Home insurance premiums are soaring: Here’s how I saved $1,415!

Recent floods and extreme weather events mean home insurance premiums are skyrocketing – so it's time to shop for a better deal.

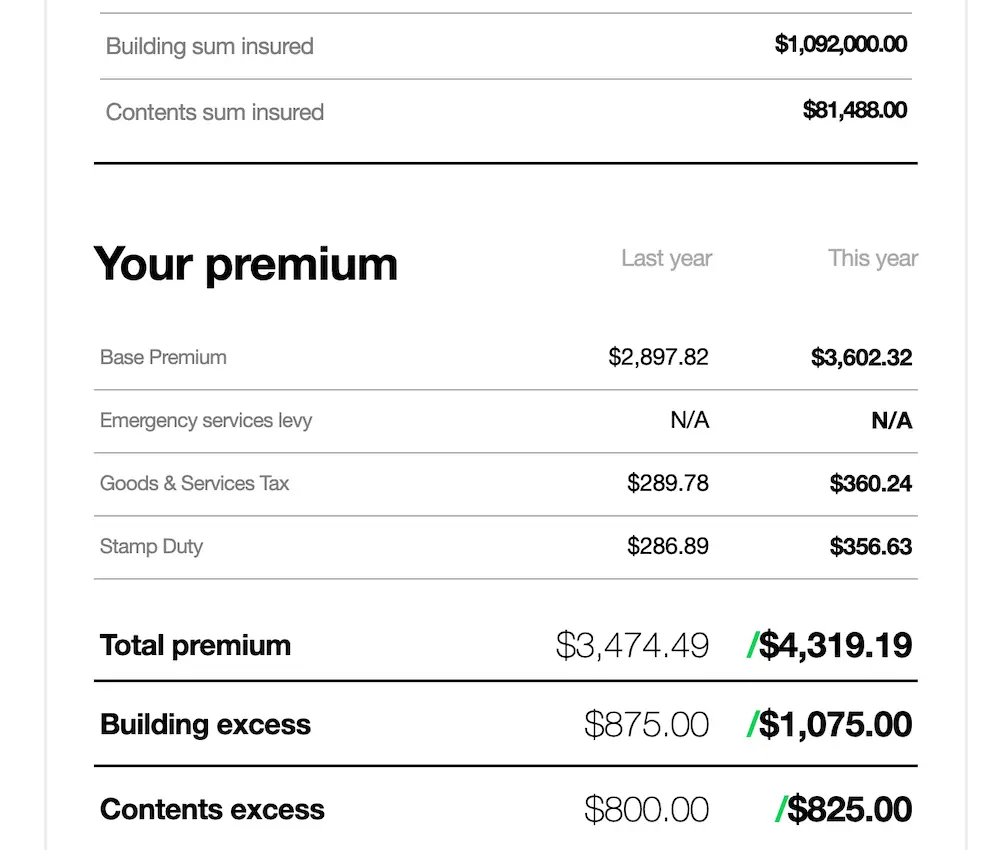

This week, I received my annual renewal notice from Youi, which I've been with for 11 years. But this year, I'll be moving elsewhere.

I called my insurer to see what it could do about this whopping increase. The customer service rep tweaked it a little, but the best they could do was reduce it to $4,284.36 unless I substantially increase the excess. This figure is the price if I pay it in a lump sum, too – it's more than 10% higher (almost $5,000 total!) if I opt to pay it by the month.

Every insurer prices premiums differently, according to their own risks and payouts. So, clearly it was time to shop around!

I reviewed 5 home and contents insurance options on Finder for my 4-bedroom, 3-bathroom, split-level home on the Gold Coast.

The results ranged from $2,580 to $3,983 per year (for annual payments – often the premium is quite a bit higher if you pay by the month). Also, as you'll see in my full home insurance comparison breakdown, the inclusions are different for each policy.

So, while I could save a bucket by moving to a cheaper policy, it could leave me without coverage for floods, accidental damage or motor burnout.

Fortunately, I found a big saving and kept up the same level of cover. Check out my home insurance comparison.

Plus, a few things I learned along the way

- Quotes seem to get cheaper for older policyholders. Some insurers asked to list the oldest policy holder straight off the bat, but some quotes automatically increased once I added my date of birth.

- Not all policies are created equal! Same make it super clear they're "basic" policies, and for others, you have to dig through the details to work out what they do and don't cover.

- Be really clear about what you want. All insurers cover fires (including bushfires), storms and theft. But lots differ on flood, motor burnout, accidental damage and extra money towards clean-up/debris.

- Insure your home for the correct amount to rebuild, known as the sum insured. I increased my sum insured last year from $800,000 to $1.1 million because construction costs have gone up – if I stayed with a sum insured of $800,000 but it cost $1.1 million to rebuild my home after a fire, I'd be $300,000 out of pocket (or I'd have to rebuild a much smaller home).

- Comparing doesn't take as long as you think. I compared quotes online and in just over 1 hour, had all of these options and I was ready to make a decision.

Has your home insurance gone up? See if you could save like Sarah. Compare policies side by side or get started with our best home insurance page.

Ask a question