- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

Savings rise as almost half of Aussies plan to save their tax refund

- A finder.com.au study found 46% of Aussies will save their tax return this year

- Fifteen percent more Aussies are planning to save their tax return this year compared to last year

- Tips: How to use your tax return to save over $55,000 on your mortgage

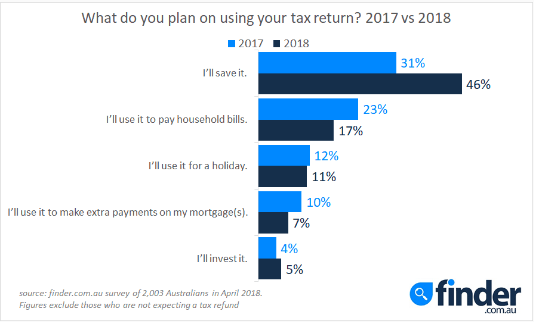

6 June, 2018, Sydney, Australia – Nearly half (46%) of Australian taxpayers are expected to save their tax return this 2018-19 financial year, according to finder.com.au, the site that compares virtually everything.

The consumer survey of 2,003 Australians shows 15% more taxpayers plan to put their tax return straight into their savings account.

Analysis of Australian Taxation Office (ATO) ‘myTax’ online lodgement figures by finder.com.au shows this equates to Australians saving around $2,800 each.

Following saving it, Australians will use the money from their tax return for household bills (17%), a holiday (11%), to make extra mortgage repayments (7%) and a small proportion plan to invest it (5%).

Bessie Hassan, Money Expert at finder.com.au, says for some people tax time brings a long-awaited-for cash boost.

“Getting cash back means you may have overpaid in taxes during the year, so it can be bittersweet, but most people look forward to the extra cash.

“Your tax return is money you’ve worked hard for throughout the financial year for so it can be tempting to want to spend it the minute you receive it.

“However, depositing your refund into a high-interest savings account like so many Australians are planning to do this year, can really help improve your overall financial health,” she says.

Alarmingly, the finder.com.au study found that 84% of homeowners who have a mortgage* won’t be using their tax return to make extra repayments on their home loan.

Ms Hassan explains using your tax return to chip away at existing bills or debt repayments such as a mortgage is one of the smartest ways to use the cash.

“Using your tax return to make extra mortgage repayments could have a sizeable impact on the size and length of your loan, meaning you could potentially own your home outright sooner,” she says.

Using the average ABS home loan of $399,200 with 5.06% standard variable rate interest, homeowners who pay $250 extra on their repayments, could save over $55,000 on their 30 year home loan.

Generation X (those aged 39-58) and Generation Y (those aged 24-38) are more likely – 13% and 12% respectively, to make extra mortgage payments than Baby Boomers (59+) who only have a 5% likelihood of making extra mortgage payments.

Australians can compare high interest savings accounts online at finder.com.au.

*Methodology

- In total, 7% of all Australians will put their tax refund towards paying down their mortgage.

- However not all Aussies have a mortgage.

- Finder's survey showed that 28% of respondents of this survey had a mortgage on their home.

- When looking at these people specifically (those with a mortgage), 16% will use their tax refund to help pay down their mortgage. This means that 84% aren't using their refund for that purpose.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel