There are 3 main credit reporting bureaus in Australia: Experian, Equifax and Illion.

These credit reporting agencies collect and distribute the credit history data that makes up your credit report and they use this data to your calculate your credit score. Each agency uses its own credit score rating system, which means your credit score varies between agencies.

Whenever you apply for credit – like a credit card, a home loan, a mobile phone plan or a car loan – lenders check your credit report as part of their assessment. The higher your score, the less "risky" you are.

What is a credit reporting agency?

A credit reporting agency or bureau is a company that collects, holds and distributes data from credit providers that relate to a borrower's financial history. This information is then used to calculate your credit score and recorded on your credit report.

Each of the 3 main credit agencies in Australia – Experian, Equifax and Illion – each use their own scoring system to determine your credit score.

You can get a copy of your credit score for free in the Finder app, and we'll send you an updated on your credit score every month. You can also contact the credit score providers directly for a copy of your report, but different waiting periods and costs apply – and they may only let you know your score if you sign up for a paid membership.

What are the three credit reporting agencies in Australia?

- This credit agency lets you order a copy of your credit report for free, once every three months.

- You need 1 form of ID (passport, licence and/or Medicare) to get your report.

- You don't need to create an account with Experian to get your report, but it takes 1-10 days to receive it.

- When you order your credit report and credit score for free through Finder, the information will be delivered by Experian.

- This is the largest credit reporting agency in Australia and provides personal and business credit reports.

- You need 2 forms of ID (passport, licence and/or Medicare) to create an account and access your report.

- You can order a free copy of your report once every 3 months (provided you haven't been declined credit in the last 90 days; or had an item corrected on your Equifax credit report)

- You won't get access to your Equifax credit score unless you sign up for a paid membership plan.

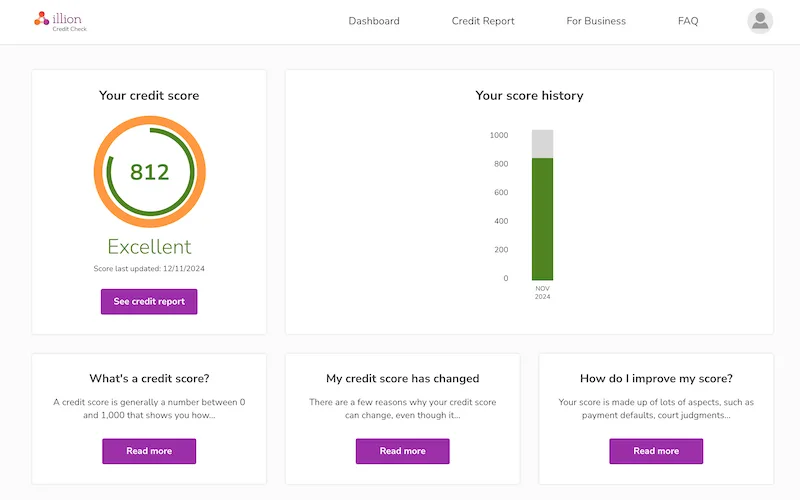

- Formerly known as Dun & Bradstreet

- Illion does personal credit checks and also offers debt recovery services and provides a business credit check service, where you can verify the credit and financial stability of a business.

- You need 1 form of ID (passport, licence and/or Medicare) to create an account.

- Once registered, you'll get immediate access to both your credit score and credit report.

Which credit agency do lenders use most?

Equifax is the largest of the three credit bureaus in Australia, with a global presence. Banks in Australia generally use both Equifax and Experian when they run credit checks, and some banks may also use Illion.

Any credit providers that you apply for an account with, such as a utility account, mobile phone contract, personal loan or credit card, will send this information to all of the credit reporting agencies so it can be noted on your file. Even if you're not approved for the account, the enquiry and application will be listed. Other public information such as court listings and bankruptcy information is also included in your report.

"I've signed up at different times to receive my credit file with all three agencies, just to make sure there's no inaccurate accounts, mistakes or issues. I now get my monthly credit score update through the Finder app, which gives me peace of mind – especially since my details have been leaked in multiple big data breaches."

Are there any differences between credit reporting bureaus?

Each bureau receives information from credit providers and various public sources. However, as all of these sources are not the same you'll find that your credit report may be different if you order from each of the agencies. If you find any information that is incorrect on your credit file it's important to get in contact with the credit bureau first. If it cannot be rectified then you can contact the credit provider, and if the provider can't have the error cleared, you can get in contact with the Privacy Commissioner.

You may also find that your credit score is different depending on which reporting agency you go with. For example, Experian's excellent credit band is between 800 and 1,000 and Equifax is between 853 and 1,200.

What information is included in your credit report?

What other ways can you get your credit score in Australia?

There are a number of companies that also offer credit scores from the 3 major credit bureaus:

- Finder (Experian credit score)

- Credit Savvy (Experian credit score)

- Credit Simple (Illion credit score)

- Get Credit Score (Equifax credit score)

- Wisr (Experian and Equifax credit scores)

- ClearScore (Experian credit score)

Finder survey: How many Australians of different generations know what a good credit score is ?

| Response | 75+ yrs | 65-74 yrs | 55-64 yrs | 45-54 yrs | 35-44 yrs | 25-34 yrs | 18-24 yrs |

|---|---|---|---|---|---|---|---|

| Yes | 55.32% | 50.91% | 59.24% | 63.1% | 67.39% | 74.74% | 65.71% |

| No | 44.68% | 49.09% | 40.76% | 36.9% | 32.61% | 25.26% | 34.29% |

Sources

Ask a question

2 Responses

More guides on Finder

-

Credit Repair Australia

Credit Repair Australia can help you sort out your credit score and improve your chances of getting a loan or credit card.

-

Mobile phone plans and credit checks

Missing a phone bill can end up hurting your credit score, but simply having a mobile plan won't impact your credit report.

-

Credit Savvy credit score

Follow these tips to get a handle on your credit with this free tool.

-

What is a good credit score?

The average Australian has a "very good" credit score according to Finder analysis. Here's how credit scores are categorised in Australia, and how to check yours.

-

Will cancelling a credit card affect my credit score?

If you're planning to cancel a credit card, here's what you need to know about the impact it could have on your credit score.

-

How to improve your credit score

9 things you can do today to start improving your credit score.

-

Credit repair in Australia

How to remove incorrect negative listings from your report and adopt positive money habits to get your credit history back on track.

-

How long do credit enquiries stay on your credit file?

How to remove enquiries from your report in 4 steps and a guide for improving your credit score.

-

How to improve your credit score with a credit card

Discover how you can use a credit card to build or repair your credit history.

Hi, I had a yahoo email account which has been breached. I’ve asked two of the credit agencies for my annual free report. This will show me if someone has applied for credit using my name?

Would you suggest doing the annual report each quarter, ie. use one of the three agencies each quarter to help quard against the above?

Can I assume all three agencies collect the same information?

thanks

Hi Mark,

Hi

Thanks for reaching out.

One of the factors being looked at when your score is calculated is credit enquiries. Every time you apply for a loan, credit card or even interest-free finance it will be listed on your credit file. If you have multiple loan applications in a short space of time it could hurt your credit score. So if someone has been making loan applications under your name, that would show on the change of your credit score. That would also mean requesting for your credit score regularly would be helpful in monitoring your security or in protecting your information from fraud.

By getting a copy of your credit report, this will allow you to contact credit report agencies and inform them of the identity theft so that they can help repair your credit standings by adding notes to your credit file.

Equifax collects certain information to calculate your credit score and Experian, another credit agency, collects information separately. Because of this your score may be different. Your Equifax Score is a number between 0 and 1200 and your Experian score will be a number between 0 and 1000.

Cheers,

Joanne