- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Media Release

Finder Cash Rate Survey: Housing affordability sentiment hits all-time high

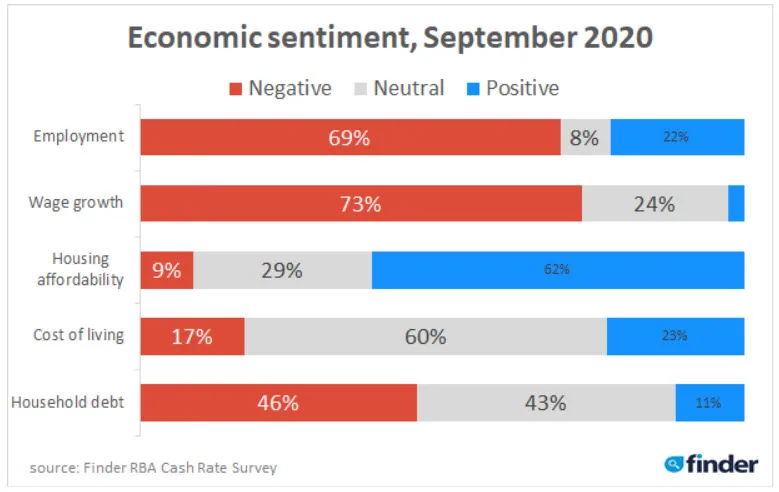

- 62% of experts and economists feel positive about housing affordability

- 52% disagree with the decision to give Australians access to their super early

- All experts (40/40) correctly predicted the cash rate to hold at 0.25% in September

1 September 2020, Sydney, Australia – Experts have never felt better about housing affordability around the country, according to Finder, Australia's most visited comparison site.

In this month's Finder RBA Cash Rate Survey™ – the largest of its kind in Australia – 40 experts and economists weighed in on future cash rate moves and other issues related to the state of the Australian economy.

While all experts and economists surveyed correctly predicted the cash rate to hold at 0.25% (40/40), nearly two-thirds (62%) responded with positive sentiment about housing affordability – a record percentage since Finder first started collecting data on the topic in March 2018.

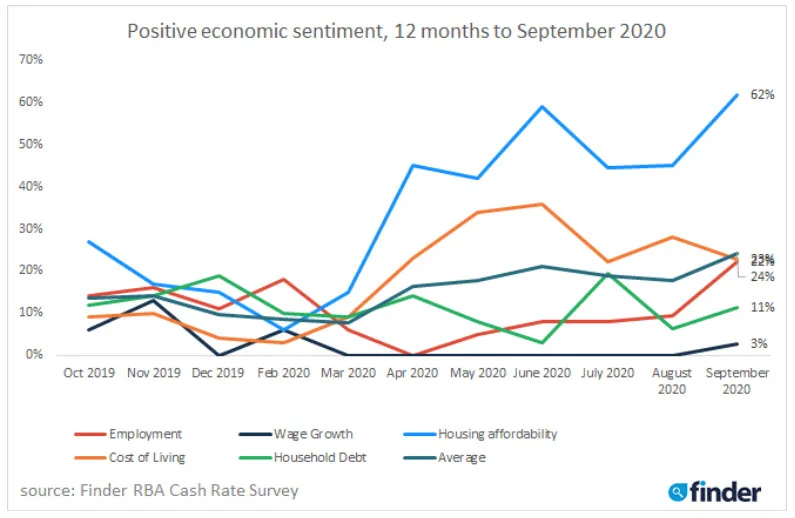

Finder's Economic Sentiment Tracker gauges experts' confidence in five key indicators: housing affordability, employment, wage growth, cost of living and household debt.

Graham Cooke, insights manager at Finder, said housing affordability is a two-way street.

"When experts feel good about housing affordability there are two ways to look at it.

"On the one hand, prices are down so those who are ready to buy or who want to negotiate rent are in a good position to do so.

"On the other hand, those who own or are looking to sell, may see that their property isn't worth what it once was.

"What is certain here is that the drop in prices, rock-bottom rates and increased competition for non-investment buyers combined with government stimulus will likely get a lot of the next generation onto the housing ladder for the first time," Cooke said.

52% of experts decry early super decision

More than half of economists (52%, 15/29) believe that Australians should not have been given access to their superannuation early.

Cooke said that he was actually surprised that the number wasn't higher.

"From all that's been made of the long-term costs associated with early super withdrawal, I'm surprised the number of economists against this move wasn't higher" he said.

Craig Emerson of Emerson Economics said, "Superannuation is for retirement incomes, not a means of savings for spending pre-retirement."

Besa Deda, chief economist at St.George Bank, said, "Withdrawing super negates the compounding effect that benefits those who may have needed it most in retirement.

"Additionally, depending on specific investment decisions, withdrawing superannuation in the middle of the pandemic was likely to have resulted in the crystallisation of large losses."

On the other side of the argument, Malcolm Wood, chief investment officer of Baillieu, called it a "low cost, highly effective policy."

Sveta Angelopoulos, economics lecturer at RMIT University, said people should have access to their funds when there is severe financial hardship.

"Super funds are ultimately the property of the Australians who hold them and individuals are in the best position to assess their own needs and requirements," Angelopoulos said.

Dr Andrew Wilson, chief economist of My Housing Market, said that a debate will soon emerge as to the economic efficacy of the current superannuation system.

Here's what our experts had to say

Nicholas Frappell, ABC Bullion: "The case for another cut (or not) appears fairly finely balanced, however the Governor is suggesting that fiscal support is the best solution to lifting the economy and alleviating unemployment. I think that is the best way to go given the degree of spare capacity and the speed of the economic contraction."

Shane Oliver, AMP Capital: "For now, the RBA will remain on hold. It views the March monetary easing package as continuing to help the economy and the main action now being in fiscal policy. There is a significant chance it may cut the cash rate to 0.1% and it may do more aggressive quantitative easing but that would not be for several months. And it remains "extraordinarily unlikely" to cut the cash rate below zero. The next interest rate move of significance is likely to be a hike but with high unemployment and underemployment, lots of spare capacity in the economy and underlying inflation way below target this is at least three years away."

Alison Booth, Australian National University: "Given comments of the RBA Governor, it seems unlikely the cash rate will be changed. With the level of uncertainty over the next few months, I'm unwilling to hazard a guess as to when a change will occur, though I do expect that any change will be downwards."

Malcolm Wood, Baillieu: "RBA to leave rates at effective zero until economy approaching full employment and inflation sustainably in the 2-3% range. This appears years away."

David Robertson, Bendigo and Adelaide Bank: "No change in rates likely for at least two years, unless the RBA decides to cut to 0.10% from 0.25%, but most likely rates are on hold here at 0.25% prior to a slow tightening cycle two to three years down the track."

Sean Langcake, BIS Oxford Economics: "We don't see the cash rate increasing until mid-late 2023."

Ben Udy, Capital Economics: "We think the RBA will launch a second tranche of QE in early 2021."

Peter Boehm, CLSA Premium: "The RBA needs to hold tight until the full extent of the Victorian crisis washes through the state and national economies, and until the impact of the withdrawal of federal financial support i.e. JobKeeper (at the end of Q1 next year) can be measured. Further announcements by the federal government on additional financial support, especially for Victorian businesses, will also need to be considered."

Saul Eslake, Corinna Economic Advisory: "Based on recent comments by the Governor, as well as my own outlook, I think the first increase in rates is likely to be some time in 2023. It's not impossible that, well before then, the RBA could lower its cash rate target to 0.10%, but since cash has been at around 0.13% for some time now, that would be more symbolic than anything else."

Craig Emerson, Emerson Economics: "There is no inflation in prospect domestically or globally."

Angela Jackson, Equity Economics: "RBA will hold until signs of recovery, which is hard to predict given uncertainty around a vaccine for COVID-19."

Mark Brimble, Griffith University: "The next six months are full of almost unpredictable uncertainty in relation to the virus and geopolitical issues. Should the virus escalate further, the RBA is likely to move, if it doesn't then they are likely to not adjust rates but hold low for the long term."

Tony Makin, Griffith University: "If economic history since Roman times is any guide (and there is no reason to doubt it), the money base expansion here and in other advanced economies due to central bank monetisation of public debt (either directly or indirectly via QE or targeting the three-year bond yield) will put upward pressure on the price level as economies recover, necessitating a rise in official interest rates. The lagged inflation response to money base growth has conventionally been assumed to be 18-24 months later."

Tim Reardon, Housing Industry Association: "[The RBA] can not lower rates, and an increase is not foreseeable."

Alex Joiner, IFM Investors: "The RBA should not be looking to remove policy stimulus before it gets the unemployment rate near levels approaching full employment. Its own forecasts have the unemployment rate well above this level by the end of 2022."

Leanne Pilkington, Laing+Simmons: "Relatively speaking, the economic fallout of the coronavirus that is reverberating around global markets has not impacted Australia as hard as many other nations. Even considering Victoria's second wave and the potential for subsequent outbreaks elsewhere, employment figures are encouraging and other key indicators point to our economy's overall resilience. Low, steady interest rates for the foreseeable future are appropriate to support the recovery."

Nicholas Gruen, Lateral Economics: "It will bump along the bottom for a good while yet."

Mathew Tiller, LJ Hooker: "Given there is little room for a significant downward movement, the RBA should keep the cash rate steady. It is likely to continue to use other measures to help stimulate economic activity."

Geoffrey Kingston, Macquarie University: "Economic activity should have picked up enough by this point to warrant an increase."

Jeffrey Sheen, Macquarie University: "The RBA has committed to an unchanged cash rate for three years."

Michael Yardney, Metropole Property Strategists: "Interest rates won't rise until unemployment drops to 4.5% and that won't be for three to four years, and it's unlikely the RBA will drop rates further."

Mark Crosby, Monash University: "Until a vaccine for COVID-19 exists, rates won't be increasing. It also seems likely that recovery will be slow, so no changes likely in 2020 or 2021."

Julia Newbould, Money Magazine: "The cash rate is already at its lowest level and there is still great uncertainty of what will happen next and how quickly the economy may recover."

Susan Mitchell, Mortgage Choice: "The RBA is unlikely to change its dovish stance on monetary policy given the uncertainty caused by the coronavirus pandemic. In a speech delivered to the House of Representatives Standing Committee on Economics, Governor Lowe indicated the cash rate is likely to remain on hold for at least three years. The low cash rate continues to stimulate activity in the home loan market and the lowest cost of borrowing in history, which is encouraging borrowers to lock in a fixed rate and to refinance to access a better deal."

Dr Andrew Wilson, My Housing Market: "Monetary policy continues to be sidelined, with economic activity generally now better than expected notwithstanding significant new challenges now for the Victorian economy, with obvious repercussions for national growth. Some better news balanced by some worse news."

Jonathan Chancellor, Property Observer: "The RBA will take the opportunity to go lower as necessitated by the unfolding economic circumstances in early 2021."

Rich Harvey, Propertybuyer: "The current recession has some time to play out. Once stimulus measures subside it will take some time for the full impacts to materialise and low interest rates continue to provide a buffer for the economy."

Matthew Peter, QIC: "The RBA has signalled that it will keep rates on hold for around three years. Governor Lowe has also indicated that the RBA is highly unlikely to shift rates into negative territory. It is more probable that the RBA will lower the cash rate to 0.10% if the outlook deteriorates. However, at this point, the RBA is likely to remain on hold for the foreseeable future."

Noel Whittaker, QUT: "The future is so uncertain – and the possibility of a vaccine is a major factor. Given that international air travel will not happen for at least another year, there will be no reason to increase rates in the next year. And lowering any further would be pointless."

Cameron Kusher, REA Group: "The RBA statements indicate that it remains reluctant to cut official interest rates. On the other hand, their forecasts would seem to indicate that they remain a long way away from achieving their economic goals, which would put them in a position to start increasing rates."

Jason Azzopardi, Resimac: "Despite the RBNZ indicating a negative OCR is on the horizon, the RBA stance of a period of stable cash rate appears to be stabilising funding markets."

Sveta Angelopoulos, RMIT University: "Given the current conditions, the rate is likely to remain on hold for the rest of the year, and likely well into next year."

Christine Williams, Smarter Property Investing: "Monitoring the unemployment [rate] and potential defaults on home loans will require a reduction in the interest rates to reduce loan defaults."

Besa Deda, St.George: "The RBA Governor has repeatedly indicated that the cash rate is unlikely to be raised for three years. Additionally, although the possibility of cutting the cash rate target to 0.1% has been raised, its effectiveness is likely to be negligible so this policy response is unlikely."

Janu Chan, St.George Bank: "The RBA is not likely to lift rates any time soon, while the unemployment rate remains elevated and spare capacity remains in the economy. If there was a risk of shifting its monetary policy stance, it would be towards greater easing. However, the RBA appears reluctant to deploy additional policy measures. The onus has been placed on the government to provide additional support."

Mala Raghavan, University of Tasmania: "The uncertainty is very high and the economic recovery heavily depends on how the coronavirus is contained (as there is always the fear of second and third waves) and the possibility of finding a vaccine. People need time to get used to this new norm of living and working style."

Other participants: John Rolfe, Elders Home Loans. Tim Nelson, Griffith University. Stephen Koukoulas, Market Economics. Brian Parker, Sunsuper.

###

For further information

- Bessie Hassan

- Head of PR & Money Expert

- finder.com.au

- +61 402 567 568

- Bessie.Hassan@finder.com.au

Disclaimer

The information in this release is accurate as of the date published, but rates, fees and other product features may have changed. Please see updated product information on finder.com.au's review pages for the current correct values.

About Finder

Every month 2.6 million unique visitors turn to Finder to save money and time, and to make important life choices. We compare virtually everything from credit cards, phone plans, health insurance, travel deals and much more.

Our free service is 100% independently-owned by three Australians: Fred Schebesta, Frank Restuccia and Jeremy Cabral. Since launching in 2006, Finder has helped Aussies find what they need from 1,800+ brands across 100+ categories.

We continue to expand and launch around the globe, and now have offices in Australia, the United States, the United Kingdom, Canada, Poland and the Philippines. For further information visit www.finder.com.au.

12.6 million average unique monthly audience (June- September 2019), Nielsen Digital Panel