- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

Cash rate on way to 0.50%, say 1 in 3 experts

- 27 of 40 experts and economists believe the RBA will cut the cash rate on Tuesday

- More than 1,000 home loan rates have been reduced in June alone

- How much the average mortgage holder could save if rates continue to ease

28 June, 2019, Sydney, Australia – The Reserve Bank of Australia (RBA) will likely back up last month's cash rate cut with a consecutive decrease in July, according to Finder, Australia's most visited comparison site.

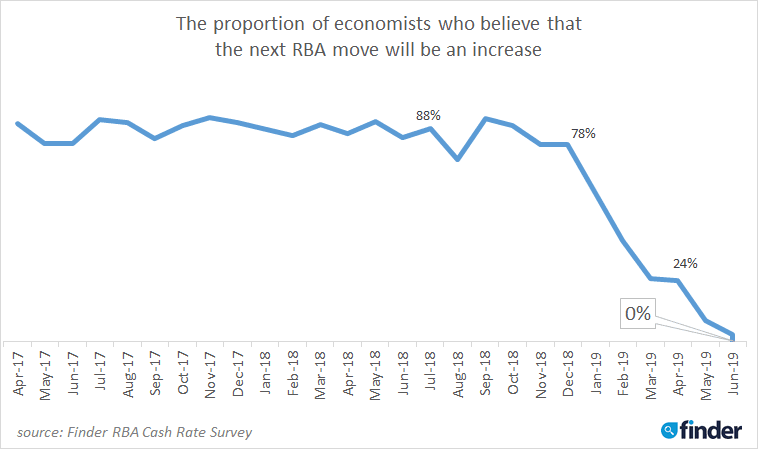

In the latest Finder RBA Cash Rate Survey™ – the largest of its kind in Australia – of the 40 experts and economists polled, 68% (27/40) tipped an easing of the cash rate on 2 July.

Nearly three-quarters of experts (72%, 23) foresee the bottom of the cycle at 0.75% or lower. However, almost a third (32%, 10) expect to see the cash rate reach 0.50%.

When asked about the timing of further cuts, experts nominated August and November as strong favourites.

Graham Cooke, insights manager at Finder, said lenders should be gearing up to get busy with further rate reductions.

"The RBA will have its scissors out for the foreseeable future to try to stimulate inflation and reduce unemployment, and lenders should be ready to follow suit.

"The heat is on for those banks who only passed on a partial rate cut (less than 25 basis points) after the June rate reduction. Doing the right thing by their customers this time around – by passing on a cut in its entirety – could see them redeem themselves," he said.

Home loan rates slashed

When the RBA cut the cash rate to an all-time low of 1.25% in June, for the most part, lenders responded thick and fast, according to Cooke.

"So far, we've seen more than 700 variable rate products reduced in June alone, with more than 1,000 rates reduced if you include fixed rate loans.

"Across all of the variable rates Finder compares, the average rate has dropped more than 20 basis points in June.

"The winners here are borrowers – they're spoilt for choice with the lowest home loan rates we've ever seen," he said.

That's the case with variable and fixed rates alike. Currently, the lowest variable home loan rate on the market is 3.09% (Reduce Home Loans), while sub-3% is the new benchmark for fixed rates (UBank and Greater Bank 1-Year Fixed; both 2.99%).

Would one larger cut be better?

Nicholas Gruen of Lateral Economics contends that the RBA may be better off making one giant cut rather than several small ones.

"I've argued that larger steps than [25 basis points] would be apposite, but smaller ones convey a less panicky picture to onlookers," Gruen said.

What more cuts could mean for borrowers

With more cuts on the way, this could spell big savings for homeowners with a variable loan or those searching for one.

"If the cash rate does get to 0.50%, down from 1.50% in May, and your bank were to pass on all of the four rate cuts in full, an average mortgage holder could be saving nearly $3,000 a year on their mortgage," Cooke said.

"Of course you don't have to wait around for these cuts to happen – you can go home loan shopping for a better deal anytime.

"It's a borrower's market. A new standard has been set with sub-3% home loan rates so compare options to maximise your savings in the long run."

Potential rate cut savings on different loan amounts:

| Current variable rate | One more cut | Two more cuts | Three more cuts | |

|---|---|---|---|---|

| 4.62%* | 4.37% | 4.12% | 3.87% | |

| RBA Cash Rate | 1.25% | 1.00% | 0.75% | 0.50% |

| Loan | Annual cost | Annual savings | Annual savings | Annual savings |

| $250,000 | $15,415 | $445 | $884 | $1,317 |

| $400,000 | $24,664 | $713 | $1,415 | $2,107 |

| $500,000 | $30,830 | $891 | $1,769 | $2,633 |

| $750,000 | $46,246 | $1,336 | $2,653 | $3,950 |

| $1,000,000 | $61,661 | $1,782 | $3,538 | $5,267 |

Source: Finder

*Average home loan rate across all variable home loans on Finder

1Average size mortgage in Australia as of November 2018 was $384,700 (most recent ABS data)

Here's what our experts had to say:

Nicholas Frappell, ABC Bullion (Decrease – 25 basis points): "RBA comments about not making inroads into spare capacity in the Australian economy, and the recent cut being insufficient to 'materially shift' the path of weaker growth and static unemployment signal that the RBA is willing to act. Additionally, the persistent uncertainties surrounding Sino-US trade conflicts, worsening tensions in the Gulf and easing monetary conditions elsewhere suggest that the RBA might be keen to get ahead of the easing cycle."

Shane Oliver, AMP Capital (Decrease – 25 basis points): "The June 0.25% rate cut has not been enough for the RBA to achieve its objective of lowering unemployment, boosting wages growth and pushing inflation back to target. More rate cuts will be needed."

Alison Booth, ANU (Decrease – 25 basis points): "The economic indicators are not so rosy and the banks haven't fully passed on previous rate cuts so the RBA is likely to lower rates either now or in the near future."

John Hewson, ANU (Hold): "[The RBA] will respond cautiously."

Malcolm Wood, Baillieu (Decrease – 25 basis points): "Strong signals from the Governor and the Board minutes."

David Robertson, Bendigo and Adelaide Bank (Decrease – 25 basis points): "Could wait until August, but recent RBA speeches have been very clear and open that they want to see a lower unemployment rate, to drive wages growth and inflation."

David Bassanese, BetaShares (Decrease – 25 basis points): "Unemployment is too high."

Ben Udy, Capital Economics (Decrease – 25 basis points): "The subdued 0.4% q/q rise in Q1 GDP will make it difficult to reach the RBA's forecast of a 1.7% rise in GDP in the year to the second quarter. We think the actual increase will be closer to 1.3%. What's more, the minutes of the June meeting were dovish, noting that it was more likely than not that a further easing in monetary policy was appropriate in the period ahead. And Governor Lowe said in a recent speech that it would be unrealistic to expect that lowering interest rates by 0.25 of a percentage point will materially shift the path of unemployment. So we think the RBA will cut the cash rate by 25 basis points in July."

Tim Moore, Credit Union Australia (Decrease – 25 basis points): "The urgency around timing of a cash rate change has increased, given the recent commentary being made by the RBA around the level of NAIRU and the need to shift the economy to more positive territory, rather than just doing 'OK'. I expect this will drive the RBA to cut sooner rather than later, as it could be argued why wait a month if they already feel the cut is needed."

Trent Wiltshire, Domain (Decrease – 25 basis points): "In recent speeches the RBA leadership has made it clear they are now aiming for an unemployment of 4–4.5%, so lower interest rates will be needed to get there. The RBA is likely to cut two more times this year, beginning in July."

John Rolfe, Elders Home Loans (Hold): "Having just moved they are likely to let the impact of last month's cut take some effect."

Debra Landgrebe, Gateway Bank (Decrease – 25 basis points): "Based on Dr Lowe's speech to the Committee for Economic Development of Australia – where he advised that it would [be] unrealistic to expect a 25bps cut to materially shift the path we're on."

Mark Brimble, Griffith University (Decrease – 25 basis points): "The rationale for last month's decrease prevail and a further move will add more support to the economy and give a point to pause and assess the impact."

Tim Nelson, Griffith University (Decrease – 25 basis points): "RBA has indicated that the NAIRU is significantly lower than previously thought, facilitating a shift to lower rates without creating inflationary pressures."

Peter Haller, Heritage Bank (Hold): "The RBA has emphasised the importance of spare capacity in the labour market in recent weeks. However, the monthly volatility in labour market data mean they will wait one more month before cutting the cash rate in August."

Alex Joiner, IFM Investors (Decrease – 25 basis points): "The RBA knows that it is not making inroads to spare capacity in the labour market as it desires and has clearly signalled it believes policy rates need to move lower further still. There seems little point in waiting for further data given the Bank has already reached this conclusion, an August move can't be ruled out as the Board may choose to see a new set of forecasts but these would not have improved so again this suggests the bank should move in July."

Michael Witts, ING (Decrease – 25 basis points): "The RBA appears to have been conditioning the market for further near term rate cuts."

Peter Boehm, KVB Kunlun (Decrease – 25 basis points): "The recent reduction of 25bps is not enough to achieve the RBA's objectives and so a further cut is likely to occur, with further on the way."

Leanne Pilkington, Laing+Simmons (Decrease – 25 basis points): "A follow-up cut has been foreshadowed as the impacts of a single cut to make real inroads in an economic sense are questionable. But the economy is in a delicate place and the RBA has reinforced the limitations of what can be achieved solely through lowering the cash rate."

Nicholas Gruen, Lateral Economics (Decrease – 25 basis points): "Because with their previous stance having blown up in their face, they have changed direction, and now seek to get the rate down. I've argued that larger steps than 0.25% would be apposite but smaller ones convey a less panicky picture to onlookers."

Mathew Tiller, LJ Hooker (Decrease – 25 basis points): "Comments made by the RBA governor, about the economy's "spare capacity", ongoing soft consumer spending and global trade concerns are expected to see the RBA reduce the cash rate at their July board meeting. On a positive note, property markets have started to show signs of life with a pick-up in the number of attendees at open homes and higher auction clearance rates. This has come about from the re-election of the coalition government, moves by APRA to ease some lending criteria and lower interest rates."

Geoffrey Harold Kingston, Macquarie University (Hold): "I'm still inclined to think the next cut will come after the next CPI print."

Stephen Koukoulas, Market Economics (Decrease – 25 basis points): "Weak economy, low inflation."

John Caelli, ME Bank (Decrease – 25 basis points): "It's likely the RBA will cut the cash rate to a new record low in July, due to ongoing low inflation, poor growth numbers and higher levels of underemployment."

Michael Yardney, Metropole Property Strategists (Decrease – 25 basis points): "The latest job figures, with another decline in May, make another rate cut almost a certainty. There's no point in the Reserve Bank delaying action, and it should make another cut in July and we'll possibly need another cut towards the end of the year due to a slowing of our economy."

Mark Crosby, Monash University (Hold): "It is possible but unlikely that the RBA will cut in consecutive months, given transmission lags would warrant observing the impact of the latest cut."

Jacqueline Dearle, Mortgage Choice Limited (Decrease – 25 basis points): "In July there is a strong case for a rate cut by the Reserve Bank of Australia, taking the OCR to 1%. In June the RBA made the decision to cut the rate to support employment growth and get inflation back on target. Since then, economic growth has come in under forecast and the unemployment rate, which the RBA has been focused on, continues to deliver disappointing results. Ideally the unemployment rate needs to be around or below 4.5%. The labor market remains a key focus for the RBA and the most recent (May 2019) labour survey revealed no improvement in the unemployment rate. However although a cut should stimulate a positive response across a range of economic factors. Should the rate cuts be passed on, this will lower mortgage rates to make housing more affordable, and subsequently give the property market a nudge in the right direction. Great for first home buyers and property investors but the fall in official interest rates will not be so welcome to those Australians with cash savings in the banks, who may see their returns diminish if the banks trim back their rates further from the current average rate of 1.4%."

Katrina Ell, Moody's Analytics (Hold): "Our expectation is the RBA will cut by 25bps in August."

Andrew Wilson, My Housing Market (Hold): "Although a close call, the RBA is more likely to leave rates on hold over July following the re-commencement last month of the latest easing cycle. The RBA has clearly indicated it is prepared to continue to cut rates to reduce the jobless rate from current levels however consecutive cuts may be counterproductive by raising general concerns of emerging serious economic circumstances. Housing market stimulus from lower rates would be better served through an August rate cut to take advantage of the more active spring selling season."

Andrew Reeve-Parker, NW Advice Pty Limited (Decrease – 25 basis points): "Continuing deterioration in economic activity."

Jonathan Chancellor, Property Observer (Decrease – 25 basis points): "The second rate cut typically quickly follows the first."

Matthew Peter, QIC (Decrease – 25 basis points): "Governor Lowe has clearly signalled to the market that rates will be lowered. Since disappointing the market in May with inconsistent communication, the RBA has been very clear in its intent and has left the market in no doubt about a July rate cut."

Noel Whittaker, QUT (Hold): "Too soon for another drop."

Nerida Conisbee, REA Group (Hold): "It is likely the RBA will wait another month to see whether the rate cut in June is flowing through to key economic data."

Sveta Angelopoulos, RMIT (Hold): "The RBA may hold off reducing the cash rate this month, waiting to see the extent of tax cuts passed how the economy progresses with the lower cash rate."

Janu Chan, St.George Bank (Decrease – 25 basis points): "The RBA has said that we should have a lower unemployment rate and that the last rate cut was not going to be sufficient in altering the path that we were on. It has provided a strong indication that another rate cut is on its way."

Brian Parker, Sunsuper (Hold): "RBA clearly signalling further cuts, but I suspect they'll hold before seeing some more data."

Clement Tisdell, UQ-School of Economics (Hold): "[The RBA will hold] to allow some time for reaction to the previous cut."

Other participants: Bill Evans, Westpac (Hold) | Alan Oster, NAB (Decrease – 25 basis points).

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel