- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

Punters Down Under: Australia home to 12.8 million everyday investors

- 64% of Australians have investments outside of the property

- More than 1 in 4 invest in the share market

- Here are our tips for online share trading

11 December 2020, Sydney, Australia – Australians are investing their cash far beyond property, according to Finder, Australia's most visited comparison website.

A new survey of 1,004 respondents found that two-thirds of Australians (66%) have some level of investments other than property.

That's an estimated 12.8 million Australians investing their money in everything from shares to precious metals.

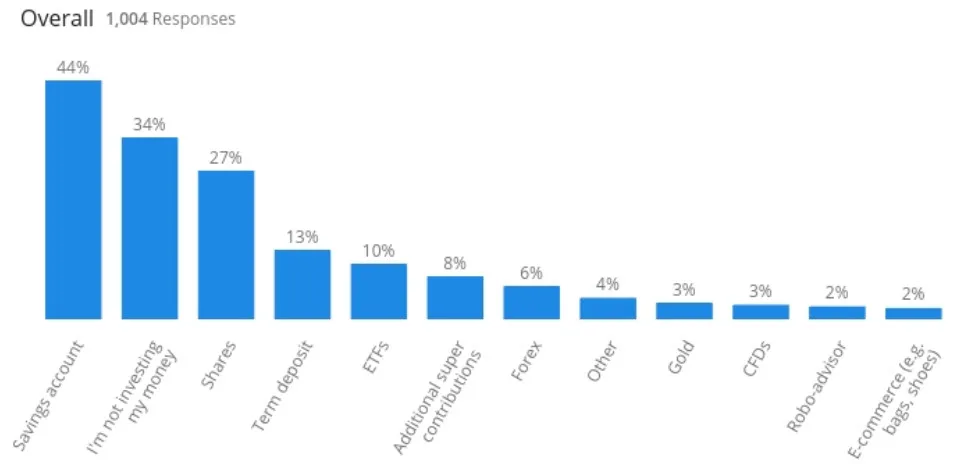

The research found that almost 1 in 3 people (27%) invest in the share market.

1 in 10 (10%) invest in Exchange Traded Funds (ETFs), while 6% of Aussies have foreign exchange assets (Forex).

1 in 8 (13%) have their money in a term deposit, while 44% stash their cash in a savings account.

Kate Browne, personal finance expert at Finder, said that the data provides key insights into the broad reach of investment in Australia.

"Australians want to build their fortunes and aren't prepared to rely solely on their income to do it.

"It's a broad spectrum – from those investors who just want to maximise savings to those who are striving for financial freedom.

"Low savings interest rates have also driven more people into the share market as they seek to make a profitable return on their investments.

"No matter the goal, it's clear there's interest in a vast array of different investment options – all with different levels of risk and potential returns," Browne said.

The research shows that 73% of men are investing their money, compared to only 60% of women.

Browne said that technology has upended the way people can invest their money.

"Micro investing and online platforms are making share trading more accessible than ever.

"The savings required to invest are no longer prohibitively expensive – you can get started for as little as $50," she said.

Trends such as growth in robo-advisors were revealed, with 2% of Australians now using one.

Browne said assets can provide security if investors experience income losses or a financial emergency.

"Uncertainty driven by the coronavirus outbreak has caused a lot of people to want to build their earnings through investments."

Browne said that Australians should make sure they have enough cash in an emergency fund and invest wisely.

"If you don't have any money left at the end of month to invest with – the first step might be to reduce spending through various forms of frugality.

"Money management tools like the Finder app can help you identify the areas and products where you spend the most and help you get a better deal.

Methodology

- This study was designed by Finder and conducted by Qualtrics, a SAP company.

- The online survey was conducted using a nationally representative survey sample of 1,004 Australian adults.

How are you currently investing your money?

Tips for online share trading

- Read the news. It's important to stay up-to-date with the broader economy and learn how major events such as national elections impact the share price of various companies.

- Research companies before buying. If you want to buy shares in a company, research as much as you can about the company before making your final decision. It's a good idea to read the company's annual reports and meeting minutes to learn what's in the pipe-line and what changes will be made that could affect its share price.

- Up-skill. It can be easy to lose a lot of money by making a poor investment decision or by simply clicking on the wrong button if you don't know what you're doing. Practice trading on a demo account first and consider taking an online investment course.

- Consider blue chip companies. This is a good strategy for people new to the share market, as blue chips often have more stable returns, are less volatile and often pay dividends.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel