- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

Christmas comedown: 1 in 4 Aussies worried about housing costs

- 9% of Aussies "extremely" nervous about making rent/mortgage payments after Christmas

- Men more likely to be stressed about how they will afford to keep a roof over their heads

- Download the Finder app to help save money in 2021

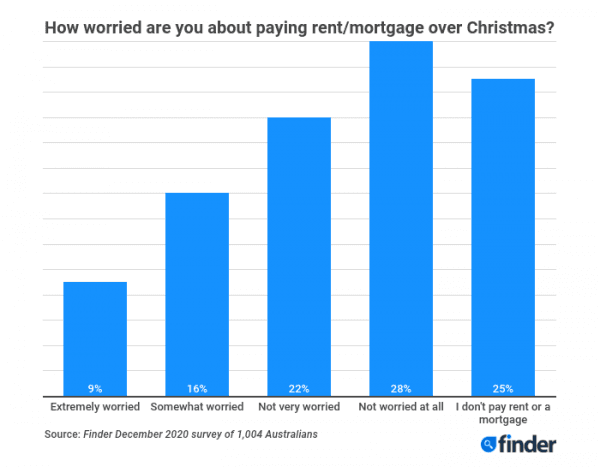

30 December 2020, Sydney, Australia –One in four (25%) Australians are worried about how they will pay the rent or mortgage after Christmas, according to new research by Finder, Australia's most visited comparison site.

That's the equivalent of 4.8 million Australians who may have difficulty coming up with the funds to pay their mortgage or rent.

The Finder survey of 1,004 respondents revealed 16% of Australians are somewhat worried about meeting payments, while a further 9% are extremely worried.

The problem is more pronounced for men, with nearly one in three (31%) anxious about paying their rent or mortgage after Christmas, compared with 19% of women.

Sarah Megginson, home loans expert at Finder, said in COVID-19 times, Christmas could push people over the edge financially.

"Many households are still facing hardship and relying on stimulus money to get by as the pandemic goes on.

"For families whose income for December is less than it was last year, this can cause significant budget shortfalls and lead to financial trouble.

"Many will have to choose which bills to fall behind on," Megginson said.

The research shows that young people are the most vulnerable when it comes to missing their payments.

One in three (33%) generation X and generation Y Aussies, respectively, are worried about paying their rent or mortgage over Christmas, compared to just 5% of baby boomers.

Many young Aussies have found themselves jobless this year, as youth unemployment hit a 23-year high of 16.4% in June, leaving them the most vulnerable to missed rental or mortgage payments.

Victorian households are the most burdened by their living costs, with a whopping 37% of residents concerned about making rent or mortgage payments over the festive season.

While Victoria bore the economic brunt of the pandemic, rental prices have not fallen in proportion with the recession. In Melbourne, the median asking rent in September was $425, down just 2% year-on-year, according to CoreLogic data.

Finder analysis of the Australian Bureau of Statistics data shows the total value of owner-occupier home loans in Australia reached a record-high $16.5 billion in October, a 24% increase year-on-year.

First home buyers are also borrowing 44% more than they were last year.

"With interest rates at record lows, Australians on fixed-term contracts may not be getting the best deal for their home loans," Megginson said.

"Now is a great time to refinance your home loan – just a small change in your rate could end up saving you thousands.

"Some lenders offer cashback for refinanced loans, so it's worth scanning your options."

Megginson said it's not too late to keep financial stress at bay this holiday season.

"Shop smart by taking advantage of the sales, avoid traveling to expensive areas, and keep your energy bill low by replacing air conditioning with a fan.

"If you're having trouble making your mortgage repayments, contact your bank and discuss your options.

"If you keep them in the loop and continue making regular repayments, they'll work with you through this tougher season," Megginson said.

The Finder app is an easy tool that can help you manage your spending habits and see where you could be getting a better deal.

What to do if you're struggling with rent or mortgage payments:

- Negotiate with your landlord. Rental rates are not set in stone, so if you feel you're paying too much it might be time to ask for a discount. Be sure to come prepared with comparative prices for similar properties in your area, emphasise why you're a good tenant and, most importantly, be polite.

- Move in with friends. If your current lease is up for renewal, why not move into a share house to save money? This way you can split the cost of rent, bills and groceries.

- Consider refinancing. If you've been with the same lender for a long time there's a good chance you could find a better deal elsewhere. Interest rates are at record lows, with some dipping as low as 1.88%. With this in mind, talk to your lender or compare your options online. Your current lender may also be willing to negotiate a lower rate in order to keep you as a customer, which can lead to instant savings.

- Do a spending audit. The new year is the perfect time to take a look at your finances and see if there are any expenses that can be left in 2020. Pay close attention to "nice-to-haves" like streaming services, gym memberships or other subscription services and see where you can put a little money back in your own pocket.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel