money matters into their own hands by tracking your spending and maximising savings. It's the only app in Australia that will tell you when you can save across several different products."

Users will also be able to access their free credit score and report in the app, so they can have greater visibility of their financial position.

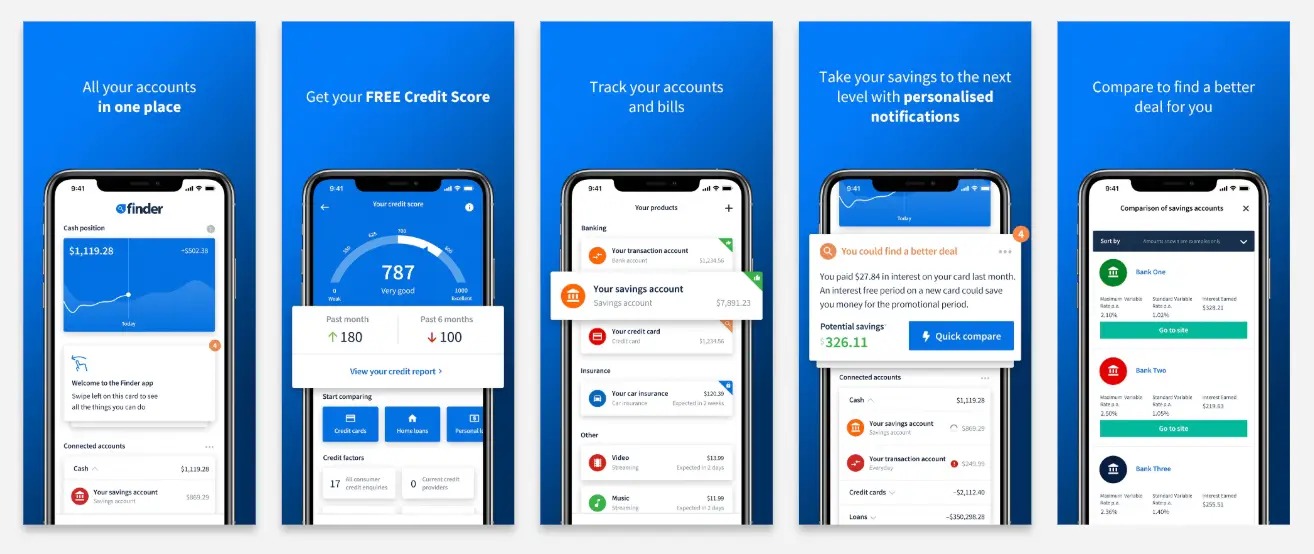

Finder app features:

- See all your money in one spot. Get better visibility of your income, spending and savings, from different bank accounts, in the one place.

- Free credit score. Australians can get their free credit score and comprehensive report in the app, and it will update each month and alert you of any changes.

- Clever insights: It analyses your spending and identifies when you can be saving more. When potential savings on a product are found, we'll let you know.

"Right now, more than ever, Australians need to get on top of their finances. It's important to have a good understanding of what's coming in, what's going out, and where you can save," says Schebesta.

"This app does the hard work for you – every time there's a rate change or a new product enters the market, the Finder app will let you know if you could be saving money by switching."

Finder has partnered with Envestnet Yodlee, a global leader in banking technology, to connect bank accounts to the app via a secure Application Program Interface (API).

The Finder app is a free service and available to download in both the App Store and Google Play Store now. There are plans to launch in the UK and US later this year.

You can find more information and FAQs regarding the Finder app here and download image assets in this folder.

Potential savings by switching

| Product | Savings |

|---|---|

| Credit cards | $253 saved if transferring the average interest accruing credit card balance to a 0% balance transfer card. |

| Home loans | $6,826 saved per year by moving from the average home loan variable rate across the Big Four banks to the lowest rates on the market. |

| Health insurance | $635 per year potential saving between the highest and lowest price policies on the same coverage tier. |

| Savings | $2,346 potential interest earned over three years when switching from the average online savings rate to one of the three banks offering the highest rates on the market, based on the average saving volume in Australia ($782 in first year) |

Source: Finder, RBA.

1 2.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel