- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

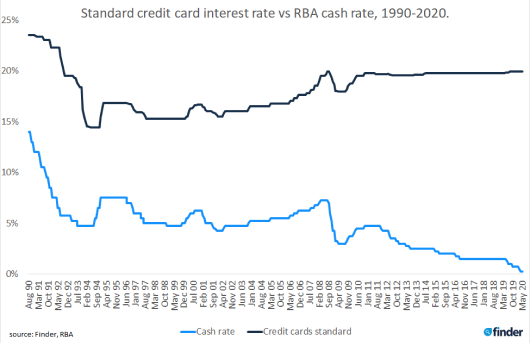

Gap between cash rate and credit card interest rate widest ever

- Standard credit card interest rate is nearly 80 times the cash rate

- Average card rate would be 12.90%, instead of 19.94%, if banks passed on cuts

- Best low-rate credit cards on the market

10 June 2020, Sydney, Australia – Australia's average credit card rate has never been this far above the official cash rate, according to new research by Finder, Australia's most visited comparison site.

Finder's analysis reveals the standard credit card interest rate has blown out to almost 80 times the cash rate.

The standard credit card rate followed a similar trend as the cash rate for a lengthy period from 1991 until 2010.

Despite the official cash rate being slashed from 4.75% in December 2010 to 0.25% today, the credit card rate has remained fairly steady (averaging 19.77% in December 2010 and 19.94% in May 2020).

Graham Cooke, insights manager at Finder, said as the gap between credit card rates and the cash rate grows even wider, credit card customers should shop around for a more competitive deal.

"The average credit card rate followed the cash rate from 1990 to 2010. Every time the cash rate went up or down, so did the credit card rate.

"But that all went out the door from 2010 onwards.

"Today's credit card interest rates range from 11.99% to 21.49% on Finder.

"If the banks had passed on the rate cuts as they did up to 2010, that would make the average standard rate today just 12.9% – it currently stands at 19.94%," he said.

"The reality is that at the high end of the credit card market, customers don't care about the interest rate. They are in it for the points, and that's what this data proves."

A potential fly in the ointment for consumers focused on earning frequent flyer points is that the value earned on these cards could be about to fall through the floor.

Nearly 70% of economists surveyed in June's Finder RBA Cash Rate Survey™ said they expect frequent flyer points to lose value in the coming months as airlines struggle to bounce back following COVID-19 restrictions.

"Does this mean we're likely to see a drop in the interest rate too? Don't count on it," Cooke said.

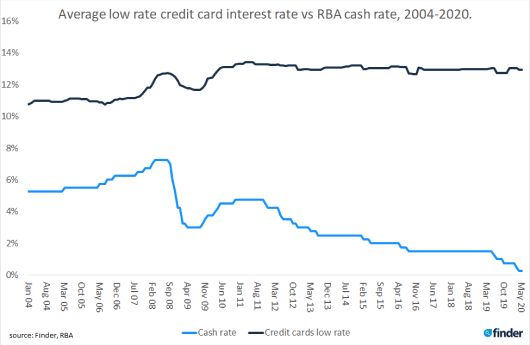

Low rate cards

Aside from standard rate cards, the average low rate credit card interest level is also near record highs since the RBA began tracking these cards in 2004.

At present, these cards are 50 times the cash rate, up from only 6.5 times five years ago.

Click here to compare the latest low rate credit card deals on Finder

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel